Real Estate Debt Fund Investing: A Guide for Family Offices and Accredited Investors

- Ryan McDowell

- Sep 6

- 13 min read

Reading Time 8 min | Good for: A, B, C

Ever thought about being the bank in a real estate deal, instead of the one buying the property? That's the core idea behind a real estate debt fund: a professionally managed pool of capital that provides loans for commercial real estate projects. For investors, it's a path to real estate exposure focused on generating predictable income rather than waiting for a property’s value to appreciate.

TL;DR: Why Real Estate Debt Funds Matter Now

You're First in Line: As a debt investor, you get paid before equity owners, providing a critical safety net if a project’s value dips.

Steady Cash Flow: Debt funds are designed to provide consistent income from regular interest payments, unlike equity deals that often depend on a future sale.

A Prime Market Opportunity: As traditional banks tighten lending standards, debt funds are stepping in to fill the financing gap, often securing stronger terms and returns for investors.

The "Why Now" for Real Estate Debt Funds

In a market defined by fluctuating interest rates and tighter bank lending, real estate debt funds have become a crucial source of capital. They offer essential financing to developers and property owners while giving investors a compelling way to earn stable, income-driven returns with built-in protection against downturns.

This isn't a fleeting trend; it's a structural shift. Private real estate debt funds are capturing a significantly larger share of the market. According to PERE News (as of Q1 2024), these credit strategies accounted for a remarkable 24.3% of all capital raised for private real estate, their largest share in at least seven years. This data underscores a clear move by sophisticated investors toward more defensive, income-focused plays as economic uncertainty lingers. You can read more about the growth of real estate debt fundraising and see how top managers are navigating the market.

For family office principals and high-net-worth investors seeking alternative income streams, the value proposition is clear:

Senior Position: Debt investors get paid first, period. This priority position in the "capital stack" is the ultimate structural advantage.

Predictable Income: Debt funds provide consistent cash flow from contractually obligated interest payments made by borrowers.

Inherent Diversification: A single investment in a fund provides exposure to a portfolio of loans—diversified across different properties, geographies, and borrowers.

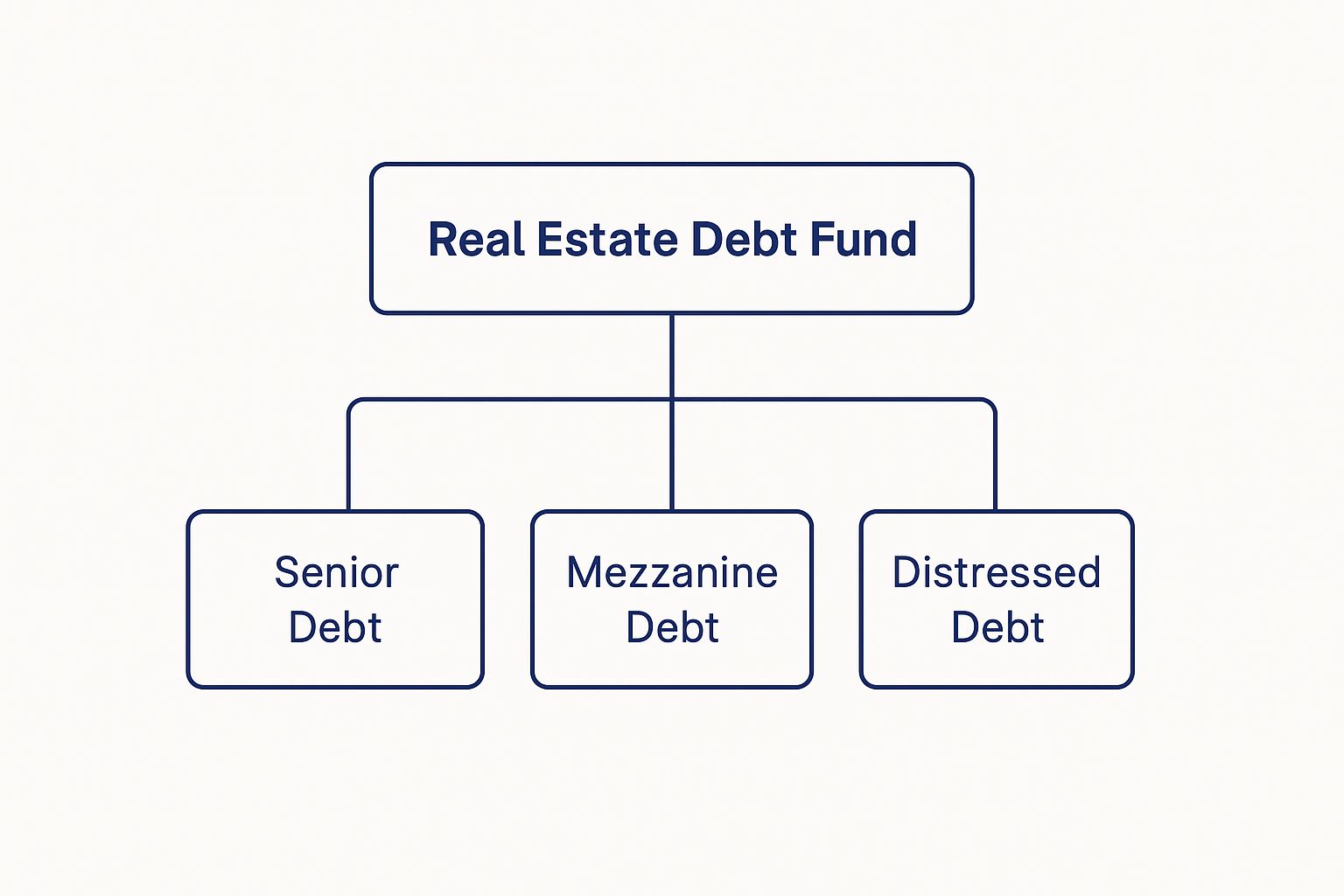

A Quick Look at Debt Fund Structures

A real estate debt fund can hold different kinds of loans, each with its own risk and return profile. This diagram breaks down the most common strategies a fund might use.

As you can see, a single fund can spread its investments across various layers of the capital stack, from the safer senior debt to higher-return mezzanine or special situation loans.

Defining the Core Concepts

If you're new to this space, understanding the terminology is the first step. Think of the capital stack like a ladder—the lowest rung is the safest place to be.

Novice Lens: A simple way to understand the capital stack is to think about who gets paid first if a property is sold or goes into foreclosure. Lenders (debt) are at the front of the line, while owners (equity) are at the back. A real estate debt fund puts you in that priority position.

Senior Debt: This is the most secure type of real estate loan, essentially a first mortgage. It has the first claim on the property's assets if the borrower defaults, making it the lowest-risk position. Returns are lower but highly predictable.

Mezzanine Debt: This loan is sandwiched between the senior debt and the owner's equity. It gets paid back after the senior loan but before the equity holders. Because it carries more risk, it offers higher interest rates to compensate investors. Developers often use it to "bridge the gap" when they need more capital than a senior lender is willing to provide.

To make the distinction crystal clear, it helps to see debt and equity investing side-by-side. While both are avenues for real estate exposure, they play very different roles.

Debt vs. Equity Investing at a Glance

Attribute | Real Estate Debt Fund (Lender) | Real Estate Equity Fund (Owner) |

|---|---|---|

Role in Deal | Acts as the bank, providing a loan. | Acts as the owner, holding title to the property. |

Return Profile | Fixed income from interest payments. Capped returns. | Potential for high appreciation. Uncapped upside. |

Primary Risk | Borrower default. | Market downturns, operational issues, vacancies. |

Capital Stack | Senior position. Gets paid first in a default. | Subordinate position. Gets paid last. |

Typical Returns | 6-12% annually. | 15-25%+ (highly variable). |

Ultimately, a debt fund offers a trade-off: you exchange the explosive upside potential of property ownership for more predictable cash flow and a stronger defensive position. For many investors, especially in the current climate, that’s a trade worth making.

How Debt Funds Generate Investor Returns

The appeal of a real estate debt fund lies in its straightforward, consistent return profile. Unlike equity investing, where returns often hinge on a future sale, debt fund returns are engineered to produce predictable cash flow. Think of it like a high-yield savings account backed by tangible commercial real estate.

At its core, a debt fund generates returns for its investors through the interest paid by borrowers. This is the primary engine driving returns, creating a steady, reliable income stream. This "current pay" structure is a key differentiator from equity investments, where cash flow can be lumpy and profits are often realized only upon exit.

On top of baseline interest, skilled fund managers can enhance returns through various fees tied to structuring and managing the loans.

The Primary Streams of Income

A well-managed debt fund taps into several revenue streams to build a compelling, blended return for its investors.

Interest Income: This is the primary driver. Borrowers make regular, contractually obligated payments on their loans at a set interest rate. This income is then passed through to the fund's investors, typically as quarterly distributions.

Origination Fees: When a new loan is originated, the borrower typically pays an upfront fee, often 1-2% of the loan amount. This fee compensates the fund manager for underwriting and closing the deal, and a portion often flows directly to the fund, providing an initial boost to returns.

Exit Fees: Similar to origination fees, these are paid by the borrower when the loan is paid off. Sometimes called prepayment penalties, they provide an additional kicker to the fund's total return upon successful loan resolution.

Novice Lens: Floating vs. Fixed RatesThink of interest rates as the price of borrowing money. A fixed rate is predictable for everyone. A floating rate, on the other hand, is tied to a benchmark (like SOFR) and adjusts over time. In a rising rate environment, floating-rate loans can generate higher income for the fund, acting as a natural hedge against inflation. If rates fall, they will produce less.

Advanced Structures and Return Enhancement

Beyond the basics, sophisticated fund managers employ more complex tools to optimize returns.

One common strategy is creating A/B Notes. Here, a single large loan is bifurcated into the "A-Note" (senior, lower risk) and the "B-Note" (subordinate, higher risk). Because the B-Note is paid after the A-Note, it commands a much higher interest rate. A fund might originate the entire loan, sell the lower-yielding A-Note to a bank, and retain the high-yield B-Note for its portfolio to enhance returns.

Managers may also use modest fund-level leverage—borrowing money at a lower rate to lend out at a higher one. Used with discipline, this can amplify overall investor returns. These advanced structures demonstrate how a skilled sponsor actively manages a portfolio to create value, not just passively collect interest payments.

Diving Into Different Debt Fund Strategies

Not all real estate debt funds are the same. Their strategies are defined by where their investments sit in the "capital stack"—the hierarchy of capital funding a real estate deal. The higher you are in the stack, the safer your capital, but the more modest your returns. The lower you go, the more risk you assume for a shot at higher returns.

Senior Secured Debt: The Bedrock of the Capital Stack

Senior secured debt is the most conservative and common strategy. This represents the first mortgage on a property. If the borrower defaults and the property is sold, the senior lender is the first to be repaid. This priority position provides a powerful safety net.

Due to this protection, senior debt offers steady, predictable returns, typically in the 6-9% range. The loan-to-value (LTV) ratios are also conservative, ensuring a healthy cushion of owner equity below the loan.

Position in Capital Stack: First Lien (Top)

Typical LTV Ratio: 60-75%

Risk Profile: Low

Return Profile: Consistent cash flow from interest payments.

This is the ideal strategy for investors who prioritize capital preservation while generating reliable income.

Mezzanine Debt & Preferred Equity: Bridging the Gap for Higher Returns

When a senior loan doesn't cover the full project cost, mezzanine debt and preferred equity enter the picture. These strategies fill the crucial funding gap between the senior mortgage and the developer's equity contribution.

Investor Takeaway: While mezzanine debt is a loan and preferred equity is technically an equity stake with debt-like features, they serve the same practical purpose. Both provide subordinate capital to complete a project and demand higher returns for taking on more risk.

These positions sit below the senior loan, making them riskier. If a project fails, these investors are paid only after the senior lender is made whole. To compensate for this risk, these strategies offer much higher returns, often in the 10-15% range or more.

Position in Capital Stack: Subordinate (between senior debt and common equity)

Typical LTV Ratio: Fills the capital stack from 70% to 85%

Risk Profile: Medium to High

Return Profile: Higher interest rates, sometimes with an "equity kicker" that grants the lender a share of the project's profits.

Deal Lens Example: A Multifamily Development

Let's illustrate with a simplified case. A developer is building a $50 million apartment complex.

Total Project Cost: $50,000,000

The capital stack might look like this:

Senior Debt Fund: Provides a $35 million senior construction loan. This sets the loan-to-cost (LTC) at 70% ($35M / $50M). This lender is first in line to be repaid.

Mezzanine Debt Fund: The developer secures a $7.5 million mezzanine loan to bridge the gap. This loan fills the capital stack from 70% up to 85% LTC. The interest rate is substantially higher to reflect its riskier position.

Sponsor Equity: The developer contributes the final $7.5 million (15%) as their "skin in the game." They are the last to be repaid but stand to make the largest profit if the project is successful.

An investor in the senior debt fund holds the safest position. An investor in the mezzanine fund is taking a calculated risk for a significantly higher return. The developer's own capital serves as the first-loss cushion, protecting both lenders.

The Strategic Advantages of Real Estate Debt

Understanding the mechanics is one thing; appreciating the strategic role of a real estate debt fund in a diversified portfolio is another. For high-net-worth individuals and family offices, the primary goals are typically capital preservation, reliable income generation, and resilience during market volatility. Real estate debt is uniquely positioned to address all three.

Unlike equity investing, where returns are tied to the often-unpredictable future value of a property, debt investing is built on a contractual promise to pay. This creates a level of predictability that is difficult to find elsewhere in private markets.

Capital Preservation Through Seniority

The greatest advantage of debt is its seniority in the capital stack. As the lender, you are first in line for repayment. This priority acts as a powerful buffer, shielding your investment even if the property’s value declines.

Why It Matters: If a property’s value drops by 10%, the equity investor absorbs that loss immediately. However, if you hold a senior loan with a 65% loan-to-value (LTV), the property’s value would have to fall by more than 35% before your principal is even at risk. That is a powerful structural advantage.

This defensive posture makes debt a compelling choice, especially in uncertain economic environments where capital preservation is paramount.

Consistent Income and an Inflation Hedge

Real estate debt funds are fundamentally income-generating vehicles. They are structured to produce a steady, predictable stream of cash. The interest payments from the underlying loans are typically distributed to investors quarterly, creating a reliable income flow.

Furthermore, many commercial real estate loans today feature floating interest rates. This acts as a natural hedge against inflation. When benchmark rates rise, the interest paid on these loans adjusts upward, which can boost the income distributions you receive. This is a significant advantage over fixed-income assets, which can lose value when inflation accelerates.

A Data-Driven Case for Debt Allocation

Recent market performance makes a strong case for debt. Since 2019, real estate debt funds have often outperformed their equity counterparts.

For instance, commercial real estate debt funds from the 2022 vintage achieved a median internal rate of return (IRR) of 11.3%. This significantly outpaced the 2.1% returned by equity funds from the same year. The divergence is clear: debt funds benefited from rising rates through their floating-rate loan structures, while equity deals faced headwinds.

The opportunity set is expanding. With an estimated $2 trillion in commercial real estate debt maturing by 2027, the lending opportunities for well-capitalized funds are immense.

For investors seeking a prudent way to access real estate, a real estate debt fund offers a powerful combination of stability and income. To see how higher-yield strategies can also fit into this picture, see our guide to mezzanine debt funds.

Understanding Risks and Mitigation Strategies

While real estate debt funds offer compelling advantages, no investment is without risk. A disciplined fund manager's primary role is not just identifying opportunities but actively underwriting and mitigating potential risks. It’s not about finding a "risk-free" investment—it’s about making calculated decisions where the potential returns justify the risks.

Here’s a breakdown of the key risks and how a sophisticated sponsor manages them.

Risk: Credit and Borrower Default * This is the primary risk: a borrower stops making payments. A default can disrupt cash flow and, in a worst-case scenario, lead to a loss of principal if the property’s value has fallen below the loan amount. * Mitigation: * Rigorous Underwriting: Experienced managers stress-test every assumption in a borrower’s business plan, from rent growth projections to construction budgets. * Conservative LTV Ratios: By lending at a lower loan-to-value (LTV)—typically 65-75%—managers build in a substantial equity cushion. * Strong Loan Covenants: These contractual rules protect the lender, requiring borrowers to maintain certain performance metrics and giving the lender early warning if a deal veers off course.

Risk: Sponsor Execution * A project can fail if the sponsor (the developer or operator) mismanages it, leading to construction delays, budget overruns, or poor leasing performance. * Mitigation: * Deep Sponsor Vetting: The best lenders only work with sponsors who have a proven history of successfully completing similar projects through multiple market cycles. * Alignment of Interests: Requiring a substantial "skin in the game" from the borrower ensures their interests are aligned with the project’s success. * Active Asset Management: Top-tier lenders conduct regular site visits and monitor project milestones to identify issues before they become critical.

Risk: Interest Rate and Market Risk * Broader economic forces can impact an entire debt portfolio. A sharp rise in interest rates can strain a borrower's ability to pay, while a market-wide drop in property values can erode the protective equity cushion. * Mitigation: * Interest Rate Caps: On floating-rate loans, lenders often require the borrower to purchase an interest rate cap, an insurance policy that protects against rates rising past a certain point. * Diversification: Smart funds build portfolios of loans across different property types, geographic markets, and sponsors to limit exposure to any single area of weakness. For a deeper dive, read our guide to commercial real estate financing options for investors.

Investor Takeaway: A fund manager's true skill shines not when deals are going perfectly, but when they hit a snag. A robust and tested workout process—the plan for dealing with a troubled loan—is a non-negotiable part of any top-tier sponsor's toolkit.

How to Evaluate a Debt Fund Sponsor

When you invest in a real estate debt fund, you're not just buying a strategy—you are selecting a partner. The sponsor (fund manager) is the single most critical factor in your investment's success. A top-tier sponsor is a disciplined steward of capital who can navigate any market cycle. Proper due diligence requires asking the tough questions that reveal a sponsor’s true expertise and philosophy.

Investor Checklist: Questions to Ask a Sponsor

Use this framework to gain a clear assessment of potential partners.

Track Record & Cycle Experience * How many market cycles has your senior management team weathered together? * Can you share the full performance history of your previous debt funds, including realized and unrealized investments? * Specifically, how did your portfolio perform during the 2008 financial crisis and the COVID-19 downturn?

Underwriting & Risk Management * Walk me through your underwriting process. What are the key metrics you stress-test? * What is your maximum target loan-to-value (LTV) or loan-to-cost (LTC) ratio? * How do you vet the borrowers themselves, beyond just the real estate?

Alignment of Interests * How much of your own capital (GP co-invest) is committed to this fund? A significant co-investment, typically 2-5% of total equity, is a non-negotiable sign of alignment. * What is your fee structure? How does it ensure you are focused on delivering strong net returns to investors? * Are there any potential conflicts of interest, such as affiliated service companies?

Handling Troubled Assets * What is your historical loan default and loss rate? * Can you provide a specific example of a troubled loan you had to work out? What was the process and the final outcome for the fund? * Who on your team leads workouts, and what is their direct experience in asset recovery?

Investor Takeaway: A sponsor's answer to the troubled assets question is often the most revealing. A transparent, detailed example demonstrates a battle-tested process. Vague or evasive responses should be a major red flag.

Asking these pointed questions will help you cut through the sales pitch and assess a sponsor's discipline and experience. This diligence process is fundamental to all forms of alternative investments, as explored in our guide to private equity real estate investing.

Your Questions Answered: Getting Into the Details of Debt Funds

Any prudent investment journey begins with asking the right questions. Here are answers to some of the most common inquiries we receive about real estate debt funds.

How Much Do I Need to Invest?

Private debt funds are designed for accredited investors, family offices, and institutions. Consequently, the minimum investment is higher than for public market securities. Minimums typically start around $100,000 and can range up to $1 million or more, depending on the fund’s strategy and target audience. The fund’s private placement memorandum (PPM) will specify the exact amount.

How Quickly Can I Get My Money Out?

This is a key distinction from public markets. Investments in private real estate debt funds are illiquid. These funds have a defined lifespan, typically 5 to 10 years. Your capital is committed for an initial lock-up period. While some funds may offer limited redemption windows later in the fund's life, this is not guaranteed. Investors should be prepared to commit capital for the full term.

What Kind of Updates Will I Receive?

Transparency is a hallmark of a good fund manager. You should expect regular, detailed reporting. Most sponsors provide quarterly reports that break down the fund’s performance, detail the underlying loans in the portfolio, and include a manager's letter discussing market conditions. You will also receive an annual report, which should be audited by a third-party accounting firm.

How Are the Returns Taxed?

Tax implications depend on your individual situation and the fund’s legal structure. Generally, the income you receive from the fund, which is derived from interest payments on the loans, is taxed as ordinary income. It is essential to consult with your tax advisor to understand how such an investment would impact your specific financial picture.

At Stiltsville Capital, we connect accredited investors with institutional-quality real estate opportunities designed to build long-term wealth. If you’re ready to see how a disciplined debt strategy could strengthen your portfolio, let's schedule a confidential call.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments