A Guide to Mezzanine Debt Funds for Sophisticated Investors

- Ryan McDowell

- Jul 30, 2025

- 14 min read

Reading Time: 8 min | Good for: Novice (A), Informed (B), Sophisticated (C)

A mezzanine debt fund is a pool of capital from accredited investors, specifically designed to provide high-yield, hybrid loans to companies and real estate developers. You can think of it as a strategic investment that blends the steady income of debt with the upside potential you’d normally find in equity. Its main job is to fill that critical funding gap that often exists between a traditional bank loan and the owner's own cash.

TL;DR: Key Takeaways

What It Is: A mezzanine debt fund pools investor capital to make loans that are subordinate to senior bank debt but senior to owner equity, offering a hybrid risk-return profile.

How Returns are Made: Mezzanine debt generates returns through a two-part structure: a fixed interest rate (the "coupon") for steady cash flow, and an "equity kicker" that provides a share of the project's upside.

Who It's For: These funds are designed for accredited investors and family offices seeking enhanced yield (typically targeting 10-15%+) with more downside protection than a direct equity investment.

Why It Matters Now: In a shifting credit market, mezzanine debt provides flexible, crucial capital for high-quality real estate projects that may struggle to secure 100% of their financing from traditional banks.

What Exactly Is a Mezzanine Debt Fund?

Picture a developer putting up a new luxury apartment building. The senior bank loan covers the foundation and the first few floors. The developer's own equity paid for the land and permits. But what about the middle floors? That crucial section connecting the base to the high-value penthouses needs funding, too.

This is exactly where a mezzanine debt fund comes in. It provides that "in-between" capital needed to get the project over the finish line.

These funds work by raising money from qualified investors—like family offices and high-net-worth individuals—and then lending it out across multiple projects. For investors, this diversification is key, as it spreads out the risk instead of concentrating it on a single deal. The real draw, though, is the yield. Mezzanine loans typically offer much higher returns than senior debt, often targeting 10% to 15% and sometimes even more.

The Hybrid Power of Mezzanine Debt

What makes mezzanine financing so interesting is its dual personality. It's technically debt, but it has an equity-like component baked in. This gives investors a powerful mix of consistent income and real growth potential.

The main return comes from the contractual interest rate, or "coupon." This is paid out regularly (usually monthly or quarterly) to the fund, creating a predictable cash flow stream, much like a bond. But to compensate for taking on more risk than a senior lender, mezzanine loans almost always include an "equity kicker."

The Insight Edge: The Equity Kicker The kicker is the secret sauce for unlocking higher returns. It might be warrants (the right to buy equity at a set price), a slice of the project's gross revenue, or a share in the profits when the asset is sold or refinanced. This structure aligns the mezzanine lender's interests with the project's success. If the deal does exceptionally well, the fund’s investors share in that upside, pushing their total return far beyond the fixed interest rate.

It's this unique blend of features that makes mezzanine debt such a compelling tool within the world of [commercial real estate financing options](https://www.stiltsvillecapital.com/post/a-guide-to-commercial-real-estate-financing-options-for-investors).

Mezzanine Debt at a Glance

Here's a breakdown of the core components:

Position in Capital Stack: Sits between senior debt and common equity. It is subordinate to the senior loan.

Primary Return: A fixed interest rate (coupon) paid regularly, typically 8-12%.

Secondary Return: An "equity kicker," which provides a share of the project's upside.

Typical Target Returns: 10% to 15% annually, sometimes higher depending on the deal.

Risk Profile: Higher risk than senior debt, but lower risk than a direct equity investment.

Key Advantage: Offers a balance of predictable income and potential for capital appreciation.

This structure allows mezzanine debt to carve out its own niche, offering a unique risk/return profile that you can't find in traditional debt or pure equity plays.

Where Mezzanine Debt Fits in the Capital Stack

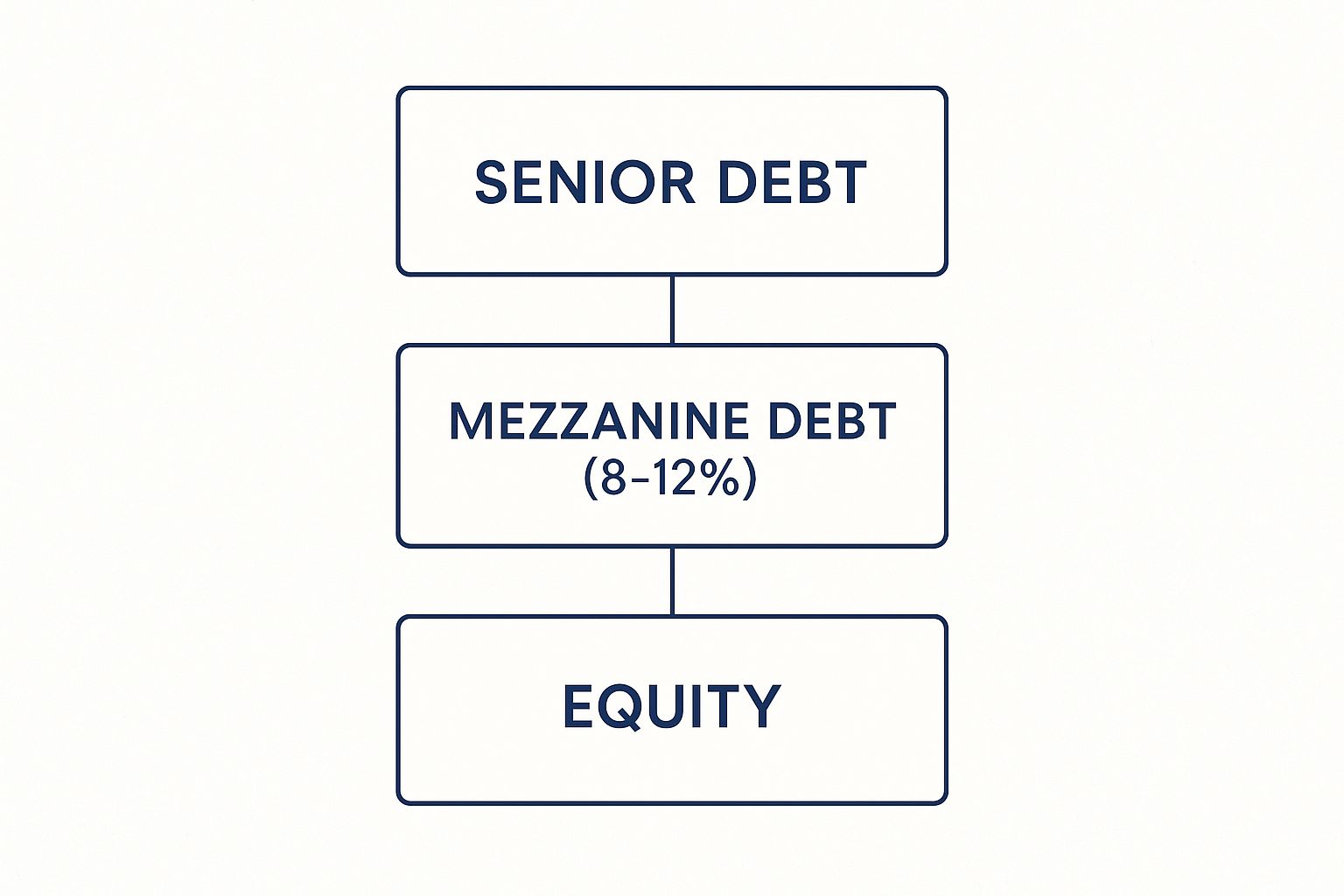

To really get a handle on mezzanine debt funds, you first have to understand where they sit in a project’s financial food chain. We call this the capital stack. Think of it as the different layers of money that get stacked together to finance a real estate deal. Each layer has its own risk profile and, in turn, its own claim on the property’s cash flow and profits.

Every dollar that goes into a project has its designated spot in this stack, from the safest bank loan down to the riskiest check written by the developer. Mezzanine debt finds its home in a unique and powerful middle ground. It sits below the main bank loan but above the equity investors, making it a critical piece of the puzzle to get a deal done.

The Three Layers of Project Finance

The capital stack is all about seniority—basically, who gets paid back first. The investors at the top of the stack are in the safest position because they have first dibs on repayment. The ones at the bottom get paid last, which is much riskier but also offers the biggest potential reward.

Here’s a quick rundown of the layers:

Senior Debt: This is the biggest, safest chunk of financing, almost always a loan from a traditional bank. Sitting at the top of the stack, it has the first claim on the property if things go south. Because it's so secure, it comes with the lowest interest rate.

Mezzanine Debt: This is the crucial layer that bridges the gap between the senior loan and the developer's equity. A mezzanine debt fund provides this capital, taking a backseat to the senior lender in exchange for a much higher return than any bank would ever consider.

Common Equity: This is the "first-loss" capital at the very bottom, put up by the project sponsor or developer. Equity holders are the last to get paid, collecting only after every debt holder is made whole. But they also get to keep all the profits left over, giving them a shot at unlimited upside.

This diagram shows exactly how a mezzanine debt fund slots into the capital stack, filling that essential gap between senior debt and sponsor equity.

As you can see, mezzanine debt’s “in-between” position perfectly reflects its risk and reward profile. It offers investors much higher yields than senior debt while providing more protection than an equity position.

Novice Lens: What is the Capital Stack? Imagine it’s a three-layer cake. The thick, sturdy bottom layer is the developer's equity. The big middle layer is the senior bank loan. But sometimes, there's a gap between those two layers. That’s where the third, smaller layer of mezzanine debt—the frosting—goes, holding the whole thing together. When it's time to eat the cake (i.e., distribute profits), the bank gets its slice first, then the mezzanine lender, and finally, the developer gets whatever is left.

The Importance of the Intercreditor Agreement

The relationship between the senior lender and the mezzanine lender isn’t just a handshake deal. It’s formalized in a critical legal document called an intercreditor agreement. This document is the official rulebook that spells out everyone's rights and responsibilities.

Sophisticated Lens: Why the Intercreditor Agreement is Non-Negotiable For serious investors, the fine print in the intercreditor agreement is everything. This document outlines "cure rights," which give the mezzanine lender the power to step in and make payments on the senior loan if the borrower defaults, preventing a messy foreclosure. It also defines standstill provisions, which stop the mezzanine lender from taking action against the borrower for a certain period, giving the senior lender time to find a solution. A well-negotiated agreement provides a mezzanine debt fund with the tools it needs to protect its capital if a project hits a rough patch.

How Mezzanine Debt Funds Generate Returns

To really get why investors are drawn to mezzanine debt funds, you have to pop the hood and look at the engine driving their returns. The appeal isn't just one thing; it's a powerful, two-part structure that gives you the steady reliability of a loan payment combined with the exciting upside you usually only get from owning equity. This unique blend is what fuels the potential for those attractive double-digit returns.

The first, most straightforward piece of the puzzle is the contractual interest rate, often called the "coupon." Think of it as the fixed interest payment the borrower makes on the loan. It's predictable, it's consistent, and it provides a steady stream of cash flow to the fund throughout the loan's term.

But the coupon is only half the story. To make up for taking on more risk by sitting behind the senior lender, mezzanine debt almost always comes with a second, more dynamic return driver: the equity kicker.

The Power of the Equity Kicker

This is where things get interesting. The equity kicker is what gives mezzanine debt its unique, hybrid character. It’s a feature that allows the fund to share in the project's financial success, perfectly aligning our interests with the borrower's. When they win, we win.

This kicker can show up in a few different ways:

Warrants: The right to buy a certain number of shares in the property-owning entity at a pre-set price down the road.

Profit Sharing: A straightforward agreement that gives the fund a slice of the project's net profits when it's sold or refinanced.

Revenue Participation: A small piece of the property’s gross revenue over the life of the loan.

This two-pronged approach—steady cash flow from the coupon plus a share of the upside from the kicker—is the core mechanism that allows a mezzanine debt fund to target returns that significantly outperform traditional debt instruments.

This structure is tailor-made for the timelines of most commercial real estate projects. Typical loan terms for mezzanine debt run from three to seven years, which lines up perfectly with the holding period for a value-add renovation or a ground-up development.

Benchmarking Performance in Private Credit

When you look at the historical performance, the appeal of mezzanine debt becomes even clearer. According to the recent KPMG Private Debt Fund Survey (published January 2024), private debt funds continue to demonstrate strong performance, with a significant majority of managers meeting or exceeding their target net IRR. This consistent performance is a major reason why sophisticated investors and family offices keep allocating capital to this space.

By understanding both the debt and equity components, you can see how a mezzanine debt fund can be a powerful addition to a diversified portfolio. For those looking to go deeper, our [guide to commercial real estate private equity](https://www.stiltsvillecapital.com/post/a-guide-to-commercial-real-estate-private-equity-building-generational-wealth) offers more insights into building wealth with disciplined real estate strategies.

Deal Lens: A Mezzanine Debt Case Study

Theory is one thing, but to really grasp how powerful a mezzanine debt fund can be, you need to see it in action. Let’s walk through a simplified, illustrative deal to show you how the pieces fit together on a real project. We'll use round numbers to keep the mechanics crystal clear.

Imagine an experienced developer has a great site for a new 200-unit multifamily community. The all-in project cost is $50 million. The developer has a solid track record and a great plan, but they need to line up the funding to break ground.

Setting the Scene: The Funding Gap

First, the developer goes to a traditional bank and secures a senior construction loan for $30 million. That’s 60% of the total project cost. The bank is comfortable with this because they have the first-priority claim on the property if anything goes wrong.

The developer is bringing their own money to the table, too—$10 million in equity, which is 20% of the total cost. This is their "skin in the game," the first money that would be lost, proving their commitment to making the project a success.

But do the math. There’s still a $10 million funding gap ($50M total cost - $30M senior debt - $10M equity = $10M gap). Without that final piece of financing, this promising project is dead in the water.

The Mezzanine Debt Fund Solution

This is where a mezzanine fund comes in. Instead of trying to raise more equity and dilute their ownership, the developer partners with a firm like Stiltsville Capital. Our fund provides the crucial $10 million loan that bridges the gap and completes the financing package.

Our investment is structured to generate returns in two different ways:

A Current-Pay Coupon: The loan comes with an 11% annual cash interest rate. This gives our fund's investors a steady, predictable income stream, usually paid out quarterly.

An Equity Kicker: In exchange for taking a riskier position behind the bank, our fund also gets a 5% share of the project’s future profits. This "kicker" aligns our interests perfectly with the developer's.

Illustrative Deal Structure: $50M Multifamily Development

Senior Debt: $30,000,000 (1st Position, Safest)

Mezzanine Debt Fund: $10,000,000 (2nd Position, Middle)

Developer Equity: $10,000,000 (3rd Position, First-Loss)

This layered capital stack allows the project to move forward.

Tracing the Project to a Successful Exit

Fast forward three years. The project is built and stabilized. Over that time, our mezzanine fund has already received $3.3 million in cash interest payments ($10M x 11% x 3 years).

The apartment community is a hit. It’s fully leased at strong market rents, and the developer gets an attractive offer to sell the property for $70 million.

Here’s how the money flows when the deal closes:

First, the senior lender gets paid back their $30 million principal. They're made whole first.

Next, our mezzanine fund gets its $10 million principal back.

That leaves a total profit of $30 million ($70M sale price - $30M senior debt - $10M mezz principal).

From this profit pool, our fund receives its 5% equity kicker, which comes out to $1.5 million ($30M profit x 5%). The remaining $28.5 million goes straight to the developer and their equity partners as their reward.

For our fund, the total return from this one deal is $4.8 million—that’s the $3.3M in interest plus the $1.5M profit share—on a $10 million investment over three years. This is a perfect example of how mezzanine debt helps a great developer bring their vision to life while delivering a compelling, hybrid return for investors.

Evaluating Risks and Sponsor Mitigation Strategies

While a mezzanine debt fund can offer compelling returns, any disciplined investor knows that reward always comes with risk. The key is understanding these risks—and more importantly, how a top-tier sponsor actually mitigates them. At its heart, mezzanine investing is all about taking calculated risks that a seasoned manager can actively get their arms around and contain.

By partnering with the right sponsor, you gain confidence that these challenges are being tackled head-on through rigorous underwriting and strong legal protections.

Risk & Mitigation Table

Risk: Subordination Risk * Mitigation: The investment is subordinate to senior debt, but a cushion of developer equity sits below it to absorb initial losses. A skilled sponsor negotiates strong intercreditor agreements with cure rights to protect the fund's position.

Risk: Project Execution Risk * Mitigation: An experienced sponsor conducts deep due diligence on the developer's track record and the project's feasibility. They stress-test financials and monitor progress closely, ready to step in if needed.

Risk: Market Risk * Mitigation: Sponsors mitigate this by underwriting conservatively with downside scenarios for interest rates, rent growth, and exit values. Diversifying the fund's investments across geographies and property types also reduces concentration risk.

Even with these risks, the appetite for this kind of financing is growing. The global mezzanine finance market is expected to grow at a healthy clip—around 7.88% annually—and hit a market size of roughly USD 420.79 billion by 2034, fueled by the growing need for flexible capital, according to [this market research report](https://www.marketresearchfuture.com/reports/mezzanine-finance-market-24034).

A sponsor’s real value shines through not just in finding great deals, but in protecting capital when challenges pop up. Experienced managers use a multi-layered defense to fence in the inherent risks of mezzanine lending. While mezzanine debt is riskier than a senior loan, it is structurally different and often considered more secure than [preferred equity in real estate](https://www.stiltsvillecapital.com/post/what-is-preferred-equity-a-guide-for-real-estate-investors), which sits even lower in the capital stack.

Investor Checklist: 8 Questions to Ask a Mezzanine Fund Sponsor

Choosing a mezzanine debt fund isn't like picking a stock; it's about finding the right partner. The single most critical factor for your success will be the quality, discipline, and experience of the fund manager (the sponsor). Before you commit capital, your due diligence should be an intense look at the team you're trusting.

A top-tier manager will welcome this scrutiny and provide transparent, detailed answers.

Probing Track Record & Expertise

1. Can you provide a detailed, loan-by-loan track record for all prior mezzanine investments, including both wins and losses?

2. What’s your team’s direct experience managing loans through a downturn? Can you walk me through a specific workout scenario?

3. How many of your past mezzanine deals involved the same property type and strategy you're targeting in this new fund?

Understanding Underwriting and Risk Management

4. Walk me through your underwriting process. What are your non-negotiable criteria for a borrower and a project?

5. How do you stress-test your assumptions for interest rates, exit cap rates, and lease-up velocity?

6. What specific legal protections, like cure rights and foreclosure rights on the equity, do you negotiate to protect our position?

Ensuring Alignment of Interests

7. How much of the General Partner's own capital is invested in this fund on the same terms as the Limited Partners ("skin in the game")?

8. Can you explain the fund's fee structure and profit-sharing waterfall in simple terms?

Armed with these questions, you can cut through the marketing fluff and conduct the rigorous due diligence needed to select a first-rate mezzanine debt fund sponsor.

FAQ: Your Mezzanine Debt Fund Questions Answered

Even after getting the big picture, it’s natural to have a few lingering questions about how mezzanine debt works in the real world. Think of this as the final walkthrough. Let's tackle some of the most common questions we hear from investors to make sure everything is crystal clear.

Is Mezzanine Debt Just a Fancy Term for a Second Mortgage?

Not at all, and the distinction is absolutely critical. While both sit behind a senior loan in the payback line, how they are secured is fundamentally different.

A second mortgage places a direct lien on the property itself. Mezzanine debt, on the other hand, is secured by a pledge of the ownership interests in the company that owns the real estate.

Why this matters: This structure allows the mezzanine lender to foreclose on the ownership and take control of the project far more quickly if things go south. It’s a cleaner, more efficient process that offers a powerful layer of protection for investor capital compared to the long, messy process of a traditional property foreclosure.

What’s the Typical Buy-In for an Investment?

These aren't your everyday investment opportunities; they are typically structured for accredited and institutional investors. You won’t find these on a public exchange.

It's common to see minimums starting around $100,000 and going up to $1 million or more, depending on the fund's size and who it’s designed for. To get the exact numbers and verify suitability, you'll always need to review the fund's private placement memorandum (PPM), the official legal document that lays out all the details.

How Quickly Can I Get My Money Out of a Mezzanine Debt Fund?

Like most private market deals, an investment in a mezzanine debt fund is considered illiquid. This is a core feature of the asset class, not a drawback, and something every investor needs to be comfortable with from the start.

Your capital is generally committed for the entire life of the fund, which can be anywhere from 5 to 10 years, matching the timelines of the underlying real estate projects. You’ll receive cash distributions as loans get repaid or properties are sold, but you can't just sell your shares on a whim like a public stock.

Why It Matters: The "Illiquidity Premium" This illiquidity is a feature, not a bug. It's a huge part of why these funds can generate premium returns. You are being rewarded for providing stable, long-term capital that a project can rely on to execute its business plan.

At Stiltsville Capital, we believe well-structured real assets can be a prudent, resilient component of a long-term wealth strategy. We specialize in bringing institutional-quality real estate opportunities to accredited investors, backed by disciplined underwriting and a hands-on management approach. If you’re ready to see how specialized strategies like mezzanine debt could enhance your portfolio, we invite you to connect with us.

**Disclaimer:** Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments