Real Estate Investing Texas: A Practical Guide for the Modern Investor

- Ryan McDowell

- 6 days ago

- 11 min read

Reading Time: 8 min | Good for: Novice (A), Informed (B), Sophisticated (C)

If you're an investor looking for growth, stability, and a market that genuinely rolls out the red carpet for business, Texas real estate demands a place on your radar. The state's powerful mix of explosive population growth, major corporate relocations, and a resilient economy has created an ideal environment for both seasoned professionals and those just entering the private real estate market. Simply put, it's a market where strong fundamentals consistently drive demand across asset classes.

TL;DR: Key Takeaways

Powerful Fundamentals: Texas's pro-business climate (no state income tax), robust job creation, and consistent population growth are the core engines driving real estate demand and long-term value.

Market in Balance: After a period of frenzy, the Texas market is stabilizing. Rising inventory and moderating price growth are creating a more rational environment, offering disciplined investors better entry points and more negotiating power.

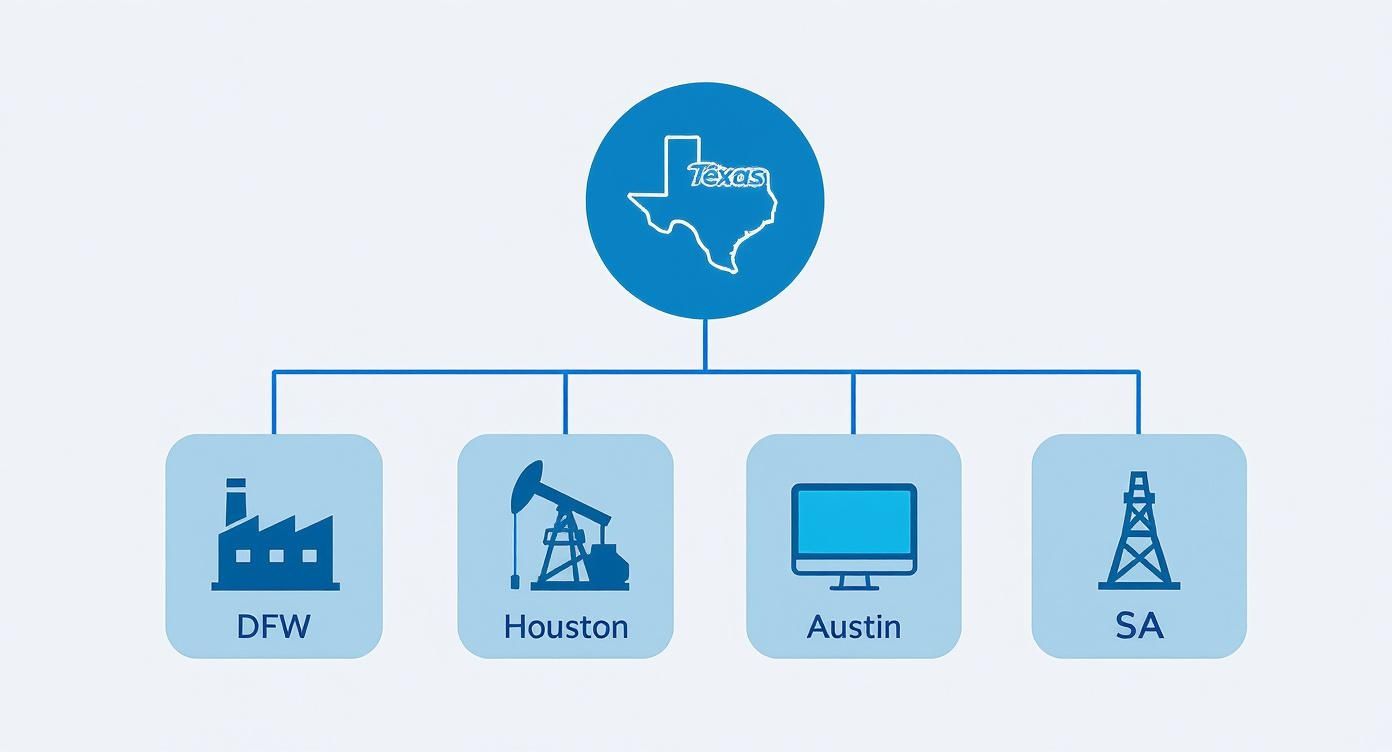

Know Your Metro: Investing in "Texas" is too broad. Success requires a nuanced strategy tailored to the unique economic drivers of its major hubs: Dallas-Fort Worth (logistics/corporate), Houston (energy/medical), Austin (tech), and San Antonio (military/tourism).

Structure is Key: For passive investors, partnering with an experienced sponsor through a real estate syndication provides access to institutional-quality deals, professional management, and risk-mitigation structures like preferred returns.

Unpacking the Texas Advantage for Real Estate Investors

The buzz around Texas real estate isn't a fleeting trend; it's grounded in powerful economic and demographic shifts. Think of it as a flywheel: major companies relocate to the state, creating high-quality jobs. These jobs attract a skilled workforce from across the country. This wave of new residents then requires places to live, shop, and work—fueling constant demand for multifamily, retail, and industrial space.

This virtuous cycle creates a resilient ecosystem for investors. Even when the national market cools, Texas often maintains its forward momentum.

The Core Drivers of Success

The state's success story is written in its numbers and policies. A few key factors work in concert to make Texas a premier destination for real estate capital.

Robust Economic and Population Growth: Texas consistently outpaces the national average in both job creation and population growth. This organic expansion is the primary engine driving real estate demand.

Business-Friendly Climate: With no state income tax and a streamlined regulatory environment, Texas signals a clear "open for business" message to corporate headquarters and major operations, ensuring a steady flow of economic activity.

Landlord-Friendly Legal Framework: The state’s laws generally favor property owners, providing clear and predictable rules for lease enforcement and property management—a significant advantage for rental property operators.

Relative Affordability: The cost of living and the price of real estate assets in major Texas cities remain attractive compared to coastal hubs like New York or California, allowing investment capital to go further.

Investor Takeaway: These fundamentals are the bedrock of long-term value. For investors, they translate directly into lower vacancy risk, strong potential for rent growth, and a deep pool of potential buyers at the time of exit.

The state’s housing market continues to demonstrate this strength. According to the Texas A&M Real Estate Research Center, 31,398 homes were sold across Texas in July 2025, accounting for 8.1% of all U.S. home sales that month. More telling, pending sales jumped 10.4% year-over-year, signaling continued strong buyer activity.

For investors comparing high-growth regions, our analysis of the best markets for real estate investment offers a wider perspective on why Texas consistently ranks at the top. This powerful combination of factors builds a compelling case for deploying capital in the Lone Star State.

Understanding Current Texas Market Dynamics

To make intelligent moves in Texas real estate, you must look beyond the headlines and understand what the data truly reveals. The market is not a monolithic entity; it's a dynamic system with rhythms and shifts that create openings for discerning investors. Getting this right is the difference between reacting to news and proactively identifying your next opportunity.

For instance, a headline about rising housing inventory might scare off an inexperienced buyer. But for a disciplined investor, that’s not a red flag—it’s a signal of opportunity. It indicates a market shifting from a frantic, seller-dominated environment toward a more balanced, rational landscape. This recalibration means more options, less competition from bidding wars, and increased negotiating leverage.

Interpreting Key Market Signals

It’s one thing to see the data; it's another to understand the story it tells. Let’s break down the core indicators and what they mean for your strategy.

Median Home Prices: Think of this as the market's pulse. When price appreciation moderates, it doesn't signal a dead market. It can indicate a healthy correction, preventing a bubble and providing a more stable entry point for your capital.

Active Listings & Inventory: A surge in listings—often measured in "months of inventory"—is a direct lever for buyer power. When inventory rises, supply is catching up with demand, which can cool rapid price hikes and provide the necessary time for thorough due diligence.

Days on Market (DOM): When the average DOM increases, properties are taking longer to sell. This often translates to more motivated sellers and a greater opportunity to acquire a property at or below the asking price—a significant advantage for value-add investors.

Market Signal Box: Q1 2025 Texas Snapshot

The data from Texas REALTORS® for the first quarter of 2025 shows this exact shift in action.

Source: Texas REALTORS®, as of Q1 2025.

Investor Take: The combination of nearly flat price growth and a massive 30.7% jump in inventory clearly indicates a market that is balancing. This isn't just a big-city phenomenon; the inventory increase was widespread, from Houston (+38%) to smaller markets like McAllen (+39%). This is precisely the kind of environment where disciplined, well-capitalized investors can uncover true value. For a deeper dive, explore the full Texas Q1 2025 housing market trends.

A Regional Breakdown of Key Texas Markets

Investing in "Texas" as a singular strategy is a novice mistake. The real opportunities are uncovered by drilling down into the state's distinct, powerhouse metropolitan areas. Each major Texas city possesses its own economic DNA, driven by different industries and demographic trends. A value-add multifamily strategy that excels in one metro might fall flat in another where ground-up industrial development is the superior opportunity.

Understanding these regional personalities is the first step toward deploying capital where it has the highest probability of success.

Dallas-Fort Worth: The Corporate and Logistics King

The Dallas-Fort Worth (DFW) Metroplex is a magnet for corporate headquarters and a critical hub in the national supply chain. Its central location and world-class infrastructure, anchored by DFW International Airport, make it an unbeatable location for logistics and distribution centers. This diverse economic base fuels relentless demand for multifamily housing to accommodate the steady influx of professionals.

Houston: The Energy and Medical Juggernaut

While known as the energy capital, Houston's evolution into a healthcare powerhouse is the real story. The Texas Medical Center, the largest medical complex in the world, provides a resilient, non-cyclical employment engine that balances the volatility of the oil and gas industry. This dual-engine economy creates a wide range of opportunities, from medical office buildings (MOBs) to residential properties catering to both energy and healthcare professionals.

Austin: The Unstoppable Tech Hub

Austin has long been the epicenter of the Texas tech boom, attracting top-tier talent and capital. This flood of high-income earners has historically driven real estate values to new heights. While the market has moderated from its recent frenzy, the core appeal remains. According to the Austin Board of REALTORS®, while July 2025 sales dipped slightly, pending sales in the Austin area surged by over 15% year-over-year, a clear signal of strong underlying buyer demand. To understand these local dynamics, review the Central Texas housing report. The continued business activity, evidenced by events like the Austin market launch event, points to sustained growth.

San Antonio: Stability in Military and Tourism

San Antonio offers a strategy built on stability rather than explosive growth. Its massive military presence provides a reliable economic foundation, while a thriving tourism and hospitality sector adds another layer of demand. This creates a dependable environment for investments like multifamily properties catering to military families and service-oriented retail, which are often less exposed to broader economic turbulence.

Comparison of Major Texas Investment Metros

This table offers a high-level comparison to help align a market's profile with your investment goals.

Novice Lens: Defining TermsAn investment "thesis" is your core strategy or belief about how you will make money in a particular market or with a specific asset. For example, your thesis might be "buy older apartment buildings near major DFW employers and renovate them to attract higher-paying tenants."

Choosing the right market comes down to matching its economic personality with your investment thesis.

Structuring Your Texas Real Estate Investment

Understanding the Texas economy is step one. The real value creation happens when you structure the investment—this is where market knowledge is translated into a tangible, working strategy.

Direct ownership offers total control but also total responsibility. Publicly-traded Real Estate Investment Trusts (REITs) offer liquidity but little say in specific assets. For many accredited investors, the most effective vehicle is partnering with an experienced sponsor in a real estate syndication.

Why It Matters: A syndication is like joining a professional team instead of competing solo. It provides immediate access to an experienced management team, institutional-quality deals you couldn't access alone, and the combined purchasing power of a group of investors.

A Deal Lens Example: The Value-Add Multifamily Play

Let's illustrate with a practical example. An experienced sponsor identifies a 100-unit, underperforming apartment complex in a growing Dallas suburb—a classic value-add opportunity.

Illustrative Capital Stack: * Total Project Cost (Acquisition + Renovation): $10 million * Senior Debt (Loan): $7 million (70%) * Investor Equity (LP Capital): $3 million (30%)

Preferred Return: To align interests, investors are offered an 8% preferred return. This means the first 8% of distributable cash flow goes to the limited partners (LPs) before the sponsor (the general partner or GP) receives any profit share. It's a critical structure that prioritizes investor capital.

Of course, sound legal footing is non-negotiable. Understanding the various real estate contracts is key to protecting your investment. To explore the debt portion of the deal, our guide to commercial real estate financing options for investors provides a comprehensive overview. This syndicated structure allows passive participation in large-scale commercial projects without the day-to-day operational burdens.

Your Due Diligence Checklist for Texas Properties

Knowing the market is one thing; properly vetting a specific deal is what separates sophisticated investors. A disciplined due diligence process is your primary defense against unforeseen risks and your key to confirming a genuine opportunity. It's about stress-testing the assumptions that underpin the entire investment.

This isn’t about finding a risk-free investment—they don't exist. It's about knowing exactly what you’re buying into.

Checklist: Questions to Ask a Sponsor

Market and Submarket Diligence

What are the specific job growth drivers within a 3- to 5-mile radius of the property?

What are the demographic trends (income, age, household formation) for this specific submarket?

What is the new supply pipeline for this asset class? How will new properties affect our projected rents and occupancy?

Sponsor and Operator Diligence4. Can you provide case studies of similar projects you've executed in this specific Texas submarket, including both successes and failures?5. How much of your own capital ("skin in the game") is being invested in this deal alongside the LPs?6. What is your communication and reporting protocol for investors during the hold period?

Deal-Level Diligence7. What are your key underwriting assumptions for rent growth, operating expense inflation, and exit capitalization (cap) rate?8. Can you provide a sensitivity analysis showing how returns are affected if rent growth is lower and the exit cap rate is higher than projected?9. What are your specific strategies for managing Texas's high property taxes and volatile insurance costs?10. Who are the key third-party partners (property manager, legal counsel, lender) on this deal, and what is your history with them?

Investor Takeaway: A sponsor’s projections for rent growth and the exit cap rate are two of the most powerful levers in any financial model. Ask them to show you a downside scenario. If the deal still works under conservative assumptions, you’ve likely found a resilient opportunity.

For a truly exhaustive breakdown, our guide offers a complete commercial property due diligence checklist for 2025.

Navigating Risks and Regulations in the Texas Market

Every prudent investment involves a clear-eyed assessment of potential risks. While Texas is rich with opportunity, a disciplined investor must understand and underwrite the unique challenges on the ground before committing capital.

Risk & Mitigation

Risk: High Property Taxes * The Challenge: Texas has no state income tax, but it compensates with some of the highest property tax rates in the nation. Underestimating this expense can severely impact cash flow. * Mitigation: Experienced sponsors build proactive tax protest strategies into their annual budgets, engaging specialized firms to challenge assessments and control costs. Ensure this is a line item in the pro forma.

Risk: Weather-Related Insurance Costs * The Challenge: From Gulf Coast hurricanes to North Texas hail storms, severe weather events can lead to high insurance premiums and significant deductibles. * Mitigation: Sophisticated operators secure layered insurance policies and, where prudent, make capital improvements to "harden" assets against storm damage (e.g., impact-resistant roofs), which can help manage long-term premium costs.

Investor Takeaway: Don't be mesmerized by the purchase price. The true performance of a deal is often determined by the management of operating expenses. A deal can look fantastic until aggressive property taxes or a surprise insurance hike erodes your net operating income. Ask sponsors exactly how they model and plan to mitigate these two critical expenses.

Smart risk management is not about avoiding risk entirely; it's about partnering with an operator who has a proven playbook for the specific economic and environmental pressures of the Texas market.

Your Texas Real Estate Investing Questions Answered

To conclude, let's address a few frequently asked questions from investors considering the Texas market.

Is Now a Good Time for Real Estate Investing in Texas?

While market timing is complex, the current Texas landscape presents a unique opportunity. We are seeing more inventory and a normalization of pricing, which provides disciplined buyers with greater negotiating leverage than they had in the recent past. Simultaneously, the powerful fundamentals driving Texas—population growth and job creation—remain robust. For long-term investors, today’s more balanced market can be an excellent entry point, particularly when working with an experienced team that can identify value.

What Are the Biggest Mistakes to Avoid When Investing in Texas?

The most common pitfalls include: 1) Underestimating property taxes and insurance costs, which can significantly erode cash flow. 2) Failing to conduct deep diligence on the specific submarket; a booming city doesn't guarantee success in every neighborhood. 3) Partnering with an inexperienced sponsor who lacks a proven local track record. Vetting the operator is as crucial as vetting the asset.

How Much Capital Do I Need to Start?

This depends entirely on your investment vehicle. Direct ownership of a commercial property often requires millions in equity. However, passive investing through a real estate syndication significantly lowers the barrier to entry. Accredited investors can often participate in institutional-quality deals with minimums typically ranging from $50,000 to $100,000, allowing for diversification across multiple assets and sponsors.

Which Property Type Is Best for Investing in Texas Right Now?

Multifamily and industrial properties continue to exhibit incredibly strong fundamentals, directly fueled by population growth and e-commerce logistics. Workforce housing, in particular, remains in high demand across all major metros as residents seek affordable, quality living. Ultimately, the "best" property type depends on your personal risk tolerance, time horizon, and portfolio goals—a critical discussion to have with your investment partners.

Ready to explore institutional-grade real estate opportunities in high-growth Texas markets? The team at Stiltsville Capital can help you navigate the landscape and identify investments aligned with your portfolio goals. Schedule a confidential call today to discuss your strategy.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments