The Definitive Guide to Investment Real Estate Tax Benefits

- Ryan McDowell

- Oct 9, 2025

- 13 min read

Reading Time: 8 min | Good for: Novice & Informed Investors (A, B)

TL;DR: Key Takeaways

Real estate offers unique tax advantages that significantly boost after-tax returns, making it a cornerstone of sophisticated wealth-building strategies.

Depreciation is the most powerful benefit, allowing you to deduct a property's value over time as a "phantom expense," shielding cash flow from taxes. Advanced strategies like cost segregation accelerate these deductions.

Mortgage interest is fully deductible on investment properties, turning leverage into a powerful tool for reducing taxable income.

1031 exchanges are a game-changer, allowing you to defer capital gains and depreciation recapture taxes by rolling sale proceeds into a new property, compounding your wealth tax-free.

A sponsor's tax strategy is critical. Asking the right due diligence questions about cost segregation, 1031 exchanges, and leverage is non-negotiable.

Why This Matters for Your Portfolio Right Now

When you're evaluating a real estate deal, the purchase price and projected rental income are just the starting point. The real magic—and what separates a good investment from a truly great one—lies in the tax benefits. For savvy investors, from family offices to individuals building their first portfolio, a smart tax strategy isn't an afterthought; it's a foundational component of underwriting that can dramatically enhance real-world returns.

In an economic environment with persistent inflation, these tax advantages become even more critical. According to a recent outlook from Deloitte, 14% of real estate investors cite tax advantages as a primary driver for increasing their allocations. Depreciation and interest deductions help you fight back by lowering your current taxable income, protecting the real-world value of your cash flow. This tax efficiency is a key reason well-structured real estate is a resilient asset class for long-term wealth preservation.

This guide will break down the foundational tax benefits that make real estate a cornerstone of intelligent wealth-building.

The Investor's Core Tax-Saving Toolkit

Whether you're acquiring your first rental property or allocating capital to an institutional-grade fund, there are three core mechanisms you must understand:

Depreciation: Think of this as a "phantom expense." The IRS lets you deduct a portion of your property's value from your taxable income each year, even though you aren't actually spending any cash. It's a direct way to shield your rental income.

Interest Deductions: The interest you pay on the mortgage for your investment property is almost always 100% deductible. This turns the cost of borrowing money into a powerful tax shield.

1031 Exchanges: This is a game-changer for growing your portfolio. It allows you to sell a property and roll all the proceeds into a new, similar property without paying a dime in capital gains tax. It keeps your capital working for you, tax-deferred.

Investor Take: In a market where every basis point of return counts, a robust tax strategy is what transforms a passive investment into an active tool for building and protecting wealth. It is often the single biggest factor in a deal's long-term success.

Even homeowners can access tax benefits, such as the federal tax credit for solar panel installations, but the advantages for investment real estate operate on a completely different scale.

Depreciation: The Ultimate Real Estate Tax Shield

Of all the investment real estate tax benefits, depreciation is arguably the most powerful. It's often called a "phantom expense" because it’s a non-cash deduction the IRS allows you to take against your property's value. This directly shields your rental income from taxes, putting more cash in your pocket without costing you a single out-of-pocket dollar.

This isn’t just a minor perk; it’s a foundational concept that can turn a good real estate deal into a great one by dramatically boosting your after-tax returns.

The Mechanics of Depreciation

Here’s how it works: the IRS assigns a "useful life" to real estate—the timeframe over which you can deduct its value. A key point here is that land itself cannot be depreciated; only the building and other improvements on it qualify.

The standard timelines are:

Residential Property: Depreciated over 27.5 years.

Commercial Property: Depreciated over 39 years.

This provides a predictable, long-term tax shield. However, sophisticated investors and sponsors use advanced strategies to supercharge these benefits.

Advanced Strategy: Cost Segregation Studies

For institutional-grade investments, a cost segregation study is a game-changer. Instead of treating the entire building as one asset depreciating over 27.5 or 39 years, this detailed engineering-based analysis breaks it down into individual components.

This allows a sponsor to identify parts of the property with much shorter useful lives, such as:

5-Year Property: Carpeting, certain appliances, and specialty light fixtures.

7-Year Property: Office furniture and equipment.

15-Year Property: Land improvements like parking lots, sidewalks, and landscaping.

By reclassifying these components, you can accelerate depreciation deductions into the first few years of ownership, resulting in a massive increase in tax savings and healthier early-year cash flow.

Insight Edge: The Power of Front-LoadingA cost segregation study can shift 20% to 40% of a property's total depreciable basis from the standard long-term schedule into these shorter 5, 7, and 15-year buckets. This front-loading of deductions is a primary reason institutional-quality real estate can deliver such superior after-tax returns, especially for value-add and development projects.

Bonus Depreciation: The Accelerator

Bonus depreciation is like pouring gasoline on the fire. This powerful provision allows investors to immediately deduct a large percentage of the cost of eligible property—generally anything with a useful life of 20 years or less—in the year it's placed in service.

While the 100% bonus depreciation from the Tax Cuts and Jobs Act of 2017 is phasing down, it remains an incredibly potent tool. For 2024, investors can still deduct 60% of the cost of qualifying assets upfront. When combined with a cost segregation study, the impact is enormous. For a deeper analysis, see our guide on The Tax Shield of Depreciation: an Investor's Guide to Boosting Returns.

More insights on market sentiment can be found in the latest commercial real estate trends from Deloitte.com.

Deal Lens Example: Illustrative Impact of Depreciation

Let's walk through a simplified example to see the difference this makes with a commercial property.

Assumptions:

Purchase Price: $10,000,000

Land Value (non-depreciable): $2,000,000

Building Value (depreciable basis): $8,000,000

Net Operating Income (NOI): $500,000

Scenario 1: Standard Depreciation (39 Years)

Annual Depreciation Deduction: $8,000,000 / 39 years = $205,128

Taxable Income: $500,000 (NOI) - $205,128 (Depreciation) = $294,872

Scenario 2: With Cost Segregation

The study reclassifies 25% ($2,000,000) of the building's value into 5-year property.

First-Year Deduction (5-Year Property): $2,000,000 / 5 years = $400,000

Depreciation on Remainder (39 Years): $6,000,000 / 39 years = $153,846

Total Year 1 Deduction: $400,000 + $153,846 = $553,846

Taxable Income: $500,000 (NOI) - $553,846 (Depreciation) = -$53,846 (a passive loss)

In Scenario 2, the cost segregation study didn't just reduce the tax bill—it completely eliminated the property's taxable income for the year, creating a "paper loss" that can potentially offset other passive gains. This perfectly illustrates how a strategic approach to depreciation maximizes an investor's real, after-tax returns.

How Mortgage Interest Deductions Maximize Returns

After depreciation, the mortgage interest deduction is one of the most reliable and impactful tax benefits in an investor's playbook. It's what turns leverage—using borrowed capital to acquire a property—into a powerful tool for boosting after-tax returns.

The concept is simple: the interest you pay on a loan to acquire or improve an investment property is a business expense. That expense directly reduces your net operating income (NOI), which lowers your taxable income and, ultimately, your tax liability.

Unlike the mortgage interest deduction on a primary home, which is capped, the deduction for investment properties generally has no limit. This makes it a cornerstone of financial modeling for any serious real estate deal.

Understanding the Business Interest Limitation

For more sophisticated investors or those in larger partnerships, it's important to be aware of Internal Revenue Code Section 163(j). This rule can limit the amount of business interest expense you can deduct in a given year. Fortunately, most real estate businesses can elect out of this limitation, though it comes with a trade-off (typically longer depreciation schedules).

Novice Lens: Why This MattersThe key takeaway is that the money you pay the bank in interest on your investment property loan isn't just a cost—it's a tax deduction. This reduces your taxable profit, meaning you keep more of the cash your property generates.

The rules around interest deductibility are complex and can change, highlighting the importance of working with sponsors and tax professionals who stay on top of the latest regulations. This includes understanding the nuances of various financing structures, from traditional bank loans to government-backed options like FHA loan offerings.

A Practical Example of the Deduction's Impact

Let's break this down with some straightforward numbers to see it in action.

Property's Net Operating Income (NOI): $100,000

Annual Mortgage Interest Paid: $60,000

Without the deduction, your entire $100,000 in NOI would be subject to income tax (before other deductions like depreciation are factored in).

But by applying the mortgage interest deduction, you immediately shrink your taxable income:

Taxable Income: $100,000 (NOI) - $60,000 (Interest) = $40,000

Just like that, you've shielded $60,000 of your income from taxes. If you're in a 32% tax bracket, this single deduction translates to $19,200 in direct tax savings for the year. That's real cash that stays in the investment or goes right back into your pocket, proving that smart financing is directly tied to tax efficiency.

Using 1031 Exchanges to Defer Taxes and Build Wealth

Of all the tax benefits available to real estate investors, the Section 1031 “like-kind” exchange is one of the most powerful tools for building significant wealth. It allows you to defer paying capital gains taxes when you sell an investment property, provided you reinvest the proceeds into a new, similar ("like-kind") investment property.

Think of it as hitting the upgrade button on your portfolio. You can sell a small apartment building and funnel every dollar of profit into a larger, more valuable one—all without writing a check to the IRS. This keeps your capital working for you, compounding your growth in a tax-deferred environment.

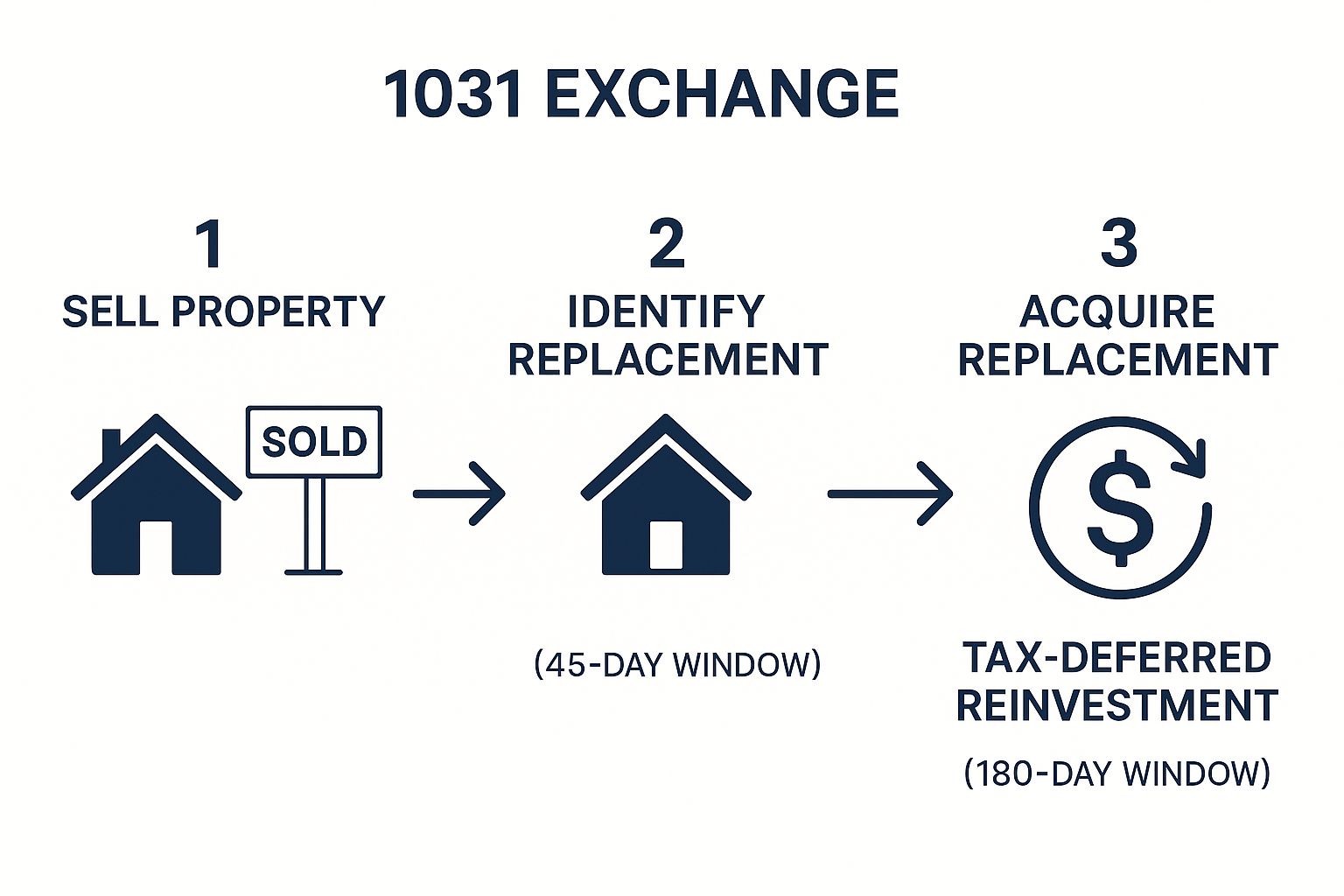

The 1031 Exchange Process Unpacked

Successfully executing a 1031 exchange requires strict adherence to IRS timelines. The process itself is straightforward, but the deadlines are unforgiving.

This flow chart breaks down the essential steps and non-negotiable timelines.

As you can see, the time windows are critical. Missing either the 45-day or 180-day deadline can disqualify the exchange, triggering the significant tax liability you sought to avoid.

Here’s the play-by-play:

Sell Your Property: The proceeds from the sale go directly to a neutral third party called a Qualified Intermediary (QI). This is a crucial step—if you touch the money, the exchange is void.

Identify the Replacement: You have exactly 45 days from the closing date to formally identify potential replacement properties in writing to your QI.

Acquire the New Property: You must close on one or more of the identified properties within 180 days of selling your original one. That 180-day clock starts on the day you sell, not after the 45-day window closes.

To defer all taxes, the new property must be of equal or greater value, and you must reinvest all net proceeds.

Key Timelines and Rules for a 1031 Exchange

The deadlines for a 1031 exchange are strict and absolute. This table summarizes the critical milestones you cannot afford to miss.

Milestone | Deadline | Key Requirement |

|---|---|---|

Identification Period | 45 Days from Sale | Formally identify potential replacement properties in writing to your Qualified Intermediary. |

Exchange Period | 180 Days from Sale | Close on the acquisition of the identified replacement property. |

Value Requirement | At Closing | The new property's value must be equal to or greater than the one you sold. |

Equity Requirement | At Closing | All net proceeds from the sale must be reinvested into the new property. |

Debt Requirement | At Closing | The debt on the new property must be equal to or greater than the debt on the old one. |

Adhering to these rules is non-negotiable for a successful tax-deferred exchange. Working with an experienced QI is essential.

Strategic Applications for Sophisticated Investors

While the basics are powerful, seasoned investors and family offices use 1031 exchanges for much more than just tax deferral. It’s about strategically repositioning an entire portfolio.

Consolidation: Exchange several smaller, high-maintenance properties for a single, institutional-grade asset like a large multifamily complex to simplify management and achieve economies of scale.

Diversification: Trade a single property in one city for multiple properties across different geographic markets to spread risk without triggering a taxable event.

Transition to Passive Investing: An active owner of a retail center can exchange it for a passive interest in a professionally managed real estate fund or syndication. This keeps their capital deployed while eliminating day-to-day operational responsibilities.

For a deeper dive, explore our guide on how to do a 1031 exchange.

Comparing Tax-Advantaged Investment Structures

How you hold your real estate is as important as what you hold. The investment structure you choose directly impacts how tax benefits flow to you.

For most passive investors, the choice often comes down to two primary paths: direct ownership through a syndication—typically structured as an LLC or Limited Partnership (LP)—and investing in a Real Estate Investment Trust (REIT). Each offers a unique set of tax advantages.

The Syndication Model: The Power of Pass-Through

When you invest in a private real estate syndication, you become a direct partner in the entity that owns the asset. This "pass-through" structure means the partnership itself pays no corporate income tax.

Instead, all financial results—income, expenses, and powerful depreciation deductions—flow directly to you and the other investors. Each year, you receive a Schedule K-1 detailing your share of the profits and losses.

Why it matters: The primary advantage here is receiving the full benefit of depreciation on your personal tax return. This "paper loss" often shelters the cash distributions you receive, making them tax-deferred or even tax-free, especially in the early years of an investment.

This direct pass-through of losses can be used to offset passive gains from other investments, giving you significant control over your tax planning. For a deeper look at these structures, see our guide to private equity real estate fund structures.

The REIT Model: Dividends and the QBI Deduction

REITs offer a liquid, publicly-traded way to invest in a diverse portfolio of properties. Their tax magic happens at the corporate level. To maintain their tax-advantaged status, REITs must distribute at least 90% of their taxable income to shareholders as dividends.

By doing so, the REIT itself avoids corporate income tax on that distributed income. For investors, these dividends often qualify for the Section 199A qualified business income (QBI) deduction, which allows shareholders to deduct 20% of their ordinary dividend income. This effectively lowers the top federal tax rate on those dividends from 37% to 29.6%.

Tax Benefit Comparison: Syndication vs. REITs

The choice between a syndication and a REIT depends on your goals for tax efficiency, liquidity, and control.

Feature | Direct Syndication (via LLC/LP) | REIT (Real Estate Investment Trust) |

|---|---|---|

Tax Reporting | Schedule K-1 | Form 1099-DIV |

Depreciation | Passed directly to investors to offset passive income. | Handled at the corporate level; investors do not directly claim depreciation. |

Primary Tax Benefit | Direct use of depreciation to create tax-deferred or tax-free cash flow. | Section 199A QBI deduction allows a 20% deduction on ordinary dividend income. |

Liquidity | Highly illiquid; capital is typically locked in for 3-7 years. | Highly liquid for publicly traded REITs; shares can be sold daily. |

Investor Control | Minimal direct control, but high transparency and alignment with a specific sponsor and property. | No control over individual properties; you're invested in a diversified portfolio. |

Ultimately, syndications offer a more direct, hands-on approach to tax management with the powerful benefit of depreciation pass-through. REITs provide simplicity, liquidity, and a straightforward tax deduction on dividends.

Checklist: Questions to Ask a Sponsor About Their Tax Strategy

Knowing the theory behind tax benefits is one thing; ensuring your sponsor is actively working to maximize them is another. A disciplined sponsor integrates a sophisticated tax strategy into the business plan from day one. Asking these questions during your due diligence is critical.

Foundational Tax Strategy Inquiries

Do you plan to conduct a cost segregation study on this asset? * Why it matters: An immediate "yes" is a strong indicator of sophistication. As discussed, cost segregation accelerates depreciation, providing a significant tax-deferred boost to cash flow in the early years. A "no" requires a very compelling justification.

How will depreciation recapture be managed at the sale of the property? * Why it matters: This question tests foresight. The gold-standard answer is a clear plan to execute a 1031 exchange, deferring both recapture and capital gains taxes to allow capital to continue compounding.

Advanced and Structural Questions

What is your philosophy on leverage, and how does that inform the interest deduction strategy? * Why it matters: You want a sponsor who uses debt strategically to enhance returns via the interest deduction, but without taking on excessive risk. Their answer should reflect a balanced, disciplined approach that matches the asset's business plan.

Will investors receive a Schedule K-1, and what is your typical timeline for delivery? * Why it matters: For a direct syndication, the Schedule K-1 is the document that passes tax benefits to you. A sponsor should confirm they issue K-1s and have a reliable timeline for delivery. Consistently late K-1s can disrupt your personal tax filing and may signal back-office inefficiencies.

A confident, transparent sponsor will welcome these questions and provide clear, detailed answers. It’s the best way to confirm their commitment to maximizing every angle of your investment.

Frequently Asked Questions

What is depreciation recapture and how does it affect me?

Depreciation is a tax benefit you receive while holding a property. When you sell that property for a profit, the IRS "recaptures" the benefit you received. The portion of your gain attributable to depreciation deductions is taxed at a special rate of up to 25%, which can be higher than the standard long-term capital gains rate. The primary strategy to defer this tax is to use a 1031 exchange, rolling the proceeds into a new property.

Can I use real estate losses to offset my W-2 job income?

For most investors, the answer is no. Rental income is generally considered "passive" by the IRS. Passive losses can typically only offset passive gains (e.g., from other rental properties). You generally cannot use them to reduce taxable income from an active source like a salary. However, these passive losses are not lost; they are carried forward and can be used to offset future passive gains or can be fully deducted when the property is sold.

Are property taxes on an investment property deductible?

Yes, absolutely. For an investment property, state and local property taxes are 100% deductible as a business expense. This is a significant advantage over a personal residence, where the state and local tax (SALT) deduction is currently capped at $10,000 per household. Investment properties are not subject to this cap, making property taxes a powerful and reliable annual deduction.

At Stiltsville Capital, a sophisticated tax strategy isn't an afterthought—it's engineered into every investment from day one. To learn how our disciplined, institutional-grade approach can enhance your portfolio's after-tax returns, schedule a confidential call with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments