8 Proven Strategies to Add Value to Real Estate Investments in 2025

- Ryan McDowell

- Oct 10, 2025

- 18 min read

Reading Time: 9 min | Good for: Novice Investors (A), Informed Principals (B)

TL;DR: Key Takeaways

Value is Created, Not Just Found: Sophisticated investors generate returns by actively improving properties, not just waiting for market appreciation. This guide outlines eight core value-add strategies.

Focus on NOI: The most effective strategies—from strategic renovations to operational efficiencies—are designed to increase a property’s Net Operating Income (NOI), which directly forces appreciation.

Sponsor Expertise is Crucial: Successfully executing value-add plans requires deep market knowledge, construction management, and operational expertise. For passive investors, choosing the right sponsor is the most critical decision.

Your Next Step: Ready to move from theory to a tangible investment? Schedule a confidential call to discuss how these strategies apply to our current deal flow.

In the competitive landscape of commercial real estate, the most successful investors don't just buy assets; they create value. While market appreciation is a welcome tailwind, disciplined operators generate their own upside through strategic intervention. This guide moves beyond theory to provide a tactical playbook for UHNWI, Family Offices, and discerning investors looking to add value real estate to their portfolios with a clear, executable plan.

This article explores eight distinct, actionable strategies designed to enhance Net Operating Income (NOI), improve market position, and ultimately, force appreciation. From the physical transformations of adaptive reuse and strategic renovations to the operational mastery of expense optimization and market repositioning, these are the levers that sophisticated sponsors pull to turn well-located properties into top-performing assets. This roundup details the proven methodologies that form the core of a successful value-add investment thesis, providing a clear framework for evaluating opportunities and unlocking the hidden potential of your commercial real estate portfolio.

1. Strategic Renovation and Modernization

Strategic renovation is a disciplined, data-driven approach to physical upgrades that directly targets the highest return on investment (ROI). Unlike wholesale gut renovations, this method focuses capital on specific, high-impact areas that tenants and buyers value most, significantly boosting a property's Net Operating Income (NOI) and market valuation while controlling costs. For any investor looking to add value real estate to their portfolio, mastering this technique is fundamental. It involves a surgical application of capital to modernize assets, correct functional obsolescence, and align the property with current market expectations.

How It Creates Value

The core principle is maximizing the value-add premium. By concentrating on key areas, investors can achieve a significant rent bump or sales price increase for a fraction of the cost of a full overhaul. This strategy is particularly effective for Class B or C assets in transitioning neighborhoods where modest, modern updates can command Class A rents or sale prices. For example, Zillow research confirms that even minor kitchen remodels can recoup over 81% of their cost at resale, underscoring the financial logic of this targeted approach.

Investor Take: Strategic renovation isn't about spending the most; it's about spending the smartest. The goal is to identify the precise upgrades that will generate the highest incremental return, whether through increased rental income, lower vacancy, or a higher final sales price.

Implementing Strategic Renovation

A successful renovation requires a clear process to ensure capital is deployed effectively. This workflow prevents scope creep and aligns the project with clear financial goals from the outset.

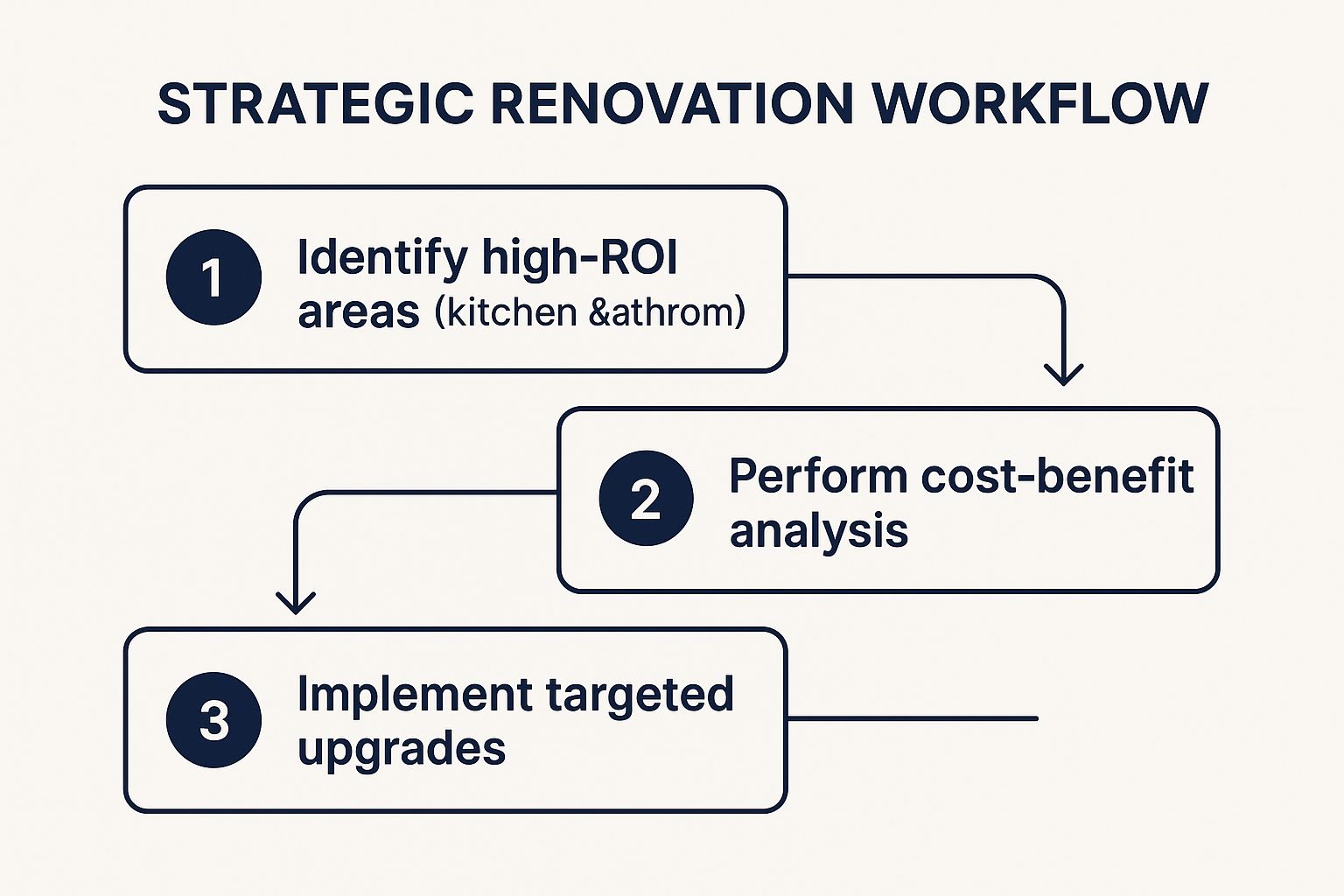

The following infographic illustrates the three-stage process for executing a strategic renovation designed to maximize returns.

This systematic workflow ensures that every dollar spent is analytically justified and directed toward features that have a proven impact on property value. Following this sequence-identifying high-ROI areas, analyzing costs against potential returns, and then executing-is crucial for transforming an underperforming asset into a profitable investment.

2. Conversion and Adaptive Reuse

Conversion and adaptive reuse is a highly creative strategy that unlocks an asset's highest and best use by fundamentally changing its purpose. This approach involves transforming a property from its original function to a more profitable one, such as converting an underutilized warehouse into residential lofts or an old factory into a vibrant food hall and office complex. It is a powerful way to add value real estate because it responds directly to market demand shifts, capitalizes on zoning opportunities, and revitalizes existing structures, creating entirely new income streams and asset classes from overlooked properties.

How It Creates Value

The value creation in adaptive reuse stems from arbitrage between an asset's current, underperforming state and its potential in a new, in-demand format. By repurposing a building, investors can deliver a product that the market desires at a potentially lower cost basis than new construction, while also benefiting from unique character and historical appeal. This strategy is especially effective in urban infill locations where land for new development is scarce and expensive.

A landmark example is New York's Chelsea Market. The former Nabisco factory was transformed into a premier food hall with office space above, and it is now valued at over $2 billion according to reports. This project didn't just renovate a building; it created a neighborhood anchor and demonstrated the immense potential of reimagining industrial spaces.

Investor Take: Adaptive reuse is the art of seeing a property not for what it is, but for what it could be. It requires vision and expertise in navigating zoning and construction complexities, but the rewards can be monumental, creating iconic assets that command premium rents and sale prices.

Implementing Conversion and Adaptive Reuse

Successful execution demands a rigorous due diligence process that goes far beyond a standard acquisition analysis. Navigating zoning laws, building codes, and structural challenges is paramount. A disciplined approach ensures the project's vision is both legally permissible and financially viable.

This video provides an excellent overview of the complexities and opportunities involved in an adaptive reuse project, specifically converting an old church.

The process for a successful conversion involves several critical, non-negotiable steps:

Zoning and Entitlement Analysis: Before acquisition, engage a zoning attorney and an experienced architect to confirm the desired use is permitted. This initial step can prevent a catastrophic investment.

Feasibility and Costing: Develop a detailed financial model that includes a significant contingency budget (often 20-30%) for unforeseen structural, environmental, or regulatory issues common in older buildings.

Stakeholder Engagement: Build relationships with local planning department officials early. Understanding their priorities and concerns can streamline the approvals process and lead to a better-designed project.

Design and Execution: Partner with professionals who have a proven track record in adaptive reuse. Their experience is invaluable in solving the unique problems these projects present, from preserving historic elements to meeting modern code requirements for things like parking and accessibility.

3. Adding Square Footage Through Expansion

Adding square footage is one of the most direct ways to increase a property’s inherent value. This strategy involves physically expanding a building’s footprint or converting non-livable areas into usable space, such as through additions, constructing additional stories, finishing basements, or transforming attics. For any investor seeking to add value real estate to their portfolio, this method offers a tangible, quantifiable boost to the asset's worth, particularly in high-demand markets where every square foot carries a premium.

How It Creates Value

The value creation is straightforward: more usable space equals a higher valuation and greater income potential. This is especially true when an expansion adds high-value areas like bedrooms and bathrooms. In markets constrained by limited land and strict zoning, maximizing the existing envelope of a property is a powerful financial lever. This approach fundamentally alters the property's core specifications, moving it into a higher comparable sales bracket.

For instance, the rise of Accessory Dwelling Units (ADUs) in cities like Los Angeles showcases this principle perfectly. By converting a garage or building a small backyard unit, owners have been able to generate $1,500-$3,000 in monthly rent while adding over $150,000 to their property value. The key is that the cost to build is often substantially lower than the market value of the newly created space.

Investor Take: Expanding square footage is a capital-intensive but often highly profitable strategy. It's not just about making a property bigger; it's about fundamentally reclassifying the asset to command a higher price point and attract a broader pool of buyers or tenants.

Implementing a Square Footage Expansion

A successful expansion project hinges on meticulous planning, strict budget adherence, and a deep understanding of local zoning regulations and market demand. Without this groundwork, costs can quickly spiral out of control, and the final product may not align with buyer preferences.

To execute this strategy effectively, investors should follow a clear, phased approach:

Feasibility and Zoning Analysis: Before anything else, confirm that local zoning codes, setbacks, and height restrictions permit the planned expansion. This phase includes initial architectural sketches and consultations with the city planning department.

Cost-Benefit Analysis: Develop a detailed budget that includes both hard costs (materials, labor) and soft costs (permits, architectural plans, engineering fees). Compare this total projected cost against the expected increase in market value based on comparable property sales ().

Design and Permitting: Finalize architectural drawings that blend seamlessly with the existing structure and maximize functionality. Submit these plans to the local building department to secure all necessary permits, which can be a time-consuming process.

Construction and Execution: Hire a qualified and insured contractor to carry out the construction. Maintain close oversight to ensure the project stays on schedule, within budget, and meets all quality standards. Efficient construction methods can also be explored; for example, investors can learn more about the benefits of modular construction to potentially accelerate timelines and control costs.

4. Improved Property Management and Operations

Improved property management is an operations-centric approach that adds value by boosting a property's efficiency and profitability from the inside out. This strategy focuses on increasing Net Operating Income (NOI) by reducing expenses, maximizing revenue through superior tenant relations, and implementing sophisticated operational systems. Unlike capital-intensive renovations, this method creates significant value with minimal physical changes, making it a powerful tool for any investor looking to add value real estate to their holdings. It is the art of transforming an asset by optimizing its day-to-day performance.

How It Creates Value

The fundamental principle is leveraging operational improvements to directly increase the property's valuation. For income-producing commercial real estate, value is often calculated as NOI divided by the market capitalization (cap) rate. Therefore, every dollar saved in expenses or gained in revenue has a multiplier effect on the property's worth. Better management leads to higher tenant satisfaction, which in turn reduces costly turnover and vacancy.

Novice Lens: What is NOI and why does it matter?Net Operating Income (NOI) is all the revenue from the property, minus all reasonably necessary operating expenses. Think of it as the property’s pre-tax profit before accounting for debt service. It matters because commercial property values are often calculated by dividing the NOI by a "cap rate" (a measure of market yield). A small increase in NOI can create a large increase in the property's value. For example, a $50,000 NOI increase at a 5% cap rate adds $1,000,000 to the asset's valuation ($50,000 / 0.05).

Investor Take: Elite property management isn't a cost center; it's a value creation engine. By focusing on operational excellence-from expense audits and tenant retention to dynamic pricing-investors can engineer significant appreciation without touching a single brick.

Implementing Improved Property Management

Effective implementation requires a systematic and proactive approach to overseeing every aspect of the property's operations. This is not passive ownership; it is active asset management designed to find and exploit inefficiencies for financial gain.

A successful operational overhaul hinges on a clear, data-informed process:

Conduct a Comprehensive Audit: Begin with a line-by-line review of all income and expense statements. Scrutinize vendor contracts, utility bills, property taxes, and insurance policies to identify immediate opportunities for cost reduction or renegotiation.

Implement Modern Systems: Deploy property management software to automate rent collection, track maintenance requests, and analyze financial performance. This technology provides the data needed for informed decision-making and operational efficiency.

Focus on Tenant Retention: Develop and launch programs aimed at improving the tenant experience. Simple gestures like responsive communication, community events, and well-maintained common areas can dramatically reduce turnover, which can be extremely costly.

Optimize Revenue Streams: Regularly analyze market rents to ensure your units are priced competitively but aggressively. Explore ancillary income opportunities, such as paid parking, storage units, or laundry facilities, and use dynamic pricing tools where applicable to maximize revenue.

5. Subdivision and Land Development

Subdivision is the strategic process of legally dividing a single, larger tract of land into multiple smaller, independent parcels. This technique creates value by capitalizing on the principle that the sum of the parts is often worth significantly more than the whole. For investors looking to add value real estate to their portfolio, land development presents a foundational opportunity to create inventory for builders and end-users, unlocking significant upside potential that is not available through existing-asset acquisition alone. It requires navigating zoning laws, infrastructure planning, and market analysis to transform raw land into marketable lots.

How It Creates Value

The primary value driver in subdivision is the creation of scarcity and utility. A large, unsubdivided parcel may only appeal to a small pool of large-scale developers, limiting its market value. By dividing it into smaller, more manageable lots, an investor opens the asset up to a much broader market of custom home builders, retail developers, and individual buyers. This increased demand directly translates to a higher aggregate sales price. This strategy is particularly effective for parcels located in the path of growth, where demand for new housing or commercial pads is escalating.

A classic example involves purchasing a 10-acre parcel on the edge of a growing city for $500,000. After incurring costs for planning, engineering, and basic infrastructure, the developer subdivides it into eight individual lots. If each lot can be sold to a custom builder for $150,000, the total revenue becomes $1.2 million, generating a substantial profit.

Investor Take: Subdivision is a form of manufacturing new real estate assets. Your role is to take a raw material (land) and, through entitlement and engineering, transform it into a finished good (a buildable lot) that commands a premium price in the market.

Implementing Subdivision and Land Development

A successful subdivision project is heavily front-loaded with due diligence and expert consultation. The process is less about construction and more about navigating regulatory frameworks and managing civil engineering requirements. A disciplined, phased approach is critical to mitigate risks associated with entitlement delays and unforeseen site conditions.

Key steps in this process include:

Feasibility and Due Diligence: Before acquisition, conduct a thorough investigation of local zoning ordinances, subdivision regulations, and comprehensive plans. Identify potential constraints such as wetlands, steep slopes, or inadequate utility access. This initial analysis determines the project's viability.

Expert Team Assembly: Engage an experienced land-use attorney and a reputable civil engineering firm from the very beginning. Their expertise is crucial for creating a viable site plan, navigating the approvals process with the local planning department, and engineering the required infrastructure.

Entitlement and Permitting: This is the core of the value-creation process. It involves submitting preliminary and final plats (maps of the subdivision) for approval by municipal authorities. This phase requires meticulous attention to detail and proactive communication with planning staff and local officials.

Site Improvement and Lot Sales: Once the final plat is approved and recorded, physical site work can begin. This may include grading, installing roads, and extending utilities like water, sewer, and electricity to each lot. After improvements are complete, the individual lots can be marketed and sold.

6. Value-Add Through Repositioning and Rebranding

Repositioning is a sophisticated strategy that fundamentally alters a property's market identity and target demographic to unlock its hidden potential. This approach goes beyond simple cosmetic upgrades; it involves a coordinated effort of physical improvements, branding, and operational changes to shift an asset from one market class to another. For investors looking to add value real estate, this method can capture significant rent premiums and increase property valuation by aligning the asset with underserved market niches and emerging demographic trends.

How It Creates Value

The primary value driver is arbitrage between market perceptions. Repositioning allows an investor to acquire an underperforming asset at a Class B or C valuation and, through strategic changes, elevate its performance and appeal to command Class A or premium boutique rents. This is not just renovation; it's a transformation of the property's story, purpose, and place in the market.

For example, a dated 1970s apartment complex can be rebranded as “urban industrial lofts” by exposing brick, installing modern finishes, and adding a coworking space, leading to a 35% increase in rents. Major real estate investment trusts like Equity Residential have long used repositioning strategies to keep their portfolios aligned with tenant demands, maximizing rental income.

Investor Take: Repositioning is about changing the narrative of an asset. The goal is to identify a disconnect between a property's current state and its potential highest and best use, then execute a plan that bridges this gap to capture untapped value.

Implementing Repositioning and Rebranding

A successful repositioning project hinges on deep market insight and disciplined execution. It requires a clear vision for the property's new identity and a multi-faceted plan to bring that vision to life, integrating marketing and operational changes with physical upgrades.

Market and Demographic Analysis: Begin with comprehensive research to identify a profitable, underserved segment in the local market. Analyze demographic shifts, psychographic profiles, and competitive offerings to define the ideal target tenant or customer.

Develop a Cohesive Brand Identity: Create a compelling brand that resonates with the target audience. This includes the property name, logo, color palette, and key messaging, which must be consistently applied across all touchpoints, from online listings to on-site signage.

Execute Targeted Upgrades and Amenity Additions: Align all capital improvements with the new brand position. This could mean converting an old laundry room into a state-of-the-art fitness center, adding pet-friendly facilities like a dog wash station, or creating collaborative tech-enabled workspaces.

Launch a Professional Marketing Campaign: Use high-quality professional photography, virtual tours, and targeted digital advertising to communicate the property's new value proposition and attract the desired demographic.

Align Operations and Management: Train on-site staff to embody the new brand standards and deliver an elevated tenant experience. This may involve phasing out incompatible legacy tenants and actively recruiting those who align with the new property profile.

7. Energy Efficiency and Green Building Upgrades

Implementing energy-efficient systems and sustainable building practices is a powerful, dual-impact strategy to add value real estate. This approach directly reduces a property's operating expenditures, which boosts Net Operating Income (NOI), while simultaneously creating market differentiation that attracts premium tenants and buyers. For today's environmentally and fiscally conscious investors, green upgrades are no longer a niche but a core component of future-proofing assets and maximizing financial returns. It involves a calculated investment in modern, sustainable technologies that deliver measurable savings and enhance a property’s brand.

How It Creates Value

The value proposition is twofold: immediate cost reduction and long-term asset appreciation. Lower utility bills directly increase NOI, which, when capitalized, results in a significant uplift in property valuation. Furthermore, certifications like LEED or Energy Star act as a marketing beacon, attracting high-quality corporate and residential tenants who are often willing to pay higher rents for sustainable, healthier spaces. This can lead to lower vacancy rates, increased tenant retention, and a stronger competitive position in the marketplace.

The famous $550 million retrofit of the Empire State Building provides a landmark example. This project reduced the iconic building’s energy consumption by 38%, saving millions annually while increasing occupancy with premium rents, as widely reported. On a smaller scale, a multifamily property that installs solar panels and cuts its common area electricity costs by just $25,000 per year can add over $400,000 to its value, assuming a 6% cap rate.

Investor Take: Green building upgrades offer a rare win-win, aligning financial performance with environmental responsibility. The goal is to identify sustainability improvements that not only cut expenses but also build a premium brand identity for the asset, driving both income and long-term appreciation.

Implementing Green Building Upgrades

A successful green upgrade initiative requires a data-first approach to identify the most impactful improvements and maximize financial incentives. This systematic process ensures capital is allocated to projects with the fastest and highest returns, avoiding low-impact "greenwashing" expenditures.

A typical implementation workflow includes:

Energy Audit & Benchmarking: Begin with a professional energy audit to identify specific areas of inefficiency. This analysis provides a data-driven roadmap, prioritizing upgrades like LED lighting (often with a payback period under two years), HVAC system modernization, or building envelope improvements like new insulation and windows.

Incentive and Rebate Analysis: Before committing capital, thoroughly research and apply for all available local, state, and federal incentives. Programs like utility rebates, tax credits, and green financing options such as PACE (Property Assessed Clean Energy) can significantly reduce the net cost of the project and accelerate ROI.

Execution and Marketing: Implement the prioritized upgrades and then actively market these new green features. Highlight lower utility costs for tenants, improved air quality, and any official certifications in all leasing and sales materials to justify premium pricing and attract the target demographic.

8. Optimizing Land Use and Density

Optimizing land use is a high-impact strategy that unlocks a property’s latent potential by maximizing its development capacity under existing zoning laws. This sophisticated approach to add value real estate involves leveraging unused development rights to increase a site's density. Methods include adding new structures, vertically expanding existing buildings, or securing zoning variances to permit a greater number of units. This technique is fundamentally about transforming underutilized land into income-producing square footage, thereby creating significant equity.

How It Creates Value

The value proposition hinges on the economic principle that, in desirable locations, higher density translates directly to higher revenue and a greater property valuation. By building to the maximum allowable floor area ratio (FAR) or unit count, investors can dramatically increase a property's cash flow potential and its ultimate sale price. This is especially potent in supply-constrained urban markets where land is the most valuable component of any real estate asset.

For instance, consider a developer in Los Angeles who utilizes a local density bonus program. By including a component of affordable housing, they are granted permission to build 35% more market-rate units than the base zoning would allow. This not only increases the project's profitability but also addresses community housing needs.

Investor Take: Optimizing land use is about seeing beyond the existing structure and recognizing the value embedded in the zoning code. The goal is to maximize the profitable use of every square foot of land, converting regulatory allowances into tangible financial returns.

Implementing Land Use Optimization

Successfully increasing a property's density requires meticulous due diligence, strategic planning, and often, navigation of complex municipal processes. A disciplined workflow is essential to ensure the project remains financially viable and compliant with all regulations.

Zoning Code Analysis: The first step is a deep dive into the local zoning ordinance. This involves hiring a land-use consultant or attorney to calculate the maximum buildable square footage, unit count, height, and parking requirements. Explore all potential overlays, special districts, and bonus programs.

Feasibility and Financial Modeling: Conduct a comprehensive feasibility study. Model the costs of construction, entitlement, and any required infrastructure upgrades against the projected rental income or sale value of the additional units. Analyze comparable sales of properties at different density levels to validate your value-add projections.

Entitlement and Permitting: Engage with city planners and local officials early in the process. Proactively meet with neighborhood groups to address potential concerns about traffic, parking, or building scale. This collaborative approach can streamline the approval process for variances, conditional use permits, or site plan reviews.

Execution and Construction: Once all approvals are secured, proceed with the construction phase. This could range from adding accessory dwelling units (ADUs) on a single-family lot to a full-scale demolition and rebuild of a commercial property.

This systematic approach ensures that the pursuit of higher density is grounded in sound financial analysis and a clear understanding of the regulatory landscape, transforming an underperforming property into a highly productive asset.

Investor Checklist: Questions to Ask a Sponsor About Their Value-Add Plan

When evaluating a passive investment opportunity, the sponsor's business plan is paramount. Use these questions to diligence their approach:

Basis of Assumptions: What specific market data (rent comps, sales comps, vacancy rates) supports your pro-forma assumptions?

Contingency Planning: What is the size of the renovation/construction contingency budget, and what are the triggers for using it?

Timeline and Milestones: What is the detailed project timeline, including key milestones for permitting, construction, lease-up, and stabilization?

Team Experience: Can you provide examples of similar value-add projects your team has successfully completed in this market or asset class?

Exit Strategy: What are the primary and secondary exit strategies, and what exit cap rate are you projecting? How does that compare to current market rates?

Risk Mitigation: What are the top three risks to this business plan, and what specific steps have you taken to mitigate them?

Alignment of Interests: How is the GP/LP structure aligned (e.g., preferred return, promote structure) to ensure you are incentivized to execute this plan?

Partnering for Success: Executing Your Value-Add Strategy

The journey from an underperforming asset to a stabilized, high-yield investment is paved with strategic decisions and meticulous execution. Throughout this article, we've explored a comprehensive toolkit designed to add value real estate assets, moving far beyond simple cosmetic fixes. We’ve dissected the power of strategic renovations, the transformative potential of adaptive reuse, and the financial uplift from operational efficiencies.

From adding rentable square footage and optimizing land use to rebranding an entire property, each tactic represents a distinct lever for driving Net Operating Income (NOI) and boosting asset valuation. The core principle is clear: value isn't just found; it's actively created. Mastering these approaches means looking at a property not just for what it is, but for what it could become. It requires a vision grounded in deep market analysis and a clear understanding of the capital required to achieve the desired transformation.

Synthesizing Strategy with Execution

The true challenge—and opportunity—lies in selecting the right combination of these strategies for a specific asset and market cycle. A successful value-add business plan rarely relies on a single initiative. More often, it's a carefully orchestrated sequence of improvements. This multi-faceted approach transforms a property from a passive holding into a dynamic business enterprise.

For investors, particularly those in passive limited partner (LP) roles, the critical determinant of success is the operating partner chosen to spearhead this process. An experienced sponsor brings not just capital, but the specialized expertise to underwrite opportunities accurately, manage complex construction projects, and navigate the nuances of lease-up and stabilization. They are the architects of the value creation process.

Your Next Step in Value-Add Investing

Understanding these strategies is the first step. The next is applying them within a disciplined, institutional framework that manages risk while pursuing outsized returns. The ability to identify properties with correctable flaws—whether physical, operational, or reputational—is the cornerstone of any successful campaign to add value real estate. By partnering with a team that has a proven track record, investors can gain access to this potent and rewarding segment of the commercial real estate market.

This approach is not merely about enhancing buildings; it’s about building resilient, long-term wealth. By transforming undervalued assets into thriving, in-demand properties, you participate in a strategy that can provide strong cash flow, significant appreciation, and a tangible hedge against inflation. Well-structured real assets, when managed by a disciplined sponsor, can be a prudent and resilient component of a long-term wealth strategy.

The strategies discussed are central to our investment philosophy at Stiltsville Capital LLC. We specialize in identifying and executing complex value-add business plans to create compelling, risk-adjusted returns for our accredited investor partners.

Ready to put these principles into practice? Schedule a confidential call with Stiltsville Capital to discuss how our disciplined approach can fit within your portfolio.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments