A Guide to Investment Types and Risk for Smart Investors

- Ryan McDowell

- Sep 2, 2025

- 16 min read

Reading Time 6 min | Good for: A, B

To build long-term wealth in today's market, you must master the relationship between different investment types and their inherent risk. Every investment, from a "safe" government bond to an opportunistic real estate deal, involves a trade-off: your potential for high returns versus your chance of taking a loss. Mastering this dynamic is what separates good investors from great ones.

TL;DR: The Bottom Line* The Core Principle: You can't achieve returns without accepting risk. It's a fundamental trade-off in every investment decision you'll ever make.* Who This Matters For: If you're an accredited investor, run a family office, or are serious about building a portfolio that lasts, this isn't just theory—it's the foundation of smart investing.* What's Next: Let's dig into the specifics. Keep reading as we unpack the unique risk characteristics of equities, bonds, real estate, and the world of private alternatives.

Decoding Today's Investment Landscape

Navigating the investment world feels complicated because, frankly, it is. For high-net-worth individuals and family offices, knowing your options isn't enough. You must understand how those options will react in a global economy that seems to change on a dime. The old playbooks just don't cut it anymore.

This guide provides a clear, institutional-grade lens on the major investment categories. We'll break down the real risk and return profiles for:

Public Equities: What really drives stock market performance and its infamous volatility.

Fixed Income: The hidden risks lurking behind assets that are supposed to be safe.

Real Estate: Why it's such a powerful inflation hedge and a source of tangible, real-world value.

Private Alternatives: The growing appeal of non-traditional assets for serious diversification.

The Fundamental Risk-Return Spectrum

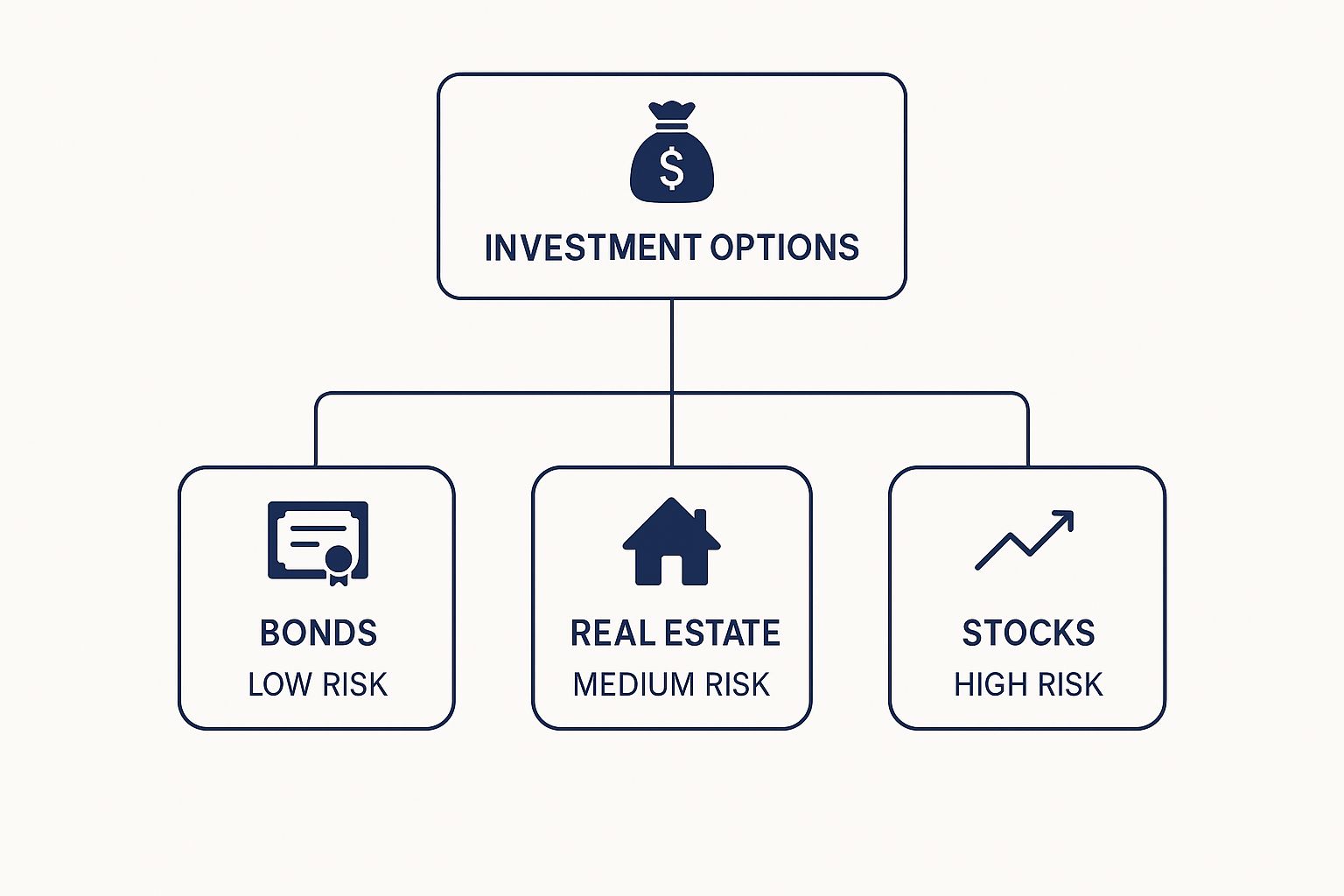

Ultimately, all investments can be placed somewhere along a risk-return spectrum. Think of it as a basic hierarchy: lower-risk assets like bonds offer stability, while higher-risk assets like stocks target much greater growth.

This simple visual places real estate right in the middle, showcasing its unique ability to balance both risk and reward. Understanding where each investment fits is the first step toward building a truly strategic portfolio. For a deeper dive into more advanced strategies, you can always explore more on our blog.

To give you a clearer picture, let's break down how these asset classes stack up against one another.

Investment Types at a Glance: A Risk and Return Spectrum

Asset Class | Typical Risk Profile | Return Potential | Liquidity | Best Suited For |

|---|---|---|---|---|

Cash & Equivalents | Very Low | Low | Very High | Capital preservation, short-term needs |

Fixed Income (Bonds) | Low to Moderate | Moderate | High | Income generation, portfolio stability |

Public Equities (Stocks) | High | High | High | Long-term growth, higher risk tolerance |

Real Estate | Moderate to High | Moderate to High | Low to Moderate | Inflation hedging, cash flow, tangible asset lovers |

Private Equity/VC | Very High | Very High | Very Low | Aggressive growth, long time horizons, accredited investors |

This table is a great starting point, but remember that the details within each category matter immensely. A U.S. Treasury bond behaves very differently from a high-yield corporate bond, just as a core commercial property in Miami is a world away from a ground-up development project.

Diving Into Public Markets: Equities and Fixed Income

For most people, the first step into the world of investing happens in the public markets. We’re talking about stocks (equities) and bonds (fixed income)—the classic building blocks of just about any portfolio. They're well-known for a reason: they offer liquidity and a level of transparency you just don't get in private markets. But don't let their accessibility fool you into thinking they're simple.

To really navigate today's economic ups and downs, you have to understand what truly drives risk and reward in these assets. Just buying a "blue-chip stock" or a "safe government bond" and calling it a day isn't a strategy anymore. You need a more tactical mindset to handle the unique dynamics of each.

Unpacking Equities: The Engine of Growth

Equities, or stocks, are your ticket to owning a piece of a publicly traded company. The main draw here is the potential for your investment to grow significantly as the company succeeds. But that growth potential doesn't come for free—it's paired with higher volatility and market risk.

It's also crucial to remember that not all stocks are created equal. The risk profile changes dramatically depending on the company's size (market capitalization) and its industry (sector).

Large-Cap Stocks: These are the big, established players—think the household names in the S&P 500. They generally offer more stability and often pay out dividends, but their explosive growth days might be behind them.

Small-Cap Stocks: On the other end of the spectrum, these smaller companies pack a punch with higher growth potential but also bring more risk. They're far more vulnerable to economic slumps and don't have the deep pockets of their larger cousins.

Sector Dynamics: A utility company stock and a tech startup are in completely different worlds. Defensive sectors like utilities and consumer staples tend to hold up better when the economy stumbles. In contrast, cyclical sectors like technology and consumer discretionary really shine when the economy is booming.

Novice Lens: What is a P/E Ratio?The Price-to-Earnings (P/E) ratio is a back-of-the-napkin way to see if a stock is cheap or expensive. You get it by dividing the stock's price per share by its earnings per share. A high P/E often means investors are betting on big future growth, while a low P/E could signal an undervalued gem—or a company with problems. It's one of the first metrics any stock investor learns.

Demystifying Fixed Income: The Bedrock of Stability

Fixed income, which mostly means bonds, works like a loan. You're lending money to a government or a corporation, and in return, they promise to pay you regular interest (coupon) and give your original investment back on a specific date (maturity).

Bonds are often labeled the "safer" option compared to stocks, but they absolutely have their own risks. The two big ones to watch are interest rate risk and credit risk.

Interest Rate Risk: This is a big one. When market interest rates go up, new bonds are issued with higher payouts, which makes your older, lower-paying bonds look less attractive. This causes the market price of your existing bonds to drop. Duration is the key stat that tells you how sensitive a bond's price is to these interest rate swings.

Credit Risk: This is the straightforward risk that the issuer won't be able to pay you back and will default on the loan. Credit rating agencies like Moody's and S&P grade this risk, sorting bonds from the safer "investment-grade" to the riskier "high-yield" (or "junk") bonds that have to offer higher returns to attract investors.

The market has been a perfect example of this complexity lately. Both stocks and bonds have been volatile, reacting to major economic shifts. According to J.P. Morgan Asset Management, investors are still juggling a messy mix of geopolitical tensions, inflation worries, and changing government policies around the world, making tactical asset allocation critical.

Advanced Lens: Factor Investing and Credit SpreadsFor more seasoned investors, simply owning the market isn't enough. In equities, factor investing means targeting specific, proven drivers of return—like "value," "momentum," or "quality"—to build a smarter, more resilient portfolio. In the bond world, savvy investors watch credit spreads closely. That’s the yield difference between corporate bonds and super-safe government bonds, and it's a great barometer for market fear. When the spread widens, it's a clear sign that investors are getting nervous.

Understanding Private Markets and Alternative Investments

When most people think about investing, their minds jump to stocks and bonds. But beyond the well-trodden path of public markets lies a massive world of private investments. For serious investors looking to build a truly diversified portfolio with the potential for higher returns, getting a handle on these alternatives isn't just a good idea—it's absolutely essential.

So, what are we talking about here? Simply put, these are investments in assets you can't buy on a public exchange like the NYSE. This umbrella covers everything from private equity and venture capital to direct real estate deals and private credit. The big draw is getting in on the ground floor of opportunities—like a promising startup or a value-add real estate project—long before the general public has a chance. That's where significant value is often captured.

Core Alternative Investment Types

While the category is broad, a few key players dominate the scene for accredited investors. Each brings a completely different risk and return profile to the table.

Private Equity (PE): Think of this as flipping a whole business instead of a house. PE firms typically buy mature, established private companies, work to improve their operations over several years, and then sell them for a profit.

Venture Capital (VC): This is the higher-risk, higher-reward cousin of PE. VC funds place bets on early-stage startups with world-changing potential, knowing that a few massive wins will more than make up for the inevitable flameouts.

Private Credit: This has become a huge space. It's essentially direct lending to companies, cutting out the traditional banks. As businesses look for more flexible financing, it has created an opportunity for investors to earn steady, income-producing returns.

Private Real Estate: This involves direct equity or debt investments in physical properties. It could be anything from developing a new apartment community to repositioning an underperforming data center. For anyone diving into this asset class, it's vital to know exactly what a sponsor is looking for by reviewing their detailed acquisitions criteria.

The Unique Risk Profile of Private Markets

The potential for outsized returns in private markets comes with a trade-off: a unique set of risks that look very different from what you see in the public markets. Getting comfortable with them is step one.

The biggest hurdle for most is illiquidity. Unlike a stock you can dump in seconds with a click, your capital in a private deal is typically locked up for 5 to 10 years or more. This isn't a bug; it's a feature. This long horizon gives managers the runway to execute their long-term plans without getting spooked by daily market noise.

Another massive factor is sponsor risk. The success or failure of a private investment often comes down to the skill of the management team (the sponsor or General Partner). Vetting their track record, their strategy, and making sure their interests are aligned with yours is non-negotiable.

Novice Lens: The J-Curve EffectDon't expect to see positive returns right away when you invest in a private equity or venture capital fund. In the early years, the fund's value will likely dip below your initial investment as it pays fees and puts money to work in ventures that haven't matured yet. This initial dip followed by a later rise creates a "J" shape on a performance chart—it’s a completely normal part of the private investment journey.

Market Signal Box: Capital Flows in an Uncertain Economy

Latest Data: A recent survey from Adams Street Partners shows that despite economic headwinds, innovation in hot sectors like AI and healthcare is still fueling growth.

Interpretation: Inflation remains the top worry for 86% of limited partners (LPs), with interest rates close behind at 83%. This shows just how much macroeconomic risks are on investors' minds.

Investor Take: Even with clear challenges, sophisticated investors are still finding compelling opportunities in private markets, especially where new technology is creating obvious value.

Exploring Real Assets as Tangible Investments

When you move past the blinking lights of the stock market, you’ll find a world of investments you can actually see and touch. These are real assets—think commercial real estate, sprawling infrastructure projects, and essential commodities. For many smart investors, these tangible assets act as a powerful anchor for a portfolio, grounding it with a sense of stability that digital assets sometimes can’t.

Real estate, in particular, is a long-time favorite for a couple of key reasons. It offers two powerful ways to generate returns: steady cash flow from rental income and the potential for long-term appreciation as the property’s value grows. It’s also earned a stellar reputation as a hedge against inflation. As the cost of living goes up, so do rents and the cost to build new properties, allowing real estate values and income to keep right on climbing.

But this physical nature brings its own set of rules and risks. Unlike stocks you can sell in a second, real estate is illiquid. It takes significant hands-on effort, is tied to the ups and downs of local markets, and requires real expertise to manage well.

Understanding Real Estate Investment Strategies

Not all real estate deals are cut from the same cloth. The strategy an investor uses will completely shape the risk and potential reward of any given project. These approaches fall along a spectrum, from safe, stable properties to high-stakes redevelopment projects.

Core: This is the most conservative play in the book. It’s all about buying high-quality, fully leased buildings in prime locations. The goal here is predictable cash flow, not a massive jump in value. Picture a shiny Class A office tower in a major downtown, locked in with a long-term lease to a Fortune 500 company.

Value-Add: This is where things get interesting. A value-add strategy means finding a property with fixable problems—maybe it’s a bit dated, poorly managed, or the rents are way below market. The sponsor then comes in with a plan to fix it up, boost the income, and "force" the property’s value to appreciate.

Opportunistic: This is the high-risk, high-return end of the pool. These deals often involve building from the ground up, completely redeveloping a vacant property, or taking a chance on an up-and-coming market. They demand a lot of patience and come with serious execution risk.

Why This Matters for Your PortfolioKnowing these strategies is everything. It's how you match an investment to your own comfort level with risk. A Core deal is about preserving wealth and generating income. Value-Add and Opportunistic plays are about creating wealth, which always means taking on more risk for the chance at a bigger payoff.

The Landscape of Commercial Real Estate Properties

Within those strategies, sponsors tend to specialize in different types of properties, and each one hums to the beat of its own economic drum. Here are the big players in the institutional-grade space:

Multifamily: Apartment buildings are always in demand because, well, people always need a place to live. Their success is tied directly to job growth and the demographics of the local area.

Industrial: Warehouses and distribution centers have become the backbone of e-commerce. Their value is driven by the endless consumer demand for fast shipping and the logistics that make it happen.

Data Centers: These are the physical homes for our digital world, housing the servers that power cloud computing and AI. Their value grows right alongside our insatiable need for more data and secure, reliable power.

Deal Lens Example: A Simplified Value-Add Multifamily Project

Let’s make this real. Here’s an illustrative walkthrough of a simple value-add deal to show you how the pieces fit together.

Acquisition: Stiltsville Capital finds a 100-unit apartment complex built in the 1990s. The kitchens are old, the amenities are tired, and the rents are too low. We buy it for $10,000,000.

Capital Stack: We finance the purchase with a $7,000,000 bank loan (that’s 70% leverage) and raise the remaining $3,000,000 in equity from our investors.

Renovation: We put another $500,000 ($5,000 per unit) into the property to upgrade the kitchens, bathrooms, and common areas.

Execution: With the renovations complete, we can now raise the average monthly rent from $1,000 to $1,250. This immediately boosts the property's annual Net Operating Income (NOI).

Exit: Three years down the road, that higher NOI makes the whole property much more valuable. We sell it for $13,500,000, pay back the bank loan, and return the original capital—plus the profits—to our investors.

This simple example shows how smart operational improvements, combined with responsible leverage, can create some serious value. It’s a perfect snapshot of the value-add strategy turning an underperforming asset into a big win.

The Geopolitical Factor in Modern Investment Risk

For decades, many investors built portfolios on the assumption of a relatively stable global order. That assumption is being tested daily.

Beyond market swings and credit ratings, a new layer of risk has become impossible to ignore: geopolitical instability. We're now forced to re-evaluate how international conflicts, trade disputes, and sudden regulatory changes impact every single investment type and risk profile out there.

This isn't just a headache for multinational corporations. The truth is, geopolitical tensions create real-world consequences that ripple through every asset class you can think of.

How Global Tensions Reshape Portfolios

It’s easy to think a distant event won't touch your domestic investments, but that’s a dangerous oversight. A conflict halfway across the world can disrupt critical supply chains, suddenly driving up construction costs for a real estate development project right here in Florida.

Likewise, a new trade dispute can lead to tariffs that squeeze the profit margins of industrial tenants, directly impacting the cash flow of a warehouse portfolio. These events introduce a level of volatility that simple financial models just can't account for.

Insight Edge: Geopolitical Risk Is Not OptionalIn the past, thinking about geopolitical risk was a niche activity, mostly for specialists investing in emerging markets. Not anymore. Today, it’s a core part of due diligence for any serious capital allocation. A sponsor who isn't stress-testing their deals against potential supply chain shocks or cross-border financial friction is overlooking a massive vulnerability.

Concrete Impacts on Investment Types

The effects of geopolitical risk aren't abstract; they have tangible, financial consequences across the entire investment spectrum. Building a resilient portfolio means understanding these connections.

Equities: Corporate earnings become vulnerable to supply chain disruptions, sanctions that lock out key markets, and sudden drops in consumer confidence.

Commodities: Prices can swing wildly based on conflicts in resource-rich regions or decisions made by state-controlled producers, which directly fuels inflation.

Real Estate: The stability of cross-border capital is essential for large-scale developments. Sanctions can freeze funding sources overnight, while trade wars jack up the cost of materials.

Currencies: Geopolitical events are a primary driver of currency volatility, which can quietly erode returns for anyone holding assets outside their home country.

This new reality is already leaving its mark on global capital flows. The World Economic Forum’s latest report highlights how escalating tensions and armed conflicts—now considered top-tier global risks—can crank up the risk profile of even the most reliable investment types. For today’s investor, analyzing a deal purely on its financial merits just isn’t enough anymore. A sharp understanding of the geopolitical landscape has become an indispensable tool for protecting and growing long-term wealth.

Building Your Resilient Investment Portfolio

You've explored the worlds of equities, bonds, real estate, and private alternatives. Now for the most important part: translating that knowledge into a portfolio that can actually stand the test of time. Building a resilient portfolio isn't about chasing the highest possible returns or timing the market perfectly. It's about a much more methodical process of understanding how different investment types and risk profiles work together to get you to your long-term goals, no matter what the market throws your way.

This whole process demands a disciplined framework for sizing up opportunities and managing threats. Instead of just reacting to the latest market headlines, a savvy investor proactively looks for potential weak spots and builds in safeguards from the start.

Key Investment Risks and Common Mitigation Strategies

Let’s be honest: every single asset class has an Achilles' heel. The first step toward neutralizing these weak points is simply recognizing what they are. Here are the biggest risks of major investment types paired with tried-and-true strategies for managing that exposure.

Risk: Market Volatility (Public Equities) * Mitigation: Diversification across sectors and geographies; long-term holding period.

Risk: Interest Rate Risk (Fixed Income) * Mitigation: Managing bond duration; diversifying across credit qualities.

Risk: Illiquidity & Sponsor Risk (Private Equity) * Mitigation: Staggering investments over time (vintage year diversification); rigorous sponsor due diligence.

Risk: Execution & Market Risk (Private Real Estate) * Mitigation: Partnering with experienced operators; focusing on markets with strong demographic tailwinds.

An Investor's Actionable Checklist

Whether you're looking at new opportunities or just stress-testing your current holdings, asking the right questions is everything. This checklist will help you run a much tighter due diligence process, whether you're sitting down with a financial advisor or a potential investment sponsor.

How does this investment fit my specific long-term goals? Is it for income, growth, or capital preservation?

What is the true time horizon? Do my own liquidity needs align with it?

Beyond the headline return, what are all the fees (management, performance, acquisition)?

What is the manager's or sponsor's track record? Have they navigated both positive and negative economic cycles?

What specific market or economic shifts pose the biggest threat to this investment's success?

How will this investment be taxed, and what does that mean for my portfolio as a whole?

What are the exit strategies, and how much flexibility do they really offer?

Your Takeaway: True portfolio resilience isn't about avoiding risk—that’s impossible. It's about intelligently selecting, measuring, and managing the risks you decide to take on. By diversifying across investment types, understanding their unique risk drivers, and asking the tough questions, you can build a robust foundation for creating sustainable, long-term wealth.

At the end of the day, building a sophisticated portfolio is a living, breathing process. It takes ongoing education and access to professionals who can help you navigate the inevitable complexities of the market. The most successful investors are the ones committed to continuous learning and growth—a core value we look for in our own team, as detailed on our Stiltsville Capital careers page. When it’s anchored in discipline and diversification, a well-structured portfolio remains one of the most powerful tools for achieving true financial resilience.

Common Questions on Investment Types and Risk

Diving into the world of modern investing always sparks a few good questions. We hear them from everyone, from those just starting their journey to sophisticated family offices. Let's tackle some of the most common ones to help build your understanding of the landscape.

What's a Smart First Move for a New Accredited Investor?

For any accredited investor looking to branch out from typical stocks and bonds, the very best first step is always education. It's that simple. Before you even think about writing a check, take the time to really get a handle on the key differences between public markets and alternatives like private real estate. You need to understand how things like liquidity, time horizons, and sources of risk change completely.

A great way to get your feet wet is to start with a smaller allocation to a fund that's been thoroughly vetted and is run by a sponsor with a proven history. This lets you gain real-world exposure and see how the process works from the inside, all without putting too much of your portfolio in one basket. The absolute priority should be understanding the sponsor's strategy and digging into their track record.

How Should I Think About Risk in Private Real Estate vs. a Public REIT?

This is a great question because the risks aren't just different in degree; they're different in kind. When you buy shares in a public Real Estate Investment Trust (REIT), your main risks are market volatility and the fact that it often moves in lockstep with the broader stock market. The share price can swing wildly day-to-day based on general market fear or greed, which often has nothing to do with how the actual properties are performing.

With a direct investment in a private real estate deal, the risks are tied directly to the asset itself. You're looking at things like:

Execution Risk: Can the sponsor actually pull off their business plan on time and within the budget they promised?

Illiquidity: Your money is committed for the long haul, usually for 5 to 10 years. You can't just sell tomorrow.

Specific Market Risk: What if the local economy takes a nosedive or demographic trends shift? How will that affect this specific property?

Your due diligence shifts from analyzing stock charts to doing a deep dive on the sponsor, the fundamentals of the property itself, and what's happening in that specific neighborhood.

How Much of My Portfolio Should I Put into Alternatives?

There's no magic number here. The right allocation is deeply personal and depends on your own risk tolerance, how much cash you need to keep on hand, and what your long-term financial goals are.

That said, we can look to the big players for a benchmark. Many institutional investors and large family offices now allocate anywhere from 20% to 50% of their portfolios to alternatives. They do this to add a layer of diversification and chase returns that aren't tied to the whims of the public markets. For someone just starting out in alternatives, a more common path is to begin with a modest allocation, say 5-10%, and then gradually increase that slice of the pie as your comfort level and knowledge grow.

At Stiltsville Capital, we believe building resilient, long-term wealth comes from a disciplined and educated approach. Well-structured real assets can be a prudent, resilient component of your long-term wealth strategy.

If you're an accredited investor ready to see what institutional-grade real estate opportunities look like, we'd be happy to chat.

Schedule a confidential call with Stiltsville Capital to see how our strategies might fit with your goals.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments