A Guide to Commercial Real Estate Investment Opportunities

- Ryan McDowell

- Aug 13, 2025

- 18 min read

Reading Time: 9 min | Good for: Novice Investors (A), Family Offices (B)

For any serious investor looking to build real, lasting wealth that can span generations, commercial real estate presents a powerful alternative to the roller-coaster ride of the stock market. We’re talking about tangible assets—buildings and land—that not only have the potential to grow in value but also generate steady income, act as a shield against inflation, and offer some incredible tax benefits. It’s a foundational piece for any truly diversified, sophisticated portfolio.

TL;DR: Key Takeaways

Portfolio Cornerstone: Commercial real estate (CRE) offers tangible assets that can generate stable income, provide a hedge against inflation, and deliver significant tax advantages, making it a prudent component of a long-term wealth strategy.

Strategy is Everything: Success hinges on matching your risk tolerance to the right strategy—from stable Core properties to growth-focused Value-Add projects and high-return Opportunistic developments.

Sectors to Watch: Sectors like Multifamily and Industrial & Logistics are powered by durable, long-term trends like housing demand and e-commerce growth, presenting compelling commercial real estate investment opportunities.

Sponsor Diligence is Key: The most critical factor is the sponsor. Asking tough questions about their track record, alignment of interests, and business plan is non-negotiable before committing capital.

Why Commercial Real Estate Is a Portfolio Cornerstone

Think of commercial real estate (CRE) as the bedrock of a well-constructed investment strategy. Unlike stocks that can swing wildly on a tweet or a market rumor, CRE is grounded in something you can actually see and touch—the offices, warehouses, and apartment buildings that are essential to our economy. That physical reality provides a unique kind of stability and a direct connection to real economic activity.

For high-net-worth individuals and family offices, this isn't just another asset class; it’s a strategic move to protect wealth from the whims of the market and the slow burn of inflation. When the cost of everything else goes up, so do rents and property values, creating a natural hedge that keeps your purchasing power intact. In fact, many global family offices continue to increase or maintain their allocations to private real estate as part of a long-term diversification strategy, according to data from firms like UBS and KKR.

Market Why-Now: A Renewed Appetite for CRE Assets

Right now, we're seeing a major shift in how investors feel about the market, and the mood is getting much more optimistic. The uncertainty that clouded the past couple of years is starting to clear.

A recent Deloitte survey perfectly captures this turnaround. An incredible 68% of respondents now expect easier financing and lower capital costs (as of Q1 2024). To put that in perspective, only 27% felt that way last year. That’s a huge swing.

Even more telling, 69% of those surveyed believe financing will be easier to get, a complete 180 from the pessimism of the previous year. This confidence is especially strong for in-demand sectors like multifamily, industrial, and specialized assets like data centers. You can dig into the numbers yourself and explore the full findings of the Deloitte 2024 outlook.

Key Commercial Real Estate Property Types

To find the right opportunities, you first need to understand the landscape. Every property type has its own rhythm, driven by unique market forces and offering a different risk-and-reward profile.

Here’s a quick overview to get you oriented.

Commercial Real Estate Property Types at a Glance

Property Type | Primary Use | Key Investment Driver |

|---|---|---|

Multifamily | Residential housing for lease | Population growth, housing affordability, household formation rates |

Industrial | Warehousing, distribution, manufacturing | E-commerce growth, supply chain logistics, port access |

Office | Corporate headquarters, professional services | Job growth in white-collar sectors, quality of amenities |

Retail | Shops, restaurants, service-based businesses | Consumer spending, foot traffic, tenant sales performance |

Hospitality | Hotels, resorts, short-term lodging | Travel and tourism trends, business conference activity |

Medical Office | Clinics, outpatient facilities, healthcare services | Aging demographics, growth in healthcare spending |

Data Centers | Housing servers and digital infrastructure | Growth of cloud computing, AI, and digital data |

This table is just the starting point. Each category has its own sub-types and nuances, but knowing the fundamentals is the first step toward building a strategy that aligns with your financial goals.

Choosing Your Investment Strategy

Think of commercial real estate investing like planning a mountain expedition. You could choose a safe, steady hike on a well-marked trail (Core), a more challenging climb with rewarding views (Value-Add), or a bold ascent to a new, uncharted peak (Opportunistic). Each path demands a different level of preparation, carries a different degree of risk, and offers a unique reward.

Matching your capital and risk tolerance to the right strategy is one of the most critical decisions you'll make as an investor. It dictates everything from the type of property you target to your expected timeline for returns.

Core and Core-Plus: The Foundation of a Portfolio

Core investing is the bedrock strategy, all about stability and predictable income. These are the trophy assets: high-quality, fully leased properties in prime locations with rock-solid, creditworthy tenants. Imagine a brand-new apartment building in a major city or a warehouse with a long-term lease to a Fortune 500 company.

Property Condition: Excellent; often new or recently renovated.

Leverage: Low, typically under 60% loan-to-value (LTV).

Returns: Primarily driven by consistent cash flow from rents, with minimal appreciation expected.

Core-Plus investments are a small step up the risk-reward ladder. These are still quality assets, but they might have minor blemishes—maybe a key lease is nearing expiration or the property needs some light cosmetic upgrades. This strategy aims for a healthy blend of stable income and modest growth potential.

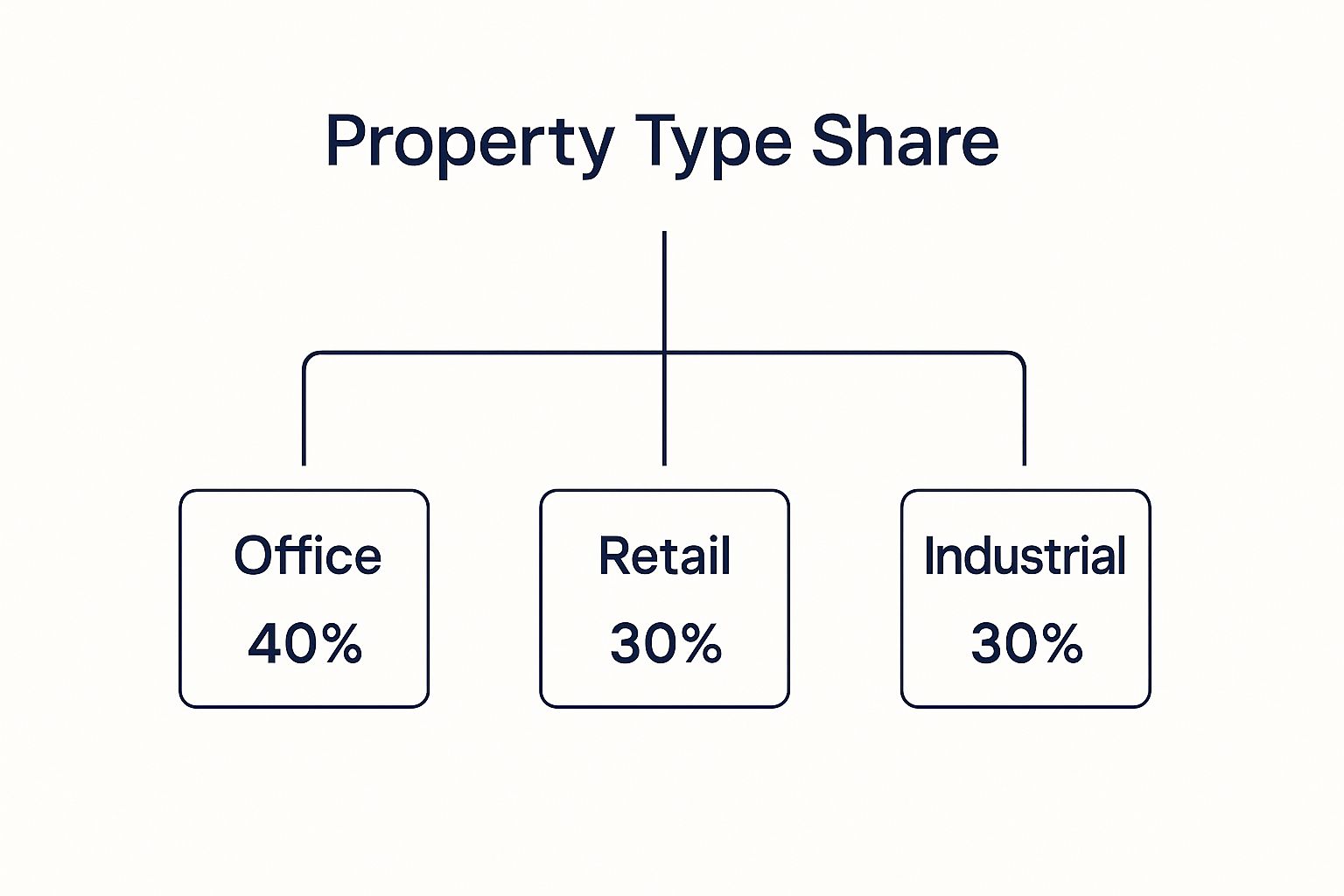

This infographic breaks down the typical property type allocation you might see in many institutional portfolios.

While the data shows a traditional mix, savvy investors often find creative ways to apply different strategies within these sectors. For instance, a single office building could be a Core asset for one investor but a Value-Add opportunity for another if it requires a significant repositioning to compete in the market.

Value-Add: The Engine of Growth

This is where many investors find their sweet spot between risk and reward. Value-add strategies zero in on properties with a clear, fixable problem. The building might be physically outdated, poorly managed, or charging rents well below what the market can bear.

The business plan is to get in there and actively create new value. This usually involves:

Renovations: Upgrading kitchens and baths in an apartment complex, modernizing a lobby, or replacing old building systems.

Operational Fixes: Bringing in professional management to cut wasteful expenses and improve the tenant experience.

Lease-Up: Filling vacant units or renewing existing leases at higher, market-rate rents.

Leverage here is more moderate, often in the 65% to 75% LTV range. Returns come from a mix of cash flow (once the property is stabilized) and significant appreciation when it's sold. These are those "challenging climbs" that can lead to spectacular results. For a deeper look at how these improvements translate to a higher asset price, check out the [top 8 commercial real estate valuation methods for investors](https://www.stiltsvillecapital.com/post/top-8-commercial-real-estate-valuation-methods-for-investors) in our detailed guide.

Opportunistic: The Pursuit of High Returns

Opportunistic strategies represent the highest risk and, consequently, the highest potential reward. These deals often involve massive undertakings like ground-up development, converting a building from one use to another (like an old hotel into apartments), or buying a completely vacant property with a plan to turn it around.

**Novice Lens: What is an "Opportunistic" Deal?**Opportunistic deals are all about the exit. They rely almost entirely on future appreciation for their returns because there is little to no initial cash flow. Success is tied directly to the sponsor's ability to execute a very complex, often multi-year business plan. This is the expert-level "peak ascent," not for the faint of heart.

Leverage can be higher, sometimes exceeding 75% LTV, and the capital stack often involves more complex financial structures. But for investors with the right expert partners and a long-term horizon, they can deliver exceptional equity multiples. Just be prepared for a longer hold period to allow for construction, lease-up, and stabilization.

Spotting High-Potential Property Sectors

Not all property types are built the same, especially when you're looking at future performance. We focus on sectors where the story is clear, compelling, and backed by solid data.

Multifamily: The Bedrock of CRE Investing

There’s a reason apartment buildings are a cornerstone for so many investors. At its heart, multifamily is a bet on something people will always need: a place to live. This simple fact creates a durable, reliable demand base that is far less shaky than what you see in other sectors.

With the challenges of homeownership affordability showing no signs of letting up, and more people choosing the flexibility of renting, the rental market just keeps getting stronger. This stability makes it an incredibly attractive anchor for any diversified real estate portfolio.

Recent data from the National Association of Realtors (NAR) backs this up. As of mid-year, the sector showed real signs of stabilization, with net absorption jumping 19% year-over-year to nearly 528,000 units absorbed. Vacancy rates are even ticking down slightly, which points to sustained demand for rental housing. To see how this compares to other property types, you can review the full commercial real estate market insights from NAR.

**Market Signal Box: Multifamily*** Data Point: After a period of rapid change, rents are stabilizing, supported by consistent demand from younger generations and those priced out of homeownership. (Source: NAR, June 2024)* Interpretation: The fundamental need for housing provides a strong floor for this asset class.* Investor Take: Keep an eye on markets with strong job and population growth, especially in the Sunbelt. Value-add plays, like updating older Class B buildings to meet modern tastes, can unlock significant rent growth and create real value.

Industrial & Logistics: The Engine of E-Commerce

The explosion of e-commerce has completely changed how we shop, and in doing so, it has launched the industrial and logistics sector from a quiet niche into an institutional favorite. We’re talking about the warehouses, distribution centers, and last-mile facilities that are the physical backbone of our digital world.

The demand for these buildings is driven by a simple, powerful need: getting products into the hands of consumers faster and more efficiently than ever before. This isn’t just a passing fad; it’s a structural change in how we live and buy.

When looking for a strong industrial investment, you want to see a few key things:

Proximity to People: Last-mile delivery is all about being close to consumers. Location is everything.

Access to Infrastructure: Being near major highways, ports, and airports is non-negotiable for an efficient supply chain.

Modern Features: Today's logistics operators need high clear heights, plenty of dock doors, and large truck courts to operate effectively.

**Market Signal Box: Industrial*** Data Point: Even with new buildings coming online, national vacancy rates for industrial properties are still hovering near historic lows, according to recent JLL reports.* Interpretation: Demand continues to outpace new development in many key markets.* Investor Take: While the big-box distribution centers get all the attention and competition is fierce, smart opportunities exist in smaller, infill logistics spots. Also, look at specialized assets like cold storage, which are seeing huge demand from the grocery and pharmaceutical industries and can command premium rents.

A Deep Dive into the Industrial Sector

Not long ago, industrial real estate was a niche play. Today, it’s a core holding for some of the world's most sophisticated investors. Given its incredible performance, this asset class has become an institutional favorite, and for good reason—it's the physical engine powering our digital economy.

Let's take a closer look at this powerhouse sector. We'll explore everything from the massive distribution centers that keep national supply chains moving to the smaller, last-mile hubs that get packages to our doorsteps. Understanding this space is essential for spotting top-tier commercial real estate opportunities.

Why Industrial Is a Powerhouse Asset Class

The success story of industrial real estate is really a story about e-commerce. Every time you click "buy now," you're creating a direct need for warehouse space. This simple connection to our everyday consumer behavior has created a powerful, long-lasting tailwind for the entire sector.

The performance has been nothing short of remarkable. Even as new warehouses are built, demand has consistently kept up. In the U.S. during the fourth quarter of last year, for example, the average asking rent for warehouses climbed to $10.13 per square foot—a jaw-dropping 61% jump from just five years earlier, per CCIM Institute data.

At the same time, vacancy rates hovered around a tight 6.7%. This healthy tension between supply and demand shows a market with strong fundamentals. You can dig deeper into these commercial real estate trends and challenges on CCIM.com. It's this kind of sustained growth that has made industrial a go-to for investors chasing both stability and upside.

Key Metrics That Tell the Real Story

When you're looking at an industrial property, a few key metrics paint a clear picture of its health and future potential. These go beyond the surface-level numbers and get to the heart of what truly drives value.

Net Absorption: This is the ultimate demand gauge. It simply measures the net change in occupied industrial space over time. When net absorption is positive, it means more space is being leased than vacated—a clear signal of a healthy, growing market.

Vacancy Rate: A simple but powerful number. Low vacancy gives landlords pricing power, which is just a fancy way of saying they can charge more for rent. When you see consistently low vacancy, you know you're in a strong industrial market.

Rental Growth: This is where the rubber meets the road for returns. Strong demand and low vacancy lead directly to rental growth, which boosts a property's net operating income (NOI) and, ultimately, its market value.

**Novice Lens: Why Metrics Matter**Think of these metrics as the vital signs of an industrial market. Strong absorption, low vacancy, and rising rents are like a healthy heartbeat and a steady pulse. They tell you the market is fundamentally sound and positioned to deliver strong returns.

The Insight Edge: Underwriting Industrial Deals

For serious investors, a great deal requires looking past the high-level market stats. The physical DNA of the building itself is what determines its long-term value and its ability to attract and keep high-quality tenants.

Here are a few of the underwriting factors that can make or break an industrial investment:

Clear Height: This is the usable vertical space inside a warehouse. Modern logistics tenants absolutely need high clear heights—often 36 feet or more—to stack their products efficiently with advanced racking systems.

Proximity to Transportation: It's all about location, location, location. A property’s value is directly tied to how easily it can access major highways, ports, rail lines, and airports. The easier it is to move goods, the more valuable the real estate.

Truck Court Depth & Door Count: Efficiency is everything in logistics. A deep truck court gives large semi-trailers room to maneuver easily, while a high number of dock doors prevents bottlenecks and keeps products moving quickly.

These are the details an experienced sponsor like Stiltsville Capital obsesses over. We know that a building with 32-foot clear heights might be functionally obsolete for a major e-commerce company, which could present a fantastic value-add opportunity if we can acquire it at the right price. It's this kind of deep, on-the-ground knowledge that gives us an "Insight Edge" in a very competitive market.

How To Evaluate A Real Estate Deal

This is where theory hits the pavement. Moving from an intriguing story to the nuts and bolts of the numbers is the single most important step you can take. A great narrative is nice, but a great deal is built on a solid pro forma and a crystal-clear, executable plan.

So, let's bridge that gap. We'll give you a practical framework for looking "under the hood" of any potential investment. We’ll start with a simplified example to show how value is really created, then arm you with a checklist of essential questions to ask any sponsor before you even think about committing capital.

Deal Lens: A Multifamily Value-Add Play

Let’s walk through a simplified case study to see how a value-add strategy actually works in the real world. Imagine an investment sponsor, like Stiltsville Capital, finds an older, 100-unit apartment complex built in the 1990s. It’s in a great, growing neighborhood, but it’s tired and poorly managed. The result? Rents are a full 15% below what similar, updated properties are getting.

The sponsor sees a clear path to creating new value. They acquire the property for $10 million and budget another $1.5 million for smart renovations and operational fixes.

The game plan is refreshingly straightforward:

Acquire: Buy the underperforming asset.

Renovate: Systematically upgrade the unit interiors (think new kitchens and baths), give the common areas a facelift (lobby, fitness center), and boost the property’s curb appeal.

Stabilize: Bring in professional management to drive up occupancy, cut wasteful spending, and—as units are renovated—raise rents to true market levels.

Exit: After a 5-year hold, sell the now-stabilized, higher-income-producing asset to a more conservative, long-term buyer at a lower, more attractive cap rate.

**Novice Lens: Why This Matters to You**This isn’t just about buying in a hot market and hoping for the best. It’s about a sponsor having a specific, proven playbook to force appreciation. They are actively manufacturing equity by transforming the asset, not just waiting for the market tide to lift all boats.

This simple table illustrates how this plan translates into real returns for investors by focusing on what the sponsor can directly control.

Illustrative Value-Add Deal Return Drivers

Return Driver | Base Case Assumption | Impact on Investor IRR |

|---|---|---|

Rent Growth | Increase average rents by 15% post-renovation over 24 months. | Significantly boosts Net Operating Income (NOI), directly increasing cash flow and property value. |

Expense Reduction | Implement professional management to reduce operating expense ratio by 3%. | Increases NOI by cutting waste, further enhancing cash flow and valuation. |

Exit Cap Rate | Sell at a 5.0% cap rate, a 0.50% compression from the purchase cap rate. | A lower exit cap rate on a higher NOI dramatically increases the sale price and overall return. |

The key takeaway is that a well-executed value-add strategy creates returns from multiple angles—not just market appreciation, but tangible operational improvements.

Your Actionable Investor Checklist

Before you invest a single dollar in a private real estate deal, thorough due diligence is non-negotiable. This isn’t just about checking the math; it’s about interrogating the sponsor’s strategy, their experience, and how well their interests are aligned with yours. For a complete breakdown, check out our [guide to commercial real estate due diligence, the investor's playbook](https://www.stiltsvillecapital.com/post/a-guide-to-commercial-real-estate-due-diligence-the-investor-s-playbook).

Here are the critical questions every investor needs to ask a sponsor:

Track Record: Have you successfully run this exact playbook on this property type in this specific market before? I want to see case studies—the wins and the losses.

Alignment of Interests: How much of your own money is in this deal? What's your fee structure, and is there a preferred return for us, the limited partners?

The "Why": Why is the current owner selling? What specific problem are you solving that they couldn’t or wouldn’t?

Capital Stack: What are the loan terms (loan-to-value, interest rate, maturity)? Are there extension options? How much of a "rainy day" fund is budgeted for contingencies?

Exit Strategy: What's the primary exit plan—a sale or a refinance? What are your best-case, worst-case, and most-likely scenarios for the exit cap rate? How sensitive are my returns to those numbers?

Budget & Timeline: Is the renovation budget detailed and backed by actual quotes? What are the key milestones, and what are the biggest risks for delays?

Reporting & Communication: How often will I hear from you and what will those reports look like? Who is my go-to person when I have questions?

Asking these tough questions separates passive participation from smart, active oversight of your capital. A confident, experienced sponsor will not only welcome this level of scrutiny—they’ll have clear, data-backed answers ready to go.

Navigating Investment Risks Like a Pro

Let's get one thing straight: smart investing isn't about finding a magic, risk-free formula. That doesn't exist. Real success comes from understanding the risks you’re taking, knowing how to manage them, and making sure the potential rewards are worth the ride. In the world of private real estate, every deal has its own unique set of hurdles.

Getting a clear-eyed view of these challenges is the very first step toward building a truly resilient portfolio. So let’s break down the most common risks and, more importantly, the proven strategies that experienced sponsors use to protect and grow your capital.

Understanding Key Risk Categories

In commercial real estate, you can generally sort risks into a few main buckets. Each one calls for a different game plan and a deep feel for the market's pulse.

Market Risk: This is the big-picture stuff. Think of broad economic shifts—a recession, a spike in interest rates, or a flood of new supply—that can pull down property values or rental income across an entire city or region.

Execution Risk: This one is all about the sponsor. It’s the risk that the management team just can't pull off the business plan. Maybe they lack experience, misread the market, or run into a construction nightmare. This is where a sponsor's track record is everything.

Asset-Level Risk: This is risk tied directly to the property itself. It could be a major, out-of-the-blue expense (like a total roof failure), the loss of a major tenant, or a shiny new competitor opening up across the street and stealing your renters.

For a deeper dive into these factors, check out our [guide to the types of investment risk in real estate](https://www.stiltsvillecapital.com/post/a-guide-to-the-types-of-investment-risk-in-real-estate). It breaks down exactly how each can shape an investment's final outcome.

Risk & Mitigation Table

This is where investing passively through a fund or syndication really shines—you get access to professional-grade risk management. A top-tier sponsor bakes protective layers right into the deal's DNA. Here’s how the pros tackle these challenges head-on:

RISK: Illiquidity * Private real estate isn't like a stock you can sell in seconds; it’s a long-term hold. * MITIGATION: Sponsors match the investment timeline to the strategy (like a 5-year hold for a value-add project) and communicate this clearly. They also budget a "rainy day" fund from day one to handle surprises without needing to sell at a bad time.

RISK: Leverage * Too much debt is like an anchor. It can sink a perfectly good property if income takes a temporary dip. * MITIGATION: Use conservative loan-to-value (LTV) ratios and lock in fixed-rate debt whenever possible. We also "stress-test" the numbers against higher interest rate scenarios to ensure the property can still cover its mortgage, even if the economy sours.

RISK: Sponsor * An inexperienced or misaligned partner can be the biggest risk of all. * MITIGATION: Partner with sponsors who have a long, verifiable track record in that specific property type and market. Most importantly, ensure they are co-investing a significant amount of their own cash. This creates a powerful alignment of interests—if you lose money, so do they.

Investor Takeaway: No single move can wipe out all risk. But a smart combination of conservative financial modeling, expert management, and diversification builds a powerful defense. The goal isn't to avoid risk entirely, but to get paid well for taking it on intelligently.

Your Top Questions About CRE Investing, Answered (FAQ)

Jumping into commercial real estate is exciting, but it's also a world where the details really matter. It's only natural to have a few questions before you get started.

We get asked a lot of the same things by smart investors looking to make their first move. Here are some of the most common ones, with straight-up answers to give you clarity.

What’s the smallest check I can write for a deal?

This really depends on the specific deal and the sponsor putting it together. Most investors access high-quality commercial properties through private syndications, where you pool your capital with others.

For these kinds of deals, the minimum investment usually falls somewhere between $25,000 and $100,000. By teaming up, the group can go after much larger, more stable assets that would be impossible for one person to buy alone. You'll always find the exact minimum clearly stated in the deal's official offering documents, like the Private Placement Memorandum (PPM).

How does the money actually get back to me?

When you invest in a commercial property, you get paid in two main ways. Think of it as getting a regular paycheck and then a big bonus when the project is done.

Quarterly Cash Flow: This is your slice of the property's rental income after all the bills are paid. It's the steady, predictable return you receive from the asset doing its job day-to-day, typically paid out every three months.

A Payout at the End: This is the big one. When the property is sold or refinanced for a profit, you get your share of the net proceeds. This lump sum is the reward for the value that was created through smart management and improvements over the life of the investment.

What are the big tax perks?

Commercial real estate is famous for its tax advantages, which can seriously boost your bottom-line returns. The single most powerful benefit is depreciation.

It’s essentially a "paper loss" you can claim against the property’s income, even while it’s generating positive cash flow. Sponsors often take this a step further with cost segregation studies, which accelerate depreciation to give you bigger tax write-offs in the first few years. On top of that, the interest on the property's loan is also a tax-deductible expense.

When it’s time to sell, your profits are typically taxed at lower long-term capital gains rates. Of course, you should always run this by your own tax advisor to see how it all fits into your personal financial picture.

How long until I see my capital again?

This isn't like the stock market where you can sell in a second. Private real estate is a long-term game, so you have to be comfortable with your capital being illiquid for a set period.

A typical value-add project, for instance, has a planned hold period of 3 to 7 years. That timeline gives the sponsor the room they need to execute the business plan—renovating units, raising rents, getting the property running smoothly, and then selling it at the right moment. The key is to go in knowing your capital is committed for the entire journey.

Ready to see how passive commercial real estate could work for your own wealth strategy? The best way to find out is to talk.

We believe that well-structured real assets can be a prudent, resilient component of any long-term wealth strategy. While all investments carry risk, working with an experienced sponsor focused on disciplined underwriting and alignment of interests can help mitigate those risks and unlock powerful opportunities.

[Schedule a confidential call with Stiltsville Capital](https://www.stiltsvillecapital.com) to discuss our current commercial real estate investment opportunities.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments