What Does Cash on Cash Return Mean for Real Estate Investors? A Clear Guide

- Ryan McDowell

- Aug 1, 2025

- 11 min read

Reading Time: 7 min | Good for: Novice (A), Informed (B)

Staring at a deal sheet can feel like information overload. So, what does cash on cash return actually mean?

TL;DR: Key Takeaways

What It Is: Cash on cash (CoC) return is the percentage of your initial cash investment you get back each year from a property's income, before taxes. It measures the performance of your actual cash in the deal.

Why It Matters: It provides an immediate, real-world gut check on an investment's annual performance, making it essential for comparing leveraged deals side-by-side.

Who It’s For: It's a critical metric for any income-focused investor, from a novice evaluating a first rental to a family office assessing a sponsor's annual performance.

What's Next: Use this metric as a first-pass filter for deals, but always dig deeper into the assumptions behind the numbers.

The Market Why-Now: The Focus on Yield

In today's market, where asset appreciation may be less certain than in recent years, sophisticated investors are renewing their focus on durable, in-place cash flow. According to a 2023 survey by CBRE, over 60% of real estate investors cited positive leverage (where borrowing costs are lower than property yields) as a key motivation, highlighting the importance of understanding cash-on-cash returns. This disciplined approach is a hallmark of long-term wealth preservation, especially as many family offices continue to increase their allocations to private real estate for its income-generating and diversification benefits.

Understanding Your Investment's Annual Report Card

Every real estate investor, whether you're eyeing your first duplex or your family office is managing a multi-asset fund, needs a quick, clear way to judge an investment's performance.

While other metrics like IRR and equity multiple are vital for understanding the total long-term profitability of a deal, Cash on Cash (CoC) Return gives you immediate, tangible insight. It answers one simple but powerful question: "How much cash am I getting back this year compared to the cash I put in?"

This metric is powerful because it’s personal. Unlike Cap Rate, which looks at a property’s performance independent of any loans, CoC return is all about your specific deal, including the financing you used to make it happen.

The Core Components of Cash on Cash Return

At its heart, the calculation is refreshingly straightforward. You only need to know two things.

Novice Lens: Think of it as your investment’s annual report card. It cuts through the noise to show you exactly how hard your own capital is working for you right now.

To make it even clearer, here's a quick breakdown of those two key inputs:

Metric Component | What It Includes |

|---|---|

Annual Pre-Tax Cash Flow | The money left after collecting all rent and paying all operating expenses for the year, including your mortgage payments. This is the profit that actually lands in your bank account before income taxes. |

Total Cash Invested | The total amount of money you paid out-of-pocket to acquire the asset. This covers your down payment, all closing costs, and any funds set aside for immediate repairs or renovations (capital expenditures). |

Understanding the various commercial real estate financing options is crucial here, as your loan structure directly impacts your Total Cash Invested and, therefore, your final return.

Let's use a quick example. If you invest $100,000 in cash and the property generates $10,000 in annual pre-tax cash flow, your cash on cash return is a solid 10%. This simple percentage tells you a lot about the deal's immediate health. You can see how professionals across the industry use this key metric on platforms like Wall Street Prep.

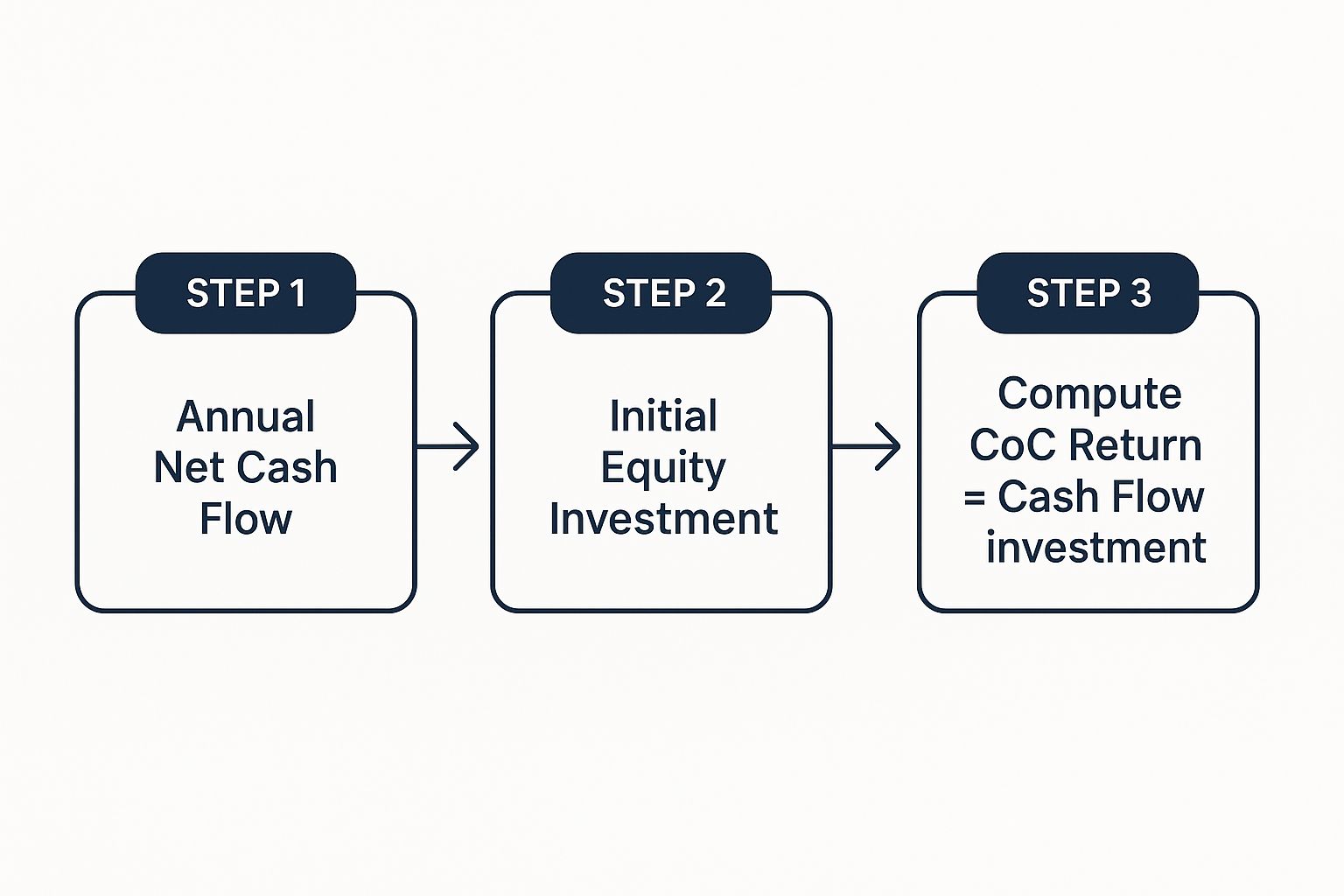

How to Calculate Your Cash on Cash Return

So, how do we actually figure out this powerful metric? The math behind it is refreshingly simple. It cuts through the noise of more complex calculations to give you a straightforward look at how your investment is performing right now. It boils down to one thing: the cash you put in versus the cash you get back.

The Formula: (Annual Pre-Tax Cash Flow / Total Cash Invested) 100 = Cash on Cash Return %

The result is a simple percentage. This makes it incredibly easy to compare different properties side-by-side, whether you're looking at a small duplex or a large office building.

Breaking Down the Formula

To really get what cash on cash return means in the real world, let's unpack the two main parts of the equation.

Annual Pre-Tax Cash Flow: This is the profit your property kicks off in a single year, before you pay any income taxes. You get this number by taking your Gross Scheduled Income (GSI) and subtracting vacancy allowance and all operating expenses. And here’s a crucial point: this includes your full mortgage payment (both principal and interest), because that’s actual cash leaving your account every month.

Total Cash Invested: This is the total amount of money that came directly out of your pocket to close the deal. It's not the property's purchase price. Think of it as the sum of your down payment, all your closing costs (like legal fees, due diligence costs, and title insurance), plus any cash you needed for upfront repairs or initial capital improvements to get the property stabilized and rent-ready.

Here’s a good analogy. If you bought a stock that pays dividends, you'd measure its performance by dividing the cash dividend you receive by what you paid for the stock. That's your yield. Cash on cash return is the exact same concept, just for real estate. It's a real-time check on how hard your invested capital is working for you, year after year.

A Real-World Cash on Cash Return Example (Deal Lens)

Formulas are great, but they don't really click until you see them in action. Let's walk through an illustrative deal to see how the numbers play out.

We'll look at a hypothetical purchase of a small commercial property: a duplex. We'll break down everything from the purchase price and closing costs to the rental income and mortgage payments.

Setting the Scene: The Duplex Purchase

Imagine you’ve found a promising duplex with a purchase price of $500,000. You plan to finance the deal, and your lender requires a 25% down payment.

Here’s the initial cash you'll need to bring to the table:

Purchase Price: $500,000

Down Payment (25%): $125,000

Closing Costs & Upfront Repairs: Let’s budget an extra $25,000. This covers essentials like legal fees, title insurance, due diligence costs, and some minor cosmetic work to get the units ready for tenants.

Add it all up, and your Total Cash Invested comes to $150,000 ($125,000 + $25,000). This is the real, out-of-pocket money you need to make the deal happen. It’s the "cash" in cash on cash return.

Calculating the Annual Pre-Tax Cash Flow

Next, let's figure out how much cash this property will put back into your pocket each year.

Each of the two units rents for $2,100 per month, giving you a total monthly rental income of $4,200. That works out to $50,400 in Gross Scheduled Income for the year.

Of course, you have to subtract the expenses. These are the real costs that reduce your take-home profit:

Annual Mortgage Payments: Your $375,000 loan comes with an annual debt service of $26,000.

Operating Expenses: This is your budget for property taxes, insurance, routine maintenance, and a reserve for when a unit is vacant. Let's say this totals $14,000 for the year.

Your Annual Pre-Tax Cash Flow is what's left after all the bills are paid: $50,400 (Gross Income) - $26,000 (Mortgage) - $14,000 (OpEx) = $10,400.

This is the pure profit you’ve generated before taxes.

As the infographic shows, you simply divide your final cash flow by your initial cash investment to get your return.

Final Calculation: ($10,400 Annual Pre-Tax Cash Flow / $150,000 Total Cash Invested) x 100 = 6.93% Cash on Cash Return

That 6.93% is your immediate, year-one return on the actual capital you put into the deal. It's a powerful, straightforward number that tells you exactly how hard your money is working for you from day one.

Why This Metric Is a Deal-Analyzer's Best Friend

Alright, you know the formula. But let's get into why this metric is so essential for any serious investor. While other numbers like IRR and ROI give you the big picture over the entire life of an investment, cash on cash return gives you an immediate, real-world gut check.

It answers the single most important question for anyone focused on income: for every dollar of my own cash I put into this deal, how many cents will I get back this year? That clarity makes it a powerful tool for comparing different deals on an apples-to-apples basis, especially when you bring financing into the mix.

Its Power in Comparison

Picture this: you're looking at two different properties. You could buy Property A with all cash, but you plan to use a mortgage for Property B. How do you know which is the better move for your capital right now? This is exactly where cash on cash return proves its worth.

Other metrics just don't cut it here.

Cap Rate: The capitalization rate is fantastic for sizing up a property's raw income potential. The problem? It completely ignores financing. It tells you about the property's return, not your return.

Cash on Cash Return: This metric, on the other hand, is intensely personal. It shows you the direct results of your specific financing choices and reveals the real-world performance of the capital you've actually invested. It’s how you see the true power of leverage in action.

Investor Takeaway: Cash on cash return is your go-to metric for annual performance. It cuts through the noise to show you how efficiently your money is working for you this year, making it indispensable for comparing leveraged deals and judging a sponsor's yearly performance.

What Is a Good Cash on Cash Return Today?

It’s the question on every real estate investor’s mind, from a family office CIO to a first-timer dipping their toes into passive investing: “What’s a good cash on cash return?” The honest, institutional-grade answer? It depends entirely on the deal's risk profile and strategy.

A higher return isn’t automatically better. More often than not, it's a signal of higher perceived risk.

Context Is Everything: Risk & Strategy

Core / Stabilized Assets: Think about a brand-new, fully leased Class A apartment building in a prime downtown area. This asset is the gold standard for stability. Because of its lower risk and predictable income, investors are willing to pay a premium for that security. This often translates to a lower cash on cash return, perhaps in the 4% to 6% range.

Value-Add / Opportunistic Assets: Now, picture a different scenario: a value-add or opportunistic project in an up-and-coming neighborhood. This deal might target a much higher return, maybe 10% or more, but often has little to no cash flow in the first year or two during renovation. The higher potential return is the reward for taking on bigger challenges like construction, lease-up, and market timing risk.

Investor Takeaway: A “good” return is simply one that adequately compensates you for the specific risks you’re taking on. There’s no magic number. The real goal is finding the best risk-adjusted return that fits your own investment strategy and portfolio goals.

Historically, these returns vary quite a bit by property type. Multifamily properties, for example, might generate returns between 6% and 10%, while office or retail sometimes see lower initial cash yields due to different market dynamics. For a deeper dive into these benchmarks, you can check out analysis from industry experts at Plante Moran.

Ultimately, setting realistic expectations is what separates seasoned investors from the pack. It keeps you from chasing risky returns that don't align with your goals and helps you understand why a deal is structured the way it is. To learn more about how this ties into financing, check out our guide on how to raise capital for real estate.

Your Next Steps in Deal Analysis

Getting a handle on cash on cash return is a foundational step toward making smarter, faster investment decisions. It’s the metric that helps you cut through the noise, sift through dozens of potential deals, and zero in on the ones that actually match your income goals.

Investor Checklist: Questions to Ask a Sponsor

When a new opportunity lands on your desk, run it through these questions. This ensures you're thinking through every angle of the cash on cash calculation:

Are the pro-forma rent and vacancy assumptions conservative? Challenge the sponsor's numbers. Are the projected rents truly at market rate? Is the vacancy assumption conservative enough for the area, or is it wishful thinking?

Is the operating expense budget realistic? Have they accounted for rising insurance costs, property taxes, and a healthy reserve for maintenance? Understated expenses can artificially inflate the CoC return.

What's *really* included in the Total Cash Invested? Make sure this figure isn't just the down payment. It must include all closing costs, acquisition fees, and any cash reserves for immediate repairs or upfront improvements. This reflects your true "skin in the game."

How does this CoC Return stack up against the project's risk? A 12% CoC return on a stabilized, fully-leased building is fantastic. But that same 12% on a heavy value-add project with major leasing risk? It might not be enough to compensate you for the uncertainty.

How does the CoC return evolve over the holding period? Ask for a pro-forma that shows the projected CoC return for each year. For a value-add deal, you expect it to start low and grow as the business plan is executed.

Investor Takeaway: Cash on cash return is a powerful snapshot, but it’s not the full movie. Use it as your go-to filter to quickly vet deals, but always remember to dig deeper into the assumptions driving that number.

A solid analysis always uses more than one metric. For a complete picture, check out our [guide to commercial real estate underwriting](https://www.stiltsvillecapital.com/post/a-guide-to-commercial-real-estate-underwriting-the-investor-s-deep-dive) to see how cash on cash fits into a comprehensive evaluation.

Frequently Asked Questions

Alright, you've got the basics of cash on cash return. But in the real world, things get a little more nuanced. Let's walk through a few common questions that pop up once investors start putting this metric to work.

Does Cash on cash return include property appreciation?

No, and this is a critical point to remember. Cash on cash return is a pure income metric. It’s laser-focused on one thing: the cash your investment is putting in your pocket this year from operations.

It completely ignores any potential profit you might make from a future sale if the property's value goes up. To see the total picture—which includes both your yearly cash flow and the final payday from a sale—you'll need other tools like the Internal Rate of Return (IRR) and the Equity Multiple.

Is a higher cash on cash return always better?

Not always. While a big number looks great on paper, an unusually high cash on cash return can sometimes be a warning sign of higher risk. An eye-popping CoC return might point to a property in a weaker submarket, one that needs significant unexpected repairs, or a deal built on overly optimistic rent projections.

Advanced Lens: For sophisticated investors, the "best" return is the one that properly compensates for the amount of risk taken. A stable, lower return on a core asset is often a much smarter move for a conservative portfolio than chasing a volatile, higher return on a speculative project.

How is it different from Cap Rate?

The single biggest difference comes down to one word: debt.

The capitalization (cap) rate looks at a property’s income potential as if you bought it with all cash. It’s an unleveraged metric, which makes it perfect for comparing the raw earning power of one property against another, apples to apples.

Cash on cash return, on the other hand, measures the return on the actual cash you personally invested—your down payment plus closing costs and capex reserves. Because it accounts for your mortgage payment, it's a levered metric. It gives you a much clearer view of how your capital is performing inside your specific deal.

Unlock Institutional-Grade Real Estate Opportunities

Understanding metrics like cash on cash return is the first step toward building a resilient real estate portfolio. At Stiltsville Capital, we provide our partners with access to disciplined, institutional-quality investment opportunities across the capital stack.

If you are an accredited investor or family office representative interested in exploring how direct real estate can fit into your long-term wealth strategy, we invite you to connect.

Schedule a confidential call with Stiltsville Capital

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments