A Guide to Real Estate Investment Exit Strategies for the Savvy Investor

- Ryan McDowell

- Aug 27

- 14 min read

Reading Time: 8 min | Good for Audiences: A, B

Ask any seasoned real estate investor a secret to their success, and they'll tell you something that sounds backward at first: while the profit is locked in when you buy, it's realized when you sell. A well-crafted exit strategy isn't just the last step—it's the engine that powers your returns, designed from day one.

TL;DR: Key Exit Strategy Takeaways

Plan Your Exit First: Your exit strategy is not an afterthought; it should be an integral part of your initial underwriting that guides every decision, from capital improvements to financing structure.

Match the Strategy to the Goal: Whether you need immediate liquidity (Outright Sale), want to compound wealth tax-efficiently (1031 Exchange), or unlock equity while retaining a cash-flowing asset (Refinance & Hold), the right strategy aligns with your specific capital goals.

Market Timing is Critical: The optimal exit is a disciplined decision made at the intersection of your personal goals, the asset's performance, and favorable market conditions, such as lower interest rates and strong buyer demand.

Why Your Exit Is As Important As Your Entry

Too many investors get tunnel vision on the acquisition. While finding the right asset at the right price is critical, it’s only half the game. Without a clear plan for disposition, even the most promising deal can fall short of its potential returns.

Think of it like a pilot filing a flight plan before takeoff. Your exit strategy guides every decision you make during the hold period, from which capital improvements to prioritize to how you structure leases and when you time a refinance.

This forward-thinking isn't just a good practice; it's the standard for institutional-grade investors. An analysis by the Exit Planning Institute highlighted that about 73% of privately held U.S. companies, including countless real estate holding companies, are expected to change hands in the coming decade. This shift represents a massive $14 trillion market opportunity (as of 2023) for those with a plan. Experts recommend mapping out your exit 3 to 10 years in advance to maximize value. Learn more about the importance of long-term exit planning on primior.com.

Core Exit Philosophies

Every real estate exit falls into one of three core buckets, each serving a different purpose for your capital. Understanding these is the first step to aligning an asset with your broader financial objectives.

Realize Profits (The Sale): This is the most straightforward play. You're simply cashing out, converting the property's appreciated value into liquid cash by selling it on the open market.

Retain and Recycle (The Refinance): This approach lets you pull equity out of a property without selling it. You keep the asset and its cash flow in your portfolio but free up capital to hunt for new deals.

Reposition and Defer (The Exchange): For investors focused on scaling and tax efficiency, strategies like a 1031 Exchange are a game-changer. They let you roll the proceeds from one sale directly into another, deferring capital gains tax and compounding your wealth.

The right move always comes down to your financial goals, the asset's performance, and prevailing market conditions. A strategy that maximizes cash today might not be the smartest for building long-term, tax-efficient wealth.

Investor Takeaway: Viewing the exit as a core part of the investment lifecycle—not just an afterthought—is what separates institutional discipline from speculative gambling. Your exit plan is the framework that helps you navigate market cycles and make smart, data-driven decisions that protect and grow your capital.

Quick Guide to Real Estate Exit Strategies

This table breaks down the main exit strategies, what they're designed to accomplish, and the market conditions where they tend to shine.

Strategy | Primary Goal | Best For |

|---|---|---|

Outright Sale | Maximize immediate profit and liquidity. | Capturing peak market value; freeing up capital for diversification; exiting a non-core asset. |

Refinance & Hold | Unlock equity while retaining ownership and cash flow. | Long-term wealth compounding; funding new acquisitions without selling existing assets. |

1031 Exchange | Defer capital gains tax to grow a portfolio's scale. | Investors actively scaling their real estate holdings in a tax-efficient manner. |

Recapitalization | Bring in new partners to buy out existing ones or fund growth. | Restructuring ownership; providing partial liquidity to LPs; injecting fresh capital into a deal. |

As you can see, each strategy is a tool for a specific job. Now, let’s explore how to decide which one is the right tool for your deal.

The Classic Profit Realization: The Outright Sale

For many investors, the outright sale is the endgame. It’s the clean break where all your hard work and paper gains turn into actual, liquid capital.

This is the most direct way to achieve liquidity. You’re converting an illiquid asset—the building—into cash you can deploy elsewhere. That could mean rolling it into a new deal, diversifying your portfolio, or funding personal financial goals. The principle is simple: buy low, sell high. But achieving a premium price is all about strategy—timing, positioning, and knowing your market inside and out.

A smart sale involves a calculated effort to showcase the property's peak potential, backed by solid numbers. This means timing the sale to catch market tailwinds, like low interest rates and strong buyer demand, which can compress capitalization (cap) rates and drive your final price higher.

Maximizing Value Before the Sale

A successful sale begins years before you list the property. It’s the culmination of executing the business plan you laid out at acquisition.

For a value-add deal, this means you've completed all planned upgrades—new kitchens, a modern gym, updated systems—and can prove they've increased rental income. That proven Net Operating Income (NOI) is the foundation of your property’s valuation.

Key steps to prepare an asset for a premium sale:

Curb Appeal and Deferred Maintenance: Address all deferred maintenance. Present a turnkey asset; first impressions significantly impact a buyer's offer.

Lease Optimization: Bring all leases to current market rates with creditworthy tenants. Staggering expiration dates is a pro move—it minimizes rollover risk for the next owner, making the asset more attractive.

Pristine Financials: Prepare a clean, organized, and transparent due diligence package with detailed financial statements, rent rolls, and records of all capital expenditures.

Why It Matters (For Novice Investors): Think of it like prepping a classic car for auction. You don't just roll it out of the garage. You detail it, tune the engine, and have every service record ready. In real estate, the "detailing" is your finished renovations, and the "service records" are your clean financials. This preparation proves the asset’s performance and commands a higher price.

Deal Lens Example: A Value-Add Multifamily Sale (Illustrative)

Let's walk through a simplified case to see how this plays out. Imagine a 100-unit multifamily property acquired for $10,000,000.

Acquisition & Plan: A sponsor identifies an underperforming property with dated units and below-market rents. The business plan allocates a $1,500,000 capital improvement budget ($15,000/unit) over two years to renovate apartments and common areas.

Execution: Over the next 24 months, the sponsor renovates units as they turn over. These upgrades allow them to increase average monthly rents from $1,000 to $1,350, directly boosting the property’s Net Operating Income (NOI).

The Exit: After three years, the property is stabilized, the improvements have proven their ROI, and the sponsor sees the market hitting a peak. It's time to sell. The now-premium asset generates significant buyer interest.

The Sale: The property sells for $15,500,000. After accounting for the initial purchase price and renovation costs (total cost basis of $11,500,000), the sale generates a $4,000,000 gross profit. This clean exit delivers a strong Internal Rate of Return (IRR) to investors and crystallizes the value created.

This disciplined approach is the hallmark of institutional real estate investment. Funding such improvements often involves sophisticated financing. To understand how more complex capital stacks work, explore our **guide to mezzanine debt funds for sophisticated investors**.

Unlocking Equity Without Saying Goodbye: The Refinance & Hold

What if you could pull value out of a property without ever putting a "For Sale" sign in the yard? A straight-up sale provides liquidity, but it also means letting go of a cash-flowing asset and its future appreciation.

For investors building generational wealth, the goal isn't just to exit a single deal. It’s about using one great deal as a launchpad for the next. This is precisely where the 'Refinance and Hold' strategy shines.

Instead of selling, you retain the asset and simply extract the equity you’ve worked to create. It's a savvy move that turns one successful investment into a powerful engine for growing your entire portfolio.

The BRRRR Method: A Framework For Compounding

One of the most popular frameworks for this strategy is the BRRRR method: Buy, Rehab, Rent, Refinance, Repeat. It's a disciplined, five-step cycle designed to systematically grow a real estate portfolio.

This 'Refinance and Hold' approach is a go-to for investors focused on lasting passive income. Unlike a sale that creates a one-time taxable event, refinancing keeps the cash flow coming while letting you recycle your equity to acquire more properties. It's a structured way to scale. You can learn more about how sophisticated investors use this to scale their portfolios with Global Vacation Rentals.

How it works on the ground:

Buy: Acquire an underperforming property with significant upside potential.

Rehab: Execute a smart renovation plan to force appreciation, bringing the property's condition well above the market standard.

Rent: Place qualified tenants at the new, higher market rent to stabilize income.

Refinance: This is your "exit." You take the stabilized, higher-value asset to a lender and secure a new, larger loan based on its After-Repair Value (ARV).

Repeat: Use the tax-free cash pulled out from the refinance as the down payment on your next acquisition, starting the cycle again.

Why It Matters: The cash-out refinance is the secret sauce. Because the funds you receive are a loan, it's considered debt, not income—meaning it's not a taxable event. This provides a massive capital boost to grow your portfolio without the tax drag of a sale, a huge advantage for compounding wealth.

When To Choose The Refinance And Hold Strategy

This play isn't for every property. It shines under the right conditions and for investors with a long-term vision.

It's the perfect move when:

You're in a Favorable Interest Rate Environment: Low rates are your best friend, keeping your new mortgage payment manageable and protecting cash flow.

The Property Has Strong Long-Term Prospects: The asset is in a market with solid fundamentals like job and population growth, ensuring future demand and rent appreciation.

Your Goal Is Long-Term Wealth Creation: You're more interested in building a portfolio of cash-flowing assets than realizing a one-time gain.

However, this strategy isn't without risk. You are increasing leverage on the property, which can squeeze cash flow if you face unexpected vacancies or capital expenditures. It demands sharp underwriting and a rock-solid understanding of debt markets.

Advanced Strategies for Tax Efficiency and Flexibility

For sophisticated investors, the exit is a strategic capital reallocation. Beyond a straightforward sale or refinance, a toolbox of more complex strategies exists to maximize tax efficiency and unlock portfolio growth.

These advanced maneuvers can turn a single asset's disposition into a powerful tool for scaling, generating new income streams, or restructuring a partnership. They demand more expertise, but the payoff in net returns can be substantial.

The 1031 Exchange: Defer, Compound, Repeat

The 1031 Exchange is one of the most powerful tax-deferral tools available to a real estate investor. Named after Section 1031 of the U.S. Internal Revenue Code, it allows you to sell an investment property and roll 100% of the proceeds into a new "like-kind" property, deferring the capital gains tax liability.

This isn't tax avoidance; it's tax deferral. You're letting your entire pre-tax gain continue to work for you, compounding in a new, larger, or better-performing asset. For investors focused on scaling, this is a cornerstone strategy.

Investor Takeaway: A 1031 Exchange lets you leverage your entire pre-tax gain to acquire a larger or better-performing asset. Over multiple transactions, this tax-deferred compounding can result in a portfolio that is substantially larger than one grown with after-tax dollars.

The 1031 Exchange comes with notoriously strict rules and tight deadlines. To dive deeper, see our comprehensive **guide to deferring taxes and compounding real estate wealth with the 1031 Exchange**.

Seller Financing: Creating Your Own Note

Another flexible move is seller financing (or a seller-carry). Instead of the buyer obtaining a bank loan, you, the seller, become the bank. The buyer makes mortgage payments directly to you over an agreed-upon term and interest rate.

This strategy offers two key advantages:

A Wider Buyer Pool: By offering to finance the deal, you can attract buyers who might not qualify for a traditional bank loan, boosting demand and helping you achieve your asking price.

A Stable Income Stream: You convert a lump-sum equity payout into a predictable stream of monthly cash flow, secured by an asset you know intimately.

Partnership Buyouts and Recapitalizations

Sometimes, the best exit doesn't involve selling the property at all; it's about restructuring ownership. A recapitalization is where you bring in a new capital partner to either buy out an existing partner's share or inject fresh capital to fund a new business plan.

This is a go-to strategy in joint ventures where one partner needs a liquidity event, but others want to hold the asset through its next phase. It provides an exit for some investors while allowing the deal to live on, often with a renewed vision and a stronger capital position.

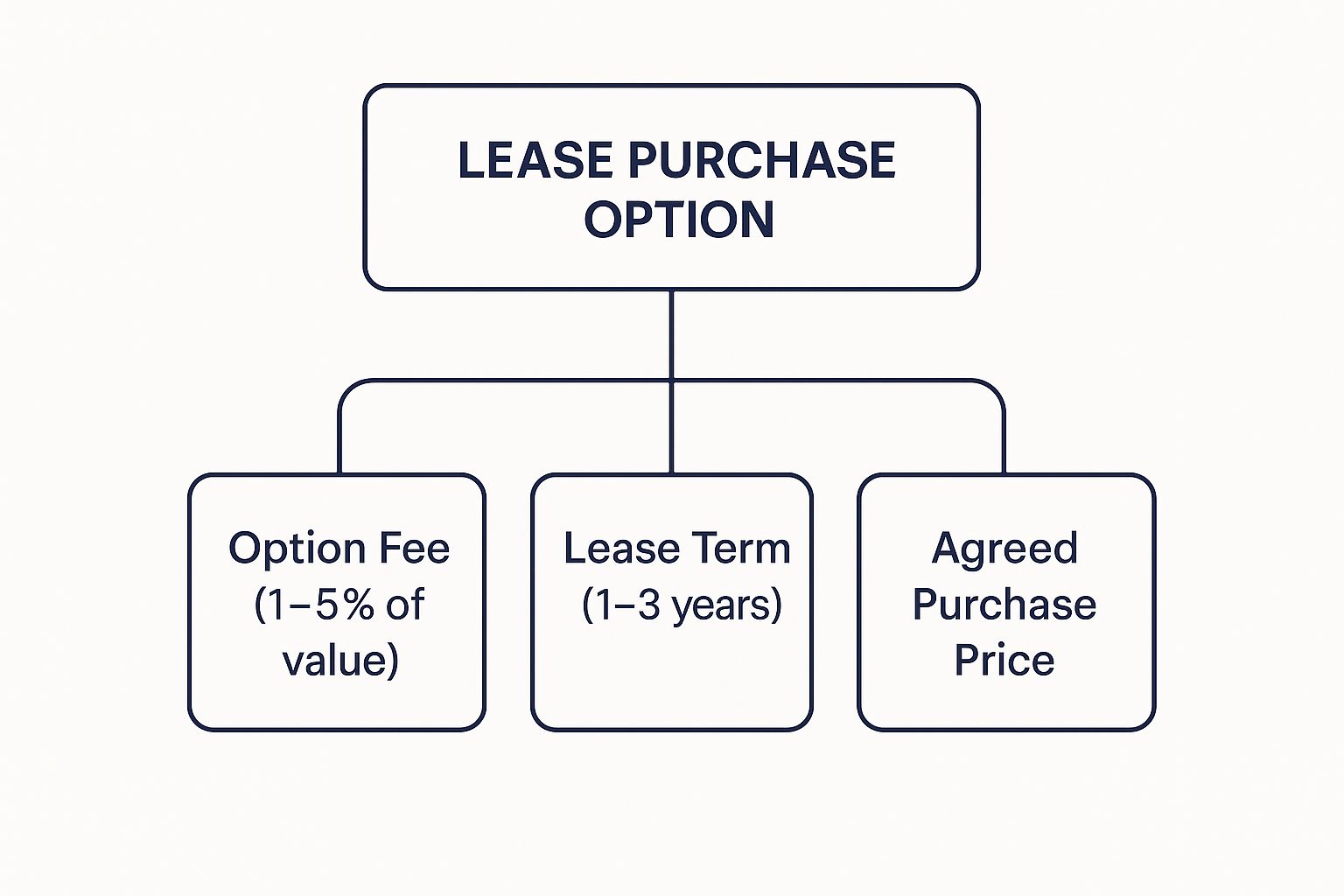

The diagram above illustrates a Lease Purchase Option, a hybrid strategy that can be used in certain situations, blending elements of leasing and selling.

Comparison of Advanced Exit Strategies

Here's a comparison to help sophisticated investors evaluate these advanced exit strategies based on key financial and operational factors.

Strategy | Tax Impact | Liquidity | Complexity Level | Ideal Scenario |

|---|---|---|---|---|

1031 Exchange | Capital gains taxes are deferred. | Low; capital is tied up in a new property. | High; strict IRS rules and timelines. | An investor wants to scale up their portfolio tax-efficiently. |

Seller Financing | Gains are recognized over time as payments are received. | Moderate; provides cash flow, not a lump sum. | Moderate; requires legal and underwriting expertise. | The seller prioritizes income over a lump sum; the buyer pool is limited. |

Recapitalization | Varies by deal structure; can provide partial tax-deferred liquidity. | Partial; allows existing LPs to cash out. | High; involves complex legal and financial structuring. | A partner needs an exit, but the asset has further upside. |

Each path offers a unique blend of benefits and challenges, shifting the focus from a simple "sale" to a strategic financial decision.

How to Choose Your Optimal Exit Strategy

There is no magic formula for the perfect exit. The right strategy is a custom plan shaped by your financial situation, the specific asset, and the ever-changing market. A disciplined decision rests on three critical pillars.

Your choice of exit comes down to your primary objective. Are you seeking a lump sum for a new venture? Or is your goal to build a legacy portfolio that generates income for years to come? The answer will point you toward the most logical path.

Balancing Your Goals, Asset, and Market

The best exit lies at the intersection of your personal needs, the property's performance, and the broader economic picture.

Your Personal Financial Goals: This is the starting point. What does your family office or personal balance sheet require? If you need immediate liquidity, a sale makes sense. If you're playing the long game for wealth preservation, a 1031 exchange or a strategic refinance is likely a better fit.

Asset Performance & Potential: Is your property a stabilized asset churning out predictable income, or an appreciation play where you've already maximized value? A high-performing asset in a great location is a prime candidate to hold and refinance. An asset that has met its business plan targets is ready for a profitable sale.

Market & Economic Conditions: You must respect the macro environment. Interest rates, local supply and demand, and cap rate trends can make or break your exit. It’s always better to sell into a strong market, but refinancing becomes more challenging when rates are climbing.

The global economic climate plays a huge part. For instance, according to a mid-2024 report from Knight Frank, Europe led a 56% quarterly increase in commercial real estate M&A activity, signaling a return of investor confidence after a period of rate-induced slowdowns. Timing your exit to catch these waves of opportunity is crucial.

Investor Checklist: Questions to Ask Before an Exit

To cut through the complexity, every investor should run through these key questions. While some seem simple, they can be tough to answer, especially when you're navigating turbulent waters in commercial real estate.

Use this checklist to guide your thinking:

Capital & Liquidity Needs: What are my true capital needs over the next one, five, and ten years?

Tax Implications: Have I consulted a tax professional to model the after-tax proceeds for each exit option?

Asset Upside: Is there still achievable upside left in this property, or have we captured the majority of the value?

Reinvestment Opportunities: If I sell, do I have a compelling replacement investment identified?

Market Timing: Based on current data, are we in a seller's market or a buyer's market for this asset class and location?

Debt & Financing: What are my current loan's prepayment terms? What do today's interest rates look like for a refinance?

Risk Tolerance: How does selling this asset change my portfolio's overall risk profile compared to holding it?

Long-Term Vision: Does this property still fit into my core wealth-building strategy, or have my goals shifted?

Your Top Questions About Real Estate Exits, Answered

Even with a solid game plan, navigating real estate investment exit strategies can be tricky. Let's tackle some of the most common questions we hear from investors.

How Early Should I Plan My Exit?

The short answer? Before you even buy the property.

Your exit strategy is a non-negotiable part of the initial underwriting process. It shapes what you're willing to pay, your renovation budget, and the entire business plan for the asset.

Detailed tactical planning should begin 3 to 5 years before your planned disposition. This provides a sufficient runway to optimize the property's performance, complete capital projects, and position it to command the highest possible price when you go to market. This long-range view gives you the flexibility to be patient and avoid a forced sale during a downturn.

What's the Biggest Mistake Investors Make with Exits?

Hands down, the most common and costly mistake is failing to have a clear, disciplined exit plan from day one. A reactive, “wait-and-see” approach almost always leads to emotional decisions and accepting a suboptimal deal under pressure. Without a strategy, you miss crucial prep work, your financials may be disorganized, and you could completely miss the window of peak market conditions.

Investor Takeaway: A disciplined investor knows their exit criteria before it's time to act. This means setting a target sale price, a minimum Internal Rate of Return (IRR), or identifying the specific market signals that will trigger a disposition.

How Do Rising Interest Rates Affect My Options?

Rising interest rates are a headwind for nearly every exit strategy, making timing critical.

For an Outright Sale: Higher rates mean borrowing is more expensive for buyers. This can shrink the qualified buyer pool and put downward pressure on pricing, as they must factor higher debt service into their underwriting.

For a Refinance: Higher rates mean your new loan is more expensive. This reduces your monthly cash flow and often limits the amount of equity you can extract from the property.

In a high-rate environment, creativity is key. Strategies like offering seller financing can become powerful tools, as you may be able to offer more attractive terms than a traditional lender, opening the door to a wider group of potential buyers.

Can I Use a 1031 Exchange for Any Property?

The 1031 Exchange is a powerful tool, but it's strictly for investment or business-use properties. You cannot use it on a primary residence or a vacation home used primarily for personal enjoyment.

The key rule is swapping for another "like-kind" property. Fortunately, the IRS definition of "like-kind" is broad for real estate; you could exchange an apartment building for a medical office building, for example.

However, the timelines are strict and unforgiving. You have exactly 45 days from the sale of your property to identify a replacement and a total of 180 days from the sale date to close on the new property. These deadlines are absolute, which is why working with a specialized Qualified Intermediary is essential.

Ready to build a resilient real estate portfolio?

Navigating exit strategies is a critical component of successful real estate investing. At Stiltsville Capital, we help sophisticated investors and family offices build durable, institutional-grade portfolios designed for long-term wealth creation.

Schedule a confidential call with Stiltsville Capital to discuss how our disciplined approach can align with your financial goals.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments