Limited Partner Real Estate: A Guide to Passive Investing for Family Offices & Accredited Investors

- Ryan McDowell

- Nov 24, 2025

- 18 min read

Reading Time: 8 min | Good for: Novice & Informed Investors (A, B)

TL;DR: The LP Advantage

What it is: As a Limited Partner (LP), you provide the capital for a real estate deal, while an expert General Partner (GP) handles all operations. It's passive investing in institutional-quality assets.

Why it matters: It offers a path to portfolio diversification, passive income, and significant tax benefits without the headaches of being a landlord.

The Bottom Line: Your primary job isn't managing property; it's performing rigorous due diligence on the sponsor (GP) before investing. Their expertise is your greatest asset and biggest risk.

So, you’re considering becoming a limited partner (LP) in a real estate deal? Excellent. For accredited investors and family offices, it's one of the most effective ways to access institutional-quality properties without managing tenants, toilets, or late-night maintenance calls.

Put simply, you are the capital partner. You are a passive investor, much like a silent shareholder in a private company. Your primary responsibility is to provide capital; in return, your liability is strictly limited to that investment.

The Role of a Limited Partner in Real Estate

At its core, the limited partner role is about strategic capital allocation, not hands-on operational management. You aren't just investing in a building; you are backing an expert operator to execute a specific business plan. You provide the capital, and a professional sponsor—the General Partner (GP)—handles everything else.

This structure unlocks access to deals that are often too large or complex for an individual to tackle alone. Think about developing a new multifamily community or repositioning an underperforming medical office building. For high-net-worth individuals and family offices, this is a cornerstone strategy for building a resilient portfolio of tangible assets.

Defining Your Responsibilities (and Lack Thereof)

As an LP, your role is passive by design. You will not be negotiating leases, overseeing contractors, or reviewing the property’s monthly financials. The GP manages all operational aspects, leveraging their expertise to execute the business plan and maximize the asset's value.

This clear division of labor is what makes limited partner real estate investing so powerful. It delivers:

Access to Expertise: You benefit from the GP's specialized knowledge, industry network, and management infrastructure.

Time Efficiency: It liberates you from the significant time commitment required for active commercial real estate management.

Liability Protection: Deals are typically structured within a Limited Liability Company (LLC), which creates a legal firewall between the property's liabilities and your personal assets.

The General Partner: Your Operational Counterpart

For every LP, there must be a General Partner. The GP is the operator—the boots on the ground. They source the deal, underwrite the financials, arrange financing, and manage the property through its entire lifecycle, from acquisition to disposition.

The GP is responsible for executing the strategy and providing transparent reporting to you and other LPs. For this work, the GP earns fees and a share of the profits (the "promote"), which aligns their interests directly with yours. Before investing, you must understand this symbiotic relationship. Your primary task isn't to second-guess property management; it's to vet the GP who will be performing it. A top-tier sponsor is the single most critical component of a successful LP investment.

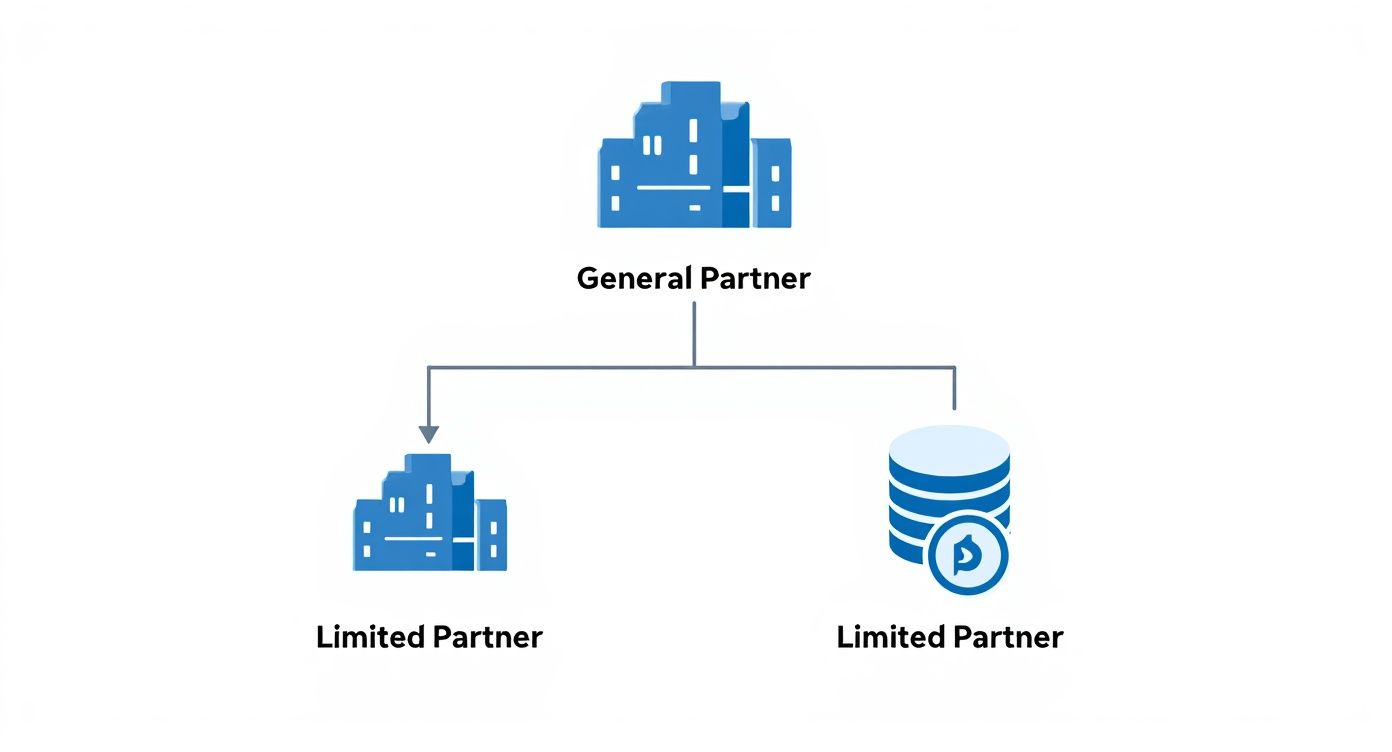

To make it crystal clear, here’s a quick breakdown of who does what.

LP vs. GP: A Snapshot of Key Roles

Limited Partner (LP) * Primary Role: Provide capital for the project. * Liability: Limited to the amount of capital invested. * Decision-Making: Passive; no control over daily operations. * Involvement: Reviews reports and receives distributions.

General Partner (GP) / Sponsor * Primary Role: Source, manage, and execute the investment. * Liability: Generally unlimited, taking on operational risk. * Decision-Making: Active; makes all key management decisions. * Involvement: Handles all aspects of the property lifecycle.

As you can see, the roles are distinct yet complementary. The LP provides the fuel, and the GP drives the vehicle. Understanding this dynamic is the first step toward becoming a savvy passive real estate investor.

Understanding the Investment Structure and Returns

Before you can confidently invest as a limited partner, you need to know exactly how the money flows. Forget the glossy property photos for a moment—the real engine driving your returns is the financial architecture of the deal. It’s what turns a sponsor’s business plan into actual cash in your pocket.

At the core of almost every private real estate deal is a Limited Liability Company (LLC). This isn't just legal boilerplate; it's your first line of defense. The LLC is set up to own the property, creating a legal shield that strictly limits your liability to the capital you invest. Your personal assets stay safely on the sidelines, completely separate from anything that might happen with the property. As you look at different deals, it's also smart to be aware of the risks involved, such as the potential for losses seen in some Icap Equity real estate funds.

This simple chart shows the classic setup: the General Partner (GP) is at the top, managing the investment for the Limited Partners (LPs) below.

This structure is what defines the partnership: the GP does the heavy lifting, and the LPs provide the capital.

Decoding the Distribution Waterfall

The heart of the deal's financial plumbing is the distribution waterfall. Think of it like a series of cascading buckets. As cash flows in from the property—whether from monthly rent or a big sale—it fills the first bucket. Once that one's full, the profits spill over into the next, and so on, all in a very specific, pre-agreed order.

A typical waterfall has a few key tiers, or hurdles, that the profits have to clear:

Return of Capital: First things first. Before anyone even thinks about profit, every limited partner gets their initial investment back in full. This is always the top priority.

Preferred Return: Once all LP capital is returned, the next bucket to fill is the preferred return, or "pref." This is a minimum annual return LPs earn on their money before the GP can start sharing in the profits. Think of it as the baseline return you’re owed for taking the risk.

Catch-Up Provision: Some deals include a "catch-up" tier. After the LPs get their pref, the GP might get 100% of the next distributions until they’ve caught up to a specific profit split.

Carried Interest (The "Promote"): After all the previous hurdles are cleared, the remaining profits are split between the LPs and the GP. The GP's share is their carried interest, also known as the "promote." This is their big reward for hitting a home run with the project.

How the Waterfall Impacts Your Returns

The specific numbers in the waterfall directly shape your final take-home profits. While the concept is simple, the details matter. For instance, industry data shows that an 8% preferred return is the most common benchmark you'll see, offered in roughly 40% of deals.

But the pref is just the start. Your actual returns depend on what happens after that hurdle. A common structure might see profits split 60/40 between LPs and the GP once a certain internal rate of return (IRR) is met. This is why you have to dig into the details—a big promote for the GP can seriously eat into your share of the upside.

### Novice Lens: Why the Waterfall MattersThe waterfall isn't just financial jargon; it’s the economic roadmap for the deal. A fair preferred return and a reasonable promote show that the GP is focused on aligning their success with yours. It's the #1 indicator of a partner-friendly structure.

Deal Lens: A Simplified Waterfall Example

Let’s run the numbers on an illustrative deal to see this in action.

Total Project Profit: $500,000

LP Investment (Return of Capital): $1,000,000

Preferred Return: 8% ($80,000)

Profit Split (Promote): 70% to LPs / 30% to GP (after the pref)

Here’s how the cash flows:

First, the LPs get their initial $1,000,000 investment back.

Next, the LPs receive their 8% preferred return of $80,000.

This leaves a remaining profit of $420,000 ($500,000 - $80,000).

This remainder is split 70/30: * LPs get $294,000 (70% of $420,000). * The GP gets $126,000 (30% of $420,000).

In the end, the LPs walk away with a total of $1,374,000 ($1M capital + $80k pref + $294k split). Getting comfortable with these numbers is crucial, and you can dive deeper by checking out our guide on how to calculate Internal Rate of Return for real estate investors. This is the kind of knowledge that empowers you to look at any sponsor's deal and see what it could really mean for your wallet.

Navigating the Key Legal Documents

Before you ever commit a dollar to a limited partner real estate deal, you’ll be handed a thick stack of legal documents. This isn’t just paperwork to skim through; it's the official rulebook for your entire investment. Knowing how to read these documents is a non-negotiable part of your due diligence.

Forget getting bogged down in legal jargon. Your goal is simple: find the specific clauses that spell out your rights, your risks, and your potential returns. This section will walk you through the three core documents you'll always see and highlight exactly what to look for.

The Private Placement Memorandum (PPM)

The Private Placement Memorandum (PPM) is the main disclosure document for the deal. Think of it as the investment's complete business plan and risk summary all rolled into one. It lays out the strategy, the property details, the market analysis, and—most importantly—everything that could potentially go wrong.

It’s almost always a long read, but its job is to give you everything you need to make an informed decision. For a much deeper dive into this critical document, you can check out our detailed guide to the real estate Private Placement Memorandum.

What to zero in on in the PPM:

Risk Factors: This section is not boilerplate. Pay close attention to risks that are specific to the property, the local market, or the sponsor. Are there any red flags like concentration risks, hurdles in the development plan, or unusual loan terms?

The Business Plan: Does the sponsor lay out a clear, believable plan for how they'll create value? It should be specific and backed up by solid market data, not just wishful thinking.

Sponsor Background: The PPM gives you the full rundown on the General Partner. You'll find their track record, their experience, and any potential conflicts of interest.

The Limited Partnership Agreement (LPA)

If the PPM tells you what the deal is, the Limited Partnership Agreement (LPA) tells you how it all works. This is the legally binding contract that defines the relationship between you (the LP) and the sponsor (the GP). It takes all the terms from the PPM and locks them into a formal agreement.

This is the document that dictates the deal's economics, the rights of every party involved, and the ground rules for how the partnership will operate. It's essentially the constitution for your investment.

### Investor Takeaway: Read the LPA.Never sign a subscription agreement without reading the LPA from cover to cover. We strongly recommend having your attorney review it, as this single document will define your rights for the next five to ten years.

Key clauses to scrutinize in the LPA:

Capital Calls: How and when can the GP ask for more money? What happens if an LP can't or won't contribute? The penalties can be severe.

Fee Structure: Look for a crystal-clear breakdown of every single fee—acquisition fees, asset management fees, disposition fees, and any others.

GP Duties and Limitations: What are the GP's exact responsibilities? And just as important, what can't they do without the LPs' approval, like selling the property?

The Subscription Agreement

Finally, we have the Subscription Agreement. This is the document you actually sign to officially become a limited partner in the deal. It's your formal application to join the partnership and "subscribe" to a certain number of shares or units.

By signing it, you are legally confirming that you’ve read the PPM, you understand the risks, and you meet the necessary investor suitability standards. This is where you’ll put down in writing the exact amount of your capital commitment.

The subscription process also involves verifying your status as an Accredited Investor, a crucial requirement under SEC rules like Regulation D. This is based on specific income or net worth levels and ensures that investors in private deals have the financial sophistication and capacity to handle the associated risks. Signing this is the final step that binds you to the terms laid out in the LPA.

From Capital Call to Cash-Out: An Investor's Journey

Committing your capital is really just the opening act. Once you've signed that subscription agreement, you're kicking off a multi-year journey with several distinct phases. Knowing the roadmap—from the first funding request to the final payout—is crucial for setting your expectations and keeping tabs on your investment.

The real action starts not when you sign, but when the General Partner (GP) is ready to put your money to work acquiring or developing the property. That’s when the clock officially starts ticking.

Phase 1: The Capital Call

The first major event after you’re in the deal is the capital call. This is the GP's formal notice asking you to wire your committed funds. It’s the moment your passive capital becomes active capital.

Your Limited Partnership Agreement (LPA) will spell out the notice period you have, which is usually somewhere between 10 to 15 business days. A good sponsor will give you clear, easy-to-follow instructions and plenty of warning.

It’s absolutely critical to take this deadline seriously. Missing a capital call can trigger some pretty steep penalties outlined in the LPA, even potentially forcing you to forfeit your entire stake in the deal.

Phase 2: The Holding Period

Once the deal is funded and the keys are in hand, the investment settles into the holding period. This is the long game, typically lasting anywhere from three to ten years, where the GP gets to work executing their business plan. Your job here is simply to monitor the progress.

A top-notch sponsor will keep you in the loop with consistent, transparent reporting. You should expect:

Quarterly Updates: These reports should walk you through what’s happening on the ground—leasing activity, renovation progress, and updated financial statements.

Annual K-1 Forms: You'll get a Schedule K-1 each year for tax season, which breaks down your share of the partnership’s income, deductions, and credits.

Cash Distributions: If the property is making money after paying all the bills and the mortgage, you'll start receiving checks, usually quarterly. These payments typically follow the "preferred return" structure we've talked about.

You might also see a major capital event during this time, like a refinancing that pulls some equity out of the property and sends a nice one-time distribution back to investors.

### Investor Takeaway: Communication is a Key Diligence SignalCommunication is a huge tell. If you’re constantly chasing down your GP for basic updates or your K-1, it’s a massive red flag. It speaks volumes about their professionalism and how organized they really are.

Phase 3: The Exit and Final Payout

The final act is the exit—the sale of the property. The GP handles everything, from listing the asset to negotiating the final price. Once the deal closes, the profits are paid out through the waterfall, just like the cash flow was during the holding period.

This final distribution pays everyone back in order: first, any remaining LP capital, then any unpaid preferred return that has built up, and finally, the profit split (or "promote") between you (the LPs) and the GP. This is the moment you see your total return on the investment crystalize.

Need an Early Out? The Secondary Market

So, what happens if you need your cash back before the planned exit? Private real estate is illiquid by nature, but there’s a growing escape hatch: the secondary market. This means selling your LP share to another investor. While the GP usually has to sign off on the transfer, it offers a potential path to getting your money out early.

This market has become a pretty significant channel for investors. In fact, these traditional LP-led secondary deals made up about 32% of global real estate secondaries volume in a recent year, which shakes out to around $7.7 billion in transactions. This trend shows just how much investors are looking for flexibility in these traditionally locked-up deals. You can dig into more data on this growing $24 billion global market by checking out the insights from CBRE Investment Management.

Just keep in mind, while it’s a great option to have, it’s not a guarantee. And more often than not, these shares sell at a discount to their actual value.

Your Due Diligence Checklist for LP Opportunities

Success as a limited partner isn't about sitting back and waiting for checks to arrive. The real work—the most important work—happens before you ever commit a single dollar. This rigorous investigation process, known as due diligence, is how you move past the glossy marketing brochure and get to the heart of whether an investment truly holds up.

To get a feel for the process, it's helpful to understand what due diligence entails in the broader investment world. We’ve distilled that process into a focused checklist of the must-ask questions for any private real estate offering. Think of this as your framework for systematically vetting any deal, whether it's your first or your fiftieth.

Evaluating The Sponsor

Before you ever fall in love with a property, you have to vet the team running the show. The General Partner (GP) is hands-down the most critical variable in any deal. A great sponsor can salvage a mediocre deal, but a bad sponsor can ruin a great one.

Questions to Ask a Sponsor:

What’s their verifiable track record? Don't just settle for the highlight reel. Ask for a complete list of past deals—the home runs, the singles, and especially the strikeouts. Transparency about their entire history is a huge green flag.

Have they successfully executed this specific strategy before? Being a rockstar at value-add multifamily doesn't mean they know the first thing about developing a ground-up industrial park. Their experience needs to be a direct match for the business plan they're pitching.

How much of their own money is on the line? A significant "GP co-invest"—typically 5% to 10% of the total equity—is a powerful sign of aligned interests. It means they have real skin in the game, right alongside you.

Can I speak with some of your past or current LPs? Any reputable sponsor will happily provide references. Getting an unfiltered perspective from other investors is the best way to learn about their communication, reporting, and how they handle things when challenges inevitably arise.

Analyzing The Deal Itself

Once you're confident in the sponsor, it's time to put the asset and its business plan under the microscope. This is where you test the story and kick the tires on the numbers.

Questions to Ask About the Deal:

Are the financial projections conservative? You need to stress-test their assumptions. What happens to the projected returns if rent growth stalls, vacancies tick up, or interest rates rise at exit? A solid deal should still pencil out in a less-than-perfect world.

Is the business plan clear and logical? The strategy for creating value should be specific and believable. "Increase rents" isn't a plan; it's a wish. Look for a detailed roadmap tied to specific capital improvements, operational tweaks, or market-driven advantages.

What’s the competitive landscape look like? Get a handle on the local market dynamics. Are a dozen new apartment buildings coming online next year that will compete for tenants? Is the local economy dangerously dependent on a single employer?

Have they completed third-party reports? An independent appraisal or a property condition assessment provides a crucial reality check against the sponsor's own analysis. It keeps everyone honest.

### Advanced Lens: Underwriting the UnderwriterA beautiful pro-forma spreadsheet can make any deal look like a grand slam. Your job is to poke holes in it. The best sponsors welcome the tough questions because they've built their underwriting to withstand the scrutiny.

Scrutinizing The Structure And Documents

The final piece of the puzzle is the legal and financial framework of the partnership itself. A great asset run by a great sponsor can still be a lousy investment if the terms are stacked against the LPs.

Questions to Ask About the Structure:

Is the fee structure reasonable and transparent? Comb through the legal documents—the Private Placement Memorandum (PPM) and the Limited Partnership Agreement (LPA)—for every single fee. Acquisition fees, asset management fees, disposition fees, and others can be a major drag on your net returns.

Is the waterfall distribution fair? A common structure includes an 8% preferred return for LPs, meaning you get the first slice of the profits. Make sure the subsequent profit split (the "promote" to the GP) is reasonable and rewards the sponsor for performance, not just for participation.

What are my rights as a Limited Partner? The LPA is your rulebook. It should clearly define your voting rights on major decisions (like selling or refinancing) and outline any restrictions on transferring your interest.

What happens in a capital call scenario? A well-run deal has cash reserves, but you need to know what happens if more money is needed. Understand the process and any penalties if you can't or don't contribute.

Due diligence is your primary defense against risk. Below is a simple framework to help you connect common risks with the actions you can take to mitigate them.

Risk & Mitigation Framework for LP Investors

Risk: Sponsor Risk * An inexperienced or misaligned GP makes poor decisions, leading to capital loss. * Mitigation: Thoroughly vet the sponsor's track record, speak to references, and confirm a significant GP co-investment.

Risk: Market Risk * Economic downturns or local market shifts negatively impact property performance. * Mitigation: Analyze third-party market reports and stress-test the sponsor's financial projections under adverse scenarios.

Risk: Asset Risk * Unexpected capital expenditures or property issues erode cash flow. * Mitigation: Review the property condition assessment and ensure the business plan includes adequate reserves and contingencies.

Risk: Structural Risk * Unfavorable deal terms (high fees, unfair waterfall) reduce your net returns. * Mitigation: Scrutinize the LPA and PPM with legal counsel to understand all fees, profit splits, and LP rights.

Ultimately, this checklist is your starting point. Diligence isn't just about checking boxes; it's about building a deep, fundamental understanding of what you're investing in.

For those who want to build an even more robust framework, we dive deeper in our guide on institutional-level real estate due diligence. Remember, the quality of your questions will directly influence the quality of your returns.

Finding the Right Partner for Real Estate Success

We’ve covered a lot of ground in this guide, and it all boils down to one simple truth: while your role as a limited partner in real estate is designed to be passive, your initial homework is anything but. Your success really hinges on a single, critical decision—choosing the right General Partner.

A great sponsor doesn't just find a good asset; they turn it into a great investment. They bring the exclusive access and deep expertise to the table, and most importantly, their interests are truly aligned with yours. For UHNWIs and Family Offices, this is where the real value lies—unlocking meaningful portfolio diversification, building durable passive income, and gaining a foothold in institutional-grade deals that are otherwise out of reach.

By understanding the financial plumbing, poring over the legal documents, and doing your diligence, you can sidestep major risks like illiquidity and poor execution. We firmly believe that well-structured real estate is a resilient cornerstone for any smart, long-term wealth strategy.

### Investor Takeaway: Your Most Active Role is UpfrontYour most active role is right at the beginning—picking a trustworthy sponsor. That one decision has the biggest impact on protecting your capital and hitting your return goals over the life of the investment.

When you're ready to see how these kinds of passive opportunities can fit into your own portfolio, we invite you to take the next step. Our team is here to give you the clarity and access you need to invest with confidence.

Frequently Asked Questions

Jumping into your first few limited partner real estate investments is exciting, but it almost always comes with a few questions. Let's tackle some of the most common ones we hear from new investors so you can move forward with total clarity.

What Are the Typical Tax Benefits for a Limited Partner?

This is where direct real estate investing really shines. As an LP, you get the advantage of pass-through taxation, which means the property’s financial performance—profits, losses, and all the good deductions—flows right onto your personal tax return.

One of the biggest perks is depreciation. Think of it as a non-cash expense that lets you deduct a slice of the property's value from its taxable income each year. This often means the taxable income you report is lower than the actual cash you have in hand. It’s all neatly packaged for you on a Schedule K-1 form the GP sends you annually.

How Is My Investment Protected if a Deal Fails?

Your protection as a limited partner is built-in on a few different levels. First and foremost is your limited liability. Every deal is structured within its own LLC, creating a legal shield that separates your personal assets from any property-related debts or legal issues. Your risk is capped at the amount of capital you invested—period.

On top of that, the General Partner always has a significant chunk of their own money in the deal right alongside yours. This "skin in the game" creates a powerful alignment of interests; they're just as motivated as you are to see the project succeed. Finally, the distribution waterfall is designed to protect you—you get your initial capital back before the GP earns any of their promote.

Can I Use Retirement Funds for an LP Investment?

Yes, you absolutely can, and it's a popular strategy. The tool for this is a Self-Directed IRA (SDIRA), a special account that lets you hold alternative assets like private real estate, which isn't allowed in a standard IRA.

It’s a fantastic option, but it comes with its own set of rules and potential tax hurdles, like something called Unrelated Business Taxable Income (UBTI). It’s critical to partner with a custodian that specializes in SDIRAs and to chat with your tax advisor to make sure everything is structured correctly.

What Exactly Is a Capital Call?

A capital call is simply the formal request from the General Partner for you to send in the funds you've committed to the deal. It's the official green light to wire your capital so the GP can close on the property or kick off a major renovation.

Most of the time, this happens right at the start of the project. However, the Limited Partnership Agreement (LPA) will spell out if and when the GP has the right to call for more capital down the road. Pay close attention to this clause—it clearly defines your funding obligations and deadlines.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments