A Guide to Net Lease Investments for Passive Income

- Ryan McDowell

- Jul 29

- 18 min read

Reading Time: 8 min | Good for: Novice Investors (A), Family Offices (B)

TL;DR: Key Takeaways

The Concept: Net lease investments turn commercial real estate into a passive income stream where the tenant, not the landlord, covers major operating expenses like taxes, insurance, and maintenance.

The Appeal: Investors gain predictable, long-term cash flow (often 10-20 years), built-in rent growth, and powerful tax benefits, all with minimal management headaches. It's like a corporate bond, but backed by a tangible, physical asset.

The Strategy: The best net lease investments pair a creditworthy, national tenant with a high-quality, well-located property. Diligence on both the tenant's financial health and the real estate's long-term value is non-negotiable.

The Market: As of Q1 2025, the industrial and necessity retail sectors are the powerhouses of the net lease market, driven by e-commerce and recession-resilient demand.

Ever dreamed of owning a high-quality commercial property without the midnight calls about a leaky roof or the hassle of paying property tax bills?

That’s the essence of a net lease investment. It’s a strategy where the tenant, not you (the landlord), covers the key operating expenses. This setup is designed to create a predictable, almost entirely passive income stream, usually backed by a long-term lease with a reliable, creditworthy business. For investors looking to build resilient, long-term wealth, it’s a seriously powerful tool in a well-diversified portfolio.

What Exactly Are Net Lease Investments?

At its core, a net lease is a special kind of contract for a commercial property. The tenant agrees to pay some or all of the building's operating costs on top of their regular rent. This simple but brilliant shift in responsibility moves the financial and management burdens from your shoulders to the tenant's, creating a much more hands-off ownership experience.

For sophisticated investors, family offices, and even those just getting started in commercial real estate, this model is incredibly compelling. It effectively turns a brick-and-mortar building into an asset that acts a lot like a corporate bond—delivering steady, coupon-like payments over a long stretch of time, often 10 to 20 years.

The Core "Nets" Explained

So, what does the "net" in net lease actually refer to? It’s all about the specific expenses being passed through to the tenant. While there are a few variations, the three main costs are:

Property Taxes: The annual taxes levied by the local municipality.

Property Insurance: The policy that covers the building against damage or liability.

Maintenance: All costs for upkeep, from landscaping and parking lot repairs to fixing the HVAC system.

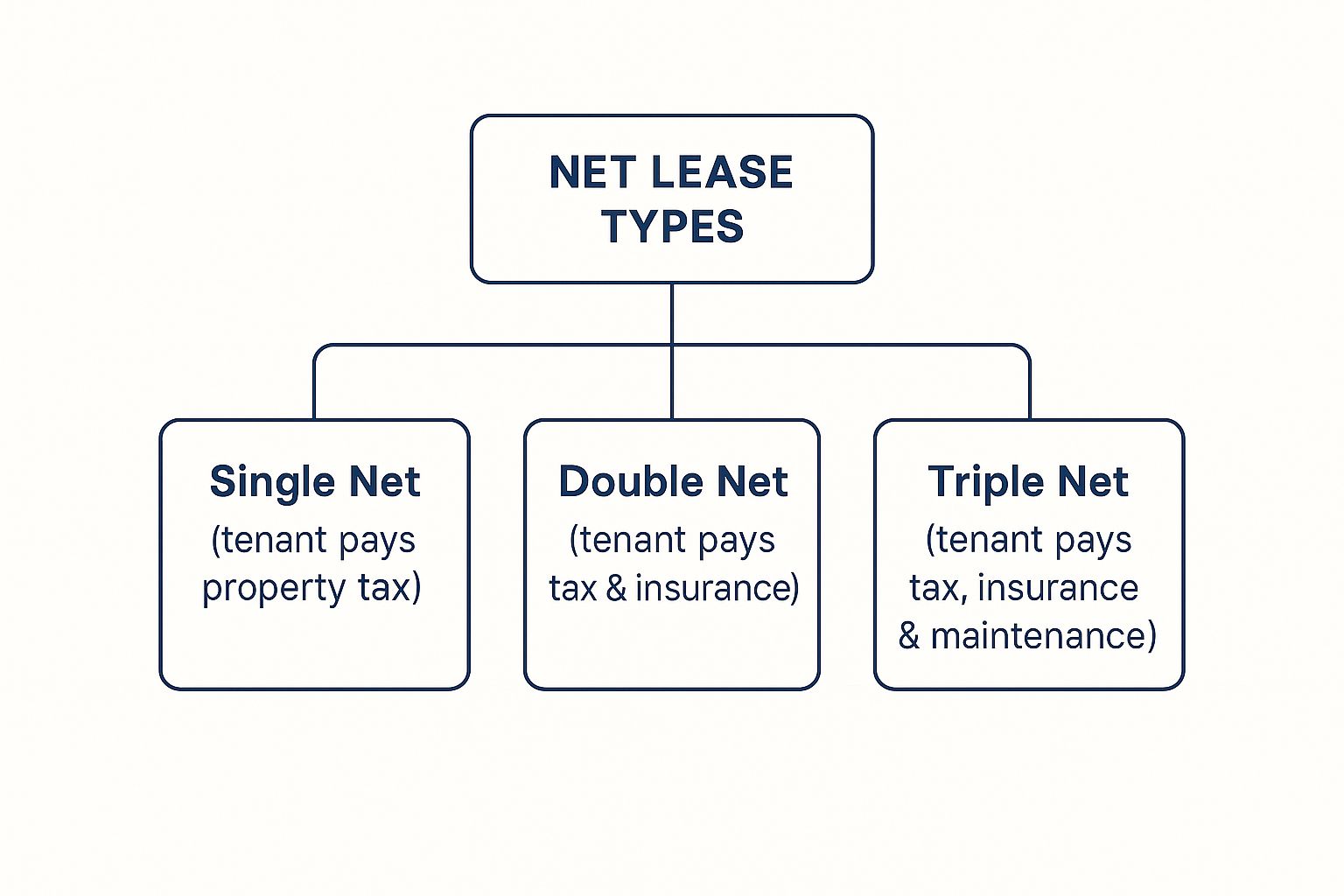

How many of these "nets" the tenant is responsible for determines the type of lease, which ranges from a Single Net (N) to the almost completely passive Triple Net (NNN) structure.

To make it crystal clear, here’s a quick breakdown of how responsibilities are divided in the most common net lease types.

Net Lease Types at a Glance

This table shows the fundamental differences in who pays for what across Single, Double, and Triple Net leases. It's a great way for investors to quickly understand the distinctions and the level of involvement required for each.

Lease Type | Tenant Pays | Landlord Pays | Best For Investors Seeking |

|---|---|---|---|

Single Net (N) | Property Taxes | Insurance, Maintenance (including structural repairs) | A balance of income and some property control. |

Double Net (NN) | Property Taxes & Insurance | All Maintenance (often including roof & structure) | Higher income with less responsibility than N, but still some management. |

Triple Net (NNN) | Property Taxes, Insurance, & All Maintenance | Typically nothing, except major structural repairs in some cases | Maximum passive income with minimal landlord responsibilities. |

As you can see, the Triple Net (NNN) lease is the most hands-off option, making it a favorite for investors who want stable income without the day-to-day headaches of property management.

Why This Matters for Your Portfolio

The real value of adding net lease properties to your portfolio goes way beyond just collecting rent checks. It's about building a foundation of resilience and predictability for your financial future.

In a world where public markets can feel like a rollercoaster, owning a physical asset leased to a strong national brand provides a reliable income stream with built-in protection against inflation. This is a core reason why many global family offices continue to increase allocations to private real estate as part of a long-term wealth preservation strategy.

Investor Take: Think of a net lease as securing a long-term revenue contract with a major corporation, collateralized by the very real estate they need to run their business. This structure is especially appealing in today's economic climate, where stable, yield-producing assets are in high demand.

This approach is also incredibly flexible. For investors focused on tax-advantaged strategies, net lease properties are a perfect fit for a 1031 exchange. They can also be held in structures like a Delaware Statutory Trust, which allows for fractional ownership and simplifies the investment process even further. You can learn more about this powerful ownership structure in our guide to **Delaware Statutory Trust (DST) investments**.

Ultimately, understanding net lease investments is your first step toward a segment of the real estate market prized for stability and low management effort. It offers a clear path for generating durable, long-term wealth without the operational grind of traditional property ownership. The trick, of course, is finding high-quality properties with creditworthy tenants—that's the bedrock of any winning net lease strategy.

Breaking Down the Net Lease Spectrum: From N to NNN

If you’re going to really get the most out of net lease investing, you have to understand that they aren't all created equal. The term “net lease” actually covers a whole spectrum of deals, and each type shifts more of the operational and financial weight from you, the landlord, onto the tenant. Where a deal falls on this spectrum directly shapes how passive and predictable your returns will be.

Think of it like a ladder. With each step up, you hand off more duties and move closer to being a pure capital partner instead of a hands-on property manager. Getting this right from the start is absolutely crucial for making sure an investment lines up with your financial goals.

The Starting Point: Single Net (N) Leases

The most basic rung on the ladder is the Single Net (N) lease. In this setup, the tenant is only responsible for paying one of the big three operating expenses: property taxes. That leaves you, the landlord, covering property insurance and all the maintenance duties—everything from a leaky faucet to a major roof repair.

While it’s a step up in predictability from a standard gross lease, an N lease is the most hands-on of the bunch. You’re still on the hook for insurance premiums and, more importantly, the unpredictable costs that come with maintaining a physical building.

Moving Up to Double Net (NN) Leases

A Double Net (NN) lease pushes the passivity a bit further. In this case, your tenant agrees to pay for both property taxes and property insurance premiums. This is a big deal because it takes two significant—and often fluctuating—expenses off your plate, which makes your income stream much more stable and easier to forecast.

But here’s the catch: the landlord is typically still responsible for all maintenance. That includes the really expensive stuff, like capital repairs to the roof, foundation, and parking lot. It’s a key distinction. While an NN lease is definitely more hands-off than an N lease, you still have to manage and fund the property’s long-term physical health.

The infographic below shows exactly how these responsibilities stack up.

As you can see, it's a clear progression of responsibility, shifting more and more to the tenant as you climb from N to NNN.

The Gold Standard: Triple Net (NNN) Leases

Finally, we get to the top of the ladder: the Triple Net (NNN) lease. This is the structure that most passive investors are hunting for. In a true NNN lease, the tenant is responsible for all three "nets": property taxes, property insurance, and all maintenance costs. This arrangement creates an income stream that’s about as close to a “mailbox money” investment as you can get in real estate.

Analogy: Think of an absolute NNN lease with a great tenant like a high-yield corporate bond. You get predictable, long-term payments, but with one huge advantage: your investment is backed by a tangible, physical building—an asset that holds its value even if the tenant eventually leaves.

This is the structure that allows family offices and high-net-worth investors to own institutional-quality real estate without the headaches. When a national brand like CVS or Dollar General signs a long-term NNN lease, they’re effectively managing the property for you, keeping it in prime condition to support their own business. The result for you is a dependable, inflation-resistant income stream with almost zero landlord duties.

### Novice Lens: Maintenance vs. Capital Expenditures (CapEx) If you're new to commercial real estate, it’s vital to understand the difference between routine maintenance and major capital expenditures. * Maintenance: These are the regular, ongoing costs needed to keep the property running smoothly. Think landscaping, HVAC servicing, or fixing a small plumbing issue. In a true NNN lease, the tenant handles all of this. * Capital Expenditures (CapEx): These are the big-ticket, infrequent expenses that improve the property or extend its life, like replacing the entire roof or repaving the parking lot. Why it matters: Even some leases labeled "NNN" might leave the landlord responsible for major structural CapEx. This is where reading the fine print becomes critical. An “absolute NNN” or “bondable” lease is the true gold standard, as it shifts all expenses—including structural CapEx—to the tenant. This is what delivers the ultimate level of passivity and ensures you can accurately project your real net returns.

The Strategic Appeal of Net Lease Properties

It’s one thing to understand the mechanics of a net lease, but it's another to fully appreciate its strategic power. So, beyond the basic structure, why should a net lease property earn a place in your portfolio? For sophisticated investors, these aren't just buildings; they're powerful tools for achieving specific financial goals with impressive efficiency.

At its core, the appeal is simple: a net lease transforms a physical property into an asset that acts a lot like a high-grade, long-term bond, but you get all the added benefits of actually owning real estate. This unique blend hits several key targets for family offices and accredited investors looking to build resilient, long-term wealth.

Predictable Income and Built-In Growth

The most compelling draw of a net lease investment is its ability to generate an incredibly predictable stream of income. Unlike traditional real estate where revenues can swing wildly with vacancies and surprise expenses, NNN leases lock in payments for the long haul—often 10 to 20 years.

This stability gets even better with contractual rent escalations. Most institutional-grade net leases have clauses that automatically increase the rent at set times, usually every year. This is a critical feature, giving you a built-in way to grow revenue that doesn't depend on what the market is doing. It creates a clear, visible path to growing your cash flow, making financial forecasting far more reliable.

A Truly Passive Ownership Experience

For many investors, especially those with plenty of capital but not a lot of time, the hands-off nature of NNN leases is a game-changer. A well-structured absolute NNN lease shifts nearly all the operational headaches—from day-to-day maintenance to big-ticket repairs—straight to the tenant.

This setup gets rid of the typical landlord burdens. No more late-night calls about a broken air conditioner or surprise bills for repaving the parking lot. The investor’s role becomes much simpler, focusing on high-level asset strategy instead of getting bogged down in the small stuff.

Investor Take: The passive structure of a quality NNN lease lets you scale your real estate portfolio without having to scale your management efforts. You can own multiple properties across different states, all managed by creditworthy national tenants, creating a diversified and efficient income-generating machine.

Powerful Tax Advantages and Inflation Hedging

Net lease properties also come with significant tax benefits. As the owner of the physical real estate, you can take advantage of depreciation deductions, which can shield a chunk of your rental income from taxes. This boost to your after-tax returns is a major plus for high-net-worth individuals.

On top of that, these assets are a natural hedge against inflation. The built-in rent bumps often keep pace with or even beat the Consumer Price Index (CPI), making sure your income’s purchasing power doesn’t erode over time. The property itself is a hard asset that tends to appreciate during inflationary periods, giving your capital a dual layer of protection.

Market Signal Box: Current Net Lease Yield Spreads

Recent market data really drives home the strong investor appetite for the stable yields that net leases provide. The overall market for the 12 months ending in Q1 2025 showed remarkable strength, with U.S. investment volume jumping by 21% year-over-year to hit $44.6 billion. This growth blew past the broader commercial real estate market.

During this time, average net-lease cap rates landed at 7.0%. With the 10-year U.S. Treasury yield sitting at 4.3% (as of Q1 2025), the spread between net-lease cap rates and this key risk-free rate widened to 269 basis points. This signals continued, robust demand for net leases as a premier yield-producing asset. For a deeper dive, you can explore net lease investment trends from CBRE.

Where the Action Is: Sizing Up the Current Net Lease Market

If you want to make smart net lease investments, you can't just follow a generic playbook. You have to know where the real opportunities are right now. The market isn't one big, monolithic entity; different property types are telling very different stories, reacting to the broader economy in their own ways.

Getting a clear-eyed view of today’s landscape is key. It shows you which sectors are thriving and which demand a more cautious touch. This insight is what allows you to put your capital to work with confidence, not just hope.

The Powerhouses: Industrial and Retail

Right now, the industrial and logistics sector is the undisputed champion of the net lease world. There's no mystery here—the explosive, non-stop growth of e-commerce has created a nearly insatiable appetite for distribution centers, warehouses, and last-mile delivery hubs. These aren't just buildings; they're mission-critical infrastructure for tenants, making them perfect for long-term, stable net lease deals.

Necessity-based retail is another major bright spot. Think about it: drugstores, grocery stores, and quick-service restaurants (QSRs) are essentially recession-proof. People need what they sell, regardless of what the economy is doing. These businesses are known for signing long-term NNN leases on prime real estate, giving investors a dependable income stream backed by solid corporate credit.

The latest numbers back this up completely. Net-lease investment activity saw a major comeback in early 2025, with investment volume hitting $9.6 billion in the first quarter. That’s a 21% jump from the same time in 2024. The driving force? Overwhelmingly, it was retail and industrial, which shot up by 25% and 46% year-over-year, respectively. You can dig into the specifics by reviewing the Q1 2025 net lease recovery data.

A Cautious Outlook for Office

On the flip side, the office sector has been losing ground. The massive shift to remote and hybrid work has thrown a wrench into the long-term demand for traditional office space, creating a cloud of uncertainty. As a result, office properties now make up a much smaller slice of the net lease pie, dropping from 29% of the market a year ago to just 19% in Q1 2025.

Of course, there are still some great opportunities out there—think Class A buildings in prime locations with rock-solid tenants. But the broader trend is clear: investors are pivoting to sectors with more predictable, durable demand. It really hammers home the importance of focusing on assets that are truly essential to a tenant's core business.

### Advanced Lens: The E-Commerce Engine For a sophisticated investor, it’s not enough to see a trend; you have to understand the engine driving it. The boom in industrial net lease isn’t just a fleeting market fad. It’s the direct result of a fundamental, structural shift in how we all shop. Every single dollar spent online creates ripples through the supply chain, cranking up the need for a complex logistics network. This demand fuels everything from giant, automated fulfillment centers leased by Amazon to the smaller, local facilities that make same-day delivery possible. When you invest in these assets, you're not just buying a building; you're making a direct play on the growth of the entire digital economy. That’s a powerful tailwind for any investment.

Essential Due Diligence for Net Lease Investors

A successful net lease investment is built on a foundation of rigorous, disciplined evaluation. While the promise of long-term, passive income is what draws many investors in, that stability is only as solid as the underwriting performed before a single dollar is committed. The allure of "mailbox money" can evaporate fast if the fundamentals are weak.

This isn't about guesswork. It’s a systematic analysis of the two pillars that hold up every net lease deal: the tenant and the real estate itself. A strong tenant in a weak location is a major risk, just as a great property with a shaky tenant is a recipe for disaster. Only the right combination of both creates a truly resilient, institutional-grade asset.

Tenant Creditworthiness: The Bedrock of Your Investment

A lease is just a piece of paper—its real value comes from the tenant's ability to consistently pay their rent. Digging into their financial health is non-negotiable and goes way beyond simply recognizing a brand name.

Here's what a good sponsor focuses on:

Financial Health: This means getting under the hood and scrutinizing the tenant’s balance sheet, income statements, and cash flow history. We’re looking for a track record of consistent profitability, manageable debt, and strong liquidity. For publicly traded companies, SEC filings offer a transparent view; for private companies, it requires deeper, direct financial discovery.

Industry Stability: Is the tenant in a growing, stable industry, or one facing major headwinds? Think about it—a dollar store or a leading healthcare provider has a much different long-term outlook than a business in a declining retail sector. The industry’s future is just as critical as the tenant’s current financials.

Corporate Guarantee: This is a crucial layer of protection. Is the lease backed by the entire parent corporation, or just a small local franchisee? A corporate guarantee from a multi-billion-dollar, investment-grade company is the gold standard. It means the full financial might of the corporation stands behind that lease payment.

Real Estate Fundamentals: The Ultimate Safety Net

Even with an ironclad tenant, the property itself must be able to stand on its own two feet. You always have to ask the critical question: "If the tenant leaves tomorrow, how easily can I lease this space to someone else?" This is what we call the property's "dark value."

To figure this out, we zero in on:

Location Analysis: We hunt for properties with great visibility, high traffic counts, and strong local demographics like population growth and household income. A corner spot at a busy, signalized intersection is fundamentally more valuable and easier to re-lease than a mid-block site with poor access.

Physical Condition: For any lease where the landlord has even minor responsibilities (like the roof and structure), a thorough property condition assessment is essential. But even in absolute NNN deals, the building's age and condition impact its long-term viability and what it might sell for down the road.

Re-Leasing Potential: Does the building have a generic layout that could work for lots of different businesses, or is it a highly customized, single-purpose facility? A standard retail box is far easier to find a new tenant for than a custom-built factory, giving your investment a much stronger safety net.

For a deeper dive into the nuts and bolts of this process, check out our guide on **commercial real estate due diligence**.

### Deal Lens Example: Underwriting a QSR NNN Deal Let’s walk through a real-world scenario. Imagine a sponsor presents a deal for a brand-new, freestanding building leased to a major national quick-service restaurant (QSR) on a 15-year absolute NNN lease. Tenant Check: The brand is a public company with an investment-grade credit rating, billions in annual revenue, and a positive growth forecast. Most importantly, the lease carries a full corporate guarantee. Result: Strong. Property Check: The site is a "hard corner" lot at a signalized intersection, right next to a major highway off-ramp and a new grocery-anchored shopping center. The building itself is a standard prototype design, which means it could be easily adapted for other QSR brands. Result: Strong. Conclusion: This is the ideal combination. You have a creditworthy corporate tenant and prime, highly functional real estate. The investment delivers predictable cash flow backed by a powerful guarantee, while the underlying property provides a robust safety net thanks to its A+ location and re-tenanting potential.

Investor Checklist: Questions to Ask a Sponsor

Before allocating capital to any net lease deal, a thorough diligence process is key. Here are critical questions to ask any sponsor:

Tenant Health: What is the tenant’s credit rating? Can you provide their financials for the last 3-5 years?

Lease Details: Is this a true absolute NNN lease? Who is responsible for roof and structure replacement?

Lease Guarantee: Is the lease backed by a corporate guarantee or a franchisee? What is the credit profile of the guarantor?

Rent Escalations: How often do rents increase, and by how much? Is it a fixed percentage or tied to CPI?

Location Viability: What are the traffic counts and local demographics? Why is this a strong location for this tenant?

Re-tenanting Risk: How easily could this property be re-leased if the current tenant leaves? What would the market rent be?

Sponsor Track Record: What is your firm’s experience with this specific property type and geographic market?

Exit Strategy: What is the anticipated hold period and planned exit strategy for this asset?

Risks and Mitigations in Net Lease Investments

No investment is without risk. The key is to understand the risks and ensure your sponsor has a disciplined plan to mitigate them.

RISK: Tenant Bankruptcy. A tenant default is the primary risk, leading to a loss of income.

MITIGATION: Focus on investment-grade tenants in recession-resilient industries. Underwrite the "dark value" of the real estate itself, ensuring it is in a strong location that can be easily re-leased.

RISK: Interest Rate Changes. Rising interest rates can decrease the market value of a fixed-income asset like a net lease property.

MITIGATION: Secure long-term, fixed-rate financing. Target properties with built-in rent escalations that can help offset the impact of rate hikes on cash flow.

RISK: Illiquidity. Private real estate is not as liquid as public stocks; you cannot sell instantly.

MITIGATION: Invest with a clear understanding of the long-term hold period. Work with sponsors who have a clear and proven exit strategy for their assets.

RISK: Concentration Risk. Putting all your capital into a single property or tenant can be dangerous.

MITIGATION: Build a diversified portfolio across multiple tenants, industries, and geographies. Consider fund or DST structures that offer built-in diversification.

The Future of Net Lease: Emerging Global Opportunities

Smart money always finds its way to the best opportunities. For a long time, that meant sticking to U.S. industrial and retail net lease properties. And while those are still a fantastic core holding, the sharpest investors are starting to look beyond our borders. Expanding into global markets isn't about chasing a trend—it's a strategic play to find new growth and build a portfolio that can weather any storm.

As investors everywhere hunt for better yields and diversification, what was once a niche strategy—cross-border net lease—is quickly becoming a must-have for major institutional portfolios.

The Nearshoring Boom in Mexico

One of the most exciting stories in global real estate is happening right next door. Mexico is in the middle of an industrial property boom, and it’s almost entirely driven by nearshoring. That's the powerful trend of companies moving their manufacturing and supply chains out of faraway countries and closer to their customers in North America. This isn't a maybe; it's happening now, creating a massive, built-in need for modern industrial buildings.

This shift has thrown the doors wide open for net lease investors. As American and international manufacturing giants set up shop, they’re creating a huge demand for both sale-leaseback and build-to-suit deals. It's a chance to lock in long-term leases with household-name multinational corporations. As one report on cross-border deals from W. P. Carey points out, this kind of geographic diversification is a savvy way to hedge against things like interest rate swings and trade uncertainty.

Insight Edge: A nearshoring-driven build-to-suit deal is a world away from speculative development. You're not building a warehouse and hoping someone leases it. Instead, you’re financing a mission-critical facility for a major company that has already signed a long-term lease. The investment is significantly de-risked before the first shovel ever hits the ground.

Unlocking Value with the Right Strategy

Jumping on these international opportunities takes more than just cash; it requires a specific playbook. In these booming industrial hubs, two strategies are proving especially powerful:

Sale-Leasebacks: A company owns its building, sells it to an investor, and immediately signs a long-term NNN lease to stay right where they are. The company gets a huge infusion of cash to pour back into its business, and the investor gets immediate, stable income from a tenant who is already settled in.

Build-to-Suits: An investor funds and manages the construction of a brand-new building, custom-built for a tenant who has already committed to a long-term lease. It's an incredible way to deploy capital into a state-of-the-art asset with absolutely zero vacancy risk from day one.

Pulling off these kinds of deals in markets like Mexico isn't for amateurs. It demands a sponsor with serious international experience—someone who knows the local laws, can handle the legal tango across borders, and has the relationships on the ground to get things done right. For investors, finding that expert partner is the key to tapping into the massive potential of global net lease and building a truly forward-thinking portfolio.

Conclusion: Building a Resilient Portfolio with Net Lease Investments

Net lease investments offer a compelling and proven path for generating stable, passive income. By focusing on high-quality tenants and well-located real estate, investors can add an element to their portfolios that provides predictability and resilience in an often-volatile world. This isn't about chasing fleeting trends; it's about disciplined underwriting and a long-term vision for wealth preservation and growth.

When structured correctly, well-chosen real assets can be a prudent and powerful component of a sophisticated wealth strategy. By understanding the risks and partnering with experienced sponsors who know how to mitigate them, you can position your capital to benefit from the durable, inflation-hedging power of net lease real estate.

Frequently Asked Questions About Net Lease Investing

What is the single most important factor in a net lease deal?

While location will always be king in real estate, for net lease deals, the tenant's creditworthiness is paramount. A long-term lease is only as good as the tenant's ability to pay the rent, month after month. A savvy investor and their partners must dig deep into the tenant’s financial health, their industry’s stability, and official credit ratings.

Are all Triple Net leases truly passive?

Mostly, but there's a crucial distinction. An “absolute NNN” or “bondable” lease is the gold standard of passive investing, as the tenant is responsible for everything—even major structural repairs like the roof. However, many standard NNN leases make the landlord responsible for these big-ticket capital expenses. It's critical to read the lease to know exactly who pays for what.

What happens if a net lease tenant goes bankrupt?

Tenant bankruptcy is the primary risk. When a tenant files for bankruptcy, they can either "affirm" the lease and keep paying rent, or "reject" it and move out. If they reject, you’re left with an empty building. This is exactly why the quality of the real estate itself—and how easily you could re-lease it—is just as important as the original tenant's credit. A great location is your best insurance policy.

How are net lease returns generated?

Returns come from two sources: a steady stream of cash flow from rent payments (which often have built-in annual increases) and the potential for capital appreciation as the property's value increases over time. This dual return profile, combined with tax benefits like depreciation, is what makes net lease properties so appealing, especially as a replacement asset in a **The 1031 Exchange a Guide to Deferring Taxes**.

At Stiltsville Capital, we specialize in identifying and structuring institutional-quality net lease opportunities designed for long-term wealth creation. To discuss how these assets can fit within your portfolio, schedule a confidential call with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments