A Guide to Commercial Real Estate Financing Options for Investors

- Ryan McDowell

- Jul 22, 2025

- 14 min read

Reading Time: 8 min | Good for: Novice (A), Informed (B)

TL;DR: Key Takeaways

Financing is Strategy: The right loan isn't just about the lowest rate; it's a strategic tool that must align with your investment plan—whether it's a stable, long-term hold or a short-term, value-add project.

The Capital Stack Rules All: Understanding the "capital stack" (senior debt, mezzanine debt, preferred equity, common equity) is non-negotiable. It dictates risk, return, and who gets paid first.

Know Your Options: From traditional bank loans and government-backed programs (SBA, Agency) to more complex tools like CMBS loans and mezzanine debt, a wide array of commercial real estate financing options exists to fit every deal type.

Investor Protection is Key: The difference between recourse (your personal assets are at risk) and non-recourse (risk is limited to the property) financing is a critical distinction that sophisticated investors must navigate carefully.

Decoding the Commercial Real Estate Financing Landscape

Financing is the engine that drives every commercial real estate (CRE) deal. Just as a builder wouldn't break ground without a blueprint, an investor needs a rock-solid financing strategy. This isn't a one-size-fits-all situation; your strategy must be tailored to the specifics of the deal—the property type, your game plan, and your comfort with risk.

The financial structure you choose has a direct impact on your project's profitability, risk profile, and ultimate success. The right loan can amplify your returns and feel like a tailwind, while a mismatched loan can quickly become an anchor, draining cash flow and jeopardizing the entire investment.

Market Signal: What's Happening in Lending Right Now?

The market for CRE financing is constantly evolving with the economy, interest rate decisions, and lender sentiment. After a period of caution, we are now seeing a significant resurgence in lending activity.

In the first quarter of 2025, the CBRE Lending Momentum Index surged by 13% from the previous quarter and an impressive 90% year-over-year. According to CBRE, this was driven by a rebound in bank lending and tighter mortgage spreads, signaling renewed confidence from capital providers. You can dig into the full story on this lending surge on cbre.com.

Investor Take: This changing environment brings both opportunities and challenges. For savvy investors, more competitive loan terms may be available. However, it also means you must remain agile and well-informed to capitalize on these shifts. This trend aligns with broader optimism, as a recent Deloitte survey found 68% of real estate leaders expect financing to become cheaper in 2025. You can explore the full findings on commercial real estate sentiment from Deloitte.com.

Understanding the Capital Stack

At the core of every deal's financial structure is the "capital stack." Picture it as a layered cake, where each layer represents a different source of money used to fund the deal. Each layer carries a different level of risk and, consequently, a different priority for repayment.

Novice Lens: What is the Capital Stack? The capital stack is the blueprint for your deal's financial structure. It typically includes: 1. Senior Debt: The safest, lowest-cost layer (like a bank mortgage). 2. Mezzanine Debt / Preferred Equity: Middle layers that fill funding gaps. 3. Common Equity: The investor's own cash—the riskiest layer with the highest potential return.

How you assemble this stack—the specific mix of debt and equity you choose—is one of the most critical decisions you'll make. It determines the pecking order for who gets paid and sets the entire risk-and-return profile for your investment.

Throughout this guide, we’ll dissect each piece of that stack, from foundational senior debt to complex equity partnerships. By the end, you'll have the knowledge to build a capital stack that perfectly supports your investment goals.

Building Your Foundation: Traditional Debt Financing

For most commercial real estate deals, traditional debt financing is the sturdy foundation upon which the entire investment is built. Think of it as the bedrock—it’s reliable, universally understood, and essential for stability. This is the most common path to financing, offered by familiar players like commercial banks, credit unions, and life insurance companies.

This type of loan, often called senior debt, sits in the most secure position in the capital stack. Because it gets paid back first, it almost always carries the lowest interest rates, making it the most affordable way to fund an acquisition or development project.

The Lender's Lexicon: Two Metrics That Matter

When you approach a traditional lender, their decision boils down to two key numbers. As an investor, mastering these is non-negotiable.

Loan-to-Value (LTV): A simple ratio comparing the loan amount to the property’s appraised value. If you’re buying a $10 million property and the lender offers a 65% LTV, they’ll fund $6.5 million. You need to bring the remaining $3.5 million in equity.

Debt Service Coverage Ratio (DSCR): This metric shows if the property’s net operating income can cover its mortgage payments. A DSCR of 1.25x means the property generates 25% more cash than needed for annual loan payments. Lenders typically require a DSCR of at least 1.20x to 1.35x to ensure a cash flow buffer.

These metrics are how lenders manage risk. A strong property with consistent cash flow will easily meet these targets, making it a prime candidate for the best available loan terms. For a deeper dive, see our post on how lower interest rates can be a catalyst for commercial real estate investment.

Recourse vs. Non-Recourse: A Critical Distinction

For sophisticated investors and family offices, a key negotiating point is whether a loan is recourse or non-recourse. This detail determines your personal risk exposure.

Recourse Loan: If the deal fails and selling the property doesn't cover the loan, the lender can pursue your other personal or business assets to recover their losses. Non-Recourse Loan: The lender's claim is limited only to the property itself. Your other assets are protected, dramatically reducing your personal risk.

While non-recourse loans are the gold standard for investor protection, they are typically reserved for high-quality, stabilized assets and borrowers with strong track records. Many conventional bank loans, especially for value-add projects, will include some recourse that may be phased out as the project achieves performance milestones.

The primary appeal of traditional debt is its low cost and widespread availability. The trade-off? The underwriting process is rigorous, flexibility can be limited, and you may have to provide a personal guarantee. It’s the perfect fit for stabilized properties with predictable income, where the main goal is to secure low-cost, long-term financing.

Tapping into Government-Backed Loan Programs

While large banks are a primary source of CRE financing, some of the most advantageous terms come from an often-overlooked area: government-backed programs. By providing a guarantee that shields lenders from risk, these programs unlock financing with higher leverage, longer terms, and lower rates than are typically available in the private market.

To be clear, you aren't borrowing directly from the government. Instead, agencies like the Small Business Administration (SBA) or government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac backstop loans issued by traditional lenders. This partnership creates powerful, specialized financing tools for specific CRE asset classes.

For Owner-Occupied Properties: SBA 504 and 7(a) Loans

If you're a business owner looking to purchase the building you operate from, SBA loans are among the best financing options available. These programs are designed to fuel small business growth by making real estate ownership more accessible.

The SBA 504 loan program is particularly powerful. It divides financing into a three-part structure:

A conventional bank loan covers 50% of the project cost.

A second loan from a Certified Development Company (CDC), backed by the SBA's guarantee, covers another 40%.

This leaves just 10% for you, the borrower, to contribute as a down payment.

This structure allows a business to acquire a property with as little as a 10% down payment—a significant advantage over the 25-35% equity typically required by banks.

Investor Takeaway: For any business currently leasing its space, evaluating an SBA-backed purchase is a strategic imperative. The ability to build equity and secure your location with a minimal down payment can fundamentally improve a company's long-term financial health.

For Multifamily Investors: Agency Loans (Fannie Mae & Freddie Mac)

For investors in the multifamily sector, the gold standard for financing comes from the "Agencies"—Fannie Mae and Freddie Mac. These GSEs exist to promote stability and liquidity in the U.S. housing market, and their multifamily loan programs are the bedrock of the apartment investment industry.

Key features make Agency loans highly desirable:

Largely Non-Recourse Terms: This is a major benefit. If a deal encounters trouble, the lender's recourse is generally limited to the property itself, protecting your other personal and business assets.

Competitive Rates: The Agencies consistently offer some of the most competitive fixed and floating interest rates available.

Long Amortization: 30-year amortization schedules are common, which means lower monthly payments and improved cash flow.

Of course, these premium loans come with stringent underwriting requirements. Your property must meet high standards for quality, occupancy, and operations. But for any stabilized multifamily property with five or more units, Agency financing is almost always the optimal path.

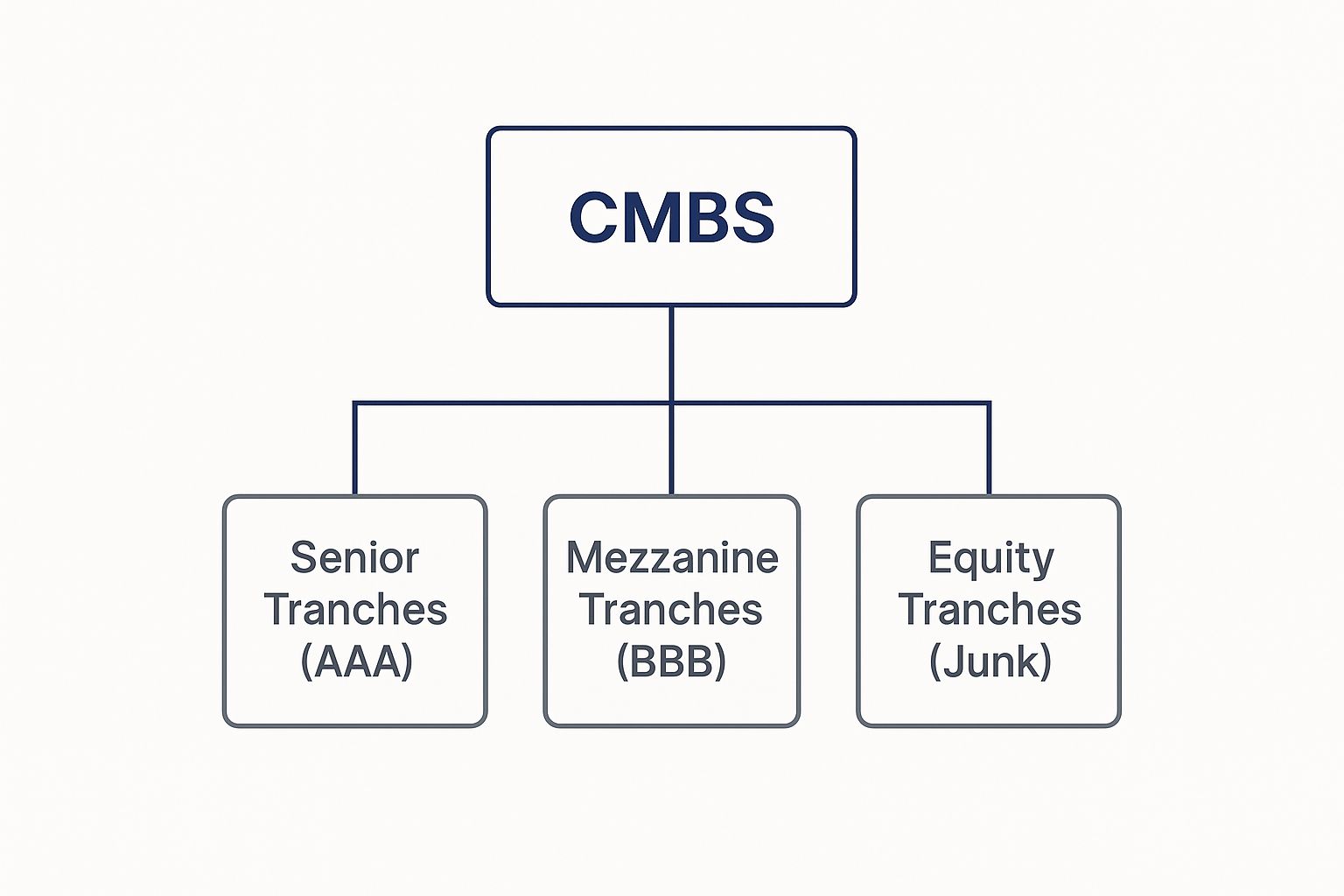

Accessing Capital Markets with CMBS Loans

When a project is too large or too specialized for a traditional bank, it's time to look toward the capital markets and Commercial Mortgage-Backed Securities (CMBS) loans. Often called "conduit loans," they offer a powerful, albeit complex, financing solution.

Instead of one bank holding your loan, a lender pools your loan with a diverse group of others. This portfolio of loans is then packaged into a single large security and sold in "tranches" (slices) to investors on Wall Street. This process, known as securitization, transforms illiquid real estate debt into a tradable financial instrument.

For a borrower, this means accessing a massive pool of capital that is independent of any single bank's lending capacity. The result is often higher leverage and the potential for interest-only payment periods, which can significantly boost cash flow in the early years of an investment.

The Allure and The Ailments of CMBS Financing

The single greatest appeal of a CMBS loan is that it is almost always non-recourse. For sophisticated investors and family offices, this protection is invaluable.

However, this benefit comes at a steep price: flexibility. Once your loan is securitized, it is managed by a third-party servicer whose sole duty is to enforce the rigid terms of a Pooling and Servicing Agreement (PSA). There is virtually no room for negotiation or modification.

Investor Takeaway: With CMBS loans, you trade flexibility for non-recourse capital. The protection is a powerful shield, but the rigid servicing and severe prepayment penalties mean your business plan must align perfectly with the loan's fixed terms for its entire duration.

This inflexibility becomes a major issue if you need to make changes or wish to sell or refinance the property before the loan matures.

Understanding CMBS Prepayment Penalties: Defeasance & Yield Maintenance

Exiting a CMBS loan early triggers some of the most punitive prepayment penalties in the industry. They exist to protect the bondholders who bought slices of your loan and expect a specific return over a set period. The two most common forms are:

Defeasance: You don't actually pay off the loan. Instead, you must purchase a portfolio of U.S. government securities (like Treasury bonds) that generates an identical stream of payments for the lender for the remainder of the loan term. The cost can be substantial, especially if interest rates have fallen since your loan originated.

Yield Maintenance: A more direct but still costly penalty. You pay the lender a lump sum calculated to compensate them for the interest income they will lose due to your early repayment, ensuring they achieve the same "yield" as if you held the loan to maturity.

The strict nature of CMBS loans makes timing everything. With many market participants anticipating a more favorable lending environment, locking into a rigid, long-term CMBS loan today requires careful strategic consideration. You're betting that the immediate benefits outweigh the future cost of inflexibility.

Deal Lens: The Advanced Investor's Toolkit

What happens when a deal’s potential is greater than what a traditional bank is willing to fund? This is where savvy investors get creative, turning to alternative financing solutions to execute more ambitious projects.

These specialized tools bridge the gap between senior debt and your own equity. They are essential for value-add or opportunistic projects that involve a major transformation—the kind of deals that often make conventional lenders nervous.

Getting Creative: Mezzanine Debt and Preferred Equity

Think of mezzanine debt and preferred equity as the high-octane fuel for your deal. While they cost more than a standard bank loan, they allow you, the sponsor, to retain more ownership and control. If the project performs as projected, that retained equity can lead to a significant boost in your returns.

Mezzanine Debt vs. Preferred Equity: What's the Real Difference?

While both mezzanine debt and preferred equity fill a funding gap, they are structurally very different. For any serious investor, understanding this distinction is crucial.

Mezzanine debt is a loan secured not by the property, but by a pledge of your ownership interest in the company that owns the real estate. In case of default, the mezzanine lender can foreclose on that ownership stake and take control of the project.

Preferred equity, by contrast, is an equity investment, not a loan. "Pref" investors are repaid before you, the common equity holder. Their power is derived from rights specified in the operating agreement, which can include the right to remove the general partner (you) and take control if the project deviates from the business plan.

Advanced Lens: The Difference is the Remedy A mezzanine lender uses a UCC foreclosure to seize ownership shares—a process much faster than a traditional property foreclosure. A preferred equity holder’s power is contractual; their influence is defined by the control rights negotiated upfront in the operating agreement.

To make this complex structure work, the senior lender, mezzanine lender, and equity partners execute a detailed intercreditor agreement. This document is the rulebook that dictates payment priority and each party's rights in the event of distress.

Example Case Study: Value-Add Hotel Repositioning

Let's illustrate how this works with a simplified example of a value-add hotel project.

Total Project Cost: $20,000,000

Senior Construction Loan: A bank provides a loan for 65% LTV, which is $13,000,000.

Remaining Funding Gap: $7,000,000

The Solution: Instead of contributing the full $7M in cash, you bring in a mezzanine lender to provide $3,000,000.

Your Equity Contribution: Your required cash is now reduced to $4,000,000.

While the $3M mezzanine loan carries a higher interest rate (e.g., 10-12%) than the senior debt, it allows you to pursue a larger, more profitable project while preserving your own capital and maximizing your potential return on equity.

The Sprinter: Using Hard Money Loans for Speed

One final tool in the alternative financing toolbox is the hard money loan. These are short-term, asset-based loans from private lenders. Think of them as the sprinters of the finance world—incredibly fast but not built for long distances.

Hard money lenders focus almost exclusively on the property's value, with less emphasis on your credit score. This makes them an ideal solution for specific scenarios:

Rapid Closings: When you need to close a deal in days, not months.

Distressed Assets: Funding deals on properties that conventional banks would avoid.

Bridge Financing: Providing a short-term "bridge" to acquire or reposition a property before you qualify for a permanent loan.

This speed and flexibility come at a cost. Interest rates are typically in the double digits, and loan terms are very short (usually 6-24 months). A hard money loan is a tactical tool used to seize an opportunity quickly, with a clear plan to refinance into cheaper, long-term debt.

Matching Financing to Your Investment Strategy

You've now seen the full menu of commercial real estate financing options. The most crucial step is selecting the right one. The sharpest investors understand that the loan is a strategic tool that must be perfectly matched to the investment plan.

The loan you’d use for a stable office tower would be a disaster for a value-add apartment building you plan to reposition. This is where we move from theory to action, building a capital stack that not only funds the deal but actively supports your business plan.

Aligning Debt with Your Deal's Timeline and Goals

The first question is simple: what are you trying to accomplish? Your answer will point you directly to the right financing.

For Core/Core-Plus Strategies (Stable, Long-Term Holds): Your goal is predictable cash flow. You need cheap, permanent financing. A conventional bank loan, life company mortgage, or long-term, fixed-rate CMBS loan is your best friend. Flexibility is secondary to locking in a low cost of capital.

For Value-Add Strategies (Reposition and Refinance): Your plan involves a short-term transformation followed by a sale or refinance. Flexibility is paramount. A short-term bridge loan or a bank loan with minimal prepayment penalties is ideal. This allows you to exit the loan without punitive fees once you've stabilized the property.

For Opportunistic Strategies (Ground-Up Development): These are high-risk, high-return plays that demand the most creative capital solutions. You'll almost always require a combination of a senior construction loan paired with more expensive capital, like mezzanine debt or preferred equity, to make the project viable.

Checklist: Questions to Ask Before You Sign

Before you commit to any loan—whether borrowing directly or investing with a sponsor—insist on clear answers to these questions.

What are the exact prepayment terms? Can I sell or refinance when I want to, or am I facing a massive defeasance or yield maintenance penalty that could destroy my profit?

Is there a personal guarantee? If so, what are the "burn-off" provisions? At what point does my personal liability decrease or disappear?

What are the key loan covenants? What specific Debt Service Coverage Ratio (DSCR) or occupancy level must I maintain to avoid a technical default?

What are the lender's reserve requirements? How much of my capital will be held in escrow for taxes, insurance, and future capital expenditures?

How are construction draws handled? For development deals, how quickly and reliably can I access funds to pay contractors? Delays can sink a project.

What is the lender's track record? Have they financed this property type in this market before? An experienced lender is a partner; an inexperienced one is a liability.

This final check is more critical than ever. The Mortgage Bankers Association reported that 20% of all outstanding commercial mortgages, worth $957 billion, are set to mature in 2025. You can read more in the MBA's 2025 maturity report. This "maturity wall" will create both refinancing challenges and incredible acquisition opportunities.

The complexity of the financing world shouldn't be intimidating; it's an opportunity. When you understand the full spectrum of commercial real estate financing options and meticulously align them with your goals, capital ceases to be a simple necessity. It becomes your most powerful strategic advantage. To see these ideas in action, explore our guide on how to invest in commercial real estate.

Frequently Asked Questions

When it comes to financing commercial real estate, a few key questions come up time and time again.

What’s the difference between recourse and non-recourse financing?

A recourse loan includes a personal guarantee. If the property sale doesn't cover the debt, the lender can pursue your other personal or business assets. A non-recourse loan limits the lender's claim strictly to the property itself, shielding your other assets. This is the preferred structure for sophisticated investors and is common with CMBS, agency, and life company loans.

How does my investment strategy affect my financing options?

Your strategy is paramount. A stable, cash-flowing property ("Core") can easily secure low-cost, long-term debt. A "Value-Add" or "Opportunistic" strategy (renovation, development) signals more risk and requires more flexible, and often more expensive, financing like bridge loans, mezzanine debt, or preferred equity to fund the transformation.

Why It Matters: Using a rigid, long-term loan for a short-term, value-add project is a classic mistake. The prepayment penalties can destroy your business plan. Always align the loan’s flexibility with your project’s timeline.

What is a capital stack and why is it important?

The capital stack represents all the money used to buy a property, layered by risk. At the base is secure senior debt. Above it sit mezzanine debt or preferred equity. At the top is common equity (your cash), which is the riskiest position but has the highest potential return. This structure is critical because it dictates who gets paid first and defines the deal's overall risk-return profile, a key concept for navigating the challenges confronting commercial real estate investors.

At Stiltsville Capital, we specialize in structuring sophisticated financing solutions that are custom-built to match our investors' goals. We believe that well-structured real estate assets, financed prudently, can be a resilient component of a long-term wealth strategy.

Ready to build the right capital stack for your next investment? Schedule a confidential call with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments