How to Evaluate Investment Opportunities: A Proven Framework for Real Asset Investors

- Ryan McDowell

- Aug 29, 2025

- 15 min read

Reading Time: 8 min | Good for Investor Personas: A, B

TL;DR: Key Takeaways

Start with You: The best investment evaluation begins with a personal framework—defining your philosophy (income, preservation, or growth), risk tolerance, and timeline before you ever see a deal.

Stress-Test the Numbers: Treat a sponsor's pro forma as a starting point, not the final word. Focus on stress-testing key assumptions like rent growth, exit cap rate, and operating expenses to find the most likely outcome, not just the best-case scenario.

Invest with a Tailwind: A great asset in a declining market is a losing proposition. Your diligence must include macro and micro analysis of job growth, economic diversification, and where the specific market is in its real estate cycle.

Next Step: This guide provides a foundational process. To see how it applies to live opportunities, schedule a confidential call to discuss your portfolio goals.

The Market Why-Now: A Disciplined Approach is Non-Negotiable

In today's complex market, a disciplined evaluation framework is more critical than ever. According to CBRE's 2024 U.S. Investor Intentions Survey, over 60% of investors expect to either maintain or increase their purchasing activity this year, signaling a return of capital to the market. However, the same report notes a clear "flight to quality," with investors prioritizing modern, well-located assets and experienced sponsors. This bifurcated market means that while opportunities are emerging, the penalty for poor deal selection is severe. A rigorous, personal framework is the only way to sift the high-quality deals from the high-risk ones.

Forget the deal sheets for a moment. The most crucial first step in evaluating any investment opportunity has nothing to do with cap rates or IRR projections—it starts by looking in the mirror.

You need to build a personalized framework that acts as a strict filter. Think of it as your financial DNA, a blueprint that ensures you only spend your precious time and capital on deals that actually make sense for you. This isn't just theory; it's your most powerful due diligence tool.

Building Your Personal Investment Framework

Before they even look at a single deal, the sharpest investors we know—from CIOs at family offices to individuals making their first passive real estate investment—define their own rules of the game.

Without that internal clarity, it's easy to get swept up in market hype or a slick presentation. You end up chasing deals instead of executing a strategy. A well-defined framework is what separates strategic investing from speculation. It’s a gut check that saves an incredible amount of time and, more importantly, prevents those costly mistakes that come from betting on a horse that isn't even in your race.

Define Your Investment Philosophy

First things first: what are you actually trying to do with your money? This is your "true north," the core question that dictates which deals are even worth a second look.

Your answer will slot you into one of three main camps:

Income Generation: Are you looking for steady, predictable cash flow to supplement your income or cover expenses? If so, you’ll gravitate toward stabilized assets like a multifamily building with high occupancy or a medical office with long-term, credit-worthy tenants.

Wealth Preservation: Is your number one goal to protect your capital from inflation and pass it down to the next generation? This mindset prioritizes lower-risk, core properties in top-tier locations over a riskier ground-up development project.

Aggressive Growth: Are you in a position to take on more risk for a shot at a much bigger payday through appreciation? This puts you squarely in the value-add or opportunistic space, where the real money is made by creating value over the holding period.

Investor Takeaway: Getting crystal clear on your philosophy is a non-negotiable. Knowing if you're an "income," "preservation," or "growth" investor lets you say "no" to 90% of the deals that come across your desk, freeing you up to dig deep on the 10% that really matter.

Get Honest About Your Risk Tolerance

Every investment has risk, but not all risk feels the same. How much you can stomach comes down to your financial situation, your timeline, and frankly, your personality. A family office with a perpetual investment horizon can handle illiquidity far differently than someone five years from retirement.

Ask yourself how comfortable you are with a few key factors:

Illiquidity: Can you realistically lock up your capital for 5-10 years without it causing you to lose sleep or impacting your financial stability? Private real estate is not a stock you can sell tomorrow.

Leverage: How much debt on a property are you okay with? More debt can juice your returns, but it also magnifies the pain if things go south.

Execution Risk: Do you prefer the predictability of a stabilized, cash-flowing asset? Or are you willing to roll the dice on the uncertainties that come with a major renovation or a ground-up build?

Nailing down these personal guardrails creates that powerful filter we talked about. This isn't just some academic exercise; it's the practical discipline you need to build a portfolio that can weather any storm.

Getting Under the Hood: Mastering Financial Due Diligence

Think of a sponsor's pro forma as their best-case scenario. Your job is to build your own model to find the most likely one. Getting this right is a cornerstone of evaluating any investment opportunity.

Deconstructing the Key Return Metrics

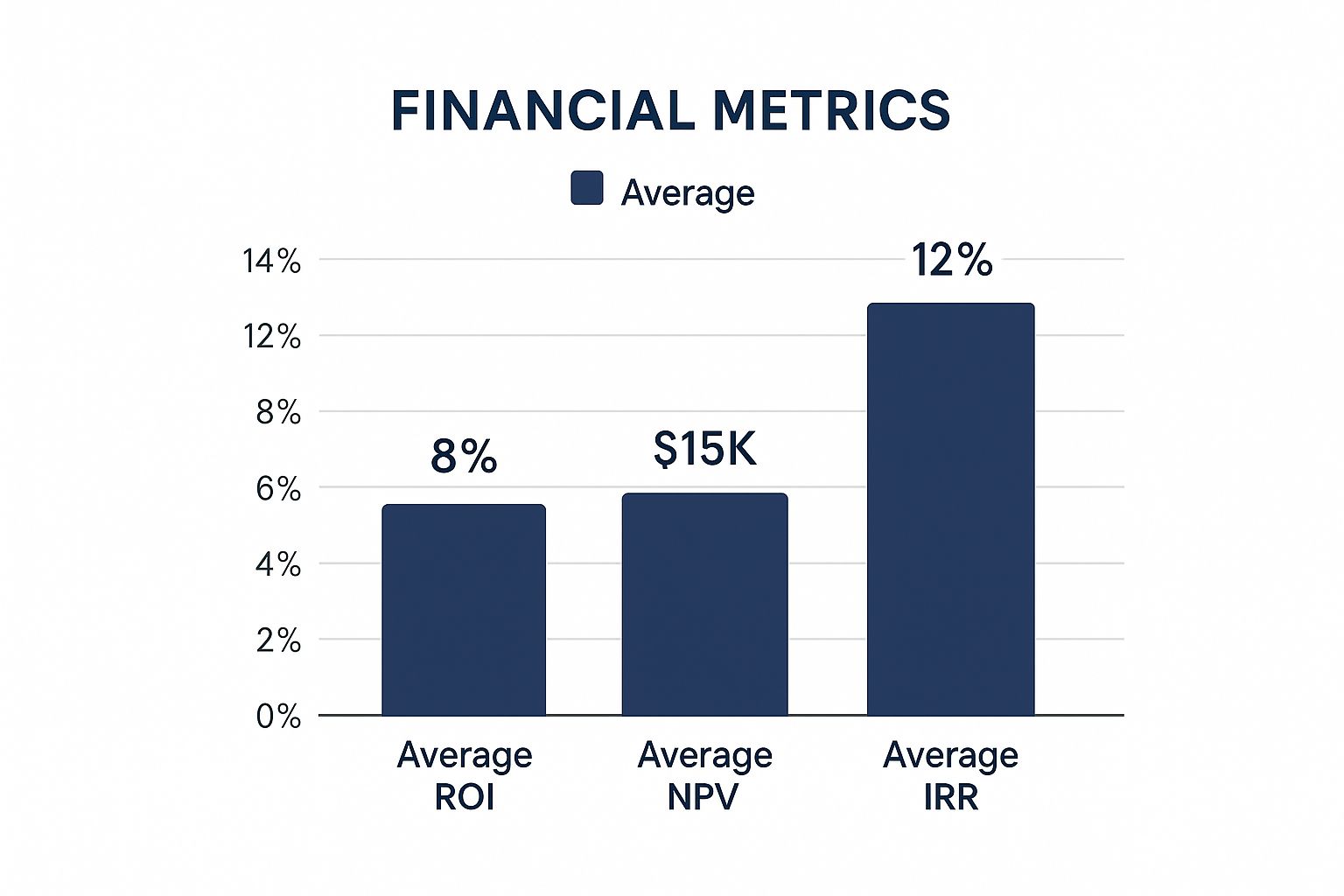

First, let's talk returns. Sponsors will throw a few key metrics at you, and you need to know what they really mean. Don't just glance at the final number; dig into what’s driving it.

Novice Lens: Defining Key Terms* Internal Rate of Return (IRR): This is the total annualized rate of return on an investment. It’s important because it accounts for the time value of money—it recognizes that a dollar today is worth more than a dollar five years from now.* Equity Multiple: This shows you how many times you get your initial investment back. An equity multiple of 2.0x on a $100k investment means you received a total of $200k ($100k of your original capital back plus $100k in profit).* Capitalization Rate (Cap Rate): A property's Net Operating Income (NOI) divided by its market value. Think of it as a snapshot of the property's unlevered yield at a specific moment in time.

Investor Takeaway: I like to think of IRR as the investment's annual speed and the Equity Multiple as the total distance traveled. A high IRR over a short period looks flashy, but a solid Equity Multiple over a longer hold can build more actual wealth. You need both to see the complete picture.

Stress-Testing the Sponsor's Assumptions

This is where the pros really earn their stripes. A sponsor's projections are only as strong as the assumptions they're built on. It's your job to poke holes in them—this is the very heart of financial due diligence.

Zero in on the variables that can make or break a deal:

Rent Growth: Is the sponsor projecting 5% annual rent growth in a market that has historically averaged 2.5%? Ask what specific market data backs that up. Be skeptical of any projection that assumes the good times will roll on forever.

Exit Cap Rate: This is one of the most critical assumptions. A lower exit cap rate equals a higher sale price. If a sponsor assumes the cap rate will compress (get lower) during the hold period, you need to understand why they think the market will pay more for the asset in the future. A more conservative—and often safer—approach is to assume the exit cap rate will be the same or even slightly higher than the purchase cap rate.

Vacancy Rates & Operating Expenses: Make sure these numbers feel right for the local market and the specific property type. Underestimating expenses is one of the easiest ways to make projected returns look better than they really are.

By building your own simple financial model, you can plug in different numbers for these variables and see what happens to the IRR and equity multiple. This "sensitivity analysis" quickly shows you how fragile the deal's returns are. If a tiny change to the exit cap rate turns a home run into a single, you’ve just uncovered a major risk.

For a much deeper dive into the entire process, check out our comprehensive guide to commercial real estate due diligence. It’s a playbook you can use to tighten up your own approach.

Reading the Market Cycles and Economic Winds

You can have a fantastic asset in a terrible market and still end up with a losing proposition. The numbers in a financial model are crucial, but they don't exist in a vacuum. They’re directly tied to the bigger economic picture and what’s happening on the ground locally.

This is why you have to lift your gaze from the spreadsheet. You need to make sure you’re investing with the market at your back, not in your face. It's all about understanding the powerful currents of supply, demand, and demographic shifts that will ultimately decide if an asset sinks or swims.

Analyzing Macro and Micro Economic Drivers

Smart investing is about finding a tailwind. On a macro level, you’re looking at national trends like interest rate policy, inflation, and overall GDP growth. These big-picture factors set the stage for the entire market.

But real estate is intensely local. The micro drivers—what’s happening in a specific city or neighborhood—often have a much more immediate impact on a property's bottom line.

When we evaluate a market, we're looking for a perfect storm of positive signals:

Population and Job Growth: Are people and companies moving to the area or running for the exits? Consistent, positive net migration is a powerful green flag for future real estate demand.

Economic Diversification: Is the local economy a one-trick pony, completely dependent on a single industry? Or does it have a healthy mix of sectors like healthcare, tech, logistics, and education? A diversified economic base is your best defense against a downturn.

Local Infrastructure Investment: Is the city pouring money into new roads, public transit, or airports? These projects are often leading indicators of where the next wave of growth will hit.

Why This Matters for Novices: Think of it like this: a strong local economy is a rising tide that lifts all boats. Even a perfectly managed property will struggle in a city that’s bleeding jobs and people.

Understanding Geographic and Market Cycles

Markets move in predictable cycles, and knowing where you are in that cycle is a game-changing skill. This doesn't just apply to property types, but to entire regions. A key principle is understanding the back-and-forth between U.S. and international markets to decide when it makes sense to diversify geographically.

Looking at historical data since 1975, U.S. and international stock markets tend to take turns outperforming each other in cycles that last about eight years on average. As noted by Hartford Funds, the U.S. is currently in a cycle of outperformance that has stretched on for about 14.3 years—way longer than the historical norm (data as of 2023).

Recognizing these long-term patterns helps you decide whether to double down on domestic deals or start looking for opportunities abroad to capture global growth and hedge your bets. For a deeper dive, check out these market cycle findings on hartfordfunds.com.

This kind of cyclical awareness is what keeps you from overpaying at the peak of a hot market or being too scared to invest when things look grim. It gives you the context you need to make disciplined, long-term decisions instead of just reacting to short-term noise.

A Practical Guide to Assessing and Mitigating Risk

Chasing aggressive returns is exciting, but let’s be honest—disciplined risk management is how real, long-term wealth is actually built and preserved. A smart approach to evaluating any deal goes way beyond just the sunny-day upside. It means you have to rigorously stress-test the downside.

This is all about identifying the specific risks tied to the deal, the market, and the sponsor. From there, you need to see clear, effective strategies in place to handle those risks before you even think about committing your capital.

Identifying the Primary Risk Categories

Every investment has its own unique risk profile, but most potential problems fall into a few key buckets. Your due diligence has to hit every single one, starting with the most important factor of all: the team you’re backing. You can have a fantastic asset in a hot market, but an inexperienced operator can still run it straight into the ground.

You need to ask some pointed questions to really get a feel for how a sponsor is preparing for the inevitable challenges:

Sponsor Risk: What is their direct, hands-on experience with this exact asset class and business plan? How much of their own money is in the deal alongside yours? A significant co-investment from the sponsor is the clearest sign you’ll find that your interests are truly aligned.

Execution Risk: What could realistically go wrong with the business plan? If it’s a renovation, what are the contingency plans for construction delays or blowing the budget? If it's a lease-up strategy, what happens if new tenants are harder to find than projected?

Market Risk: How would the deal hold up if interest rates suddenly shot up or cap rates expanded? A solid underwriting model isn't just a best-case scenario; it includes sensitivity analyses showing how returns get hit under various negative outcomes.

Leverage Risk: Is the debt structured conservatively? High leverage can juice returns when the market is climbing, but it can be absolutely devastating in a downturn, potentially wiping out all of your equity.

To get a deeper understanding of the different layers of risk you'll encounter, you can explore our guide to the types of investment risk in real estate.

Common Investment Risks and How to Address Them

Here’s a look at common risks and their potential mitigants. This isn't about finding reasons to say no; it's about building the confidence to say yes to the right opportunities.

Risk: Market Downturn * Description: Changes in economic conditions, interest rates, or local demand negatively impact property value and income. * Mitigation: Invest in markets with diverse economic drivers. Conduct thorough market analysis and stress-test financials against rising interest rates or cap rates.

Risk: Sponsor/Operator Inexperience * Description: The poor management, inexperience, or misalignment of interests of the investment sponsor. * Mitigation: Vet the sponsor's track record thoroughly. Look for deep experience in the specific asset class and business plan. Ensure significant sponsor co-investment.

Risk: Excessive Leverage * Description: The use of too much debt, which can magnify losses and increase the risk of foreclosure if cash flow drops. * Mitigation: Favor deals with conservative loan-to-value (LTV) ratios. Ensure debt service coverage ratios (DSCR) have a healthy cushion.

Risk: Flawed Execution * Description: Failure to successfully implement the business plan, such as construction delays or inability to achieve projected rents. * Mitigation: Scrutinize the business plan for realistic assumptions. Confirm adequate contingency budgets and a clear operational strategy.

Investor Checklist: Questions to Ask Any Sponsor

Before you commit capital, make sure you get clear answers to these diligence questions. A quality sponsor will welcome them.

What is your specific track record with this exact asset type and strategy?

Can you walk me through a past deal that didn't go as planned and what you learned?

How much of your own capital is invested in this deal, and on what terms?

What are the top three assumptions in your financial model that keep you up at night?

What is your contingency plan if operating costs come in 10% higher than budgeted?

How will you communicate with investors (frequency, format) during the hold period?

What are the total fees (asset management, acquisition, disposition, etc.) involved?

Making the Final Call and Monitoring Your Investment

You’ve done the heavy lifting. The financials have been stress-tested, the market deep-dive is complete, and you’ve mapped out the risks. Now comes the moment of truth: pulling all those data points together into a single, confident decision.

This isn’t about a gut feeling. It’s about building a clear, defensible investment thesis. Think of it as a concise summary explaining why this specific deal, in this market, with this sponsor, makes perfect sense for your portfolio right now.

Investor Takeaway: A strong investment thesis should be short and to the point. For example: "We are investing in this value-add multifamily asset in a high-growth Sunbelt market because of the experienced sponsor, the conservative leverage, and the clear path to increasing net operating income through targeted renovations, which aligns with our five-year income and growth objectives."

From Diligence to Decision

To get from piles of analysis to a firm "yes" or "no," it helps to use a simple decision-making framework. This isn't about overcomplicating things; it's about forcing objectivity and weighing the pros and cons without letting emotion take the driver's seat.

Try scoring the key areas on a simple 1-5 scale:

Sponsor Quality: How strong is their track record, alignment, and transparency?

Financials: Are the assumptions conservative? Are the risk-adjusted returns attractive?

Market Fundamentals: Is there strong local job and population growth?

Asset & Business Plan: Is the strategy for creating value clear and achievable?

Risk Mitigation: Is the leverage prudent? Are there well-defined contingency plans?

This kind of structured approach helps you compare different deals on an apples-to-apples basis. It ensures your final choice is based on a balanced view of the entire opportunity, not just one impressive return metric.

Post-Closing: Your Work Is Not Over

Sending the wire might feel like the finish line, but it’s really the start of a new phase. Sophisticated investors know that ongoing monitoring is a non-negotiable part of stewarding their capital. The sponsor is on the hook for execution, but you are ultimately responsible for oversight.

Your primary tool here is the sponsor’s reporting. Scrutinize every quarterly update. Are the key performance indicators (KPIs)—like occupancy, rental rates, and renovation progress—tracking against the original pro forma? If they aren't, you need to know why. A good sponsor will proactively provide clear explanations for any variances.

Remember, understanding how sponsors raise capital for real estate deals here gives you crucial insight into the mechanics of the deal you just funded.

This kind of proactive monitoring keeps you in the loop, shows you’re an engaged limited partner, and helps you spot potential issues long before they become serious problems. It’s the final step that closes the loop on your evaluation process, cementing your status as a disciplined, long-term investor.

Your Top Questions, Answered

As you get deeper into evaluating deals, you'll naturally start having some specific questions. That’s a good sign—it means you’re thinking like an owner. Getting solid answers to these questions is what builds the confidence to pull the trigger when a great opportunity lands on your desk.

Let's tackle a few of the most common ones we hear from investors, whether they're just starting out or have been in the game for years.

What Metrics Should a Beginner Actually Focus On?

When you're new to passive real estate, the alphabet soup of metrics can feel like a firehose. The trick is to ignore the noise at first and zero in on the two things that really tell the story: how much cash will this deal spin off, and what’s the total profit potential?

Start by getting really comfortable with these two:

Cash-on-Cash Return: This one is beautifully simple. It’s the annual cash you get back, divided by the cash you put in. If you invest $100,000 and get $7,000 in distributions that year, you've got a 7% cash-on-cash return. It’s the clearest snapshot of a deal's immediate income power.

Equity Multiple: This metric cuts right to the chase: "How many times will I get my money back?" An equity multiple of 2.0x means the plan is to double your money. You get your original $100,000 back, plus another $100,000 in profit over the life of the investment.

Here's the takeaway: While sophisticated metrics like IRR are crucial for a full analysis, mastering Cash-on-Cash and Equity Multiple gives you a powerful, real-world grasp of a deal's two most important benefits: the income you earn while you hold it and the total profit you walk away with.

How Do You Really Vet a Sponsor’s Track Record?

A sponsor's track record is so much more than a list of deals on a slide deck. It’s the story of their expertise, their integrity, and their gut-level ability to get things done when a plan meets reality. A glossy marketing package means nothing without real-world, hard-earned experience to back it up.

When you’re digging into a sponsor, you need to go beyond the summary numbers and ask the tough questions:

Have they run this exact play before? Success in developing new multifamily high-rises doesn't mean they know how to turn around a struggling retail center. You’re looking for specific, directly relevant experience.

Have they ever lost investor capital? A good sponsor won't hide from the deals that went sideways. They’ll be upfront about it and, more importantly, they’ll be able to tell you exactly what they learned and what they changed in their process because of it.

How much of their own money is in the deal? This is the ultimate tell. When the sponsor has a significant chunk of their own capital on the line, you know their interests are perfectly aligned with yours. They’re just as motivated to protect the downside as you are.

How Is Analyzing Private Real Estate Different from Buying Stocks?

While they're both investments, the way you evaluate them couldn't be more different. Analyzing public stocks often comes down to quarterly reports, market sentiment, and macroeconomic trends. It’s a 30,000-foot view.

Private real estate due diligence is boots-on-the-ground. It’s far more granular and all about the specific asset. The process involves:

Direct Asset Underwriting: You're not analyzing a stock ticker; you're digging into a physical building. You’re looking at its condition, the quality of its tenants, the rent roll, and the block-by-block dynamics of its submarket.

Sponsor Diligence: In a private deal, you’re placing a bet on the jockey as much as the horse. Vetting the management team—their skills, their integrity, their plan—is a critical piece of the puzzle that has no real equivalent in public market investing.

The Illiquidity Premium: Private deals are illiquid. You can't just click a button and sell your shares tomorrow. Your analysis has to account for this longer hold period and ensure the projected returns are high enough to compensate you for that lack of flexibility. That extra potential return is your "illiquidity premium."

At the end of the day, evaluating private real estate is an investigative, hands-on process. It’s about tangible assets and the operators who bring them to life.

At [Stiltsville Capital LLC](https://www.stiltsvillecapital.com), we believe that well-structured real assets can be a prudent, resilient component of a long-term wealth strategy. We know that a well-informed investor is the best kind of partner, and our disciplined process is designed to identify opportunities where risks are understood and proactively mitigated. If you’re ready to put these principles to work, we invite you to schedule a confidential call to discuss your investment goals.

You can see our disciplined approach in action by exploring our current offerings at https://www.stiltsvillecapital.com.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments