A Guide to Investing with a Private Equity Real Estate Firm

- Ryan McDowell

- Dec 2, 2025

- 15 min read

Reading Time: 8 min | Good for: Novice Investors (A), Family Offices (B)

TL;DR: Key Takeaways

What It Is: A private equity real estate firm is an investment manager that pools capital from accredited investors (Limited Partners) to acquire, improve, and sell commercial real estate properties that aren't publicly traded.

How They Create Value: These firms, acting as the General Partner (GP), execute specific strategies like Value-Add or Opportunistic development to "force" appreciation, rather than just waiting for the market to rise.

Why It Matters to You: This model gives you access to large-scale, institutional-quality deals managed by experts, offering a path to portfolio diversification, an inflation hedge, and potential for strong, risk-adjusted returns without the day-to-day management burden.

Your Next Step: The most critical decision is selecting the right sponsor. Focus on their track record, alignment of interests (do they invest their own money?), and specialized expertise.

So, what exactly is a private equity real estate firm?

Think of it as an expert investment group that brings together capital from accredited investors to buy, improve, and eventually sell commercial real estate. These aren't properties you'd find on a public stock exchange. In short, these firms act as the professional operators for investors who want a piece of large-scale property deals without getting bogged down in the day-to-day management.

What a Private Equity Real Estate Firm Actually Does

A great way to picture a private equity real estate firm is to think of them as the general manager of a professional sports team. Their job isn't just to play the game; it's to build a championship-winning organization from the ground up.

They scout for talent (undervalued properties), secure funding from a pool of investors (the team owners), and then execute a precise game plan (the business strategy) to win big (generate strong returns).

At its heart, the firm’s entire model is built around creating value where others might not see it. They are specialists at sniffing out opportunities, deploying capital smartly, and managing assets to squeeze out every last drop of potential.

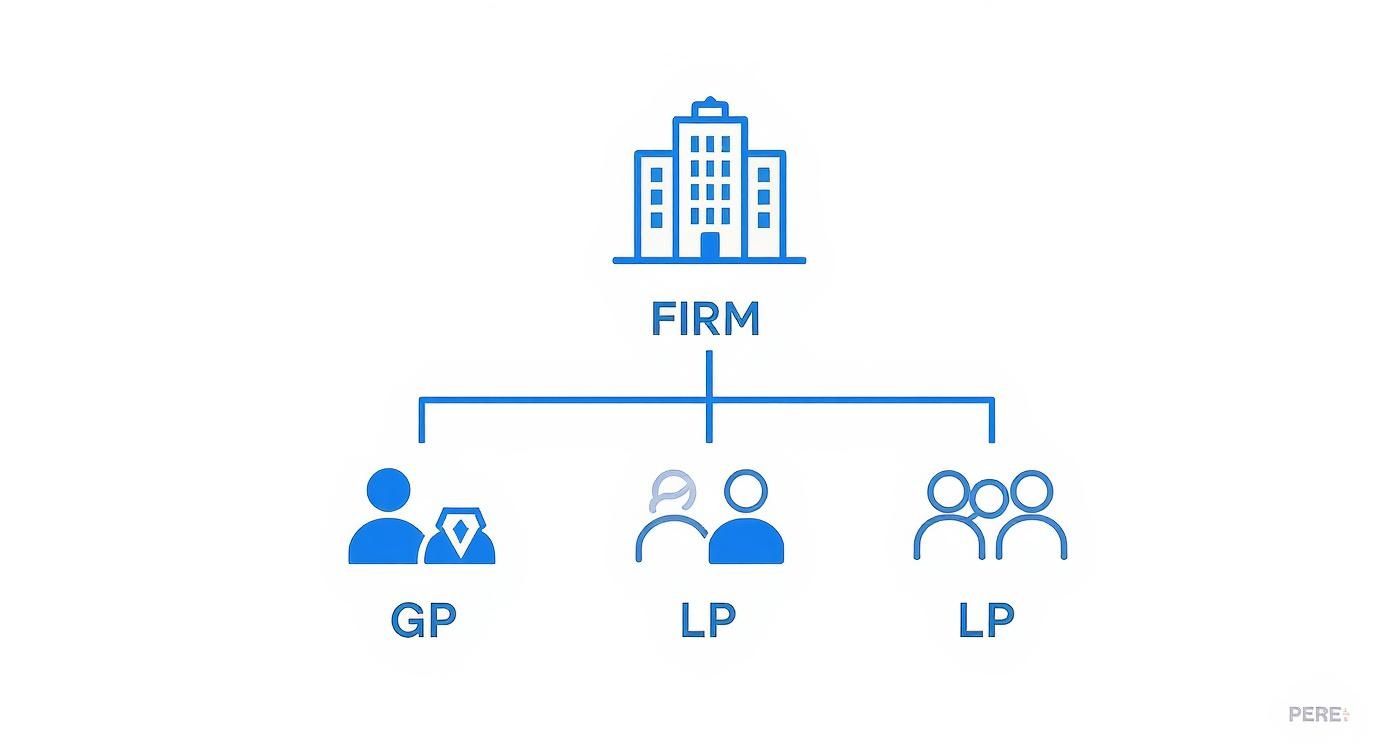

The Key Players: General Partners and Limited Partners

Every private equity real estate deal really comes down to two key groups:

General Partners (GPs): This is the firm itself—the boots-on-the-ground managers and decision-makers. The GP finds the deal, digs through the due diligence, lines up the financing, and handles the property's daily operations. They are the hands-on pros responsible for making the business plan a reality.

Limited Partners (LPs): These are the passive investors, like high-net-worth individuals, family offices, or even larger institutions. LPs put up most of the equity for the deal, but they aren't involved in the day-to-day grind. This setup limits their liability to the amount they invest.

This structure creates a powerful alignment of interests. The GP brings the operational muscle, while the LPs provide the financial fuel to get the deal done. When the investment succeeds, both parties share in the rewards.

The Investment Lifecycle

The whole process follows a clear, predictable cycle designed to maximize investor returns over a set period, usually somewhere between three to seven years.

The Fundamental Cycle: Raise Capital → Deploy Capital → Create Value → Exit Investment

First, the firm raises the necessary cash for a specific deal or a broader fund. Once the money is in, they deploy it to acquire the target property.

Then the real work begins. This is the value-creation phase, where the GP executes its strategy—maybe it's renovating units, leasing up vacant space, or completely redeveloping the site.

Finally, the GP exits the investment by selling the now-stabilized, more valuable asset. The last step is returning the original capital and profits back to the Limited Partners. It's a structured, transparent approach to building wealth. For a look at how technology is refining this process, Vestberry offers a keynote on the state of digitalization in private equity.

How Investment Strategies Create Real Value

A private equity real estate firm isn't just a passive landlord. They don't simply buy a building and hope it goes up in value. Instead, they operate with a specific, disciplined game plan designed to actively force appreciation and create value where it didn't exist before.

Think of it like an investor choosing between stable bonds and high-growth stocks. Each real estate strategy sits on a similar spectrum, carefully balancing potential risk with expected returns. This playbook dictates everything from the type of property a firm targets to the level of renovation or development needed to hit its financial goals. For you as an investor, understanding this spectrum is the key to matching a deal with your own risk tolerance.

The Four Primary Investment Strategies

In the world of commercial real estate, most deals fall into one of four main buckets. They range from lower-risk, income-focused plays to higher-risk, growth-oriented projects.

Core: This is the most conservative approach, akin to buying a blue-chip stock. These are high-quality, stable, and fully leased properties in prime locations—think of a landmark office tower in downtown Manhattan. The goal is simple: predictable cash flow and steady, long-term appreciation.

Core-Plus: A small step up in risk, Core-Plus properties are fundamentally solid but have a minor, fixable issue. This could be a building with slightly dated common areas or a few leases expiring soon. It's a blend of stable income with a touch of upside potential from light improvements.

Value-Add: This is where most private equity real estate firms make their mark. A Value-Add strategy targets underperforming properties that need a major overhaul, either physically or operationally. It’s like a large-scale "fix and flip"—buying an aging apartment complex, gut-renovating the units, adding modern amenities, and bringing rents up to market rates. This approach hinges on the sponsor's skill to execute the business plan.

Opportunistic: At the top of the risk-reward ladder, Opportunistic strategies involve ground-up development, massive redevelopments, or acquiring deeply distressed assets. These projects are complex and might involve navigating zoning changes, construction, and a full lease-up from zero. The risks are higher, but so are the potential home-run returns.

This structure is the foundation of private equity real estate. The General Partner (GP) is the hands-on operator executing the strategy, while the Limited Partners (LPs) are the passive investors who provide the bulk of the capital.

Comparing Real Estate Investment Strategies

This table breaks down the four primary strategies to give you a clearer picture of their distinct risk-return profiles.

Strategy | Typical Risk Profile | Target IRR (%) | Primary Return Driver | Example Asset |

|---|---|---|---|---|

Core | Low | 7-10% | Stable Cash Flow | Fully leased office tower in a Tier 1 city |

Core-Plus | Low to Moderate | 9-12% | Cash Flow + Minor Value Creation | A stable apartment building needing light cosmetic updates |

Value-Add | Moderate to High | 12-18% | Value Creation & Renovation | An outdated industrial warehouse to be modernized for e-commerce |

Opportunistic | High | 18%+ | Development & Entitlement | Building a new mixed-use project from the ground up |

As you can see, the path to returns shifts dramatically from relying on existing income (Core) to actively manufacturing value through development and repositioning (Opportunistic).

Specialized Strategies for Modern Markets

Beyond these core pillars, smart firms often use niche strategies to find an edge in today's market. These specialized plays can unlock value that broader approaches often overlook.

A great example is adaptive reuse, which is all about giving an old building a new life. Think of converting an abandoned textile mill into chic loft apartments or turning a forgotten warehouse into a bustling food hall. It’s a sustainable approach that preserves character while meeting modern demand.

Another innovative tactic is modular construction. Here, large portions of a building are manufactured in a factory and then assembled on-site like building blocks. This method can slash construction timelines, improve quality, and lower costs—a huge advantage for building assets like apartments or hotels quickly and efficiently.

Mapping Your Journey as an Investor

So, what does an investment actually look like from your side of the table? It’s not just about wiring money and hoping for the best. The path from your initial commitment to the final payout is a well-defined process, designed to be transparent and efficient.

Think of it as a roadmap. It shows you exactly how your capital is put to work by a private equity real estate firm, step-by-step.

Step 1: Fundraising and Commitment

First things first: raising the capital. A firm will put together a Private Placement Memorandum (PPM), which is essentially the investment’s rulebook. It lays out the business plan, potential risks, fee structure, and the returns the firm is targeting.

Novice Lens: What is a PPM?A Private Placement Memorandum (PPM) is the comprehensive legal document for the investment. Think of it as the ultimate owner's manual for a deal. It details the strategy, risks, terms, and projections, ensuring you have all the necessary information before committing capital.

This process is typically structured under federal securities exemptions like Regulation D, Rule 506(c), allowing firms to raise capital from accredited investors. After you review the PPM and decide to move forward, you’ll sign a subscription agreement. That’s what legally commits your capital to the project.

Step 2: Capital Calls and Acquisition

You don't usually wire your entire investment all at once. Instead, the firm will issue a capital call when funds are needed for a specific milestone, like the down payment on the property.

This "just-in-time" approach is more efficient because it ensures your money isn't just sitting around idle. For new investors, this part can feel a bit slow at first. It's a normal part of the process where you see money go out before you see it come in, a phenomenon often called the J-curve. We break this down in our guide on the J-Curve in private equity.

While this is happening, the sponsor is deep in the trenches of due diligence—verifying every single assumption about the property's finances, physical condition, and legal standing. Once everything checks out and the deal closes, we move to the next phase.

Step 3: Asset Management and Value Creation

With the property officially acquired, the sponsor shifts gears into asset management. This is the hands-on, roll-up-your-sleeves stage where the business plan comes to life.

This is where the real work happens. It could involve:

Overseeing Renovations: Managing contractors and capital improvement projects.

Leasing and Marketing: Driving an aggressive campaign to fill vacant units.

Operational Efficiency: Finding ways to cut costs and streamline how the property is run.

Regular Reporting: Keeping you in the loop with quarterly updates on performance.

An experienced sponsor really earns their keep here, navigating the inevitable challenges and pushing the project toward its goals.

Step 4: Disposition and Profit Distribution

The final act is the exit, or disposition. Once the business plan is complete and the asset is stabilized, the firm puts the property on the market to capture the value that’s been created.

The sale price is largely driven by the property's Net Operating Income (NOI) and the market’s current capitalization (cap) rate. Generally, selling at a lower cap rate than you bought it for is a great sign of a successful investment.

After the sale, the proceeds are distributed based on the "waterfall" structure detailed in the PPM. This means LPs get their initial capital back first, then a preferred return, and then the remaining profits are split between the LPs and the GP. This final step brings your investment journey full circle, delivering the returns you signed up for.

Understanding the Metrics That Matter Most

When a private equity real estate firm presents an opportunity, they speak a language of numbers. Learning to speak that language is the key to confidently evaluating any deal that comes across your desk.

While the acronyms can seem intimidating at first, the core concepts are actually pretty straightforward. They’re all designed to answer two simple questions: How hard is my money working, and how much am I getting back in the end?

Let's break down the three most important key performance indicators (KPIs) you’ll see in every single deal.

The Big Three Performance Metrics

These metrics work together to give you a complete picture of an investment's success. Think of them as a team—no single number tells the whole story, so you have to look at all three to get the full picture.

Equity Multiple (EM): This is the simplest and most intuitive one. It answers the question, "How many times did I get my money back?" If you invest $100,000 and get a total of $220,000 back over the life of the deal, your Equity Multiple is 2.2x. It’s a powerful, at-a-glance measure of your total profit.

Internal Rate of Return (IRR): While the Equity Multiple tells you how much you made, the IRR tells you how fast you made it. It calculates your annualized rate of return, but it uniquely accounts for the timing of all cash flows—both your initial investment and every distribution check you receive. A 2.0x multiple achieved in two years is a whole lot better than the same multiple achieved in five, and IRR is the metric that proves it.

Cash-on-Cash (CoC) Return: This metric measures the cash income you receive from a property in a given year, divided by the total cash you’ve put in. If an investment generates $8,000 in distributions for the year on your $100,000 investment, your CoC return is 8%. This is your go-to number for gauging the ongoing income performance of an asset before the final sale.

For a deeper dive, our guide on decoding asset management performance metrics offers even more detail on these essential KPIs.

Illustrative Multifamily Value-Add Project

This simplified model shows how a typical value-add project might perform.

Metric | Year 0 | Year 1 | Year 2 | Year 3 (Sale) | Total |

|---|---|---|---|---|---|

Initial Equity Investment | ($500,000) | ||||

Cash Flow from Operations | $30,000 | $40,000 | $50,000 | $120,000 | |

Net Sale Proceeds | $1,000,000 | $1,000,000 | |||

Total Cash to Investor | $30,000 | $40,000 | $1,050,000 | $1,120,000 | |

Projected Metrics: | |||||

Equity Multiple | 2.24x | ||||

IRR | 31.5% | ||||

Avg. Cash-on-Cash | 6.0% | 8.0% | 10.0% | 8.0% |

In this example, your initial $500,000 turns into $1,120,000 in total returns. The 2.24x multiple shows a solid profit, and the 31.5% IRR tells you that your capital grew quickly over the three-year hold.

The Investor Lens: A Simple Breakdown

For investors just starting out, it helps to have simple definitions that cut through the financial jargon.

* Equity Multiple: Think of this as your "total payout multiplier." Anything over 1.0x means you made money.* IRR: This is the "speed" of your return. A higher IRR means your capital was put to work more efficiently.* Cash-on-Cash: This is your "annual paycheck" from the property's operations. It tells you how much income the investment is spinning off each year.

An Advanced Perspective

For more sophisticated investors, the real analysis happens when you dig into the nuances behind these numbers.

* IRR Sensitivity: Be aware that IRR can be heavily influenced by early cash flows. A quick return of capital can inflate the IRR, even if the Equity Multiple is just so-so. You should always look at IRR and EM together to make sure the total profit justifies the speed of the return.* "Phantom" Income: Keep an eye on how capital events, like a refinancing that returns some of your initial equity, affect CoC calculations. A high CoC after a refi might look great on paper, but it's crucial to track performance against your original invested capital to see the full picture.* Hold Period Impact: Longer hold periods tend to compress IRR but can allow for bigger Equity Multiples as the asset has more time to appreciate. Your personal liquidity needs and time horizon will determine which metric you should prioritize.

How to Choose the Right Investment Firm

As a passive real estate investor, picking the right partner—often called a "sponsor" in this world—is easily the most important decision you'll make. It’s tempting to be swayed by glossy brochures and impressive-looking track records, but that's just scratching the surface. Real due diligence is about digging in to understand a firm’s character, discipline, and hands-on expertise.

A great sponsor doesn’t just find good deals; they create value through sharp asset management and know how to navigate rough waters with a steady hand. You’re looking for a partner whose interests aren’t just similar to yours, but are fundamentally tied to your success.

Checklist: Questions to Ask a Potential Sponsor

When evaluating a private equity real estate firm, use this checklist to guide your conversation:

Track Record: Can you walk me through your full-cycle deals, including any that underperformed? How did you manage assets during the 2008 and 2020 downturns?

Alignment: How much of the firm's own capital is invested in this deal alongside the LPs?

Specialization: What specific property types and geographic markets are your core focus? Why?

Underwriting: What are your key assumptions for rent growth, exit cap rate, and interest rates? Can you show me your downside scenarios?

Team: Who are the key principals, and what is their direct, hands-on experience in asset management and operations?

Communication: What is your standard reporting process for investors, and can I see a sample report?

References: May I speak with a few investors from one of your previous deals?

Underwriting Discipline and Specialization

A firm that claims to be an expert in everything is usually an expert in nothing. Real excellence comes from deep specialization in a specific asset class and geographic market. A sponsor who lives and breathes multifamily assets in the Sunbelt will have an operational edge and a local network that a generalist firm just can't match.

The market agrees. A recent McKinsey report on trends shaping private markets (as of 2023) noted that general partners with deep operational expertise now manage 37% of real estate assets, a huge jump over the last decade. This shows just how critical hands-on management has become for driving returns.

When you're reviewing a deal, press them on their underwriting assumptions. Are their rent growth projections and exit cap rates conservative? Are they backed by solid, third-party data? A disciplined private equity real estate firm will stress-test its financial models for multiple downside scenarios, proving they’ve planned for potential bumps in the road. That kind of rigor is the hallmark of a partner you can trust for the long run.

Navigating Risks and Governance Structures

Every investment has its risks, and in the world of private real estate, these can feel complex and long-term. But here’s the secret: it's not about trying to avoid risk entirely—that’s a fool's errand. Instead, a top-tier private equity real estate firm is laser-focused on identifying, pricing, and intelligently managing those risks at every turn.

The whole game is about building a fortress around your capital. This comes from disciplined underwriting, hands-on asset management, and rock-solid, transparent governance. It’s this clear-eyed confidence that separates a prudent investment from a risky gamble.

Risk & Mitigation Table

Risk: Illiquidity * Mitigation: Your capital is tied up for a multi-year ride. A good sponsor makes this crystal clear in the Private Placement Memorandum (PPM), outlining the business plan and expected timeline. They might also build in opportunities for capital events, like a refinancing, to return a slice of your equity before the final sale.

Risk: Market Cycles * Mitigation: The economy zigs and zags. This is where conservative underwriting is your best friend. A good sponsor stress-tests deals against higher interest rates and slower rent growth. Focusing on resilient assets like workforce housing, which holds up better in downturns, is another key strategy.

Risk: Execution Risk * Mitigation: What if that big renovation plan faces delays or goes over budget? This is where experience really shows. A sponsor with a deep, vertically-integrated team and strong local contractor relationships can keep projects on track and on budget. Many teams now lean on advanced tools like BIM for effective clash detection and project governance to manage development complexities from the start.

Governance That Protects Investors

Strong governance isn’t just paperwork; it’s the bedrock of trust. These structures are legally binding frameworks designed to ensure the sponsor always acts in the best interests of their investors (the Limited Partners, or LPs).

The most important document by far is the Limited Partnership Agreement (LPA). Think of it as the constitution for the investment. It spells out everything—from fees and profit splits to the rights and duties of both the sponsor (GP) and the investors (LPs). You can dive deeper in our guide to private equity real estate fund structures.

Many firms also set up an LP Advisory Committee (LPAC). This is a small group of major investors who can weigh in on key decisions, acting as a valuable sounding board and a check on the sponsor's power. This kind of transparency is the hallmark of an investor-first private equity real estate firm.

Frequently Asked Questions (FAQ)

Diving into the world of private equity real estate can feel complex, especially if you're new to the game. Here are some straightforward answers to the questions investors ask us most.

What's the Minimum Check Size to Get in a Deal?

This really depends on the firm and the specific deal they're putting together. For offerings geared toward high-net-worth individuals and family offices, you'll often see minimums in the $100,000 to $250,000 range. For the bigger, institutionally-focused funds, that entry point can easily jump to $1 million or more. No matter the amount, every investor in these types of deals has to meet the SEC's "accredited investor" definition, which is based on your income or net worth.

How Does a Firm Like Yours Actually Make Money?

It’s a mix of fees and, more importantly, performance incentives. The structure is designed to make sure our goals are locked in with our investors' success.

Fees: Think of these as the cost of doing business. There might be a one-time acquisition fee, an annual asset management fee (usually 1-2% of the equity you invest), and sometimes a disposition fee when we sell.

The Promote: This is the real driver. Often called "carried interest," it's our share of the profits—say, 20%—that we only earn after our investors get all their initial capital back, plus a preferred return (like an 8% annual return). If our investors don't win, we don't either.

How Long Will My Money Be Tied Up?

Private real estate isn't like the stock market; it's an illiquid investment. That means your capital is committed for the entire life of the project's business plan. The holding period is tied directly to the strategy. A value-add project is typically a 3-5 year journey. More stable Core or Core-Plus deals might be planned for 7-10+ years. Every deal’s Private Placement Memorandum (PPM) will lay out the expected timeline.

What Kind of Updates Should I Expect to See?

Any reputable firm knows that keeping investors in the loop is non-negotiable. As a Limited Partner, you should absolutely expect to receive quarterly updates. These reports should give you the full picture: property financials, a clear narrative on how the business plan is progressing (leasing wins, renovation status), and a quick take on the local market. You’ll also get an annual summary of your capital account and the K-1 tax forms you'll need. Consistent, transparent communication is one of the biggest green flags you can look for in a sponsor.

Ready to see how well-structured real estate can be a prudent, resilient component of your long-term wealth strategy? Stiltsville Capital focuses on finding and managing high-potential commercial assets in booming Sunbelt markets for accredited investors and family offices.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments