Real Estate Investment Management: A Guide for Family Offices & Accredited Investors

- Ryan McDowell

- Nov 16

- 16 min read

Reading Time: 8 min | Good for: Novice & Informed Investors (Personas A, B)

Let's be honest, for most high-net-worth individuals and family offices, trying to invest directly in real estate can quickly turn into a second full-time job. It’s a demanding field that requires an almost obsessive level of market knowledge, operational savvy, and a huge time commitment—all things you’d probably rather spend on your primary business or with family. This is exactly where professional real estate investment management steps in, transforming a hands-on headache into a genuinely passive, institutional-quality investment.

TL;DR: Key Takeaways

What it is: Real estate investment management is the professional, end-to-end oversight of a property portfolio, from acquisition and underwriting to active management and disposition.

Who it's for: It serves family offices and accredited investors seeking passive exposure to institutional-grade real estate without the operational burden.

Why it matters now: As family offices increase allocations to private real estate for diversification and inflation hedging, disciplined management is critical to navigating a complex market and maximizing returns.

The Strategic Discipline of Real Estate Investment Management

Think of a real estate investment manager as the CEO of your property portfolio. Their job isn't just to cash rent checks. It's to quarterback a sophisticated business plan for every single asset, from the day it's acquired to the day it's sold. They are the critical link connecting your capital to the brick-and-mortar world of commercial real estate, making sure every move is aimed at hitting specific financial targets—whether that’s generating steady cash flow, building long-term appreciation, or preserving wealth for the next generation.

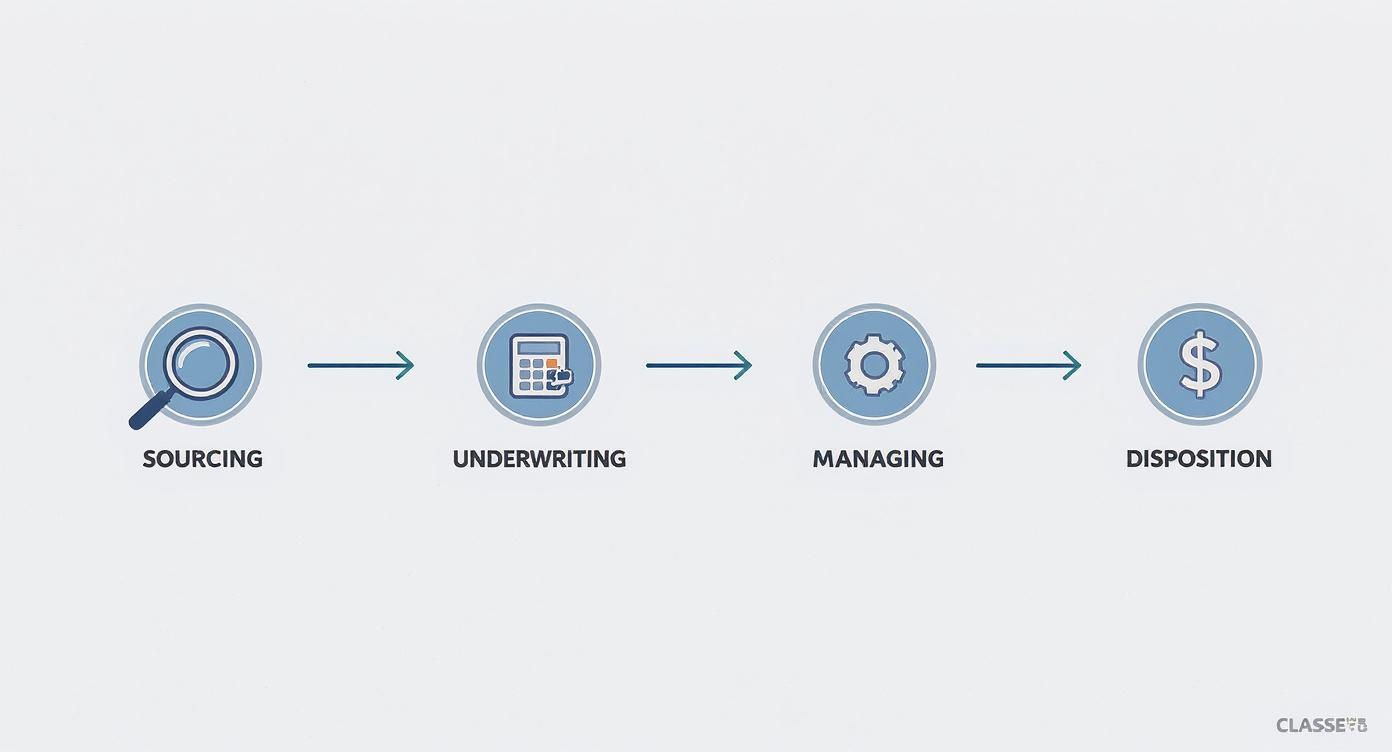

The Four Pillars of the Discipline

When you boil it down, this entire practice rests on four crucial pillars. Each one is a distinct phase of an asset's life and demands its own unique set of skills and a highly disciplined approach.

Sourcing & Acquisition: This is all about the hunt—identifying and locking down high-potential investment deals, often before they ever hit the public market.

Underwriting & Due Diligence: Here’s where the numbers get crunched. It involves intense financial modeling, deep market research, and kicking the tires with physical inspections to stress-test every assumption.

Active Asset Management: Once the deal closes, the real work begins. This is the hands-on implementation of the business plan, covering everything from renovations and operational tune-ups to leasing strategies and transparent investor reporting. For a deeper dive, check out our guide on real estate asset management best practices.

Disposition: This is the exit. It involves strategically timing the sale of the property to cash out at the right moment, maximizing returns and bringing the investment full circle.

Novice Lens: Why It MattersWithout a professional manager, you’re not really a passive investor—you’re a landlord. You're the one on the hook for everything from leaky toilets to labyrinthine financial reports. An investment manager takes all of that off your plate, letting you reap the rewards without the daily grind.

For more seasoned investors and family offices, the value is just as strong, but it shifts toward access. It’s about getting a seat at the table for institutional-grade deals you wouldn't otherwise see. It's about tapping into sophisticated financial models and an experienced team whose sole focus is flawless execution. Ultimately, it’s about using a sponsor’s expertise and network to build a smart, diversified portfolio of real assets that perfectly aligns with your long-term financial goals.

The Real Estate Investment Lifecycle: How Value is Created

Every successful real estate deal follows a disciplined path. It’s a journey that transforms an undiscovered opportunity into a profitable exit, and for a passive investor, understanding this process is everything. It shows you exactly how a skilled manager puts your capital to work to create value, step by step.

This isn’t about a single transaction. It’s a multi-stage process that demands deep expertise at every turn. This four-pillar flow shows the full journey, from finding a diamond in the rough to realizing its full potential.

As you can see, this is a structured, end-to-end process—not just a series of disconnected tasks.

Sourcing and Acquisition

It all starts with the hunt. The best managers don't just scroll through public listings. They tap into deep networks of brokers, lenders, and property owners to find off-market deals—opportunities the general public never even sees. We focus on these hidden gems in high-growth Sunbelt cities where strong demographic tailwinds create real demand. But it’s not just about finding any deal; it's about finding the right one. We’re looking for properties where value is just waiting to be unlocked, like a mismanaged apartment building with rents far below market or an old industrial site that’s perfect for adaptive reuse.

Underwriting and Due Diligence

Once we pinpoint a potential asset, it goes through a financial gauntlet called underwriting. This is where we stress-test the story against cold, hard numbers and worst-case scenarios.

Think of it this way: Underwriting is like the most intense home inspection imaginable, but for a multi-million dollar commercial property. We dig into every lease, maintenance record, and financial statement to build an ironclad projection of its future.

This phase is all about rigor and detail:

Financial Modeling: We project cash flows, map out potential rent growth, and forecast operating expenses and the final exit value.

Market Analysis: We dive deep to confirm local job growth, supply-and-demand fundamentals, and what comparable properties are renting for.

Physical Inspection: We walk the property to assess its condition, identify any deferred maintenance, and budget for every dollar of capital improvements.

Only the properties that survive this intense filtering process move forward. It’s this discipline that separates an institutional-grade opportunity from a speculative gamble.

Structuring and Capitalization

With a viable deal in hand, we shift to structuring the investment and raising the capital. This involves designing the capital stack—the specific mix of debt (a commercial mortgage) and equity (investor capital) needed to buy and improve the property. This is also when the legal framework gets built, usually through a private placement memorandum (PPM) that lays out the business plan, risks, and terms for our investors. The entire goal is to create a structure that perfectly aligns our interests as the General Partner with yours as the Limited Partner.

Market Signal BoxData Point: According to Preqin, private real estate funds globally were sitting on an estimated $418 billion in "dry powder" as of Q1 2024.Interpretation: Despite a slower transaction market, significant institutional capital remains committed to real estate, indicating long-term confidence from sophisticated investors.Investor Take: For passive LPs, this means that experienced sponsors with strong deal flow can still execute on compelling opportunities, even in a challenging capital environment.

Active Asset Management

This is where the real work begins. The active asset management phase is the longest and most critical part of the lifecycle—it’s where we execute the business plan and bring our vision to life. This is all about the hands-on work of increasing the property’s value and its net operating income (NOI).

For a value-add apartment project, that means we get to work:

Executing Renovations: We’re upgrading kitchens, bathrooms, and common areas to command higher rents.

Optimizing Operations: We bring in new management software, find ways to cut utility costs, and renegotiate contracts with vendors.

Strategic Leasing: We market the newly improved units to the right tenants and strategically push rents to true market levels.

This is the roll-up-your-sleeves stage that directly drives investor returns.

Reporting and Disposition

Throughout the hold period, you are never in the dark. We believe in total transparency, so our investors receive regular, detailed reports on financial performance, renovation progress, and what’s happening in the local market.

The final stage is disposition—the sale of the asset. A smart manager knows how to time the exit to take advantage of market tailwinds and maximize profits for everyone. It involves marketing the newly stabilized, higher-value property to the next buyer, closing the sale, and distributing the profits back to our investors.

Want to go deeper on this final step? Check out our guide to real estate investment exit strategies.

Key Metrics That Measure Investment Success

To really manage a real estate investment well, you need a clear way to keep score. Financial metrics are the language we speak in this industry, turning complex deals and market swings into straightforward, comparable numbers. Getting a handle on these key figures is critical for any investor, whether you're just getting started or you're managing a multi-generational family office portfolio.

Think of it like planting a fruit tree. You want to know more than just if it will grow. You need to know how much fruit it will produce (cash flow), how much the tree itself will be worth when you sell it (appreciation), and how quickly you get your initial investment back (velocity of capital). The core metrics in real estate investment management answer these exact questions.

Unpacking The Core Three Metrics

While dozens of data points go into any institutional-grade underwriting, three metrics consistently rise to the top. They give you a panoramic view of an investment's potential.

Internal Rate of Return (IRR): This is the big one, the most holistic metric of them all. It tells you the annualized rate of return on your money, but its real power is that it accounts for the time value of money. In simple terms, it knows a dollar today is worth more than a dollar five years from now. A higher IRR means your capital is working harder and more efficiently over the life of the deal.

Equity Multiple (EM): This one is much more intuitive. It answers a simple question: "For every dollar I put in, how many will I get back?" An Equity Multiple of 2.0x means you doubled your money, plain and simple. It’s a powerful way to gauge total profit, even though it doesn't factor in how long it took to get there.

Cash-on-Cash Return (CoC): This metric is all about the here and now. It measures the annual cash flow the property kicks off relative to the actual cash you invested. It’s the clearest indicator of an investment’s income-generating power while you own it. For investors focused on income, unlocking rental property cash flow is the name of the game.

To help clarify how these metrics serve different needs, here’s a simple breakdown:

Key Performance Metrics Explained

Metric (Abbreviation) | Simple Explanation (For Novice Investors) | Technical Application (For Sophisticated Investors) |

|---|---|---|

Internal Rate of Return (IRR) | Your investment's average annual "speed" of growth. Higher is better and faster. | A discount rate that makes the Net Present Value (NPV) of all cash flows equal to zero; essential for comparing projects with different timelines and cash flow patterns. |

Equity Multiple (EM) | The "total distance" your money traveled. Did you double it (2.0x) or triple it (3.0x)? | A gross measure of return that calculates total cash distributions divided by total equity invested. Useful for assessing capital appreciation but blind to the holding period. |

Cash-on-Cash (CoC) | The "fuel efficiency" of your investment. How much cash does it generate each year? | The annual pre-tax cash flow (NOI minus debt service) divided by the total cash invested. A key metric for evaluating current income and operational efficiency. |

A great investment performs well across the board, giving you speed, distance, and efficiency.

Advanced Lens: Stress Testing for Sophisticated InvestorsFor family office CIOs and investment committees, the base-case numbers are just the opening act. The real discipline comes from sensitivity analysis—stress-testing financial models against the unexpected. We ask tough "what if" questions: What happens to returns if interest rates jump 1%? How does a 5% haircut on projected rent growth ripple through the final sale price? What if construction costs blow the budget by 10%? By modeling these downside scenarios, we spot vulnerabilities early and build in protections, ensuring investments are built to withstand market turbulence, not just thrive when the sun is shining.

This rigorous approach is what separates speculative hope from a disciplined, institutional strategy built for long-term wealth preservation and growth. To go even deeper, check out our full guide on decoding asset management performance metrics for the complete picture.

Core Strategies in Modern Real Estate Investing

In real estate, just buying a good property isn’t enough. True success comes from having the right game plan. A savvy manager knows how to pick a strategy that fits the property's potential, the current market, and what investors are looking for. Think of it like a spectrum of risk and return. Knowing where a deal falls on that spectrum is key to deciding if it's the right fit for your family office, whether you're after steady cash flow or more aggressive growth. For many, that sweet spot is the value-add approach.

The Power of the Value-Add Strategy

The value-add strategy is the real workhorse of private equity real estate. It’s all about finding properties with solid foundations but some correctable flaws, either physical or operational. Imagine finding a C+ building in an A- neighborhood and executing a clear plan to bring it up to a B+ asset. This is more than just a quick paint job. A real value-add play involves a smart mix of targeted capital improvements and sharper, more professional management. A big part of that today is optimizing income, which makes understanding the core strategies for revenue management in rental properties absolutely essential.

Investor Takeaway: The goal here is to force appreciation. You’re not just sitting back and hoping the market lifts your property’s value. The manager is actively creating new value through direct action, boosting the Net Operating Income (NOI) and, in turn, the property’s overall worth.

These types of deals usually have a holding period of 3 to 7 years. They target higher returns than a stabilized, "core" property to make up for the moderate risk involved in getting the work done.

Deal Lens Example: A Sunbelt Multifamily Transformation

Let’s make this real. Here’s a simplified, illustrative look at a value-add play on a 150-unit apartment community in a booming Sunbelt city.

The Opportunity: We find an apartment complex built in the 1990s. Great location, but the interiors are tired and the management is asleep at the wheel. As a result, rents are a full 20% below what renovated units nearby are getting.

The Business Plan: Over the next 24 months, we’ll systematically renovate 75% of the units as leases expire. We’re talking new countertops, stainless steel appliances, and modern flooring. At the same time, we'll give the curb appeal a lift by upgrading the pool area and clubhouse.

Operational Lift: We bring in a professional third-party management team. Their job is to improve leasing, cut down on tenant turnover, and roll out a utility bill-back program to capture revenue that was being left on the table.

The Result (Illustrative): Once the renovation plan is complete, the property can command full market-rate rents, which gives the NOI a serious boost. We’ve turned an underperforming asset into a desirable, stabilized community—creating a fantastic opportunity to sell to a long-term, buy-and-hold investor, potentially achieving a 1.8x - 2.2x equity multiple.

This hands-on approach directly manufactures new equity and creates a very clear path to a profitable exit.

Exploring Opportunistic Strategies

Moving further down the risk-return spectrum, you'll find opportunistic strategies. These are the high-stakes plays that come with the highest potential returns, often targeting an IRR of 20% or more. Opportunistic investing isn’t about minor fixes; it's about complete transformation. Some classic examples include:

Ground-Up Development: Building a brand-new property from a plot of dirt, which involves navigating entitlements, zoning, and all the risks of construction.

Adaptive Reuse: Giving a building a new life by converting its use—think turning an old warehouse into cool loft apartments or a vacant big-box store into a medical center.

Major Repositioning: A full gut-renovation of a property that's become obsolete or needs a massive capital injection to compete in the modern market.

These projects demand longer timelines and deep, specialized expertise to pull off. They’re best for investors with a higher risk tolerance and a long-term view, who might allocate a smaller slice of their portfolio to these high-growth scenarios.

One exciting trend in this space is modular construction. Building sections of a property off-site can slash waste and construction timelines. It's not only a greener approach but also helps de-risk the project schedule—a modern answer to some of development's oldest challenges.

Mastering Risk Management and Due Diligence

Let's be clear: every investment has risk. The goal in professional real estate isn't to pretend risk doesn't exist—it's to get really good at spotting it, pricing it into the deal, and actively managing it down. This is the chasm that separates institutional-grade strategy from a speculative gamble. If you're building a serious real estate portfolio, understanding this framework is non-negotiable.

The primary risks in private real estate deals boil down to a few key areas, and thankfully, each has a set of proven tactics to keep them in check.

Risk & Mitigation Framework

Market Risk: The risk of a broad economic downturn, interest rate spikes, or local market decline impacting property values and rental demand. * Mitigation: Geographic diversification across high-growth markets; conservative underwriting that stress-tests for downturns; focusing on resilient asset classes like workforce housing.

Execution Risk: The risk that the specific business plan fails due to construction delays, budget overruns, or leasing shortfalls. * Mitigation: Partnering with an experienced sponsor with a proven track record in that exact strategy; building budget and timeline contingencies; rigorous project management.

Liquidity Risk: The risk that you cannot access your invested capital quickly, as private real estate is an illiquid asset. * Mitigation: Aligning investment with long-term capital; clear communication on the expected 3-7 year hold period; structuring deals with potential for earlier refinancing distributions.

While you can't stop a recession, a sharp manager can build a defense. According to a recent global real estate outlook from UBS (as of May 2024), while global investment has faced headwinds, there are signs of capital value stabilization, indicating a fragile but real recovery. This underscores the need for selective, well-managed strategies.

Your Diligence Checklist: Questions to Ask a Sponsor

What’s your specific track record with this exact asset class and strategy? Can you share case studies of both wins and losses?

How much of your own capital ("skin in the game") are you co-investing in this deal alongside LPs?

What are the most critical assumptions in your financial model (e.g., rent growth, exit cap rate, occupancy)?

Show me your sensitivity analysis. How do returns hold up in a recessionary or rising-rate scenario?

Who are your key partners—lenders, contractors, property managers—and what is your history with them?

How do you source your deals? What percentage are off-market versus broadly marketed?

What is your communication and reporting protocol during the hold period?

What do you see as the single biggest risk in this deal, and what is your specific plan to manage it?

How Private Real Estate Investments Are Structured

When you invest passively in a real estate deal, you aren't just handing over a check; you're stepping into a carefully designed legal and financial partnership. Understanding this structure is everything, because it’s built to align everyone’s interests and protect all parties involved. For most accredited investors and family offices, the on-ramp to these deals is a private placement, typically following SEC rules known as Regulation D.

The General Partner and Limited Partner Relationship

Think of a private real estate deal like a well-organized expedition. You have an experienced guide leading the way and a group of backers who fund the journey.

The General Partner (GP): This is the manager or sponsor—the expert guide. The GP (like Stiltsville Capital) handles all the heavy lifting: finding the property, underwriting it, managing the day-to-day operations, and executing the business plan. They shoulder the operational burden and make the critical decisions.

The Limited Partners (LPs): These are the investors. LPs provide the lion’s share of the equity needed to get the deal done. In return, they get ownership in the property and a slice of the profits, all with limited liability and zero management headaches.

This GP/LP structure is most often set up as a Limited Liability Company (LLC). The growing demand for this kind of professional oversight is staggering; see for yourself in the data about this growth on McKinsey.com.

Creating Alignment with Prefs and Promotes

So, how do you make sure the GP is laser-focused on the LPs' success? It all comes down to how the profits are split, using a model that puts investors first.

Key Takeaway: The structure of a deal is just as important as the property itself. A well-designed agreement ensures the manager only wins big when the investors win first.

First, investors receive a preferred return, or "pref." This is a hurdle rate—often 6-8% annually—that LPs must be paid before the GP earns any performance-based fees. It’s a simple, powerful tool that prioritizes the return of your initial capital plus a solid return.

Once that preferred return is paid, any remaining profits are split. A portion goes back to the LPs, and the GP receives a promote, also known as carried interest. This is the GP’s reward for a job well done—a share of the profits earned above and beyond the investor hurdle. It's a powerful incentive that ensures everyone is rowing in the same direction.

Answering Your Top Questions (FAQ)

Stepping into the world of private real estate always brings up a few questions, even for seasoned investors. Here are some straightforward answers to the things we're asked most often.

What’s the Typical Buy-In for a Private Real Estate Deal?

The minimum investment really depends on the sponsor and the specifics of the deal. For most accredited investors looking to participate, the entry point usually falls somewhere between $50,000 and $250,000. If you're a family office or a larger investor looking to take a more significant position, like a direct investment or a co-GP stake, you'll often see minimums starting around $1 million and going up from there.

How Does Liquidity in Private Deals Compare to Public REITs?

This is probably the biggest difference, and it all comes down to the holding period. Private real estate is an illiquid investment by design, with a business plan that typically plays out over 3 to 7 years. You can't just log in and sell your shares tomorrow like you can with a publicly traded REIT on the stock market. Your capital is tied to the physical asset until the sponsor executes a sale or a major refinancing event. That trade-off—swapping daily liquidity for potentially higher, non-correlated returns—is at the very heart of private real estate investing.

What Are the Main Fees I Should Expect to See?

A good sponsor makes the fee structure crystal clear so everyone's incentives are aligned. In any deal's offering documents, you'll typically see a few key fees:

Acquisition Fee: This is a one-time fee for all the legwork involved in finding, negotiating, and closing the deal. It's usually around 1-2% of the property’s purchase price.

Asset Management Fee: Think of this as the ongoing oversight fee for executing the business plan—managing renovations, leasing, and operations. It’s an annual fee, typically 1-2% of the equity you’ve invested.

Promote/Performance Fee: This is the sponsor's share of the profits, but it only kicks in after investors get their initial capital back, plus a preferred return. It’s the ultimate "we win when you win" fee.

How Do I Know the Sponsor's Interests Are Aligned with Mine?

True alignment isn't just a talking point; it's built right into the deal's DNA. The most obvious sign is when sponsors put their own money on the line through co-investment. When we have our own capital at risk right alongside yours, our interests are naturally synced up. Beyond that, the promote structure is a huge factor. The sponsor doesn't see a significant share of the profits until every investor has hit their preferred return threshold. It’s an "investors-first" waterfall that keeps everyone laser-focused on a successful outcome for the property.

Well-structured real assets can be a prudent, resilient component of a long-term wealth strategy. While risks like illiquidity and market shifts are real, partnering with a disciplined sponsor who emphasizes conservative underwriting and clear alignment can provide a powerful path to diversification and growth.

Ready to explore how a disciplined approach at Stiltsville Capital can fit within your family's long-term wealth strategy? Schedule a confidential call with our team to discuss your goals and our current offerings.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments