Reading Time 6 min | Good for: A, B

TL;DR: Your Investment Blueprint

A Four-Stage Journey: Successful commercial real estate (CRE) investing follows a disciplined lifecycle: Identify, Acquire, Manage, and Exit. Mastering this process is key to building a resilient portfolio.

Data Beats Instinct: Professional investors win by connecting macroeconomic trends (like interest rates and job growth) with granular, local data (like infrastructure spending and zoning changes) to find undervalued opportunities before the market does.

Beyond the Purchase Price: True value is created after the acquisition through strategic asset management—executing a clear business plan, whether it's a value-add renovation or optimizing a stabilized property's operations.

Your Next Step: For accredited investors ready to move beyond public markets, understanding this framework is the first step toward accessing institutional-quality real estate. Schedule a confidential call to discuss your goals.

Your Blueprint for CRE Investment Success

For investors looking to diversify beyond stocks and bonds, commercial real estate (CRE) is a powerful tool for building long-term wealth. It offers the potential for steady cash flow, appreciation, and significant tax advantages. But unlike buying shares with a click, direct real estate investing demands a solid, strategic plan.

Think of this guide as your roadmap. We're going to break down the entire investment journey, from the 30,000-foot view down to the nitty-gritty details. Whether you're a novice investor or a Family Office principal, mastering this framework is the first step toward making smarter, more confident decisions.

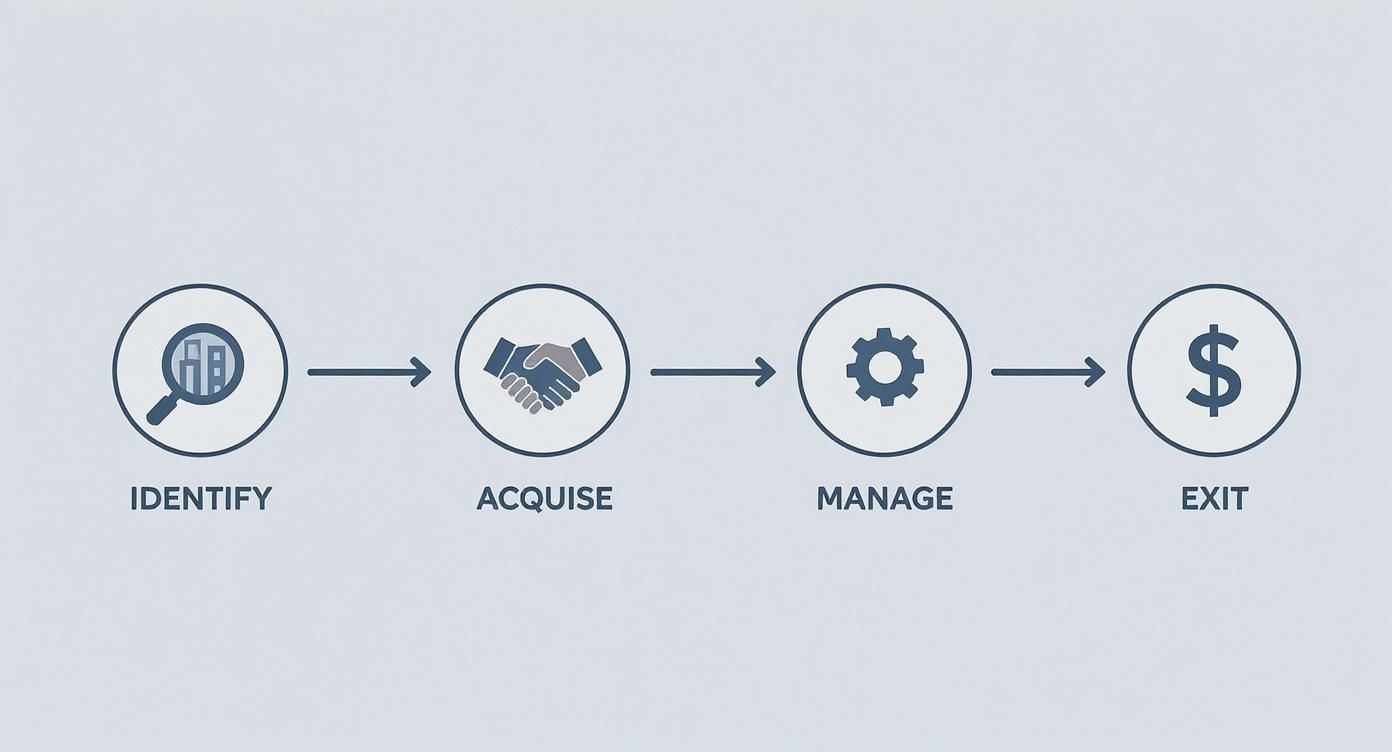

The Four Core Phases of Real Estate Investing

Every solid CRE investment moves through a distinct lifecycle. It's a continuous flow that starts with finding the right opportunity and moves through acquisition, hands-on management, and finally, a well-planned exit.

This process drives home a key point: value isn't just created when you buy. It’s built and amplified throughout the entire time you hold the asset, all leading up to a strategic sale that locks in your gains.

Mapping Out the Investment Lifecycle

To turn this concept into a real-world game plan, it helps to understand the objective at each stage. Here’s a quick breakdown of how to move methodically from broad market analysis down to the specific financials of an asset, making sure every decision is backed by solid research.

The Commercial Real Estate Investment Lifecycle at a Glance

This table summarizes the key phases, objectives, and considerations for successfully investing in commercial real estate, from initial strategy to final exit.

Investment Phase | Primary Objective | Key Activities for Investors |

|---|---|---|

1. Identify & Analyze | Source opportunities that align with your risk/return profile and market thesis. | Conduct market research, build broker networks, and perform initial screening of potential deals. |

2. Acquire & Finance | Secure the asset under favorable terms and structure the capital stack effectively. | Underwrite financials, conduct due diligence, negotiate purchase agreements, and secure debt/equity. |

3. Manage & Optimize | Execute the business plan to increase Net Operating Income (NOI) and asset value. | Oversee property management, execute capital improvements, and manage tenant relations. |

4. Exit & Redeploy | Sell the stabilized asset at the optimal time to maximize investor returns. | Position the property for sale, market to qualified buyers, negotiate the disposition, and plan for capital redeployment. |

Ultimately, the goal is to ensure that by the time you're ready to sell, you've created a valuable, well-run asset that another investor will be eager to acquire.

Finding Opportunities Through Market Analysis

A great commercial real estate deal isn't found by luck. It's uncovered long before you ever step foot on a property, starting with sharp market analysis and a disciplined way of finding deals. The pros move past the generic advice; they zero in on the specific data points that signal "opportunity."

This is all about connecting the dots. You have to see the link between big-picture economic shifts and what's actually happening on the ground, block by block. The whole point is to spot markets with real, lasting demand drivers before everyone else does—and before they get overpriced.

Reading the Macroeconomic Tea Leaves

You've got to start with the 30,000-foot view. Broad economic indicators set the stage for any investment you're thinking about. They shape everything from capital availability and tenant demand to the final value of the asset itself.

Here are the big macro trends we always keep an eye on:

Interest Rate Trajectories: This is a big one. Changes in borrowing costs hit property valuations and the feasibility of new projects directly. When rates go up, returns can get squeezed. When they fall, it can kick off a buying frenzy.

GDP and Job Growth: A healthy, growing economy means more jobs. More jobs mean more demand for office space, industrial warehouses, and, of course, places for people to live. National trends tell you which sectors are heating up.

Inflationary Pressures: Commercial real estate, especially assets with shorter leases like multifamily, can be a fantastic hedge against inflation. Why? Because you can adjust rents to keep up with rising costs.

These national trends tell you why now is a good time to look, but the real gold is found when you zoom in on the local scene.

Pinpointing Thriving Submarkets

This is where the real work begins and where granular, location-specific data becomes your best friend. A rising economic tide might lift all boats, but some harbors are just better positioned for a storm. You’re hunting for areas with specific, sustainable catalysts that will keep tenants coming for years.

Once you’ve got a few potential sectors in mind, using solid data-driven decision making strategies is what separates the winners from the losers. You're looking for a convergence of positive signs.

Insight Edge: Don't just track population growth; track high-income job growth. Think about it: a new corporate HQ bringing 500 six-figure jobs will have a much bigger ripple effect on local retail and luxury apartments than 1,000 minimum-wage jobs ever could.

Here's the kind of local data that gets our attention:

Demographic Shifts: Is the area getting younger or older? Are household sizes changing? These trends drive demand for everything from medical offices to starter apartments.

Infrastructure Investment: A new light-rail line, an expanded highway, or a port dredging project can completely change a submarket's value and accessibility. These are massive signals.

Zoning and Entitlement Changes: Pay attention to city hall. Local governments often telegraph future growth by upzoning areas or creating special tax districts. If you can get in before these changes are common knowledge, you can unlock serious value.

### Market Signal Box* The Data: Even in a shifting market, multifamily and office transactions showed surprising strength in a recent Q2, with multifamily deal volume surging 39.5% and office volume rising 11.8% year-over-year, contributing to a total transaction volume of $115 billion (Source: CBRE, Q2 2023).* Interpretation: This resilience shows that capital is flowing decisively toward asset classes with clear demand drivers, even amid broader economic uncertainty.* Investor Take: Follow the institutional money. Focus diligence on sectors demonstrating strong fundamentals rather than trying to time the bottom of the market.

Sourcing On-Market and Off-Market Deals

Okay, you've identified your target markets. Now it's time to build a pipeline of actual deals. This means running a two-pronged attack, balancing the deals everyone can see with the ones nobody knows about.

On-Market StrategiesThis is the public-facing side of the business, accessed through brokers and listing platforms. To win here, it’s all about relationships. Build a rock-solid network of commercial brokers who specialize in your asset type and geographic area. Make sure they know you’re a serious buyer who can close.

Off-Market StrategiesThese are the hidden gems—the deals that never hit the open market. They often represent the best opportunities because you're not bidding against the world. Finding them is an active, hustle-driven process:

Direct Outreach: Pull a list of property owners in your target submarket and start making calls or sending letters. It’s old school, but it works.

Networking: Get to know the real estate attorneys, accountants, and property managers in town. They're often the first to hear when an owner is thinking about selling.

Niche Expertise: Become the go-to person for a specific type of deal (like medical office conversions or self-storage facilities). Before you know it, the deals will start coming to you.

By developing a consistent, multi-channel sourcing strategy, you'll ensure a steady flow of opportunities lands on your desk, putting you in the perfect position to find that one investment that checks all your boxes.

Underwriting and Structuring Your Investment

Finding a deal that looks good on paper is one thing. Actually making it work is another. This is where underwriting comes in—it's the deep-dive, no-nonsense process of figuring out if the story behind a property holds up to the numbers.

Think of it as the ultimate stress test. A broker might tell you a building can achieve 5% annual rent growth, but underwriting is where you dig into the submarket data, comparable properties, and economic trends to see if that's reality or just a sales pitch. It’s about building a financial model that’s not just optimistic, but defensible.

Decoding the Core Financial Metrics

To really get a handle on a deal, you need to speak the language. While there are countless metrics you can track, a few key players tell you almost everything you need to know.

### Novice Lens: Defining Key Terms* Net Operating Income (NOI): This is your property's pure, pre-debt profit. It's all your revenue minus operating expenses. Why it matters: NOI is the fundamental driver of a property's value.* Capitalization Rate (Cap Rate): This is the NOI divided by the Purchase Price. It’s a quick snapshot of the property's unlevered return in year one, perfect for comparing similar assets.* Internal Rate of Return (IRR): This is the total annualized return over the entire investment hold period, accounting for all cash flows from start to finish. Why it matters: It gives you the full picture of performance, not just a one-year snapshot.

If NOI is the engine, the cap rate is its current horsepower, and the IRR is its performance over the entire race.

Building the Capital Stack in Today's Market

The "capital stack" is simply how you layer different types of money—both debt and equity—to buy a property. With the Federal Reserve's effective funds rate sitting at 4.33% as of late 2023, lenders are cautious. This means investors often need to get creative with financing structures. We're seeing more deals use a mix of financing tools like preferred equity, mezzanine debt, or seller financing to get across the finish line.

For a more detailed look, check out our guide on commercial real estate financing options for investors.

Deal Lens: A Simplified Value-Add Multifamily Model

Let's walk through an illustrative example to see how this all plays out. Imagine we're looking at a 100-unit apartment building.

Metric | Current State (Illustrative) | Pro Forma (Year 3) |

|---|---|---|

Purchase Price | $10,000,000 | N/A |

Renovation Budget | $1,000,000 | N/A |

Total Project Cost | $11,000,000 | N/A |

Average Rent/Unit | $1,000/month | $1,300/month |

Annual Gross Income | $1,200,000 | $1,560,000 |

Operating Expenses | $600,000 (50%) | $624,000 (40%) |

Net Operating Income (NOI) | $600,000 | $936,000 |

Exit Cap Rate (Assumed) | N/A | 5.5% |

Stabilized Value (NOI/Cap) | N/A | $17,018,181 |

In this scenario, we put $1M into renovating units and tightening up management, which helped drop our expense ratio. That work boosted the NOI by $336,000. Based on our exit cap rate assumption, that extra income could create over $6M in new value. That's the power of a value-add play.

Before you ever sign on the dotted line, a serious risk assessment is non-negotiable. It’s about protecting your capital and making sure you’re truly ready for what’s ahead. Getting a handle on understanding comprehensive risk management is a smart move for any serious investor.

Conducting Flawless Due Diligence

You've underwritten a deal, the numbers look solid, and you're feeling good. Now comes the real test: due diligence. This is where you trade your spreadsheet for a magnifying glass and verify every single assumption you've made. Rushing this stage is, without a doubt, one of the most expensive mistakes you can make.

Investor Due Diligence Checklist

A rock-solid due diligence process rests on three pillars: financial, physical, and legal. This checklist breaks down the core components of your investigation. For a deeper dive, read our comprehensive guide to commercial real estate due diligence.

Diligence Area | Key Questions to Ask | Essential Documents to Review |

|---|---|---|

Financial | Are the reported revenues and expenses accurate? What is the tenant quality and concentration risk? Are there opportunities to increase income or cut costs? | Last 3 years of operating statements, current rent roll, T-12 financials, individual lease agreements, vendor contracts. |

Physical | What is the condition of the roof, HVAC, and structure? Are there any hidden environmental issues? Does the property comply with zoning? | Property Condition Assessment (PCA), Phase I Environmental Site Assessment (ESA), ALTA survey, zoning report. |

Legal | Does the seller have a clean title? Are there any liens, violations, or pending lawsuits against the property? | Preliminary title report, municipal permit search results, litigation search, entity formation documents. |

Financial Diligence: Verifying The Numbers

This is all about auditing the property’s economic engine. Your job is to separate historical facts from hopeful projections. Get your hands on the rent roll and at least three years of operating statements to understand the property's financial heartbeat. Are leases expiring soon? Is one tenant responsible for a huge portion of the income? This is where you spot concentration risk.

Physical Diligence: Kicking The Tires

The financials tell you where the property has been, but its physical condition tells you where it's going—and how much it's going to cost. This is about sniffing out deferred maintenance before it becomes your problem. This isn't a DIY job. Bring in experts for a Property Condition Assessment (PCA) and a Phase I Environmental Site Assessment (ESA).

Legal Diligence: Clearing The Path to Ownership

The final pillar is all about ensuring you can take ownership free and clear of any messy legal entanglements. This is your real estate attorney’s time to shine. A Title Search is fundamental, confirming the seller actually has the right to sell and uncovering any liens that need to be resolved before closing.

By methodically working through these three pillars, you’re not just buying a property; you’re making a well-vetted, confident investment decision.

Maximizing Returns Through Asset Management

So you’ve closed the deal. Pop the champagne, but don't kick your feet up just yet. Closing isn't the finish line—it's the starting gun. The real, durable value in commercial real estate is forged during the holding period. This is where strategic asset management becomes the active driver of your investment's performance.

Executing the Business Plan

Every property is bought with a specific goal. Asset management is the process of steering the property toward that goal.

For Value-Add Plays: This means overseeing capital improvement projects—like unit renovations or lobby upgrades—on time and on budget, and repositioning the property to attract premium tenants.

For Stabilized Assets: Even a fully occupied building isn't on autopilot. Sharp management focuses on fine-tuning operational efficiencies, controlling expenses, and proactively managing tenant relationships to keep retention rates high.

For anyone new to this side of the business, our article on 9 real estate asset management best practices can really move the needle on returns.

Monitoring Performance as a Passive Investor

If you're investing passively with a sponsor like us, your role shifts from execution to oversight. Your most important tool becomes the quarterly report.

Novice Lens: Don't get overwhelmed. In every report, lock in on three core metrics: the Occupancy Rate (are we full?), Actual vs. Budgeted NOI (are we hitting our profit targets?), and Leasing Velocity (how fast are we signing new tenants?). These three numbers tell 90% of the story.

A good sponsor will always provide detailed narratives alongside the hard numbers, explaining both the wins and the challenges. That kind of regular, transparent communication is the hallmark of a healthy partnership.

Planning Your Exit from Day One

A smart investor always begins with the end in mind. Your exit strategy isn't something you figure out when you're ready to sell; it’s baked into your initial investment thesis. The goal is to time the sale to perfectly capture the maximum value you’ve created.

Several factors will influence how and when you exit, including a stabilized sale to a core investor, a tax-deferred 1031 Exchange, or a refinance and hold strategy to return capital while retaining the asset. Understanding where you are in the market cycle is critical. Research from Hines indicates that as of late 2024, over 66% of global markets were in a buying cycle, the highest level since 2016, suggesting a favorable environment for executing a well-timed exit. To get a better handle on the dynamics, you can read the full analysis of the 2025 market recovery.

Common Questions About Investing in CRE

Jumping into commercial real estate is exciting, but it almost always brings up a lot of questions. Let's tackle some of the most common ones we hear from investors.

What Is the Minimum Investment for Commercial Real Estate?

This really depends on how you decide to play the game. If you're looking to buy a small commercial property directly, you could easily need a few hundred thousand dollars just for the down payment. But for private deals and syndications managed by a sponsor, the typical minimum check from an accredited investor is usually somewhere between $25,000 to $100,000. It's all about finding the right structure for the capital you have.

Which Property Type Is Best for Beginners?

We see a lot of new investors lean toward multifamily properties, and for good reason. The demand driver is simple—people always need a place to live. Another great entry point is a single-tenant net lease (NNN) property, where a creditworthy tenant handles most operating costs, giving you a predictable income stream. Lately, small-bay industrial warehouses have become a hot ticket due to e-commerce and the need for last-mile logistics.

How Do You Calculate Potential Returns on a CRE Investment?

Seasoned investors live and die by a few core metrics. Each one paints a different part of the financial picture:

Cap Rate (Capitalization Rate): A quick, back-of-the-napkin way to see the property's unleveraged annual return.

Cash-on-Cash Return: Tells you exactly what your equity is earning on an annual, pre-tax basis.

IRR (Internal Rate of Return): The most complete view, calculating the total annualized return over the entire investment lifecycle.

What Are the Biggest Risks in Commercial Real Estate?

Knowing what can go wrong is just as crucial as projecting your returns.

Market Risk: An economic downturn can crush tenant demand and sink occupancy rates.

Liquidity Risk: CRE is an illiquid asset. You can't sell a building with the click of a button.

Tenant Risk: If you lose a major tenant, your cash flow can dry up overnight.

Leverage Risk: Debt is a double-edged sword; it magnifies both gains and losses.

Your best defense? Meticulous due diligence, conservative financial modeling, and—most importantly—partnering with experienced operators who have navigated multiple market cycles.

At Stiltsville Capital, we provide accredited investors a direct line to institutional-quality commercial real estate deals. If you're ready to add tangible, resilient assets to your portfolio, let's schedule a confidential call to talk about your goals. Explore our strategy and contact us today.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.