A Guide to Private Equity Real Estate Investing

- Ryan McDowell

- Aug 12

- 12 min read

Reading Time 8 min | Good for: Novice Investors (A), Family Offices (B)

At its core, private equity real estate investing is about partnership. A specialized investment firm, known as a sponsor or general partner (GP), pools capital from accredited investors and family offices. This collective buying power provides access to acquire, improve, or develop commercial properties that would be too large or complex for a single investor to tackle alone.

TL;DR: Key Takeaways

What it is: Partnering with an expert firm (a sponsor) to invest in large-scale commercial real estate deals typically inaccessible to individual investors.

How it works: Sponsors use investor capital to execute a specific business plan—like renovating an apartment complex—to increase its value and generate returns.

Why it matters now: A capital gap left by traditional banks and a slowdown in new construction are creating unique opportunities for private investors with ready capital.

What Is Private Equity Real Estate Investing?

Imagine a world-class chef (the sponsor) has a vision for a spectacular new restaurant. Opening it requires a prime location and a top-of-the-line kitchen—a significant upfront cost. Instead of funding it all themselves, they invite a select group of patrons (the investors) to contribute capital. The chef then uses their expertise to find the perfect spot (the property), design the menu and run the kitchen (execute the business plan), and ultimately, create a wildly successful restaurant where everyone who backed the vision shares in the profits.

This model is a world away from buying shares in a publicly traded Real Estate Investment Trust (REIT). While REITs are liquid, they trade like stocks and are subject to the daily whims of the public market. Private equity real estate, conversely, is a direct investment in a physical building with a hands-on team dedicated to a specific business plan, insulating it from stock market volatility.

How We Create Value: A Hands-On Approach

The real magic of private equity real estate is active management. This isn't about buying a property and hoping the market goes up. The sponsor takes direct control of the asset to force appreciation through strategic improvements.

This hands-on work often includes:

Physical Renovations: Giving apartment units a modern facelift, upgrading a dated office lobby, or adding sought-after amenities like a new gym or resident lounge.

Smarter Operations: Bringing in a superior management team, cutting utility costs with ESG-focused green upgrades, or renegotiating service contracts to boost the bottom line.

Strategic Repositioning: Rebranding a tired property, shifting its use to meet new demand (like converting retail to medical office), or attracting higher-quality tenants to drive significant rent growth.

This direct involvement is the key differentiator. You’re not just buying a stock ticker; you’re backing a team with a clear, actionable plan to improve a specific property's performance. For a deeper look at finding the right partner, review our **guide to private equity real estate firms and their strategies**.

Private Equity Real Estate vs. Public REITs

While both offer exposure to real estate, the experience and potential outcomes are vastly different. Here’s a quick breakdown of the key distinctions:

Control: * Private Equity: Direct control by the sponsor to execute a specific business plan. * Public REITs: Passive ownership with no direct influence on property-level decisions.

Liquidity: * Private Equity: Illiquid; capital is typically locked up for 5-10 years. * Public REITs: Highly liquid; shares can be bought and sold daily on public exchanges.

Volatility: * Private Equity: Lower volatility, insulated from daily public market swings. * Public REITs: High volatility, with prices fluctuating alongside the broader stock market.

Valuation: * Private Equity: Based on property-level performance and periodic third-party appraisals. * Public REITs: Based on public market sentiment and daily trading (Net Asset Value).

Investor Access: * Private Equity: Typically limited to accredited investors and institutions. * Public REITs: Open to any investor with a brokerage account.

The choice depends on your portfolio goals. REITs offer convenience and liquidity, while private equity provides an opportunity to partner directly with experts, sidestep public market volatility, and pursue higher, value-driven returns.

Novice Lens: Why It Matters for YouIf you’re looking to diversify beyond the stock market, private equity real estate is your ticket to institutional-quality deals. It’s a powerful way to add tangible assets to your portfolio that can act as a hedge against inflation, offer significant tax benefits, and generate returns that don't rise and fall with the S&P 500. You get a seat at a table typically reserved for the biggest players, with a professional team managing the entire process for you.

The Market Why-Now: Why Private Equity Real Estate Is Compelling

In a market buzzing with volatility, sophisticated investors are looking past the headlines. Success in today's private equity real estate investing isn't about timing the market; it’s about understanding powerful structural shifts. A key trend is the retreat of traditional banks from certain commercial real estate loans, creating a significant opportunity for private capital to fill the void.

Market Signal Box (Q3 2024)* The Data Point: A financing gap estimated at $150 billion annually has emerged in U.S. and European commercial real estate as traditional lenders tighten standards.* Our Interpretation: This isn't a crisis—it's a realignment. Private capital is now in a prime position to negotiate more favorable terms on new deals.* Investor Take: Sponsors with ready capital can structure deals with better risk-adjusted returns, securing debt-like safety with equity-like upside.

This capital scarcity also means less competition for high-quality assets. Firms with strong industry relationships can acquire properties at more sensible prices, creating a better entry point and a clearer path to value creation.

Favorable Supply and Demand Fundamentals

It’s not just about the capital markets. The physical real estate market itself has powerful forces at play, especially in high-demand sectors like multifamily and industrial. After several years of active development, new construction is slowing significantly.

According to research from JLL and other market analysts, multifamily construction is expected to drop by as much as 30% year-over-year in 2025, with new industrial supply projected to fall by around 50%. For more context, see the global real estate trends from JLL's market perspectives.

This emerging scarcity makes existing, well-located buildings much more valuable. When fewer new properties are built, demand naturally flows to what’s already there, pushing up occupancy and supporting strong rent growth. This combination of capital market dislocations and classic supply-demand fundamentals makes now a compelling time to partner with experienced sponsors.

How Sponsors Create Value and Generate Returns

In private equity real estate, a sponsor doesn't just buy a building and cross their fingers. Their job is to execute a specific, well-thought-out business plan to actively create value. This process turns a good property into a great investment.

Every deal lands somewhere on a spectrum of risk and reward. Understanding where a deal fits is key to ensuring it aligns with your portfolio goals.

The Three Core Strategies

Nearly every private equity real estate deal falls into one of three main categories, each with a distinct risk profile and return target.

Core/Core-Plus: These are the most conservative strategies. A Core investment is a high-quality, fully leased property in a prime location, focused on generating stable cash flow from rent. Core-Plus involves minor upgrades to an already strong asset to achieve a modest boost in rent or efficiency.

Value-Add: This is the sweet spot for many investors. A Value-Add strategy targets properties with good "bones" but correctable flaws, such as outdated finishes, poor management, or below-market rents. The sponsor implements a plan to fix these issues—renovating units, adding amenities, or installing professional management—to drive up income and "force" the property’s value higher.

Opportunistic: These are the most aggressive strategies, carrying the highest risk but also offering the highest potential returns. Opportunistic deals often involve ground-up development, major redevelopments, or converting a building's use (e.g., an old warehouse into loft apartments).

The Return Driver Stack

Returns in real estate are built from a combination of factors that stack on top of each other.

Income (Cash Flow): The bedrock of any return, this is the net income the property generates from rent after paying all operating expenses.

Value Creation (Forced Appreciation): This is where the sponsor’s direct actions pay off. By renovating, improving operations, and boosting the Net Operating Income (NOI), the sponsor makes the property fundamentally more valuable.

Market Appreciation: This is the tailwind from a rising market. While helpful, sophisticated sponsors never rely on market appreciation alone to make a deal successful.

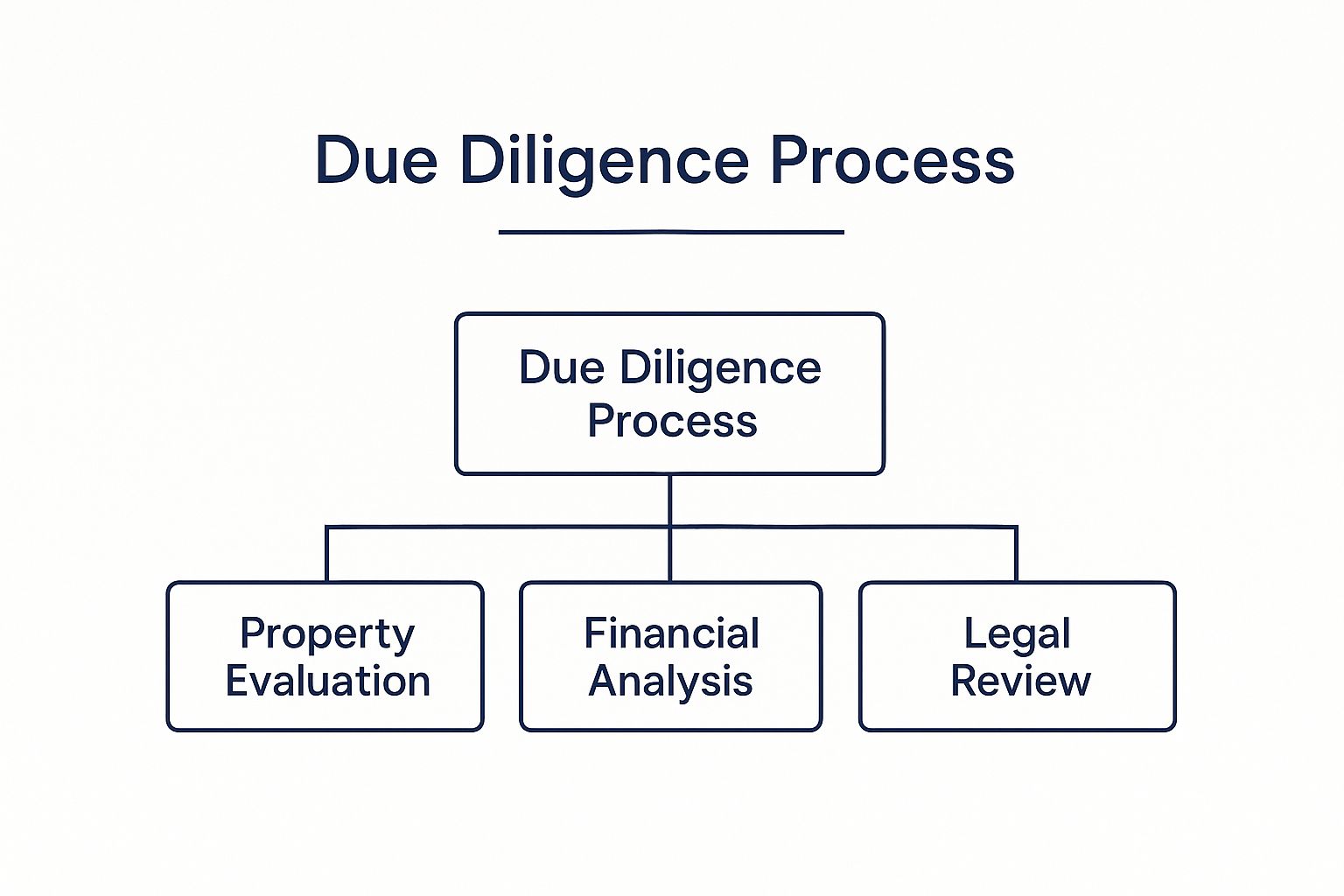

The image below breaks down the key stages of a sponsor's due diligence process, which is critical for figuring out where and how they can create this value.

A rigorous due diligence process is the foundation of any successful private equity real estate investment.

Novice Lens: IRR, Cap Rate, and Equity Multiple ExplainedYou'll encounter these terms frequently. Here’s what they mean in plain English:* Internal Rate of Return (IRR): The annualized rate of return on your investment over its entire life. An 18% IRR means your money grew at an average of 18% per year.* Capitalization (Cap) Rate: A property's annual net operating income divided by its price. A 5% cap rate means the property generates net income equal to 5% of its value each year. Lower cap rates typically signify higher-quality, lower-risk assets.* Equity Multiple (EM): The total cash you get back divided by the total cash you put in. An equity multiple of 2.0x means you doubled your money.

Advanced Lens: The GP/LP WaterfallIn most deals, profits are split using a "waterfall" structure to align interests. First, the Limited Partners (LPs, the investors) receive a preferred return (e.g., the first 8% of profits). After this hurdle is met, remaining profits are split between the General Partner (GP, the sponsor) and the LPs. The GP's share (the "promote") often increases as the deal hits higher return targets, incentivizing outperformance.

Deal Lens: A Value-Add Multifamily Example (Illustrative)

Let's walk through a simplified case study of a classic value-add apartment deal to see how a sponsor's strategy creates returns for investors.

The Acquisition and Business Plan

Our sponsor, Stiltsville Capital, identifies "The Veridian," a 200-unit apartment complex from the 1990s. The property is in a growing submarket but is held back by dated interiors and subpar management, with rents 15% below market rate.

Here’s the initial deal structure:

Purchase Price: $30,000,000

Renovation & Reserve Budget: $2,000,000

Total Project Cost: $32,000,000

Capital Stack: * Bank Loan (Debt): $22,400,000 (70% Loan-to-Cost) * Investor Equity (LP Capital): $9,600,000

The sponsor's business plan is clear: execute a focused value-add strategy over a four-year hold period to systematically increase the property’s Net Operating Income (NOI).

The playbook includes:

Renovating 150 units with modern finishes like new flooring, stainless steel appliances, and quartz countertops.

Upgrading common areas by adding a dog park, a modern package locker system, and a refreshed fitness center.

Installing professional, tech-enabled property management to improve operations and resident experience.

Novice Lens: What is Net Operating Income (NOI)?Think of NOI as a property's gross profit. It’s all the income a property generates (primarily rent) minus all necessary operating expenses (like taxes, insurance, and maintenance), but before mortgage payments. A higher NOI makes a property more valuable—it's that simple.

Executing the Plan and Driving Value

Over the next three years, the sponsor executes the plan. Renovated units lease quickly, achieving an average rent premium of $300 per month. The new amenities and sharper management not only justify higher rents but also improve tenant retention.

Let's look at the impact on the bottom line:

NOI at Acquisition (Year 1): $1,500,000

NOI at Stabilization (Year 4): $2,025,000 (a 35% increase)

This income growth was the direct result of executing the value-add plan. The property is now a far more desirable—and profitable—asset. This happens as the broader market shows strength. According to Adams Street Partners' 2025 survey, many family offices are increasing allocations to private markets, creating a strong buyer pool. You can read the detailed 2025 investor survey from Adams Street Partners.

The Successful Exit

In year four, with the property stabilized and operating efficiently, the sponsor decides it's the right time to sell. Thanks to the significantly higher NOI, buyers are attracted to the high-quality, cash-flowing asset.

The Veridian sells for $40,500,000.

Let's break down the final math:

Sale Price: $40,500,000

Loan Payoff: ($22,400,000)

Gross Proceeds: $18,100,000

Return of Initial Investor Equity: ($9,600,000)

Total Profit for Distribution: $8,500,000

This $8.5 million profit, plus any cash flow distributed during the hold period, is then split between the LP investors and the GP sponsor according to the waterfall structure. For the LPs who invested the initial $9.6 million, this outcome represents a successful execution of a value-add strategy.

Your Essential Due Diligence Checklist

A great property isn't enough; success hinges on the sponsor leading the charge. Before committing capital, asking tough questions is crucial. This checklist helps you vet the sponsor, the strategy, and the alignment of interests.

Questions to Ask a Sponsor

The Sponsor and Their Track Record

Who are the key principals, and what is their direct experience with this specific asset class and strategy? (You want a team with a proven playbook).

Can you provide a full, deal-by-deal track record of all past investments, including both wins and losses? (Transparency is non-negotiable).

How much of your own capital are you and the other principals investing in this deal on the same terms as LPs? (Look for significant "skin in the game," typically 5-10% of the required equity).

The Deal and Underwriting Assumptions

What are your key assumptions for rent growth, exit cap rate, and expense inflation? How do these compare to third-party market data? (Overly optimistic assumptions are a red flag).

What does the capital stack look like? Who is the lender, what are the loan terms, and is the debt non-recourse to investors? (Conservative, long-term financing provides flexibility).

What are the primary risk factors for this deal, and what are your specific mitigation strategies for each? (A good sponsor has a clear plan for what could go wrong).

For more on this topic, see our **guide to commercial real estate due diligence**.

Understanding and Mitigating Investment Risks

In private equity real estate, sharp investors know that risk and reward are two sides of the same coin. Acknowledging and planning for potential headwinds is the hallmark of a disciplined, institutional-grade strategy. The most successful investors partner with sponsors who have a clear, battle-tested plan to manage risk. A frank discussion of potential pitfalls is a sign of expertise, not weakness.

Common Risks and Smart Mitigation

Every investment carries risk. The key is to ensure those risks are identified, understood, and proactively managed. Here is a breakdown of primary risks and the mitigation strategies that experienced sponsors employ.

Risk: Illiquidity * Why it Matters: Your capital is locked in for several years (typically 3-7 years), so you cannot access it on demand. * Mitigation Strategy: The sponsor provides a clear business plan with a defined hold period and exit strategy, creating a predictable timeline for liquidity.

Risk: Market Downturn * Why it Matters: A broad economic recession or rising interest rates can negatively impact property values and rental demand. * Mitigation Strategy: The sponsor uses conservative underwriting based on realistic market data and targets assets with strong, in-place cash flow to weather volatility.

Risk: Execution Failure * Why it Matters: The sponsor might not execute the business plan as promised, such as failing to complete renovations on time and on budget. * Mitigation Strategy: Partnering with a sponsor who has a proven track record of executing the same strategy on similar properties dramatically reduces operational risk.

Risk: Leverage (Debt) * Why it Matters: While debt can amplify returns, excessive leverage can lead to foreclosure if the property underperforms. * Mitigation Strategy: Using moderate leverage (typically under 75% Loan-to-Value) and securing favorable, long-term loan agreements provides a crucial safety buffer.

By tackling these potential issues head-on, a sponsor demonstrates foresight and a genuine commitment to capital preservation. To learn more, explore our detailed **guide to the types of investment risk in real estate**.

Got Questions? We Have Answers (FAQ)

Jumping into private equity real estate can feel like learning a new language. Here are answers to some of the most common questions.

How do I qualify to invest in these deals?

Most private real estate offerings are available to Accredited Investors, as defined by the U.S. Securities and Exchange Commission (SEC). This designation is for individuals with the financial experience to understand and manage the risks of private investments. You generally qualify if you meet one of these criteria:

Income: An individual annual income over $200,000 (or $300,000 combined with a spouse) for the past two years, with the same expectation for the current year.

Net Worth: A net worth exceeding $1 million, individually or with a spouse, excluding the value of your primary residence.

What are the typical fees involved?

The fee structure is designed to align the sponsor’s interests with yours. The classic "2 and 20" model is common:

Management Fee (the "2"): An annual fee, typically 1-2% of invested equity, to cover the sponsor's operational oversight, asset management, and reporting.

Performance Fee (the "20"): Also called a "promote" or "carried interest," this is the sponsor's share of profits. Crucially, it only kicks in after investors have received a pre-agreed-upon "preferred return" (e.g., 6-8% annually). This incentivizes the sponsor to exceed performance targets.

What is the typical minimum investment?

Minimum investment amounts vary widely depending on the sponsor and the deal size. For institutional-grade offerings, minimums typically range from $50,000 to $1,000,000.

How long is my capital committed?

Private equity real estate is a long-term investment. Capital is illiquid, meaning it is committed for the duration of the project. For a typical value-add strategy, expect a hold period of 3-7 years. It is essential that this timeline aligns with your personal financial plan, as you cannot withdraw funds until the property is sold or refinanced.

Take the Next Step

Private equity real estate offers a compelling path to build long-term wealth through tangible assets, sheltered from public market volatility. When structured correctly and led by a disciplined sponsor, it can be a prudent and resilient component of a diversified portfolio.

If you are an accredited investor interested in learning more about how passive real estate allocations can fit into your wealth strategy, we invite you to take the next step.

Schedule a confidential call with Stiltsville Capital to discuss your investment goals.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments