What Is a 1031 Exchange? A Guide to Deferring Real Estate Taxes

- Ryan McDowell

- 2 days ago

- 16 min read

Reading Time: 8 min | Good for: Novice Investors (A), Informed Principals (B)

At its core, a 1031 exchange is one of the most powerful tax-deferral tools available to a real estate investor. It allows you to sell an investment property and roll the full proceeds into a new "like-kind" property, all while deferring capital gains taxes. This isn't about tax elimination, but a strategic move to keep 100% of your capital working for you, compounding and growing over time.

TL;DR: The 1031 Exchange in a Nutshell

What it is: A strategy under Section 1031 of the U.S. tax code allowing investors to defer capital gains tax on the sale of an investment property by reinvesting the proceeds into a similar property.

Who should care: Any real estate investor—from individuals to family offices—looking to build wealth by trading up in asset value, diversifying their portfolio, or relocating capital without an immediate tax hit.

Why it matters now: In a market with shifting valuations, a 1031 exchange provides the flexibility to reposition capital into higher-growth assets or markets while preserving equity that would otherwise be lost to taxes.

Your Definitive Guide to the 1031 Exchange

For savvy commercial real estate investors, the 1031 exchange is more than just a tax code—it's a wealth-building engine. It’s the mechanism that lets you trade up in value, diversify your portfolio, or pivot into a new asset class without taking an immediate tax hit.

This strategy gets its name from Section 1031 of the U.S. Internal Revenue Code and is a cornerstone of the real estate market. Just how impactful is it? A 2021 study by Ernst & Young (EY), cited by the Federation of Exchange Accommodators, found these exchanges supported approximately 568,000 jobs and contributed over $55 billion to the U.S. GDP in a single year. For a deeper look at the nuts and bolts, many investors turn to resources like Mastering 1031 Exchange Real Estate Rules.

The Role of the Qualified Intermediary

You can't just sell one property and buy another to make a 1031 exchange work. The process is governed by strict rules, and the most critical player is the Qualified Intermediary (QI), sometimes called an accommodator.

Why it matters: A Qualified Intermediary is an independent, third-party professional who facilitates the exchange. The QI holds the sale proceeds from your relinquished property in escrow, ensuring you never have "constructive receipt" of the funds. Touching the money, even for a moment, would invalidate the exchange and trigger the tax. Using a QI is absolutely non-negotiable.

Here’s a quick overview of the key pieces you’ll need to understand.

Component | Description | Why It Matters for Investors |

|---|---|---|

Relinquished Property | The investment property you are selling. | This is the source of the capital you will roll into the new asset. |

Replacement Property | The "like-kind" investment property you are acquiring. | Must meet specific value and debt requirements to achieve full tax deferral. |

Qualified Intermediary | An independent third party who holds the funds. | Prevents "constructive receipt" of proceeds, which is essential for a valid exchange. |

Strict Timelines | 45 days to identify and 180 days to close. | These deadlines are firm and non-negotiable. Missing them will disqualify the exchange. |

"Like-Kind" Rule | Properties must be of the same nature or character. | This is a broad rule; you can exchange an apartment building for raw land, for example. |

Understanding these components is the first step toward successfully leveraging a 1031 exchange.

Throughout this guide, we’ll break down the entire process—from what "like-kind" really means to the critical timelines and common pitfalls. You’ll get a clear roadmap for scaling your portfolio, whether you're a hands-on operator or a passive investor looking for institutional-grade assets. The economic footprint here is massive; the average purchase price of a replacement property in an exchange was around $1.32 million (per a 2020 industry survey), proving just how vital this strategy is for serious investors.

Mastering the Critical Timelines and Rules

A successful 1031 exchange runs like a finely tuned clock, demanding absolute precision. The entire process hinges on two non-negotiable deadlines and a strict set of rules. Getting this sequence right is the difference between a seamless tax deferral and a very costly mistake.

The first step, which must happen before your relinquished property even closes, is to engage a Qualified Intermediary (QI). This independent third party is mandated by the IRS to hold your sale proceeds, making sure you never have "constructive receipt" of the funds. This is a bright-line rule; if you don't have a QI in place before the sale finalizes, your exchange is disqualified on the spot.

Once the sale of your property closes, the clock officially starts ticking.

The 45-Day Identification Period

From the day of closing, you have exactly 45 calendar days to formally identify potential replacement properties. You'll submit this list in writing to your QI. This is a notoriously short window that requires you to have done your homework well in advance.

The IRS gives you three ways to structure your identification list:

The Three-Property Rule: This is the most common and straightforward choice. You can identify up to three properties of any market value.

The 200% Rule: If you need more options, you can identify more than three properties, but their total fair market value can't exceed 200% of what you sold your property for. Sell a property for $2 million? Your list of potential replacements can’t top $4 million in total value.

The 95% Rule: This one is less common and used for specific scenarios. You can identify an unlimited number of properties, but you must ultimately close on at least 95% of the total value you identified.

These rules didn't just appear out of thin air. They evolved over decades to give investors a clear and structured framework for these deferred exchanges.

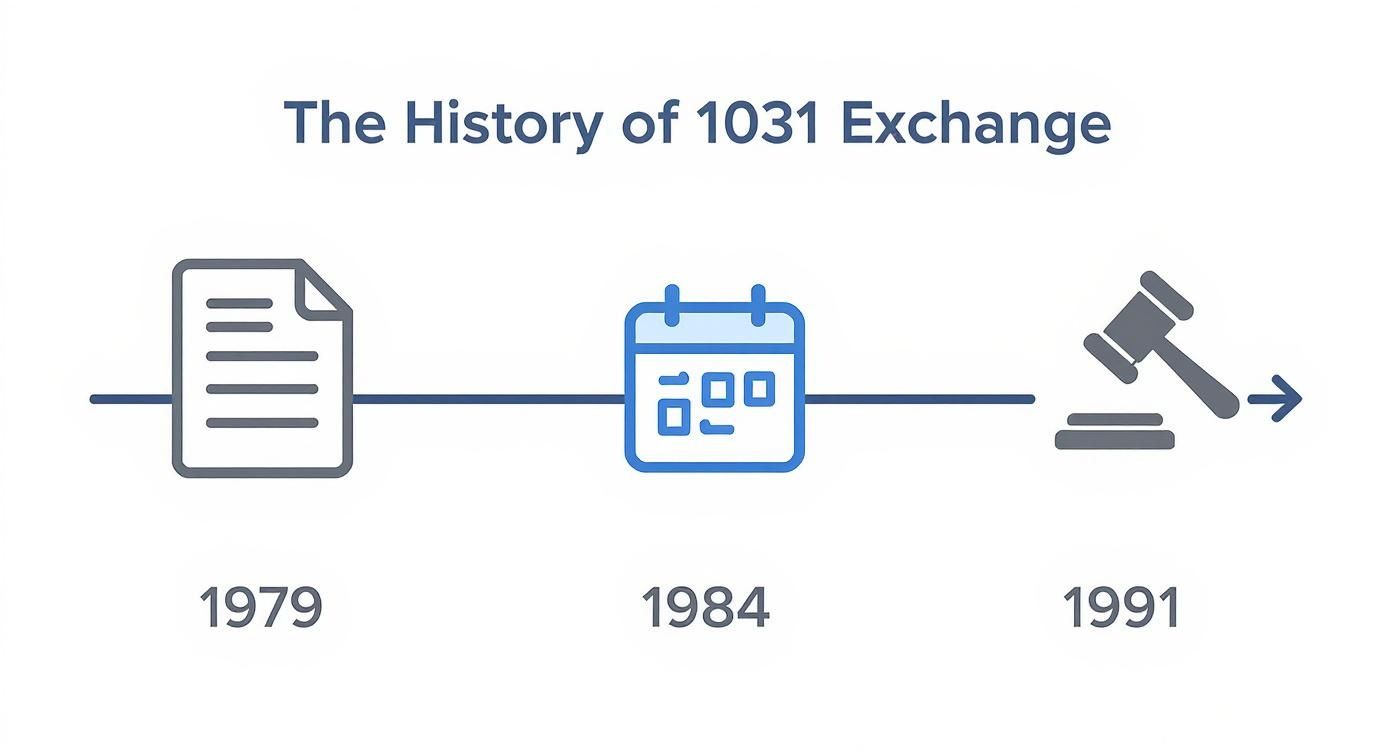

The journey from the landmark Starker court case to the formal timelines established in the Tax Reform Act of 1984 shaped the disciplined process investors follow today. The 1979 Starker v. United States case first permitted these non-simultaneous exchanges. Then, the 1984 Act introduced the strict 45-day and 180-day limits, and final Treasury regulations in 1991 gave us the safe harbors that provide confidence in the process. You can explore a detailed history of the 1031 exchange to see how these pivotal moments created today's rules.

The 180-Day Exchange Period

The second critical deadline runs concurrently with the first. You must close on the purchase of one or more of your identified properties within 180 calendar days from your original sale date. It’s crucial to understand this isn't 45 days plus another 180. Both clocks start on the exact same day.

Novice Lens: Why Can't I Just Hold the Money?The core principle of a 1031 is that you are exchanging one property for another, not cashing out. The moment sale proceeds touch your bank account, the IRS sees it as a taxable event. This is called constructive receipt. The Qualified Intermediary acts as a secure firewall, holding the funds so you never have control over them, which is the key to qualifying for tax deferral.

This 180-day period must cover everything—due diligence, securing financing, and navigating the entire closing process on your new asset. It leaves absolutely no room for error or delay.

Advanced Lens: Building a Resilient Identification ListFor sophisticated investors, the 45-day identification period is a strategic exercise in risk management. You should always identify more than one property—ideally all three allowed under the Three-Property Rule. Commercial real estate deals can fall apart for countless reasons: failed inspections, financing hiccups, or title defects. If your top target collapses after day 45 and you have no backups identified, your entire exchange fails. A flexible list with vetted backup options is your best insurance policy against an unexpected tax bill.

Understanding Like-Kind Property and Avoiding Boot

To successfully execute a 1031 exchange, there are two concepts you absolutely have to master: "like-kind" property and "boot." These aren't just IRS jargon; they're the core rules that determine whether you successfully defer your taxes or get hit with an unexpected bill. Getting them right is everything.

First, let’s clear the air on "like-kind." For real estate investors, this term is surprisingly flexible. Many people assume it means you must trade an apple for an apple—like swapping one office building for another identical one. That's a common myth.

The reality is much more accommodating. The rule simply requires the properties to be of the same "nature or character." The only hard-and-fast requirement is that both the property you sell and the one you buy must be held for productive use in a trade or business, or for investment.

What Qualifies as Like-Kind Property

This flexibility opens up a ton of strategic possibilities for your portfolio. It gives you the freedom to pivot your capital between different asset classes, chasing market trends or aligning with new investment goals.

Here are a few examples of swaps that would easily qualify as like-kind:

An apartment building for a portfolio of single-family rentals.

A retail center for a medical office building.

Raw, undeveloped land for an industrial warehouse.

A long-term leasehold interest of 30 years or more for outright ownership of a property.

The critical distinction is always usage, not form. A property held for personal use, like your primary residence or a vacation home you don't rent out, will not qualify. The IRS is black and white on this; the property’s purpose has to be business- or investment-related.

Demystifying and Avoiding Taxable Boot

While "like-kind" defines what you can exchange, "boot" is all about what you can't. In the 1031 world, boot is any property you receive in the exchange that isn't like-kind. Receiving boot doesn’t automatically kill the entire exchange, but it does trigger taxes—that boot portion is subject to capital gains tax.

Think of it this way: the goal of a 1031 exchange is a clean, dollar-for-dollar rollover of your investment. Any value that "leaks" out of the exchange in a non-like-kind form becomes taxable profit.

There are two main types of boot that investors must watch out for to achieve full tax deferral.

Cash Boot: This is the most obvious one. It’s any cash you pull out from the sale of your old property that you don't reinvest into the new one. If your Qualified Intermediary cuts you a check for leftover proceeds, that money is cash boot, and it's taxable right away.

Mortgage Boot (Debt Relief): This one is more subtle and trips people up all the time. Mortgage boot happens when the debt on your new property is less than the debt on the old one. For instance, if you paid off a $1 million mortgage on the property you sold but only took on an $800,000 mortgage for the replacement, you have $200,000 of mortgage boot. The IRS sees that debt reduction as a financial gain, making it taxable.

To sidestep mortgage boot, the debt on your new property must be equal to or greater than the debt on your old one. You can offset mortgage boot by bringing more of your own cash to the closing table, but that’s a move you need to plan carefully with your tax advisor.

Deal Lens Example: How Boot Creates a Tax Bill

Let's walk through an illustrative example. Say you're selling an apartment building.

Sale Price of Old Property: $3,000,000

Mortgage on Old Property: $1,000,000

Your Equity: $2,000,000

You find a new warehouse to buy as your replacement property.

Purchase Price of New Property: $2,800,000

New Mortgage: $800,000

In this scenario, you’ve accidentally created two kinds of boot:

Cash Boot: The new property costs $200,000 less than what you sold the old one for ($3M - $2.8M). That leaves you with $200,000 in leftover equity, which is taxable cash boot.

Mortgage Boot: Your new mortgage ($800k) is $200,000 less than your old one ($1M). This debt relief is also considered taxable mortgage boot.

Even if you reinvested every penny of your equity, that drop in debt still creates a taxable event. To make matters worse, a chunk of this gain could be hit with depreciation recapture, which is taxed at a higher ordinary income rate (up to 25%) than your typical capital gains. It’s a nasty surprise if you’re not prepared for it.

Choosing the Right 1031 Exchange Structure

Not all 1031 exchanges are created equal. The right structure depends entirely on your specific situation, timing, and what you're trying to achieve with your portfolio. Understanding the different ways to structure an exchange lets you tailor the strategy to your needs, whether you're jumping on a sudden opportunity or meticulously planning a portfolio upgrade.

The Delayed Exchange: The Standard Approach

The Delayed Exchange—often called a forward or Starker exchange—is the most common play in the 1031 handbook. This is the classic structure where you sell your property first, then buy a new one within those strict 45/180-day timelines.

It follows a linear path:

You engage a Qualified Intermediary (QI).

You sell your property, and the cash goes straight to the QI.

The 45-day and 180-day clocks start ticking.

You formally identify potential replacement properties within 45 days.

You close on one or more of those properties within 180 days, using the funds held by your QI.

This structure is popular because it's straightforward and works perfectly for most investors who can plan their sale and subsequent purchase without a huge rush.

The Reverse Exchange: Seizing an Opportunity

What happens when you find the perfect replacement property before you've even listed your old one? In a competitive market, you can't always afford to wait. That's where the Reverse Exchange comes in, letting you acquire the new asset before selling the old one.

Because the IRS doesn't allow you to own both properties at once in an exchange, the process is more complex and costs more. It requires a third party called an Exchange Accommodation Titleholder (EAT)—usually an entity set up by your QI—to temporarily "park" or hold the title to one of the properties.

A Reverse Exchange flips the timeline on its head. The EAT buys and holds the new property for you, giving you 180 days to sell your old one and complete the exchange. It’s a powerful tool when you need to act fast on a great deal.

This structure is a lifeline in hot markets, but the higher fees and complex legal footwork mean it’s best reserved for high-value deals where the opportunity is too good to pass up.

The Improvement Exchange: Building Value with Tax-Deferred Dollars

Sometimes the ideal replacement property isn't perfect—yet. It might be a value-add project that needs a major facelift, or a plot of land where you plan to build from the ground up. The Improvement Exchange (or Construction Exchange) lets you use your tax-deferred exchange funds to pay for those renovations or new construction.

Like a reverse exchange, an EAT takes title to the new property while the improvements are made. Your QI then disburses the exchange funds to cover construction costs, and the value of these improvements gets added to the property's final price. This ensures you’re rolling over the full value from your old property into the newly improved asset. It's a complex but incredibly effective way to create value with pre-tax dollars.

Delaware Statutory Trust (DST): The Passive Investor’s Play

For investors looking to step back from the headaches of active management, the Delaware Statutory Trust (DST) is an excellent 1031 exchange solution. A DST lets a group of investors pool their exchange proceeds to buy a fractional interest in large, institutional-grade properties managed by a professional sponsor.

The IRS gives DSTs its seal of approval as a "like-kind" replacement property (Revenue Ruling 2004-86). This opens up huge advantages:

Truly Passive Ownership: Say goodbye to landlord duties for good.

Instant Diversification: You can trade one property for a slice of a portfolio of assets, spread across different markets and property types.

Access to Premier Assets: It’s your ticket to owning a piece of properties typically out of reach for individual investors.

DSTs are the perfect exit ramp for investors who want to simplify their real estate holdings without getting hit with a massive tax bill. For anyone considering this powerful strategy, our complete guide to Delaware Statutory Trusts offers a deep dive into how they work.

Comparison of 1031 Exchange Structures

Choosing the right structure is less about which one is "best" and more about which one is best for you. Your timeline, goals, and the specific deal in front of you will dictate the right path.

Exchange Type | Primary Use Case | Key Challenge/Consideration |

|---|---|---|

Delayed | The standard transaction: selling one property and buying another within a planned timeframe. | Sticking to the strict 45/180-day deadlines without overpaying for a replacement property. |

Reverse | Acquiring a must-have property before the current one is sold, common in competitive markets. | Significantly higher costs and complexity due to the EAT's involvement. |

Improvement | Using exchange funds to renovate, improve, or build a replacement property from the ground up. | Requires careful construction management and coordination with the EAT to stay on schedule. |

DST | Transitioning from active property management to a passive, professionally managed investment. | Less control over the asset and requires thorough due diligence on the DST sponsor. |

Ultimately, each of these structures is a tool in the savvy investor's toolbox. Knowing when and how to use them can make all the difference in preserving your capital and growing your portfolio.

Beyond Tax Deferral: Using a 1031 Exchange for Strategic Growth

A 1031 exchange is much more than a way to sidestep a tax bill—it’s one of the most powerful portfolio management tools a real estate investor has. Understanding the mechanics is essential, but the real magic happens when you move from the "how" to the "why." This is where you graduate from just saving on taxes to actively sculpting your real estate legacy.

From Consolidation to Diversification

Many investors find their portfolio is a collection of smaller, management-heavy properties. A 1031 exchange is the perfect way to clean that up. You can roll the equity from several small sales into a single, institutional-grade asset that delivers better returns with professional management. Conversely, an exchange is an ideal vehicle for diversification. If you're over-concentrated in a single asset class—like retail—you can swap that property for a multifamily complex or an industrial warehouse, spreading your risk across different economic drivers without a tax hit.

Trading Up in Quality and Location

Think of the 1031 exchange as your engine for continuous improvement. It allows you to systematically "trade up" the quality of your portfolio. You can move from older Class B or C buildings into newer, more stable Class A properties in prime locations. This strategy is also perfect for geographic repositioning. If your assets are stuck in a slow-growth market, an exchange lets you seamlessly move that capital into high-growth Sunbelt markets or other thriving economic hubs. This capital mobility isn't just good for you; it's a vital engine for the entire real estate economy.

Market Signal Box: The Economic Impact of Capital MobilityThe ability to move capital efficiently through 1031 exchanges fuels investment and improves property stock nationwide. A 2021 study by Ernst & Young projected that these exchanges would support approximately 568,000 jobs, generate $27.5 billion in labor income, and add $55.3 billion to the U.S. GDP in a single year. These transactions are a powerful catalyst for economic activity. You can explore the full findings on the economic contributions of 1031 exchanges at irei.com.

Resetting Your Depreciation Clock

One of the most powerful—and often overlooked—benefits of a 1031 exchange is resetting your depreciation schedule. When you acquire a new, higher-value property, you get a fresh, larger basis for depreciation. This move can dramatically increase your annual depreciation write-offs, which slashes your taxable income and boosts the property's after-tax cash flow. This strategic reset can be just as valuable as the initial tax deferral itself.

For a deeper dive, check out our post on The Definitive Guide to Investment Real Estate Tax Benefits.

Your Pre-Flight Checklist for a Smooth Exchange

Proactive planning is the secret to a successful 1031 exchange. Rushing into this process after your property is already under contract is a recipe for disaster. This pre-flight checklist turns abstract rules into concrete risk-management steps, putting you in the pilot's seat to navigate the process with confidence.

Investor Checklist: Questions to Ask Before Starting a 1031 Exchange

Have I assembled my expert team? Before listing your property, engage a Qualified Intermediary (QI), a tax advisor/CPA, and a real estate attorney who specializes in 1031s. Getting them on board early transforms a reactive, high-stress situation into a proactive, strategic one.

Have I researched the replacement market? One of the biggest mistakes is listing a property without a realistic grip on the replacement market. You should be researching potential properties and understanding current inventory, pricing, and cap rates in your target markets before you sell.

Is my financing pre-approved? Don't wait until you've identified a property to talk to a lender. Get pre-approved for financing before the exchange period begins. Underwriting delays are a common reason exchanges fail. Having financing lined up makes your offers more competitive and helps you close within the 180-day window. A key part of this is understanding the concept of escrow.

Have I modeled the tax implications? Work with your CPA to calculate your potential capital gains tax, including depreciation recapture. This confirms the financial benefit of the exchange and helps you structure the deal to avoid boot.

Am I prepared for preliminary due diligence? While you can't perform a full deep-dive on properties you don't have under contract, you can and should start building a preliminary list of viable targets. For a detailed breakdown of what that involves, you can review your ultimate commercial property due diligence checklist.

Common Questions About 1031 Exchanges (FAQ)

Here are answers to some of the most common questions we get from investors as they move from theory to a real-world deal.

Can I use a 1031 exchange for my vacation home?

Usually no, at least not directly. The rules are clear: both properties must be "held for investment or for productive use in a trade or business." A personal vacation home does not meet that standard. However, it can sometimes be converted into a qualifying property by renting it out at fair market value and strictly limiting personal use for a solid period—often two years—before initiating the exchange. This is a nuanced move that requires careful planning with a tax advisor.

What happens if my 1031 exchange fails?

If you miss a deadline or break a rule—like taking "constructive receipt" of the sale proceeds—the exchange fails. The outcome is swift: the sale of your original property is immediately reclassified as a standard, taxable sale in the year it occurred. You'll be on the hook for all capital gains taxes, including federal, state, and any depreciation recapture.

Can I do a partial 1031 exchange?

Yes. A partial exchange occurs when you don't roll the full sale proceeds into the new property. This is common if you want to pull some cash out for other purposes. Any cash you receive or any debt that isn't replaced on the new property is considered taxable boot. You'll pay capital gains on that portion, but you'll still successfully defer the taxes on the amount that was reinvested.

How do 1031 exchanges work for partnerships?

Partnerships add a layer of complexity. The rule is that the taxpayer who sells the old property must be the same one who buys the new one. A partnership as an entity can execute a 1031 exchange. The challenge comes when some partners want to cash out and others want to exchange. This requires advanced planning, often involving a "drop and swap" strategy where the property is legally restructured before the sale. These maneuvers are highly technical and require experienced tax and legal counsel.

Navigating the complexities of a 1031 exchange is just one part of building a resilient, long-term real estate portfolio. At Stiltsville Capital, we help accredited investors access institutional-grade opportunities designed for wealth preservation and growth.

If you're considering a 1031 exchange and want to explore passive, professionally managed replacement options, we can help. Schedule a confidential call with Stiltsville Capital to discuss how our strategies can align with your investment goals.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments