The 1031 Exchange: A Guide to Deferring Taxes & Compounding Real Estate Wealth

- Ryan McDowell

- Jul 26, 2025

- 12 min read

Reading Time: 8 min | Good for: Novice Investors (A), Informed Principals (B)

TL;DR: A 1031 tax-deferred exchange allows real estate investors to sell a property and defer capital gains taxes by reinvesting the proceeds into a new "like-kind" property. This powerful tool, governed by strict IRS rules and timelines, accelerates wealth compounding by keeping your entire capital base at work.

Who It's For: Any investor—from individuals with a single rental to family offices with large portfolios—looking to strategically scale, diversify, or upgrade their real estate holdings without an immediate tax hit.

What's Next: Understand the critical rules (like-kind, timelines, reinvestment) and the non-negotiable role of a Qualified Intermediary (QI).

What if you could sell an investment property, cash in on years of appreciation, and roll every last dollar into a bigger, better asset—all without writing a massive check to the IRS?

That's the power of a 1031 tax-deferred exchange. For any serious real estate investor, it’s one of the most effective tools in the tax code for building generational wealth. It allows you to keep your capital compounding for you, instead of seeing a significant portion of it disappear to taxes after a successful sale.

The Power of Compounding Your Real Estate Wealth

At its heart, a 1031 exchange allows you to postpone—or defer—paying capital gains taxes when you sell a business or investment property. The catch? You must reinvest all the proceeds from the sale into a new "like-kind" property, following a strict set of rules and timelines.

Think of it like trading in a car. You don't pay sales tax on the full trade-in value, only on the price difference for the new vehicle. A 1031 exchange operates on a similar principle for real estate investments, but instead of sales tax, you're deferring capital gains tax.

To be clear, this isn't about avoiding taxes forever. It's about deferring them. You're essentially signaling to the government, "I'm keeping my money in play and continuing to invest in U.S. real estate," and the tax code rewards you for that continued economic activity.

Why This Matters for Smart Investors

This ability to defer taxes provides a significant advantage for building a real estate portfolio. By reinvesting the full, pre-tax amount from a sale, you can acquire a much larger or higher-quality asset than you could if you had to pay taxes first and reinvest only what remains.

This creates a powerful compounding effect. Each time you complete an exchange, you're building on a larger base of capital. Your wealth grows much faster than it ever could in a traditional "sell, pay tax, reinvest" cycle.

For family offices and high-net-worth investors playing the long game, this strategy is a game-changer. It allows you to:

Scale Your Portfolio: Trade up from smaller, management-intensive properties to a single, larger institutional-grade asset.

Diversify Geographically or by Asset Class: Swap a multifamily building in one city for an industrial warehouse or medical office building in another, spreading out your risk.

Upgrade Asset Quality: Move capital out of an older, capex-heavy building and into a brand-new, stabilized development.

Enhance Estate Planning: You can continue deferring the tax liability across multiple exchanges. For your heirs, the tax liability might even be eliminated entirely through a "step-up" in basis when they inherit the property.

To get a handle on the terminology, here’s a breakdown of the key concepts in a 1031 exchange.

1031 Exchange Key Concepts at a Glance

Concept | Plain-English Explanation | Why It Matters to Investors |

|---|---|---|

Relinquished Property | The investment property you are selling. | This is the starting point. Its sale price and debt determine how much you must reinvest to achieve full tax deferral. |

Replacement Property | The new "like-kind" property you are buying. | This is your target. It must be of equal or greater value to the one you sold to fully defer taxes. |

Like-Kind | Properties of the same nature or character held for investment. | This rule is surprisingly flexible. You can exchange a duplex for raw land, or an office building for a warehouse. |

Boot | Any non-like-kind property received, like cash or debt relief (a smaller mortgage on the new property). | Receiving "boot" makes that portion of your gain immediately taxable. The goal in most exchanges is to have zero boot. |

Qualified Intermediary (QI) | A neutral third party who holds your funds between the sale and the purchase. | Using a QI is mandatory. They ensure you never have "constructive receipt" of the money, which would void the exchange. |

45-Day Identification Period | The strict 45-day window you have after your sale to formally identify potential replacement properties. | This is the first critical, non-negotiable deadline. Miss it, and the entire exchange fails. Preparation is key. |

180-Day Exchange Period | The total time you have to close on the purchase of your replacement property, starting from the day you sell. | This is your final deadline. It runs concurrently with the 45-day period, not in addition to it. |

This table covers the fundamentals, but every deal is unique. Adhering to these rules is what separates a successful tax deferral from a costly mistake.

Understanding the Pillars of a Successful Exchange

While the idea of a 1031 exchange is powerful, it’s built on a foundation of strict, non-negotiable rules. Think of them not as hurdles, but as guardrails designed to keep your tax deferral on track. Mastering these pillars is essential.

The first and most misunderstood rule is the "like-kind" property requirement. This is a classic source of confusion. It does not mean you have to swap a duplex for another duplex. The IRS defines "like-kind" very broadly for real estate, focusing on its use for investment or business purposes, not its physical form.

This opens up tremendous flexibility for strategic portfolio adjustments.

You can exchange an apartment building for a portfolio of medical office buildings.

A piece of raw land can be exchanged for a bustling retail shopping center.

That single-family rental you've outgrown can be swapped for a passive interest in a massive logistics warehouse.

The key is that you absolutely cannot exchange an investment property for your personal residence.

Reinvesting Equity and Replacing Debt

To achieve 100% tax deferral, you must satisfy two critical financial rules. First, you must reinvest all the net equity from your relinquished property into the new one. If you pocket any cash from the sale, that money is taxable "boot." Period.

Second, you must acquire your new property with an equal or greater amount of debt. The IRS views any reduction in your mortgage liability as a financial benefit, which is also treated as taxable boot. You have to "trade up" or at least trade equal in both value and debt to fully kick the tax can down the road. For a deeper look at financing strategies, our guide to commercial real estate financing options for investors is a great resource.

The Concept of Boot

What happens if you don't follow those rules perfectly? You run into "boot." This is the term for any value you receive in an exchange that isn't like-kind property, and it's the primary way a taxable event gets triggered.

Novice Lens: Why It Matters "Boot" is just a funny word for any part of your sale profit that you don't roll into the next deal. Think of it as "leaking" money out of the exchange. Any cash you take, or any debt that gets paid off and not replaced, becomes immediately taxable. The goal is to keep the entire value locked inside the exchange to defer 100% of the tax.

Let's say you sell a property for $2 million but only reinvest $1.8 million into the new one. That $200,000 difference is boot, and you'll be paying capital gains tax on it. This is why careful planning with your Qualified Intermediary is so critical—they help you structure the transaction to avoid these pitfalls.

Navigating the Strict 1031 Exchange Timelines

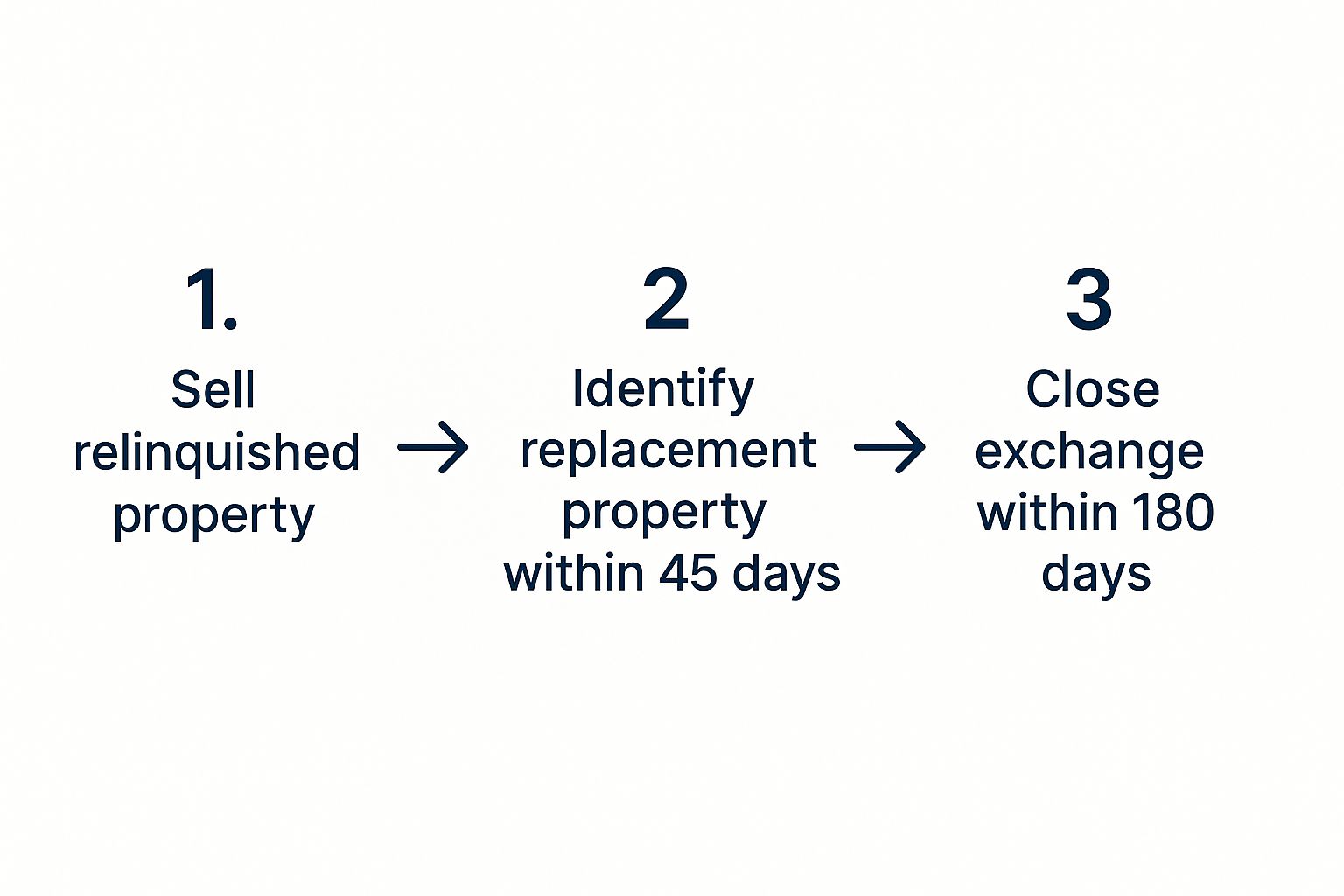

In a 1031 exchange, the calendar is king. Once you sell your property, a countdown begins on two critical, non-negotiable deadlines. Miss either one, and the entire exchange fails, resulting in a fully taxable event. These timelines are set in stone—there are no extensions for market conditions or personal reasons.

The clock starts the moment the sale of your original property (the "relinquished property") closes. From that day, you have exactly 45 calendar days to officially identify potential replacement properties. This is your Identification Period. You must deliver a signed, written list to your Qualified Intermediary.

The second deadline is the Exchange Period. You must close the deal and acquire one or more of the properties you identified within 180 calendar days of the original sale. Critically, the 45-day identification window is part of the total 180-day timeline, not in addition to it.

This visual breaks down the non-negotiable flow of these deadlines.

As you can see, it's a straight line with no room for error. Diligent, upfront planning isn't just a good idea; it's a requirement for success.

The Role of the Qualified Intermediary

A crucial rule: you cannot, under any circumstances, touch the money from the sale yourself. If you do, it's called "constructive receipt," and it instantly disqualifies the entire exchange.

To prevent this, the IRS requires you to use a Qualified Intermediary (QI). This is an independent third party who holds your funds in an escrow account and handles the transactional paperwork to ensure compliance. Choosing a reputable, experienced QI is one of the most important decisions in the entire process.

Rules for Identifying Replacement Properties

During that 45-day Identification Period, you must adhere to one of three specific rules for your list of potential properties.

The Three-Property Rule: The most common choice. It’s straightforward—you can identify up to three potential replacement properties, regardless of their market value.

The 200% Rule: For investors needing more options. You can identify more than three properties, provided their total fair market value doesn't exceed 200% of the value of the property you sold.

The 95% Rule: This is rare and carries risk. If you identify properties that exceed both of the above rules, you are then required to acquire at least 95% of the total value of all the properties on that list.

Interestingly, these rigid timelines haven't always existed. It took a landmark court case, Starker v. United States (1979), to prompt Congress to formalize the process. In 1984, they officially added the 45-day and 180-day rules to the tax code. You can dig deeper into the history of the 1031 exchange to see how it has evolved.

Deal Lens Example: A 1031 Exchange in Action

Rules and regulations are important, but nothing clarifies the power of a 1031 exchange like a real-world example. Let’s walk through an illustrative case to see how an investor can use this strategy to build their portfolio and protect hard-earned capital.

Meet Alex, an investor who bought a small multifamily property years ago for $500,000. Through smart management and market appreciation, that property is now worth $1.5 million. If Alex sold it outright, he’d face a $1 million capital gain. Assuming a combined federal and state capital gains tax rate of 25%, a straight sale would trigger a $250,000 tax bill, leaving him with only $1,250,000 to reinvest.

Instead, Alex opts for a 1031 exchange.

The Numbers: Before and After the Exchange

Here’s a simplified breakdown as Alex transitions from his small apartment building into a professionally managed retail center.

Relinquished Property Sale Price: $1,500,000

Original Cost Basis: $500,000

Capital Gain: $1,000,000

Potential Tax Bill (25% rate): $250,000

Taxes Deferred via 1031 Exchange: $250,000

Total Capital Reinvested: $1,500,000

By using the exchange, Alex keeps his entire $1.5 million working for him. He can now acquire a larger, more stable asset without watching $250,000 of his equity vanish. This is the compounding engine of the 1031 exchange.

Navigating the Timeline

The moment the sale of Alex's multifamily property closes, the clock starts ticking. His Qualified Intermediary now holds the $1.5 million in proceeds.

Days 1-45 (Identification): Alex identifies three potential replacement properties in writing. He zeroes in on a stable, grocery-anchored retail center and submits his formal identification list to his QI on Day 40.

Days 46-180 (Acquisition): With his target identified, he performs due diligence on the retail center. He successfully negotiates the purchase and closes the deal on Day 165, comfortably inside the 180-day window.

The full $1.5 million from the sale flows directly from the QI into the new purchase, making it a completely tax-deferred transaction. This strategy isn't just for massive corporations. Data from the National Association of Realtors shows that most 1031 participants are individual investors; the profile of typical 1031 exchange investors reveals the median replacement property purchase price has been around $1.32 million in recent years.

Advanced Strategies & Investor Checklist

Getting the basics right is step one. But sophisticated investors know how to navigate common traps and use more advanced strategies to their advantage.

The most common mistake? Missing a deadline. The 45-day identification and 180-day closing periods are unforgiving. Your best defense is to begin your search for replacement properties before you even list your old one. Another frequent error is mishandling funds, which is precisely why a properly vetted Qualified Intermediary is a non-negotiable requirement.

Advanced Exchange Structures

Once you've mastered the standard "sell then buy" exchange, you'll find the tax code offers flexibility for unique situations.

Reverse Exchanges: This clever strategy lets you acquire the new property before you sell your old one. It's a lifesaver in a competitive market where you need to act fast, but it requires more complex structuring and higher upfront capital.

Improvement (or Construction) Exchanges: Found the perfect property, but it needs a major renovation? This structure allows you to use exchange proceeds to not only buy the new property but also to fund the construction or improvements.

Checklist: Questions to Ask a Sponsor or Qualified Intermediary (QI)

Choosing the right partners is critical. Your QI, in particular, acts as the fiduciary guarding your entire investment. Don't compromise on their experience or security.

How long have you specialized in 1031 exchanges?

How many exchanges do you facilitate annually, both simple and complex?

How are my funds secured? Are they held in a segregated, qualified escrow account?

What are the limits of your fidelity bond and errors & omissions (E&O) insurance policies?

What is your process for handling a failed identification or closing?

Can you provide references from attorneys or CPAs you've recently worked with?

If I'm exchanging into a syndicated deal (DST/LP), what is your experience with that structure?

These strategies can also open the door for investors looking to shift from active property management to passive investments, like a limited partnership. To see how this works, check out our guide to limited partnership real estate.

The Enduring Role of the 1031 Exchange in a Portfolio

Thinking of the 1031 exchange as just a tax trick misses the bigger picture. It's a foundational strategy for long-term real estate portfolio construction. This powerful tool, with roots going back to the Revenue Act of 1921, is designed to promote continuous investment and economic activity.

This means you can pivot your portfolio as markets shift. Imagine exchanging an older apartment complex in a cooling market for a new medical office building in a high-growth sunbelt region. A 1031 exchange makes that strategic recalibration possible without the drag of immediate taxes.

It's About Control, Not Avoidance

Let's be crystal clear: a 1031 exchange is about controlling the timing of your tax obligations, not erasing them. You're simply deferring the gain, which gives you the incredible advantage of compounding your returns on a pre-tax basis.

Investor Takeaway: By stringing together a series of exchanges over an investing lifetime, you can trade up in asset quality, diversify risk, and build a more resilient portfolio. The tax is only due when you finally sell a property and cash out for good.

When used with discipline and the right guidance, the 1031 exchange is a cornerstone for the steady growth of real assets. At Stiltsville Capital, we see these exchanges as a key component of a larger wealth-building puzzle, a topic we explore in our guide to commercial real estate private equity.

Frequently Asked Questions (FAQ)

Even when you understand the rules, real-world questions always arise. Here are the most common ones we hear from investors.

Can I use a 1031 exchange on my primary residence?

No. A 1031 exchange is exclusively for properties held for investment or used in a trade or business. Your personal home is covered by a different part of the tax code (Section 121), which provides a capital gains exclusion, not a deferral. A vacation home may qualify, but only if you can prove it was primarily an investment by strictly limiting personal use and documenting rental activity.

What happens to the deferred tax when I eventually sell for good?

The tax liability doesn't vanish. When you finally sell a replacement property and do not roll the proceeds into another exchange, all of the accumulated deferred gains become due. However, you can continue the deferral chain indefinitely by executing another 1031 exchange each time you sell.

Why is a "step-up in basis" at death so powerful?

This is a cornerstone of estate planning. When an heir inherits your property, its cost basis is typically "stepped up" to its fair market value at the time of your passing. This can completely eliminate the deferred capital gains tax liability that was built up over your lifetime, allowing wealth to be passed to the next generation much more efficiently.

Why is a Qualified Intermediary absolutely necessary?

The QI is the non-negotiable referee of your exchange. The IRS is clear: you cannot touch, control, or have "constructive receipt" of the sales proceeds. Doing so invalidates the exchange. The QI is the independent, bonded, and insured third party who holds your funds in escrow, ensuring every step of the process is compliant.

Ready to see how a 1031 exchange could be the strategic key to unlocking your portfolio's potential? The team at Stiltsville Capital specializes in helping investors transition their equity into institutional-quality assets. Schedule a confidential call with us today to start building your long-term wealth strategy.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Tax laws are subject to change and investors should consult with their own tax and legal advisors.

Comments