A Guide to Private Equity Real Estate Firms: Strategies & Insights for Investors

- Ryan McDowell

- Aug 11, 2025

- 13 min read

Reading Time 8 min | Good for: Novice (A), Informed (B)

Imagine you want to invest in large-scale real estate—like apartment buildings or office complexes—but don't have the time, connections, or massive capital to do it alone. What if you could partner with a world-class team to find, buy, upgrade, and manage these properties for you, then sell them for a profit?

That's the core function of a private equity real estate (PERE) firm. These specialized investment managers pool capital from accredited investors to acquire and improve commercial properties that are typically out of reach for individuals.

TL;DR: Key Takeaways

What PERE Firms Do: They act as expert partners (General Partners) who raise capital from investors (Limited Partners) to buy, manage, and sell commercial real estate, aiming to generate returns through hands-on value creation.

How They Create Value: Returns come from a mix of steady rental income, "forced" appreciation through strategic renovations and operational improvements, and the smart use of leverage to magnify gains.

Who Should Care: This guide is for high-net-worth individuals, family offices, and anyone looking to diversify their portfolio into tangible, private-market assets that offer a potential hedge against inflation and a different risk/return profile than public stocks.

Next Step: Understand the key strategies firms use and the critical questions you must ask a sponsor before committing capital.

What Are Private Equity Real Estate Firms?

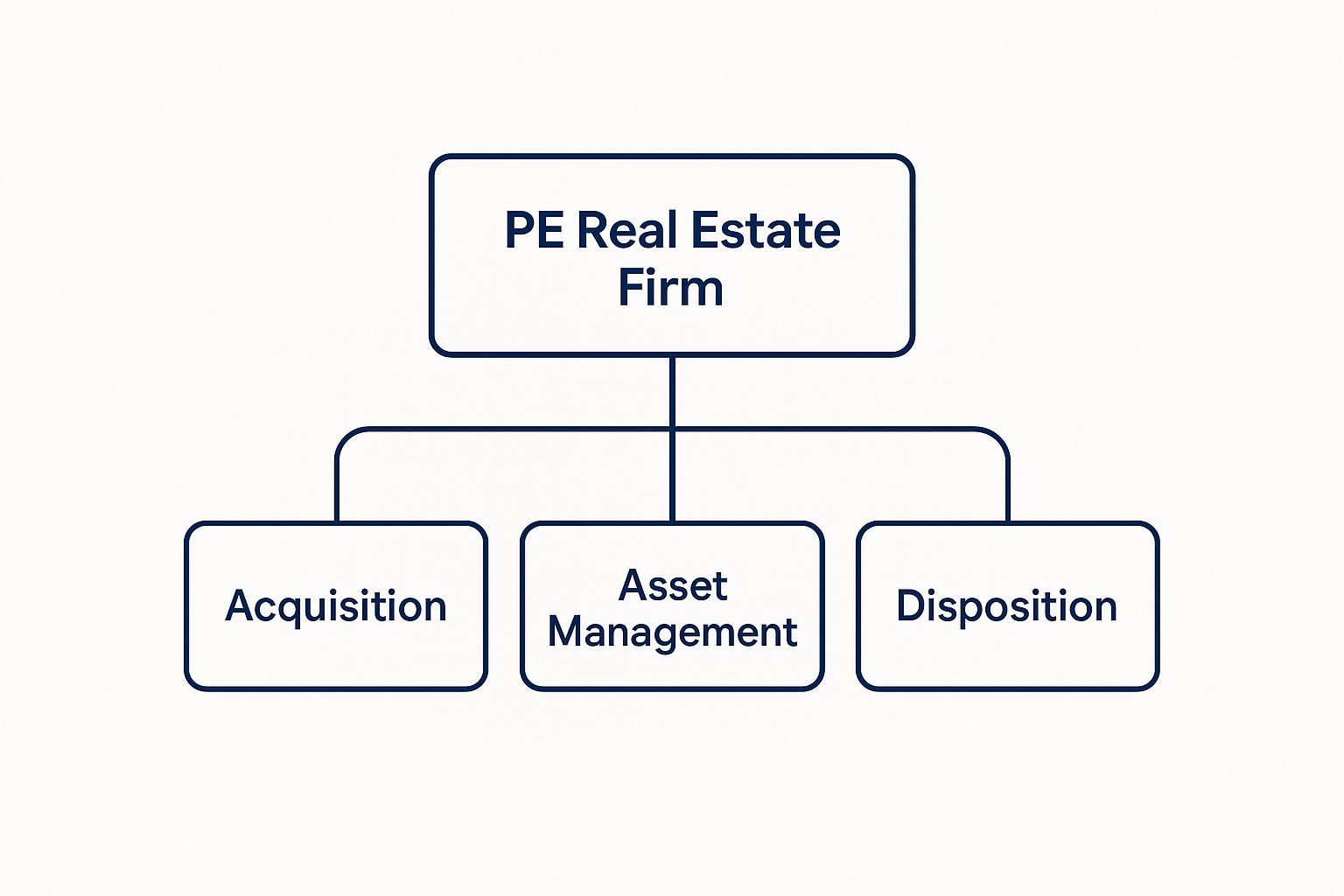

At its heart, a PERE firm is both an investment manager and a hands-on operator. They raise capital from private investors to buy, manage, and eventually sell real estate assets. This is very different from buying a publicly traded Real Estate Investment Trust (REIT) on the stock market. PERE firms operate in the private markets, offering exclusive, direct access to property investments.

The entire business model is built around a partnership designed for focused execution and aligned interests.

The General Partner and Limited Partner Structure

The most common setup you'll see is a Limited Partnership (LP). This structure clearly defines everyone's roles and creates a powerful relationship between the firm and its investors.

The General Partner (GP): This is the PERE firm itself, like Stiltsville Capital. The GP is the active, boots-on-the-ground manager handling everything from sourcing deals and performing due diligence to overseeing the property and planning the final sale. They also invest their own money, ensuring they have "skin in the game."

The Limited Partners (LPs): These are the passive investors, often family offices or high-net-worth individuals, who provide the capital for a fund or a specific deal. Their liability is typically limited to their investment amount, and they trust the GP's expertise to deliver returns.

The Fundamental Purpose of a PERE Firm

The main goal of a private equity real estate firm is to create significant value where it didn't exist before. They aren't just landlords collecting rent checks. They are active value-creators who drive profits through smart, strategic improvements. This is a key concept we explore in our **guide to commercial real estate private equity**, which details how this approach can build long-term wealth.

A PERE firm's true mission is to unlock a property's hidden potential. This could mean renovating a dated apartment complex to justify higher rents, repositioning a retail center with a more attractive tenant mix, or even developing a brand-new data center to meet modern demand.

This value-add process is anything but random. Firms hunt for underperforming assets—properties that might be poorly managed, need a cash infusion, or are located in an up-and-coming area. By injecting capital and operational expertise, they work to boost the property’s net operating income (NOI) and, in turn, its total market value. After a typical holding period of 5-10 years, the GP sells the now-stabilized, more valuable asset, generating a profit for both themselves and their Limited Partners.

How PERE Firms Make Money for Their Investors

Private equity real estate firms don't just buy a building and hope its value goes up. They operate like hands-on business owners, actively finding ways to increase a property's income and force its value higher. For investors, understanding this active, deliberate process is key to seeing why this model works.

The returns you see as an investor, or Limited Partner (LP), come from a powerful combination of three financial engines working together.

Consistent Rental Income (Current Yield): This is the cash left over after paying all the bills each month. A sharp PERE firm doesn't just collect rent; they find ways to grow it. That might mean bringing in better management, filling vacant units, or making smart upgrades that justify higher rents.

Forced Property Appreciation: This is the increase in the property's market value over time. A PERE firm manufactures appreciation. By renovating units, adding in-demand amenities, or getting the property rezoned for a better use, the firm directly pushes the value upward, leading to a big payoff at sale.

Strategic Use of Leverage: PERE firms almost always use a mortgage to buy properties, which magnifies the returns on the cash invested. By using 70% debt for a purchase, investors only have to put in 30% of the total cost, yet they benefit from 100% of the property’s growth. While this boosts gains, it also adds risk, which is why a firm’s experience is so important.

Novice Lens: Key Metrics Explained If you're new to real estate investing, the jargon can feel overwhelming. Here’s what you need to know: * Internal Rate of Return (IRR): Think of this as the annualized rate of return on your investment, considering the timing of cash flows. A higher IRR is better because it means you're making your money back faster. * Equity Multiple (EM): This simple metric tells you how many times you got your original investment back. An EM of 2.0x means for every $1 you put in, you got $2 back. * Capitalization (Cap) Rate: This is a snapshot of a property's profitability if you bought it with all cash (NOI ÷ Price). When selling, a lower cap rate means a higher sale price.

Fees, Splits, and the "Waterfall"

To ensure everyone is pulling in the same direction, private equity firms use a compensation structure often called "2 and 20." It’s designed to reward the firm, or General Partner (GP), for delivering strong performance. The structure includes a management fee to cover operational costs and a performance fee, known as carried interest or "the promote," which the GP only earns after investors get their capital back plus a preferred return.

For experienced investors, the critical element is the distribution waterfall. This is a tiered payout system that dictates exactly who gets paid and when, providing a crucial protection for investors.

Return of Capital: First, 100% of all distributable cash goes to investors (LPs) until they have received their entire original investment back.

The Preferred Return: Next, LPs continue to receive 100% of cash flow until they’ve earned a pre-agreed minimum annual return, often 6-8%. This is the hurdle the deal must clear before the GP shares in profits.

The GP Catch-Up & Final Split: After the LPs have their capital and preferred return, profits are split between the investors and the firm, most commonly an 80/20 split, with 80% going to the LPs and 20% to the GP.

Fee Type | Typical Range | What It Covers |

|---|---|---|

Asset Management Fee | 1% - 2% Annually | An ongoing fee, usually based on invested equity, covering the sponsor's operational overhead—salaries, office costs, and the day-to-day work of overseeing the asset. |

Acquisition Fee | 0.5% - 1% of Purchase Price | A one-time fee paid at closing for sourcing, underwriting, and successfully acquiring the property. |

Carried Interest ("Promote") | 20% of Profits | The sponsor's performance bonus. It's their share of the profits after investors have received their capital back plus the preferred return. This is the key alignment mechanism. |

Preferred Return Hurdle | 6% - 8% Annually | Not a fee, but a minimum return threshold that must be paid to investors before the sponsor can earn their carried interest. |

This structure is built on alignment: the PERE firm gets paid for doing the work (management fees) and gets rewarded handsomely for delivering excellent results (the promote).

Key Investment Strategies Top Firms Use

Private equity real estate firms execute specific strategies designed to hit clear risk and return targets. Understanding these strategies is like knowing the difference between a safe government bond and a high-growth tech stock—each plays a different role in a portfolio.

The main approaches fall along a risk-return spectrum. With each step up, the potential reward gets bigger, but so do the complexity and risk.

The Four Primary Strategies

Top firms usually build their reputation around one or more of these four core approaches.

Core: The most conservative play. It involves buying high-quality, fully leased, stable buildings in top-tier locations. The goal is steady, predictable cash flow. Leverage is low (typically <60%), and target returns are in the 7-10% range.

Core-Plus: A step up from Core, these properties are generally high-quality but have a manageable flaw, like minor deferred maintenance or near-term lease expirations. The strategy is to make light improvements to increase rental income and property value.

Value-Add: This is where many PERE firms excel. Value-Add strategies focus on underperforming properties that need significant capital and operational expertise. The classic example is buying an older apartment complex, renovating all the units, adding modern amenities, and raising rents to market rates. Leverage is higher (60-75%), and target returns are in the 12-18% range.

Opportunistic: The high-risk, high-reward end of the spectrum. Opportunistic deals often involve ground-up construction, major redevelopments (like turning an old factory into lofts), or investing in emerging markets. These projects demand deep expertise. Leverage can exceed 75%, and firms target returns of 18% or more.

Deal Lens Example: A Value-Add Multifamily Project

Let's use a simplified case study to see how a value-add strategy creates wealth.

A firm buys "The Courtyard Apartments," a 100-unit complex from the 1980s. It’s in a great neighborhood but has dated kitchens and no modern amenities. The average rent is $1,200/month, while renovated nearby properties get $1,600.

The Acquisition: The firm acquires the property for $15 million, using $4.5 million of investor equity and a $10.5 million loan.

The Renovation: Over two years, the team invests an additional $1.5 million ($15,000 per unit) for a full facelift—new countertops, modern flooring, and adding a dog park and outdoor grill station.

The Value Creation: As renovated units become available, new tenants happily pay the higher market rent of $1,600. This directly boosts the property’s Net Operating Income (NOI).

The Exit: Three years later, the complex is fully renovated, stabilized, and generating much higher income. The firm sells it for $21 million. After repaying the loan, it returns the original capital plus a healthy profit to its investors.

This hands-on approach "forced" the appreciation of the asset—the hallmark of successful private equity real estate. While apartments and offices have long been the bread and butter, many firms now look to alternative sectors like data centers, life sciences, and industrial logistics, which offer resilient demand. This pivot reflects lessons from past downturns, a trend you can explore further in recent industry analyses.

Navigating The Current Real Estate Market

Before you invest, you have to understand the "why now" of the market. After a turbulent period of rapid interest rate hikes, the private equity real estate world is showing signs of life, presenting unique opportunities for prepared investors.

The market has largely absorbed the shock of higher borrowing costs. This new stability means disciplined firms can underwrite deals with more confidence, moving past the "wait and see" paralysis that gripped the industry. And while overall transaction volume slowed, the fundamental demand for high-quality properties in sectors like multifamily and logistics never disappeared. This creates a compelling moment for well-capitalized investors to partner with experienced sponsors.

Market Why-Now: A Resurgence in Investor Confidence

Recent fundraising numbers signal a clear shift. After a multi-year slowdown, private real estate fundraising is on the rebound.

According to Preqin data (as of mid-2024), global private real estate fundraising commitments shot up to $110.54 billion in the first half of the year—a significant 16% increase compared to the same period last year.

This surge, partly driven by mega-fund closes from firms like Blackstone and Brookfield, shows that sophisticated capital is flowing back into the market with conviction. This fresh capital is building a strong deal pipeline, which suggests the window for acquiring assets at today's reset prices may be closing.

Market Signal Box: An Investor's Edge

The Data Point: Family offices and ultra-high-net-worth individuals are steadily increasing allocations to private markets. A 2024 survey from a leading investment bank found that nearly half of all family offices plan to increase their allocation to private equity, including real estate, over the next year. The Interpretation: Amid public market volatility, investors are seeking tangible assets that provide steady income and a potential inflation hedge. They value the control and direct ability to create value that PERE firms provide—something you don't get with passive REITs. Investor Take (For Family Offices & UHNWIs): Now is the time to review your real asset allocation. The current climate rewards investors who can act decisively with proven partners. As competition for the best properties heats up, relationships with firms that have deep market access and a strong deal pipeline become your biggest advantage.

This environment highlights the importance of a clear strategy. To succeed, you must understand the real-world challenges confronting commercial real estate investors, from shifting tenant demands to new financing structures. The firms that master these variables are poised to win.

How to Evaluate Private Equity Real Estate Firms

Choosing your investment partner is the single most important decision you'll make in private real estate. A slick pitch deck is just the start; the real story is found in the team’s discipline, alignment of interests, and commitment to transparency.

Evaluating a PERE firm isn't about finding one that’s never lost money. It’s about finding a partner with a repeatable, battle-tested process for protecting capital and executing its game plan. Your goal is to cut through the marketing fluff and get to the heart of the operation by asking tough, specific questions.

Checklist: Key Questions to Ask a Sponsor

This checklist provides a framework for systematically vetting a PERE sponsor to ensure you partner with the right team.

1. Team and Track Record

Can you provide the full, asset-level track record for all prior deals with a similar strategy, including both winners and losers?

What specific experience do the key principals have in this exact asset class and geographic market?

Who are your key service providers (attorneys, accountants, property managers), and how long have you worked with them?

2. Investment Sourcing and Discipline

What percentage of your deals are sourced off-market versus through brokers? Can you give an example of a recent off-market deal?

Walk me through your underwriting model for a recent acquisition. What were your key assumptions for rent growth, exit cap rate, and operating expenses?

How do your return projections change if interest rates rise by 1% or if the exit cap rate is 50 basis points higher than projected (stress testing)?

3. Alignment of Interests

How much of the General Partner's own capital ("GP co-invest") is being invested in this specific deal as a percentage of total equity?

Can you provide a detailed breakdown of all fees? (Acquisition, asset management, disposition, etc.)

Please explain the distribution waterfall. Is there a preferred return hurdle that must be met before the promote is paid?

4. Reporting and Transparency

Can I see a sample of your quarterly investor report and a redacted K-1 tax form?

How do you communicate bad news or unexpected challenges? Can you provide a specific example from a past deal?

Can you provide references from at least two other investors who have been with you through a full market cycle?

Investor Take (For Family Offices & UHNWIs): Treat your diligence process like a two-way interview. You are not just being sold an investment; you are selecting a fiduciary who will manage a significant component of your wealth. A top-tier firm will welcome this level of scrutiny.

The private equity market is heating up. A recent report notes that global dealmaking saw a major surge, with deal value climbing 22% to $1.75 trillion worldwide, and exit values also rose significantly. This renewed activity is largely driven by expectations of a more stable interest rate environment. You can get more details from the full 2025 investor survey from Adams Street Partners. This uptick makes your due diligence more critical than ever.

Understanding and Mitigating Investment Risks

Smart investing requires understanding both reward and risk. In private real estate, navigating risk isn't about avoiding it—it's about understanding, managing, and mitigating it. A top-tier firm’s true value is often revealed not when a project sails smoothly, but when it hits an unexpected storm and the team successfully steers the ship to shore.

The high returns that attract investors to PERE don't come without unique challenges. Success hinges on a firm's foresight and its ability to build defenses against potential headwinds.

Risk & Mitigation Framework

Most challenges fall into three big buckets. An experienced sponsor will have a clear, battle-tested plan for each.

Risk: Illiquidity * This is the big one. Your capital is tied up for a typical hold period of 5 to 10 years. You cannot easily access your money before the planned exit.

Mitigation * Investors must ensure the allocation fits their personal liquidity needs. A good sponsor mitigates this by providing clear timelines, targeting assets that can generate distributable cash flow during the hold period, and giving proactive updates on the exit plan.

Risk: Market Downturn * This covers economic curveballs like a recession that slows rent growth, a spike in interest rates that increases borrowing costs, or new supply that hurts occupancy.

Mitigation * A disciplined firm stress-tests its underwriting against "what-if" scenarios. This means using conservative assumptions, not over-leveraging the property, and investing in resilient property types located in markets with diverse, stable economies.

Risk: Execution Failure * This is the risk that the sponsor’s business plan derails. A renovation could face cost overruns, leasing could take longer than projected, or entitlements could face delays.

Mitigation * Deep operational expertise is the only defense. Experienced firms have trusted contractor relationships, a proven playbook for capital projects, and sophisticated systems to keep projects on schedule and budget. A strong track record in a specific niche is your best indicator of execution capability.

Investor Take (For Time-Pressed Principals): The quality of a firm’s risk mitigation plan is a direct reflection of its experience. Don't just ask a sponsor if they have a plan. Ask them to walk you through a specific example of how they handled a project that ran into unexpected trouble. Their answer will tell you more than any financial model.

A deeper understanding of these factors is crucial. You can find a more detailed breakdown in our **guide to the types of investment risk in real estate**. Ultimately, partnering with a firm that has a disciplined, forward-looking approach to risk is your strongest defense.

Ready to Build Your Real Asset Portfolio?

Partnering with the right private equity real estate firm can be a powerful way for investors to access institutional-quality deals, diversify beyond public markets, and build long-term, tax-efficient wealth. The key lies in conducting thorough due diligence and aligning with a sponsor whose strategy, discipline, and commitment to transparency match your own investment goals.

Well-structured real assets can be a prudent, resilient component of a long-term wealth strategy. At Stiltsville Capital, we provide our accredited investor partners with direct access to private real estate opportunities across the multifamily, industrial, and data center sectors.

If you are an accredited investor interested in learning more about our disciplined approach and current offerings, we invite you to schedule a confidential call with our team.

Disclaimer: Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

To learn more about Stiltsville Capital, please visit us at **https://www.stiltsvillecapital.com**.

Comments