The Institutional Playbook for Investment in Multi-Family Properties

- Ryan McDowell

- Dec 14, 2025

- 13 min read

Reading Time: 12 min | Good for: Novice Investors (A), Informed Principals (B), Sophisticated CIOs (C)

For accredited investors and family offices, investing in multi-family properties isn't just about buying buildings with a few units. It's about strategically participating in institutional-quality private equity deals that acquire, improve, and operate large apartment complexes to drive resilient cash flow and long-term appreciation.

TL;DR: Key Takeaways

Market Why-Now: A sharp drop in new apartment construction is creating a "supply drought" for 2025 and beyond, increasing the value of existing, well-located assets.

How Returns are Made: Value is created by executing a disciplined business plan—renovating units, modernizing amenities, and optimizing operations to increase Net Operating Income (NOI).

Investor Action: The key to success is partnering with an experienced sponsor who provides institutional-grade underwriting, transparent reporting, and has significant "skin in the game."

Decoding the Current Multifamily Investment Climate

Before allocating capital, it's crucial to understand the story the market is telling. Right now, the narrative for investment in multi-family properties centers on a profound supply-and-demand shift creating a unique window of opportunity. It’s a classic case of looking past the short-term headlines to see the structural opening on the horizon.

For the last couple of years, the market has been absorbing a significant wave of new apartment deliveries. This influx temporarily softened rent growth in some submarkets and gave the impression of oversupply. But that's only half the story.

The very same economic pressures—namely, tighter financing and elevated construction costs—that pushed this delivery wave are now causing a sharp pullback in new projects breaking ground.

The Supply Pipeline Is Pinching Shut

This dynamic is setting up a compelling macroeconomic picture for the next few years. According to research from the National Multifamily Housing Council (NMHC), between 2023 and late 2024, the U.S. multifamily market absorbed nearly 560,000 new units. Looking ahead, however, construction starts are projected to plummet.

By the middle of 2025, new starts could be as much as 74% below their 2021 peak (Source: NMHC, as of Q2 2024). This steep drop in future supply is a game-changer for underwriting returns. With less competition on the way, the value of existing assets is set to rise once the current supply is fully absorbed. You can dive into the full research in this multifamily outlook.

This isn't a statistical blip; it's the market reacting logically to a higher-cost world. Developers face a trifecta of headwinds:

Higher Interest Rates: Securing construction loans is tougher and more expensive, putting many planned projects on indefinite hold.

Elevated Building Costs: While moderating, costs for materials and labor remain significantly higher than pre-pandemic levels.

Stricter Lending Standards: Lenders are demanding more equity and have a much lower appetite for new development risk.

Market Signal Box: The Supply Drought* Data Point: New multifamily construction starts are projected to fall by over 40% between 2023 and 2025. (Source: NMHC, Q2 2024)* Interpretation: The pipeline of new apartments is constricting rapidly due to high financing and construction costs.* Investor Take: This impending supply "drought" means that existing, well-located multifamily properties will face less competition in 2025 and beyond. This dynamic provides owners of today's assets with greater pricing power to drive stronger rent growth and, consequently, higher property valuations.

The Unwavering Demand for Rentals

While the supply side is tightening, demand for rental housing remains robust, especially in our target Sunbelt markets. Several powerful demographic and economic tailwinds sustain the need for apartments.

First, household formation continues to outpace new housing development over the long term, creating a structural shortage of places to live. Younger generations, often burdened by student debt and high home prices, are renting for longer than ever before.

Second, booming job growth in key southern and western states acts as a magnet for migration. These regions consistently lead the nation in creating new jobs, pulling in a steady stream of new residents who need a place to live—and they almost always start as renters.

Finally, the affordability gap between renting and owning has become a chasm. With mortgage rates at elevated levels, the monthly cost of buying a home is simply out of reach for a huge portion of the population. This makes renting the only practical choice, creating a massive and stable tenant base for well-run multifamily properties.

How to Underwrite Multifamily Properties Like an Institution

Moving from high-level market theory to the reality of a single deal demands a disciplined, institutional-grade underwriting process. This isn't just plugging numbers into a generic spreadsheet; it's about building a defensible financial narrative for an asset.

Frankly, this is how sophisticated investors separate genuine opportunities from overly optimistic projections.

Great underwriting is fundamentally about pressure-testing a sponsor's assumptions. It means taking a deep dive into the property’s history and then crafting a realistic projection of its future. This is where the real work begins—scrutinizing every line item to understand how returns will actually be generated.

Deconstructing the Core Metrics

A cornerstone of underwriting is fluency in key financial metrics, starting with understanding what Net Operating Income (NOI) means. Think of NOI as the raw profit an asset generates from its day-to-day operations. It's the property's gross income minus all operating expenses, but before factoring in debt service or major capital projects.

From there, we derive other critical metrics that tell the rest of the story:

Capitalization Rate (Cap Rate): This is the NOI divided by the purchase price. It shows the unlevered annual return if you were to buy the property with all cash. A lower cap rate usually signals a higher-quality, lower-risk asset in a prime location.

Internal Rate of Return (IRR): The ultimate performance metric, IRR calculates the total annualized return on your investment, accounting for all cash flows over the entire hold period and the time value of money. It answers the crucial question: "What is the total, time-weighted return on my invested capital?"

Equity Multiple: A simpler but powerful metric. It's the total cash you get back divided by the total cash you put in. An equity multiple of 2.0x means you doubled your money. It tells you how much you made, while IRR tells you how fast you made it.

Novice Lens: Simplifying the Jargon* NOI is the property's annual profit before the mortgage is paid.* Cap Rate is like the dividend yield on a stock for a real estate asset.* IRR is the all-in, annualized "growth rate" of your investment from start to finish.

Deal Lens: A Simplified Value-Add Example

Let's put these numbers into a practical scenario. Imagine Stiltsville Capital is evaluating a 200-unit, Class B apartment complex in a growing Sunbelt market. The plan is to acquire it, inject capital for strategic upgrades, and stabilize the asset at higher market rents—a classic value-add play.

The Initial Numbers (Illustrative):

Purchase Price: $40,000,000

Current NOI: $2,000,000

Purchase Cap Rate: 5.0% ($2M NOI / $40M Price)

The Business Plan:

Renovation Budget: $5,000,000 ($25,000 per unit)

Total Project Cost: $45,000,000

The Pro-Forma (Projected) Outcome after 3 Years:

Projected NOI: $2,925,000 (achieved through renovations commanding higher rents and better expense management)

Projected Sale Price (at a 5.0% exit cap): $58,500,000 ($2.925M NOI / 0.05)

Gross Profit: $13,500,000 ($58.5M Sale - $45M Cost)

This simplified example shows how a sponsor creates value. The goal isn't just to buy a property; it's to execute a specific plan to "force appreciation" by increasing the NOI. For a more detailed look, see our full guide to commercial real estate underwriting.

The real underwriting process involves tearing apart every assumption. Can the market truly support those rent bumps? Are the renovation costs and operating expense projections grounded in reality? This skeptical, data-driven analysis is what separates institutional underwriting from a sales pitch.

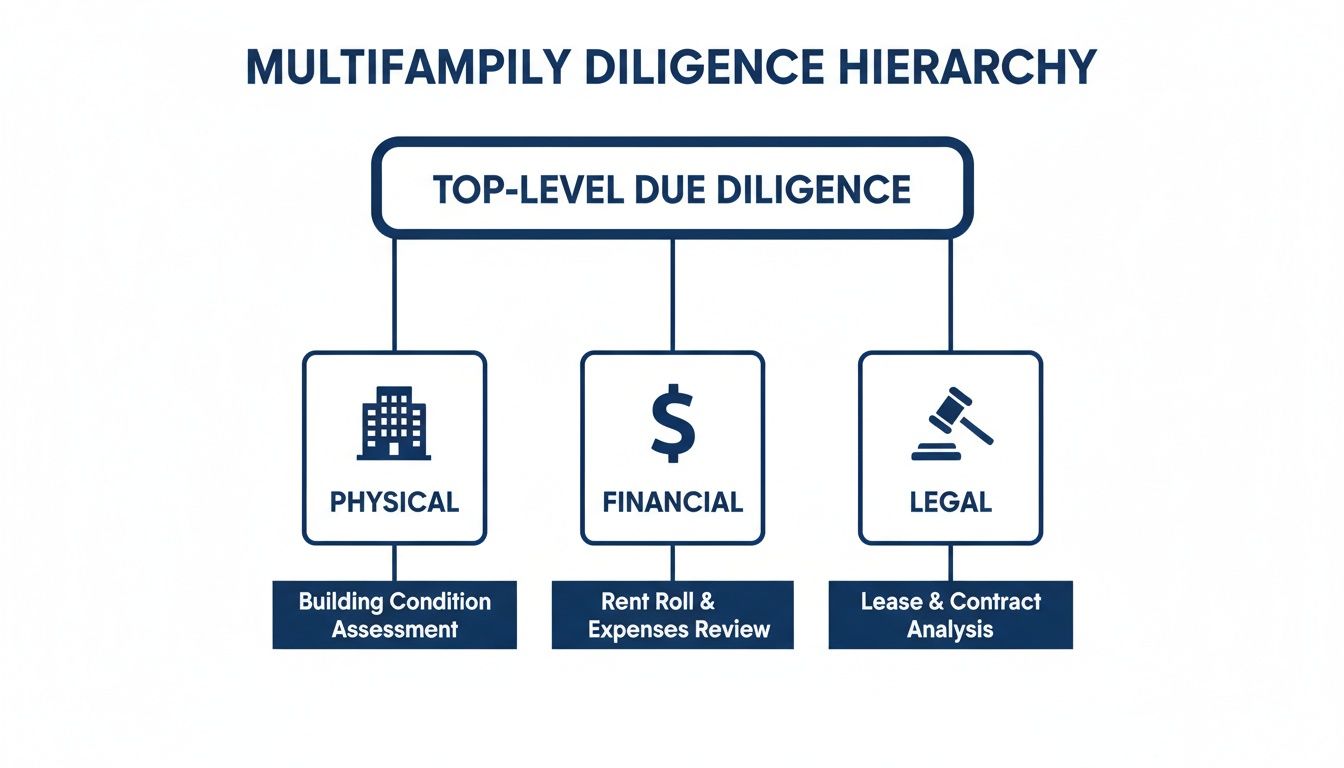

Your Due Diligence Checklist for Multifamily Assets

Once the initial numbers look promising, the real work begins. Proper due diligence is a forensic investigation that goes miles beyond a simple walkthrough. It’s about methodically verifying every assumption baked into that initial pro-forma.

An institutional-grade approach dissects this crucial phase into three pillars: physical, financial, and legal. This isn't just ticking boxes; it’s about sniffing out hidden risks and spotting overlooked value-add potential.

Physical Diligence: Uncovering the Bones of the Building

Physical diligence kicks off with a professional Property Condition Assessment (PCA), but that's just the starting line.

Deferred Maintenance vs. Value-Add Capex: It’s critical to separate "must-do" repairs (a failing boiler) from "should-do" capital improvements (modernizing a dated lobby). One prevents disaster; the other creates future income.

Unit-by-Unit Walkthroughs: A statistically significant sample of units must be walked to verify actual condition and confirm the renovation budget is based in reality.

Amenity and Common Area Audit: Are the amenities competitive for the target renter? Could a tired business center be converted into a profitable co-working space?

Financial Diligence: Verifying Every Dollar

This is where the sponsor’s story meets hard numbers. Financial diligence is a forensic accounting exercise to audit historical performance and stress-test future projections.

Investor Insight: Never take a rent roll at face value. A sophisticated investor will tear it apart, looking for tenant concentrations, hidden concessions artificially propping up rents, and delinquency trends that signal problems with tenant quality.

Your sponsor should be running a meticulous lease audit. Key documents for scrutiny include:

Trailing 12-Month (T-12) Financials: Establishes the property's baseline performance.

Bank Statements and Utility Bills: Unbiased proof that verifies reported revenues and key operating costs.

Real Estate Tax Records: Confirms the current tax assessment and investigates the likelihood of a major reassessment after the sale.

For a deeper dive, review our comprehensive guide on the institutional investor’s guide to real estate due diligence.

Legal and Title Diligence: Mitigating Hidden Liabilities

The final pillar, legal diligence, is insurance against hidden problems. This phase is about securing a clean title and understanding all property regulations.

Key items on the legal checklist include:

Title and Survey Review: Confirms clear ownership and identifies any easements or encroachments.

Zoning and Permit Compliance: Verifies the property’s current use is compliant with local laws.

Service Contract Analysis: Reviews all existing agreements to find opportunities for renegotiation or termination.

Actionable Investor Checklist: Questions to Ask a Sponsor

Diligence Category | Key Questions to Ask |

|---|---|

Physical Diligence | What is the total estimated cost for immediate repairs versus value-add capex? What percentage of units were physically inspected, and did they match the rent roll? |

Financial Diligence | Can you walk me through the T-12 and explain any significant variances month-to-month? What is the projected property tax increase post-acquisition, and how did you arrive at that number? |

Legal Diligence | Are there any easements or use restrictions that could impact our business plan? Are all permits for past work closed, and is the property fully compliant with current zoning? |

Sponsor Track Record | Can you provide case studies of similar projects, including original pro-forma versus actual results? How much of your own capital is being invested in this deal alongside LPs? |

By systematically pushing on these areas, you and your sponsor can build a complete, transparent, and defensible picture of the asset.

Understanding the Deal Structure and Capital Stack

Before getting comfortable with a multifamily investment, you must understand its financial architecture: the capital stack. This layered structure dictates who gets paid first and who carries the most risk.

Every real estate deal is funded with a mix of debt and equity. Understanding how sponsors go about securing an investment property loan is fundamental, as it forms the foundation of the stack.

The Layers of Capital Explained

The capital stack in a multifamily deal typically has two main parts, often with distinct layers.

Senior Debt: The primary mortgage, typically from a bank. It's the safest position, first in line to be paid, and thus offers the lowest return.

Preferred Equity: A hybrid layer between debt and common equity. "Pref" investors get a fixed "preferred return" before common equity investors see a dollar. It's less risky than common equity but with less upside potential.

Common Equity: Where the sponsor (General Partner or GP) and passive investors (Limited Partners or LPs) put their capital. This is the highest-risk, highest-return position with unlimited upside potential after all other layers are paid.

How Profits Flow: The Distribution Waterfall

When the property generates cash or is sold, profits flow through a distribution waterfall, a series of hurdles defining the profit-sharing agreement between LPs and the GP.

A typical waterfall looks like this:

Return of Capital: 100% of cash flow goes to LPs until their initial investment is returned.

Preferred Return: LPs continue to receive 100% of cash flow until they hit their preferred return (e.g., an 8% annualized return).

The Catch-Up: The GP often gets a larger slice of profits for a period, allowing them to "catch up."

The Split (Promote): Remaining profits are split between LPs and the GP based on a predetermined ratio, like 70/30 or 80/20.

This top-down approach—physical asset, financial structure, legal compliance—ensures every layer of the deal is solid.

Sponsor Co-Investment: Skin in the Game

Finally, a key signal of a healthy deal is the sponsor's co-investment. When the GP puts significant personal capital into the common equity, their interests are perfectly aligned with yours. Their money is on the line, turning the relationship into a true partnership.

Driving Returns Through Post-Acquisition Asset Management

Getting a deal across the finish line isn't the end; it's the starting gun. The real work—and where true alpha is generated—begins with disciplined, hands-on asset management. This is the operational engine that turns a static building into a dynamic, income-producing machine.

This shows our passive investors exactly how we actively manufacture value instead of just hoping the market lifts all boats. This isn’t about timing the market; it’s about making the market work for our asset.

Our strategy attacks the property's P&L statement: we systematically increase revenue while meticulously controlling expenses. Every action is designed to directly boost the Net Operating Income (NOI), the key metric that drives valuation.

The Revenue Enhancement Playbook

The mission is to make the property a more desirable place to live, commanding higher rents and attracting a stable, high-quality tenant base.

Strategic Unit Renovations: The most direct path to pushing rents. We upgrade kitchens, install stainless steel appliances, and add in-unit washer/dryers, delivering a finish level today's renters demand without over-improving for the submarket.

Amenity Modernization: We transform underused spaces—like a dated clubhouse—into high-demand amenities like modern fitness centers, co-working lounges, or secure package rooms.

Ancillary Income Streams: We introduce new income sources like reserved parking fees, rentable storage units, or "pet rent" policies.

The Expense Optimization Strategy

Boosting revenue is exciting, but controlling costs is where operational expertise truly shines. Every dollar saved on expenses drops straight to the bottom line.

Advanced Lens: The Power of Expense ControlExpense reduction is often more predictable and controllable than revenue growth. While future rents are a projection, cost savings from renegotiated contracts and new technologies can be implemented from day one, providing a crucial buffer for the business plan and de-risking the investment.

Common Expense Reduction Tactics:

Utility Management Programs: Installing low-flow fixtures, LEDs, and smart thermostats to cut utility consumption.

Service Contract Renegotiation: Putting all third-party contracts out to bid—landscaping, trash removal, insurance—to leverage portfolio scale for better pricing.

Property Tax Appeals: Immediately challenging the property's assessed value post-acquisition, which can be one of the single largest expense reductions.

Implementing Technology: Using modern property management software to automate rent collection and maintenance requests, slashing administrative overhead.

Mastering these operational details is what separates average returns from exceptional ones. To get a more complete picture, investors can explore these real estate asset management best practices we apply across our portfolio.

Risk & Mitigation Table

Smart investing isn't about finding a deal with zero risk—that doesn't exist. It’s about understanding the risks and ensuring your sponsor has a battle-tested plan to mitigate them. Transparency is the bedrock of a solid partnership.

Risk: Market & Economic Downturn * A local recession leads to job losses, softening rental demand and putting downward pressure on income. * Mitigation: We focus on Sunbelt submarkets with diverse job creators (healthcare, logistics, tech). This economic diversification creates a more resilient tenant base.

Risk: Interest Rate & Refinancing Volatility * A spike in interest rates increases debt service costs, squeezing cash flow and making refinancing at the loan term's end more difficult or costly. * Mitigation: We employ conservative leverage and use tools like interest rate caps to hedge against volatility. We also stress-test our underwriting models against higher exit-year interest rates.

Risk: Operational & Execution Failure * The sponsor fails to deliver on the business plan. Renovations go over budget, lease-up targets are missed, or poor property management leads to high turnover and a declining NOI. * Mitigation: We partner with vertically integrated property management teams with a proven track record in the specific submarket. A detailed capex budget with contingency funds and a milestone-driven project plan are non-negotiable.

What to Expect After You Invest: Investor Reporting

A true partnership is built on continuous, transparent communication. A high-quality quarterly report is more than an update; it's a critical tool for accountability.

Investor Takeaway: If a sponsor's reporting is vague, late, or hard to understand, it’s a massive red flag. Institutional-grade reporting should be so detailed that you can independently track the asset's performance against the original pro-forma.

Essential Components of a Quarterly Report:

Executive Summary: A clear narrative from the asset manager on the quarter's highlights, business plan progress, and market shifts.

Detailed Financials: Balance Sheet, Income Statement (P&L), and a Budget vs. Actual analysis.

Key Performance Indicators (KPIs): Physical and economic occupancy, rent collections, and leasing velocity.

Capital Project Updates: A summary of renovation progress with photos, budget tracking, and updated timelines.

Distribution Information: A clear statement of any distributions paid to investors during the quarter.

Common Questions on Multifamily Investing (FAQ)

Even sophisticated investors have questions. Here are straight answers to the most common inquiries.

What’s a typical hold period for a multifamily real estate investment?

For most value-add or opportunistic multifamily deals, the target hold period is 3 to 7 years. This provides enough time for the sponsor to execute the business plan—renovating units, improving management, and stabilizing the property to maximize its value before an exit.

How do distributions work in a multifamily syndication?

Distributions, typically paid quarterly, come from the property's net cash flow after all expenses and mortgage payments are made. These payments usually begin with a "preferred return," a target return paid to investors (e.g., 6-8%) before the sponsor shares in the profits. Upon sale, capital gains are distributed according to the "waterfall" structure in the operating agreement.

What are the key differences between Class A, B, and C multifamily properties?

Multifamily properties are generally grouped into three classes based on age, location, and quality.

Class A: Newest, high-end properties in prime locations with premium amenities and the highest rents.

Class B: Slightly older but well-maintained buildings that appeal to a broad renter base. They are often the sweet spot for value-add investment.

Class C: Typically 20+ years old and often requiring significant improvements. Rents are lower, but they can be strong cash-flow assets when managed well.

What tax advantages come with investing in multifamily properties?

Real estate offers significant tax benefits for passive investors. The primary advantage is depreciation, a non-cash deduction that can shelter rental income from taxes. Investors can also benefit from deducting mortgage interest and property taxes. Upon sale, profits are typically taxed at lower long-term capital gains rates. Always consult a qualified tax professional for advice specific to your situation.

Ready to see how a professionally managed portfolio of investment in multi-family properties could fit into your long-term wealth strategy? The team at Stiltsville Capital is here to provide the transparency and institutional expertise needed to make smart, confident decisions. Well-structured real assets can be a prudent, resilient component of your portfolio.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.