Limited Partnerships in Real Estate: A Complete Investor's Guide

- Ryan McDowell

- Aug 19, 2025

- 14 min read

Reading Time: 8 min | Good for: Novice (A), Informed (B)

TL;DR: The Bottom Line Up Front

What it is: A limited partnership is a legal structure that pairs a hands-on real estate operator (the General Partner or GP) with passive capital investors (the Limited Partners or LPs).

Why it Matters: It allows you to invest in large, institutional-quality real estate deals, with your liability capped at your investment amount, while experts handle all the operational work.

Investor Takeaway: Success in a limited partnership hinges on choosing the right GP. Your primary job is to perform deep due diligence on the sponsor's track record, alignment, and the deal's structure.

When you hear about big-time real estate deals—the kind that shape skylines and build serious wealth—you're often hearing about limited partnerships in real estate. This isn't just a fancy legal term; it's the engine that powers some of the most successful property investments.

Think of it like producing a blockbuster movie. You have the director, the on-the-ground expert who handles everything from casting to filming—that's the General Partner (GP). Then you have the financial backers who provide the capital to make it all happen but aren't on set every day. They're the Limited Partners (LPs). As an investor, you get to be the backer, sharing in the profits without the daily operational grind.

Your Blueprint for Passive Real Estate Investing

For anyone serious about building a real estate portfolio—from seasoned family offices to individuals just stepping into the private market—understanding this structure is everything. It’s arguably more important than the property itself, because the structure dictates your role, your risk, and your potential reward.

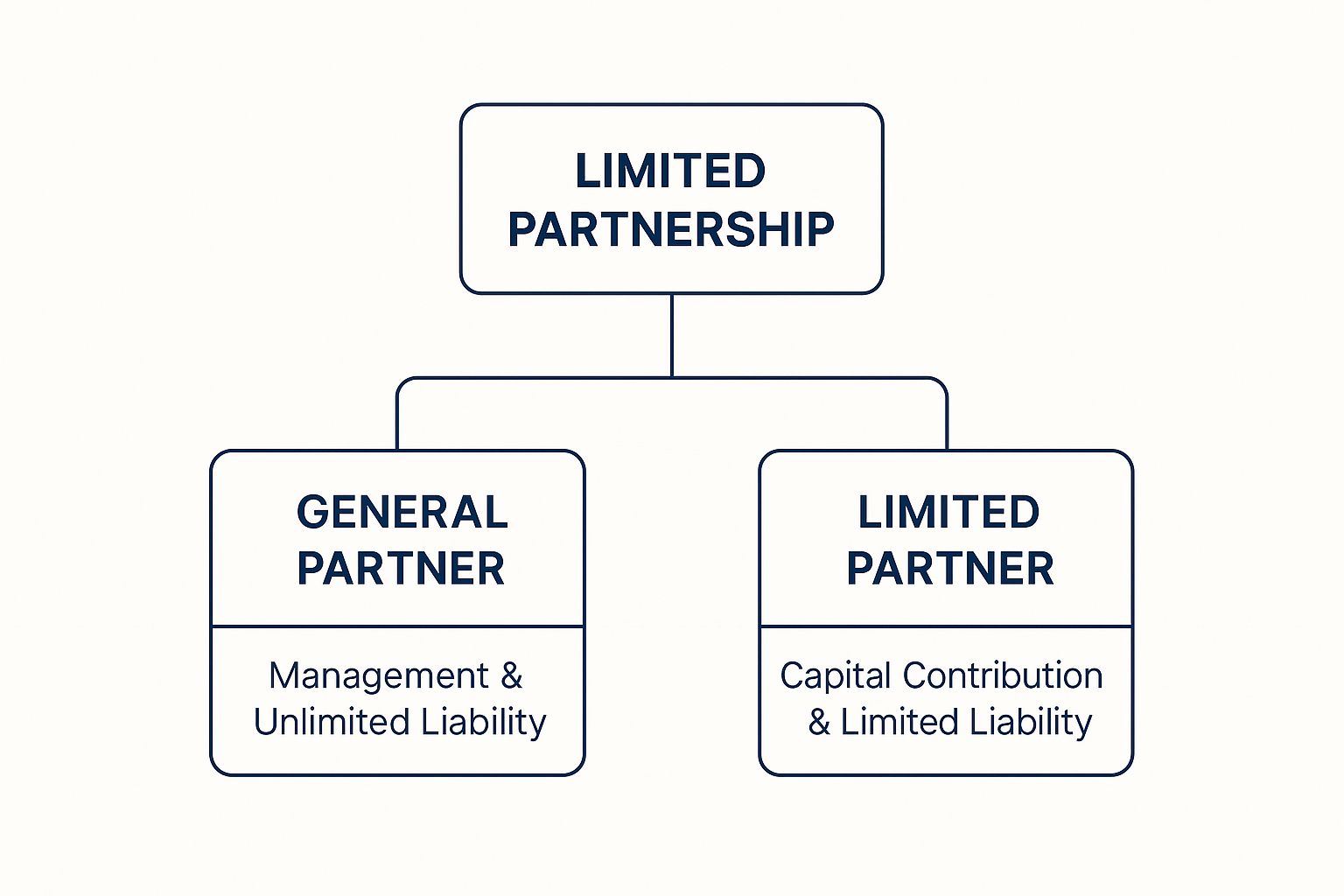

The Limited Partnership (LP) model creates a brilliantly simple and legally sound relationship between two distinct groups:

The General Partner (GP): This is the sponsor, the operator, the boots-on-the-ground team. They're the ones who find the deal, run the numbers, secure the financing, manage the property, and ultimately execute the plan to sell it for a profit. They have all the control and carry all the direct operational liability.

The Limited Partners (LPs): This is you. As an LP, your job is to provide a portion of the equity capital. That’s it. You have no management duties, no late-night calls about leaky pipes, and no operational headaches. Your role is to trust your capital with proven experts.

This division of labor is what makes the whole thing work so well. It allows you to place your money into a hard asset managed by pros, freeing you from the immense complexities of day-to-day real estate operations.

Why This Structure Matters for Your Portfolio

So, why should a family office or an accredited investor care? Because the LP structure solves the single biggest problem for most investors: how to own a piece of high-quality real estate without the nightmare of becoming a landlord. It's designed from the ground up to align the interests of the people with the money (you) and the people with the expertise (the GP). When the deal succeeds, everyone wins.

For your portfolio, this means you get some incredible advantages baked right in:

Instant Expertise: You partner with firms that live and breathe this stuff, with deep market knowledge and a proven track record.

Built-in Protection: Your financial risk is capped. The most you can ever lose is the amount you invested. Period.

Effortless Diversification: It’s a straightforward way to spread your capital across different property types and geographic markets without having to become an expert in all of them.

This isn’t a newfangled idea; it’s a time-tested model for building wealth. History is filled with examples of real estate partnerships delivering incredible returns that can outperform public markets, especially during certain cycles. If you want to dig deeper, the historical performance data available from places like EIP Investments can be pretty eye-opening.

At the end of the day, this framework isn't just a legal wrapper. It's a strategic blueprint for pursuing your long-term financial goals with solid, tangible assets.

Anatomy of a Real Estate Limited Partnership

To really grasp what makes a real estate limited partnership tick, you have to look under the hood. Don't think of it as some tangled legal web—it’s more like a high-performance vehicle, finely tuned for one job: combining money and expertise to generate impressive returns.

At its heart, the entire setup is a strategic team-up between two key players. Each has a very specific, and equally important, role. This clear split in duties is exactly what makes the model so powerful for passive investors.

This diagram shows you the fundamental relationship, breaking down how the management and the capital are kept separate.

This structure neatly separates the hands-on management from the passive capital, creating a framework that protects investors while giving the sponsor the freedom to execute the business plan.

The Two Pillars of the Partnership

Every real estate LP is built on the dynamic between the General Partner and the Limited Partners. Getting a handle on their distinct jobs is your first step to becoming a sharp investor in this space.

The General Partner (GP): Also called the "sponsor" or "operator," the GP is the one in the driver's seat. They find the deal, perform the due diligence, line up financing, manage the renovation or development, and handle the day-to-day grind until the property is sold. For all this work, they carry unlimited liability, meaning their personal or company assets are on the hook if the deal goes south.

The Limited Partners (LPs): This is where you, the investor, come in. LPs provide the equity—the cash—needed to buy and improve the property. In exchange, they get a slice of the profits. The key part? Their liability is limited to the amount of their investment. You can't lose a penny more than what you put in.

To give you a clearer picture, here’s a quick breakdown of how their roles and responsibilities stack up against each other.

General Partner vs. Limited Partner Roles and Responsibilities

Attribute | General Partner (GP) | Limited Partner (LP) |

|---|---|---|

Role | Active Manager. Finds, acquires, and manages the asset. | Passive Investor. Provides the equity capital. |

Decision-Making | Makes all operational and strategic decisions. | No involvement in day-to-day decisions. |

Liability | Unlimited personal or corporate liability for debts. | Limited to their total investment amount. |

Time Commitment | Full-time, hands-on management of the project. | Minimal. Primarily involves reviewing reports. |

Compensation | Fees and a share of the profits (carried interest). | A share of the profits and return of capital. |

This table highlights the fundamental trade-off: GPs take on the work and the risk in exchange for a larger share of the upside, while LPs enjoy passive returns with protected downside.

The Partnership Agreement: Your Governing Document

The entire relationship—every single rule, right, and responsibility—is locked down in one critical legal document: the Limited Partnership Agreement (LPA). This is your playbook.

The LPA is the single most important document in any limited partnership. It governs everything from capital calls and fee structures to profit distributions and exit strategies. Diligently reviewing it is non-negotiable.

This agreement spells out the economic terms designed to get everyone rowing in the same direction. Inside, you'll find the nitty-gritty on how everyone gets paid, which is typically structured as a "distribution waterfall."

How The Money Flows: The Waterfall Model

Picture profits from the property filling a series of buckets, one after the other. That's the basic idea behind a distribution waterfall. It’s a structured way to pay out cash flow and profits in a specific, pre-agreed order.

Here’s how it usually works:

Return of Capital: First things first. The LPs get 100% of all distributions until they have received every dollar of their initial investment back.

The Preferred Return: Next, the LPs continue to receive 100% of distributions until they hit a specific annual return, known as the "preferred return" or "pref." A common pref in today's market is between 6% to 8%. Think of it as a hurdle the GP has to clear before they can start sharing in the profits.

The Catch-Up: Once LPs have their capital back and have hit their pref, the GP often gets a larger slice of the profits for a period to "catch up."

The Carried Interest: After all that, any remaining profits are split between the LPs and the GP based on a predetermined ratio (say, 80% to LPs, 20% to the GP). That GP slice of the final profits is called the "carried interest" or "promote," and it’s their main incentive to knock the deal out of the park.

This structure is designed to heavily motivate the GP, since their biggest payday only happens after the investors have been paid back and earned a solid baseline return. This alignment of interests is a cornerstone of successful investing in limited partnerships real estate. For a more detailed look, our guide to institutional-grade deals breaks these structures down even further.

Why LP Investing is a Strategic Move in Real Estate

Jumping into a limited partnership isn't just about the legal paperwork; it's a calculated move to boost returns while keeping risk in check. For busy professionals, family offices, and savvy investors, the LP structure offers a potent mix of protection, access, and efficiency that you just can't get from owning property directly. It effectively turns real estate from a hands-on, operational headache into a sophisticated, passive portfolio asset.

These aren't just abstract ideas. They’re real, tangible benefits that have a direct impact on your capital, your time, and your ability to build wealth for the long haul.

Ironclad Liability Protection

The single most important benefit of an LP is the protective wall it builds around your personal finances. As a Limited Partner, your financial risk is strictly limited to the amount of money you put into the deal. That's a critical difference.

Think about it: if you owned a property on your own and a massive lawsuit hit—something beyond what your insurance covers—your other assets could be on the line. In a well-structured LP, that risk stops dead in its tracks at the partnership level. Your exposure is capped, giving you the kind of peace of mind essential for smart wealth management.

Why it Matters: This concept of limited liability is the absolute foundation of passive investing. It lets you share in the upside of large-scale real estate projects without taking on the unlimited operational and legal headaches that come with being the owner and manager.

This protection allows you to invest with confidence, knowing that a worst-case scenario in one deal won't trigger a domino effect across your entire portfolio.

Access to Institutional-Grade Opportunities

Let’s be honest, most of the best real estate deals—like developing a new apartment complex or buying a portfolio of warehouses—are way too big and complicated for one person to handle alone. They demand deep operational know-how, extensive industry connections, and a whole lot of capital.

This is where limited partnerships really shine. By pooling resources, this collective buying power opens the door to a class of assets usually reserved for the big institutional players.

Diversification Power: Instead of putting all your eggs in one local basket, you can spread smaller amounts across different deals, property types (like multifamily or data centers), and even different cities, all managed by experts who live and breathe that specific niche.

Professional Management: You get the huge advantage of a dedicated sponsor whose entire job is to find, vet, and execute these complex real estate strategies. They handle everything from getting the financing and managing construction to finding tenants and eventually selling the property.

Economies of Scale: Big projects get better loan terms, discounts on materials, and more sophisticated management systems. All of this can lead to better potential returns for you.

This structure really levels the playing field, allowing accredited investors to build a portfolio of high-quality real estate that would otherwise be completely out of reach. To get a better feel for how these deals are managed, you can dive deeper into the role of [private equity real estate firms](https://www.stiltsvillecapital.com/post/a-guide-to-private-equity-real-estate-firms-strategies-insights-for-investors) and their strategies.

Significant Tax Advantages

Real estate is famous for its tax perks, and the LP structure is built to pass those benefits directly on to you. Because a partnership is a "pass-through" entity, it doesn’t pay corporate income tax. Instead, all the profits, losses, and deductions flow straight through to the individual partners.

This means you can tap into powerful deductions like depreciation, a non-cash expense that can lower your taxable income from the property, even while it's generating positive cash flow. Everything is reported to you on a simple Schedule K-1 form each year, which makes tax time much easier. These benefits can seriously boost your after-tax returns, a crucial part of building durable, long-term wealth and protecting yourself against inflation.

Navigating the Risks and Challenges of LP Investing

Let's be real: while a great real estate limited partnership can be a game-changer for your portfolio, no investment is a sure thing. Understanding the potential bumps in the road isn't about scaring you off—it's about making you a smarter, more disciplined investor who knows how to protect their capital. The best investors don't run from risk. They get to know it, price it into the deal, and have a plan to manage it.

Risk & Mitigation Framework

RISK: Illiquidity * Your capital is locked in for the deal's duration, typically 5-10 years. There is no public market to easily sell your stake. * MITIGATION: Only allocate capital you are certain you won't need for the entire investment term. Align the deal's timeline with your personal long-term financial plan.

RISK: Sponsor Performance * Your returns are entirely dependent on the General Partner's expertise, integrity, and execution ability. A poor operator can ruin a great asset. * MITIGATION: Conduct exhaustive due diligence on the sponsor. Verify their track record, speak to past investors, and ensure they have significant "skin in the game" (their own capital invested).

RISK: Market & Economic Headwinds * Rising interest rates, recessions, or local market downturns can negatively impact property values, rental income, and exit prices. * MITIGATION: Partner with sponsors who underwrite deals conservatively and stress-test their models for downturn scenarios. A deal should be resilient, with reasonable leverage and a clear, achievable value-add plan.

Market Signal: A Shifting Landscape

The global commercial real estate (CRE) market is a perfect example of volatility. After a hot streak, CRE deal volume plummeted by a staggering 62% in 2023, down to about US$158 billion, as uncertainty took over. However, by early 2024, the market was already showing signs of a comeback.Source: Deloitte's 2024 Commercial Real Estate Outlook (data as of late 2023).Investor Take: This rapid shift highlights why you should partner with sponsors who are built to withstand turbulence, not just ride a rising market. Conservative underwriting is paramount. For more on these dynamics, see Deloitte's commercial real estate outlook.

Your Due Diligence Checklist for Vetting Real Estate LPs

Moving from theory to actually writing a check for a real estate partnership is a big step. The difference between a great investment and a costly mistake often comes down to one thing: your due diligence. Think of it like a pilot’s pre-flight checklist. A methodical review of the sponsor, the property, and the deal itself is your best defense against nasty surprises down the road.

Questions to Ask a Sponsor

Track Record: Can you provide a complete, verifiable list of all past deals, including those that underperformed, and explain the key lessons learned?

Sponsor Co-Investment: How much of your own capital is invested in this specific deal, and on the exact same terms as the LPs? (Look for 5-10% of equity).

Team Experience: Who are the key principals on this project, and have they successfully executed a similar business plan in this specific market before?

Underwriting Assumptions: What are your specific projections for rent growth, vacancy, and exit cap rate? How do these compare to current market data from sources like CoStar or CBRE?

Stress Testing: Can you show me a sensitivity analysis? How do returns hold up if interest rates rise by 2%, the exit is delayed by a year, or rent growth is flat?

Capital Budget: Is there a detailed, line-item budget for all capital expenditures, including a contingency reserve of at least 10%?

Fee Structure: What are all the fees being charged (acquisition, asset management, disposition)? Ensure they are aligned with industry standards (e.g., 1-2% asset management fee on invested equity).

Waterfall & Promote: Can you walk me through the distribution waterfall? Is the preferred return cumulative? At what point do you, the GP, earn your carried interest (promote)?

Reporting Cadence: What is your policy for investor reporting? Will we receive quarterly reports with detailed financials and progress updates? (See the industry's push for global data standards from MSCI for context on best practices).

This checklist is your starting point. For an even deeper dive, check out our guide on commercial real estate due diligence, the investor's playbook. Doing your homework is the best way to invest with confidence.

Partnering for Success with Stiltsville Capital

Getting a handle on how a limited partnership works is step one. But the real make-or-break moment for any limited partnerships real estate investment comes down to one thing: picking the right General Partner.

The legal structure is just a blueprint; its strength is entirely dependent on the sponsor who’s actually running the show. The right partner turns a smart idea on paper into a powerful engine for building real wealth.

The LP model is a savvy and effective way to get a piece of institutional-grade real estate. It shields you from liability, puts professionals in the driver's seat, and opens doors to deals you couldn’t access on your own. But none of that matters if you're not partnered with a sponsor who wants the exact same thing you do.

Our Guiding Philosophy

At Stiltsville Capital, that alignment is everything. We build our entire approach on it. We believe that when our money is in the deal right alongside yours, our goals are perfectly in sync. This isn't just a tagline for us—it’s the bedrock of our investment philosophy and a hard-and-fast rule for every single deal we touch.

Our process is defined by a few core tenets:

Disciplined Underwriting: We don't just hope for the best. We stress-test every single assumption and build conservative models designed to hold up through all kinds of economic weather, not just sunny days.

Proactive Asset Management: We’re not passive owners. We get our hands dirty, actively managing properties to squeeze out value, streamline operations, and execute the business plan with surgical precision.

Complete Transparency: You’ll never be in the dark. Our partners get clear, consistent, and detailed reports, so you always know exactly how your investment is doing and what’s driving the results.

We succeed when you succeed—period. We have deliberately structured our fees and profit-sharing so that our biggest payday only comes after our investors get their capital back and hit their preferred return.

Take the Next Step

For accredited investors and family offices ready to see how passive real estate can fit into a sophisticated wealth strategy, the conversation starts right here. It's time to go beyond the theory and see how our disciplined approach can help you meet your financial goals. Well-structured real assets can be a prudent, resilient component of a long‑term wealth strategy, and we are here to help you navigate this asset class.

If you’re ready to explore direct access to institutional-quality real estate opportunities, we invite you to schedule a confidential call with our team.

Alternatively, [join our accredited investor list](https://www.stiltsvillecapital.com/subscribe) to receive future deal flow and market insights sent straight to your inbox. Let's build something lasting together.

Frequently Asked Questions (FAQ)

What’s a typical minimum investment for a real estate LP?

You won't find a single industry-wide number, but minimum buy-ins for institutional-quality real estate LPs are designed for accredited investors. For most high-caliber offerings from reputable sponsors, you should be prepared for minimums in this ballpark:

Common Minimums: Most deals start at $50,000 and often go up to $250,000 or more for an individual investment.

Family Office & Institutional Tiers: For larger players or family offices wanting a more significant slice of the pie, it's not uncommon to see minimums hit $1 million or higher.

How do I get taxed on returns from an LP?

A limited partnership is a pass-through entity, meaning the partnership itself doesn't pay corporate income tax. Instead, all financial results flow directly to the partners. Each year, the GP will send you a Schedule K-1 tax form, which breaks down your share of the partnership's income, expenses, and depreciation. A key benefit is pass-through depreciation, a non-cash deduction that can significantly reduce your taxable income from the property. Always consult a qualified tax professional to understand the implications for your specific situation.

Can I sell my share in a limited partnership?

The short answer? It’s very difficult. An interest in a private real estate LP is a classic illiquid investment. There is no public market for LP interests, and the partnership agreement will almost always have strict rules about transfers, requiring the GP's consent. You should go into any deal assuming your capital will be tied up for the entire project life, which is often 5 to 10 years.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Learn more about our approach at Stiltsville Capital LLC by visiting https://www.stiltsvillecapital.com.

Comments