How to Figure the Cap Rate: A Guide for Real Estate Investors

- Ryan McDowell

- Oct 8

- 11 min read

Reading Time: 7 min | Good for: Novice (A), Informed (B)

TL;DR: Key Takeaways on Calculating Cap Rate

The Formula: Cap Rate = Net Operating Income (NOI) / Property Market Value. It's the unlevered annual return on an asset.

Why It Matters: The cap rate is the great equalizer in real estate, allowing you to compare the raw earning power of different properties, regardless of financing.

NOI is Everything: Your cap rate is only as good as your Net Operating Income calculation. Underwrite your own numbers; never trust a seller's pro-forma at face value.

Context is King: A "good" cap rate is relative. It depends entirely on the property type, location, asset condition, and the broader economic environment. A 5% cap rate might be a great deal for a Class A industrial asset but a terrible one for an aging office building.

Investor Action: Use the cap rate formula in reverse (Market Value = NOI / Target Cap Rate) to determine your maximum offer price and maintain investment discipline.

The Market Why-Now: Cap Rates in a Shifting Landscape

For sophisticated investors and family offices, understanding how to figure the cap rate has never been more critical. In today's dynamic market, the spread between asset classes tells a compelling story. As of early 2024, the U.S. office sector saw its average cap rate climb towards 7.4%, reflecting ongoing uncertainty. In stark contrast, multifamily and industrial properties continued to trade at much tighter (lower) cap rates, prized for their perceived stability and strong rental growth prospects, according to analysis from CBRE. This divergence highlights that a disciplined, property-level underwriting process is paramount for identifying value and avoiding mispriced risk.

What a Cap Rate Really Tells You

Before you open a spreadsheet, you need to grasp what a cap rate represents. Think of it as the great equalizer in commercial real estate. It cuts through the noise of financing and complex debt structures to show you the raw, operational earning power of an asset.

This is what allows you to make clean, apples-to-apples comparisons. Suddenly, a small multifamily building in Austin can be benchmarked against a sprawling retail center in Miami using one powerful number. Getting this right is the foundation for making disciplined, data-driven investment decisions.

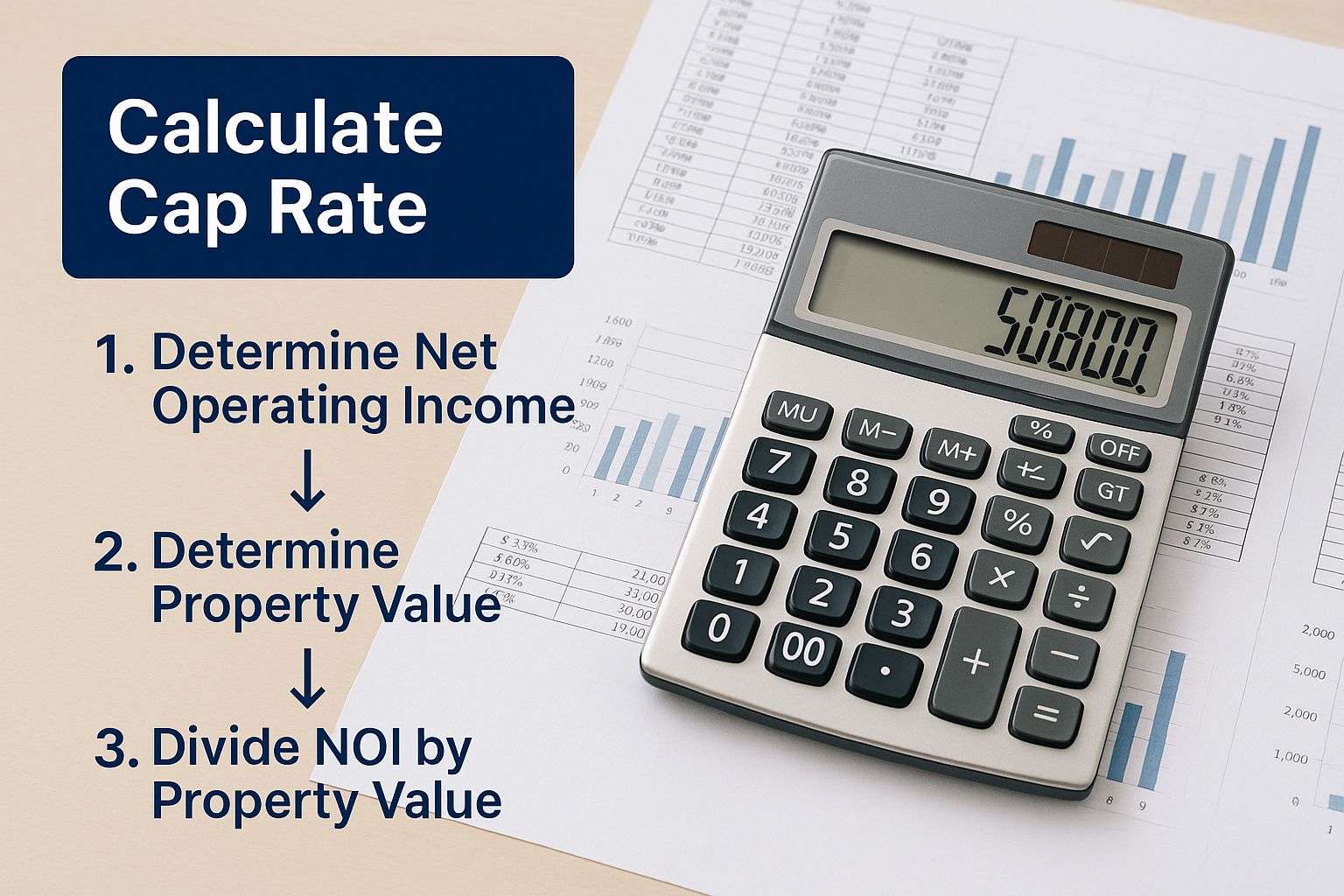

The Core Formula Explained

The capitalization rate formula is beautiful in its simplicity:

Cap Rate = Net Operating Income (NOI) / Property Market Value

Let's put it into practice. A property bringing in $100,000 in NOI that’s valued at $2,000,000 would have a 5% cap rate. ($100,000 / $2,000,000).

Novice Lens: What is NOI?What exactly is Net Operating Income? It’s all the revenue a property generates (from rent, fees, etc.) minus all of its day-to-day operating expenses. The key here is what it excludes: mortgage payments, major capital improvements, and income taxes. This gives you the purest view of a property's operational health and is the true engine of your return.

Why This Metric Matters for Investors

For a real estate investor, the cap rate is more than just a number—it’s a barometer for risk, value, and overall market sentiment. Understanding its nuances separates savvy investors who spot a great deal from those who overpay.

To get comfortable with the inputs, here's a quick breakdown of what goes into the formula.

Cap Rate Formula Components at a Glance

Component | What It Is | Why It Matters for Your Analysis |

|---|---|---|

Net Operating Income (NOI) | The property's total income minus its operating expenses. | This is the engine of your return. A higher, stable NOI signals a healthier, more profitable asset. |

Property Market Value | The current price the property would likely sell for on the open market. | This is your denominator—the "cost" of the investment. It reflects market demand, location, and asset condition. |

Understanding these two components is your first step toward using the cap rate effectively in your deal analysis. For investors who want to go deeper, a great resource is this guide on analyzing real estate investment deals.

Calculating Your Net Operating Income Accurately

A rock-solid cap rate hinges on an equally solid Net Operating Income (NOI). This number is the absolute engine of your investment analysis, and frankly, getting it right is what separates disciplined investors from those just taking a flyer on optimistic projections. The process starts with a property’s total potential income and then systematically strips away the realistic costs.

Here’s where many investors stumble: they accept the seller's pro-forma numbers at face value. Those documents are marketing, plain and simple. They often paint a rosy picture, downplaying expenses and assuming every unit is full. Real underwriting means you build your own NOI from scratch, using verifiable income and accounting for every operational cost.

From Gross Income to Realistic NOI

To get your cap rate right, you must start with the property's real-world income potential. Before you can even touch your NOI calculation, you have to calculate rental income accurately for the property. This first figure, the Gross Potential Income (GPI), is your starting line—and you'll immediately start adjusting it downward.

Your math must reflect real-world revenue drains, such as:

Vacancy Loss: No property stays 100% occupied forever. You have to deduct a realistic vacancy rate—say, 5-10% of GPI—based on the local market and the building's history.

Credit Loss: This covers the unfortunate reality of tenants who don't pay their rent. Budgeting even a small percentage for this keeps your numbers grounded in reality.

Once you subtract vacancy and credit loss from your GPI, you have your Effective Gross Income. From there, you subtract all the operating expenses—the day-to-day costs of keeping the lights on and the property running. These can't be ignored. For a complete deep dive, our team put together a detailed guide on how to find net operating income for your real estate investments.

Deal Lens: A Small Multifamily Property

Let's walk through a simplified case showing how a sponsor creates value. This highlights how quickly an optimistic projection can get derailed by realistic underwriting when you're figuring out the cap rate.

Assumptions (Illustrative):

Property: 10-unit apartment building.

Rent per Unit: $1,500/month.

Purchase Price: $1,800,000.

Income / Expense Line Item | Seller's Pro-Forma | Realistic Underwriting |

|---|---|---|

Gross Potential Income | $180,000 | $180,000 |

Vacancy & Credit Loss (5%) | $0 | -$9,000 |

Effective Gross Income | $180,000 | $171,000 |

Property Taxes | -$18,000 | -$18,000 |

Insurance | -$6,000 | -$6,000 |

Management Fee (8%) | -$9,000 | -$13,680 |

Repairs & Maintenance | -$5,000 | -$7,500 |

Capital Reserves | $0 | -$5,000 |

Total Operating Expenses | -$38,000 | -$50,180 |

Net Operating Income (NOI) | $142,000 | $120,820 |

Based on these numbers, the seller might advertise a juicy 7.9% cap rate ($142,000 / $1.8M). But a more prudent calculation—one that actually accounts for vacancy and sets aside money for future big-ticket repairs—reveals the actual entry cap rate is closer to 6.7% ($120,820 / $1.8M). That 120-basis-point difference is a big deal, directly impacting your offer price and your return projections from day one.

Let's Run the Numbers: A Real-World Cap Rate Example

Theory is great, but putting it into practice is where the real value is. Let’s walk through a complete, real-world example of how to figure out the cap rate for a hypothetical 20-unit apartment building. This will show you exactly how the numbers flow, from the top-line rent all the way down to the final cap rate.

Think of it like a funnel. You start with the widest numbers (potential income) and gradually narrow them down to the precise figure you need.

Gathering the Raw Data

First, we need to assemble our key data points for this 20-unit building.

Purchase Price: The seller is asking for $4,000,000.

Gross Potential Rent (GPR): Each unit pulls in $2,000/month. That gives us a GPR of $480,000 for the year (20 units x $2,000 x 12 months).

Vacancy Allowance: We are conservative here. Let’s budget for a 5% vacancy and credit loss, which comes out to $24,000. This gives us an Effective Gross Income (EGI) of $456,000.

With our income figured out, it's time to tally up the annual operating expenses to get to our Net Operating Income (NOI).

Property Taxes: $45,000

Insurance: $15,000

Utilities (for common areas): $12,000

Property Management (a standard 8% of EGI): $36,480

Repairs & Maintenance: $20,000

Reserves for Capital Expenditures: $10,000

Add it all up, and you get Total Operating Expenses of $138,480. When you subtract that from our EGI of $456,000, you're left with a Net Operating Income (NOI) of $317,520.

Now for the easy part. We just plug the NOI and purchase price into our formula:

$317,520 (NOI) / $4,000,000 (Price) = 7.94% Cap Rate

Flipping the Formula for Smarter Investing

Here's a pro tip: the most experienced investors use this formula in reverse. This is where it becomes a powerful underwriting tool.

Let's say you already know the property's NOI is $317,520, but your target entry cap rate for a deal like this is 8.5%. You can use that to calculate your maximum offer price.

$317,520 / 0.085 = $3,735,529

Suddenly, the cap rate isn't just a simple calculation—it's a strategic negotiation tool. It ensures you never overpay based on the return you require. This analytical rigor separates good investors from great ones.

While local markets can be volatile, national average cap rates have stayed remarkably consistent over time. This underscores how important it is to get your property-level underwriting right. For a deeper dive into these long-term trends, you can explore the connections of commercial property cap rates on cbre.com.

What Your Cap Rate Is Really Telling You

Running the numbers is just the starting line. The real art is understanding what that final cap rate figure means for your investment. A cap rate is never just a number—it’s a powerful signal about a property’s risk, its value, and where it sits in the current market.

At its core, there’s an inverse relationship between cap rates and risk. A lower cap rate suggests a higher price tag and lower perceived risk. This is your brand-new, Class A apartment building in a hot downtown market, packed with long-term tenants. Investors will pay a premium for that stability, which compresses the cap rate.

On the flip side, a higher cap rate often points to higher perceived risk, but also a greater potential for upside. This could be an older, Class C building in a secondary market with a mix of short-term leases. The market demands a higher return to compensate for the added uncertainty.

Context Is Everything: Benchmarking Your Deal

A "good" cap rate doesn't exist in a vacuum. It’s completely dependent on the specifics of the deal. Disciplined investors benchmark their results against a few key factors:

Property Type: A multifamily building will trade at a totally different cap rate than a hotel or a self-storage facility.

Location Quality: A prime urban core (Class A) location will always command a lower cap rate than a suburban or tertiary (Class B/C) market.

Asset Condition: Are you buying a stabilized, cash-flowing property, or a value-add project that needs a serious capital injection?

Tenant Strength: There's a world of difference between a building leased to a Fortune 500 company on a 20-year term and one with a dozen small tenants on month-to-month agreements.

Insight Edge: Market Signal BoxIn late 2023, the U.S. office sector was seeing an average cap rate of 6.54%, and most analysts expected it to climb higher. Meanwhile, multifamily and industrial properties were trading at much lower cap rates due to their perceived stability and stronger growth prospects (Source: Statista).Investor Take: A 5% cap rate might be a fantastic deal for a new industrial warehouse near a major port, but it could be a terrible one for an aging suburban office building. You have to know the right benchmark for that specific asset class and market.

For a much deeper dive into this, check out our guide on what is a good cap rate for real estate investors.

Cap Rates in a Dynamic Market Environment

Knowing how to calculate a cap rate is a vital technical skill, but the number you get is just a snapshot in time. A static calculation misses the bigger picture.

In reality, cap rates are fluid metrics that move with the currents of the broader economy. For any serious investor, understanding how these rates are likely to shift is just as crucial as calculating them for a deal today.

A cap rate is essentially a direct reflection of investor sentiment and the cost of capital. When the market is buzzing with optimism and borrowing is cheap, investors are willing to pay more for future income streams. That competition pushes property prices up and, in turn, compresses cap rates.

But when uncertainty creeps in and interest rates start to climb, investors demand a higher risk premium for their capital. This naturally leads to cap rate expansion.

The Influence of Macroeconomic Forces

By far, the most significant outside force acting on cap rates is interest rates. The 10-year U.S. Treasury bond is the classic "risk-free" benchmark that all other investments are measured against. Commercial real estate simply has to offer a better return to compensate investors for taking on the risks of illiquidity, management headaches, and market swings.

Advanced Lens: The Cap Rate SpreadAs interest rates rise, so does the cost of debt needed to finance an acquisition. To hit their target returns, buyers have two choices: find a property with a higher Net Operating Income (NOI) or pay a lower price. If the property's income is stable, the only lever to pull is price—which directly translates to higher cap rates. The "spread" between a property's cap rate and the 10-year Treasury is a key indicator of perceived risk in real estate.

This isn't just theory; we see it play out in the data. Research from the CFA Institute has shown that a 100 basis point increase in mortgage debt growth relative to GDP can cause a 65 basis point jump in office cap rates. When credit conditions tightened after 2021, the market reacted just as you'd expect. You can learn more about the interplay between cap rates and interest rates on cfainstitute.org.

This forward-looking perspective is essential, especially when you are navigating the challenges confronting commercial real estate investors in today's environment. Understanding these market dynamics allows you to underwrite deals not just for today, but for where you believe the market is headed.

Actionable Investor Checklist: Questions to Ask a Sponsor

When evaluating a passive real estate opportunity, the cap rate is just the start. Use these questions to diligence a sponsor's assumptions:

What vacancy rate have you used in your pro-forma, and how does it compare to the submarket's historical average?

Can you provide a trailing 12-month (T-12) operating statement to validate your income and expense figures?

What are your assumptions for rental growth over the holding period?

What exit cap rate are you projecting, and what is your justification for that rate?

How have you accounted for deferred maintenance and future capital expenditures in your underwriting?

What property management fee is included, and is it in line with the market?

Are the property taxes based on the current assessment or reassessed at the purchase price?

Tying It All Together: From Calculation to Conviction

Mastering how to figure the cap rate is more than a mathematical exercise; it's about developing the discipline to look past the marketing and underwrite a deal based on its true operational and market fundamentals. For family offices and high-net-worth investors, this foundational skill is the first line of defense against overpaying and the first step toward identifying resilient, long-term value. When structured correctly within a diversified portfolio, high-quality real estate assets can provide a prudent, inflation-hedged component of a lasting wealth strategy.

At Stiltsville Capital, we believe that mastering foundational metrics is the key to identifying compelling investment opportunities. If you're an accredited investor interested in exploring institutional-quality real estate, we invite you to schedule a confidential call with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments