Reading Time: 7 min | Good for: A, B, C

In the world of institutional-quality real estate, few tools are as potent for building after-tax wealth as the tax shield on depreciation. It’s a concept that can feel abstract, but for sophisticated investors, mastering it is non-negotiable.

Simply put, depreciation is a non-cash expense the IRS allows you to deduct, accounting for the perceived wear and tear on a property. This "paper loss" lowers your taxable income without costing you a dime in actual cash. The result is a direct reduction in your tax bill, boosting cash flow and enhancing overall returns.

TL;DR: The Bottom Line for Investors

What It Is: The tax shield on depreciation is the total tax savings you realize from deducting a property's depreciation expense against its income.

Why It Matters: It's a "paper loss" that creates real cash savings, increasing your after-tax cash flow and improving key investment metrics like IRR and cash-on-cash return.

Investor Takeaway: Proactive sponsors use advanced strategies like cost segregation and bonus depreciation to accelerate these tax benefits, maximizing the time value of money and putting more capital back in your pocket sooner.

Market Signal: The Shifting Tax Landscape

As investors look toward 2025 and beyond, the tax landscape is in focus. Bonus depreciation, a key accelerator, began phasing down from 100% in 2023 and is set to continue its reduction. According to tax advisors at Vedder Price, the bonus depreciation rate for 2024 is 60%, dropping to 40% in 2025. This gradual reduction makes strategic tax planning, like cost segregation, more critical than ever for maximizing early-year returns.

Unlocking One of Real Estate's Greatest Advantages

For high-net-worth investors and family offices, understanding how depreciation creates a tax shield is fundamental to maximizing portfolio performance. Even as a property appreciates in market value—which is the ultimate goal—the IRS allows you to deduct a portion of the building's cost each year.

That annual deduction is what creates the tax shield, effectively turning a non-cash expense into hard-dollar savings.

This is a game-changer because it directly pads your bank account. By lowering your taxable net operating income, the depreciation deduction lets you keep more of the cash flow your property generates. Think of it as a government-sanctioned incentive for owning income-producing real estate.

Why This Matters for Sophisticated Investors

The benefits of the depreciation tax shield go far beyond a smaller tax bill. A smart depreciation strategy significantly improves a project’s internal rate of return (IRR) and its cash-on-cash returns. It's one of the key levers experienced sponsors pull to optimize every dollar.

Increased After-Tax Cash Flow: By shrinking your taxable income, depreciation leaves more cash in your pocket. It's as simple as that.

Improved Investment Metrics: Lower taxes mean higher net returns. This makes an investment far more attractive when analyzed on an after-tax basis.

Capital Preservation: Those tax savings aren't just a one-time win. You can reinvest that cash, allowing your capital to compound more efficiently over the life of the investment.

Novice Lens / Why it Matters: Think of it this way: if your property earns $100 in profit, you'd normally pay tax on that full amount. But if you can claim $80 in depreciation, you now only pay tax on $20. You still received the full $100 in cash, but the IRS only sees $20 of it. The tax you saved on the other $80 is the "tax shield."

A truly experienced sponsor will move beyond basic methods. They’ll use advanced techniques like cost segregation studies to accelerate these deductions, front-loading the tax benefits into the early years of the investment when they have the most impact.

To dive deeper, explore our comprehensive guide to real estate tax benefits.

How the Depreciation Tax Shield Really Works

To grasp this powerful benefit, you must understand the mechanics. Think of your investment property like a piece of high-performance machinery. The IRS understands that over time, this machine—the building—will experience wear and tear.

Depreciation is the annual deduction that accounts for this decline, creating a “paper expense” that directly lowers your taxable income.

This is a core strategy that separates professional operators from amateurs. The key is knowing the simple building blocks used to calculate it.

Core Components of Depreciation

To calculate your annual depreciation deduction, you need three key numbers:

Cost Basis: This is your starting line—the property's purchase price plus certain closing costs, but critically, it excludes the value of the land. Land doesn't wear out, so the IRS won’t let you depreciate it.

Useful Life: This is the timeline the IRS sets for depreciating an asset. The standards are 27.5 years for residential rental properties and 39 years for commercial properties.

Depreciation Method: For most passive real estate deals, sponsors use the straight-line method. It's simple and predictable, spreading the deduction evenly over the property’s useful life.

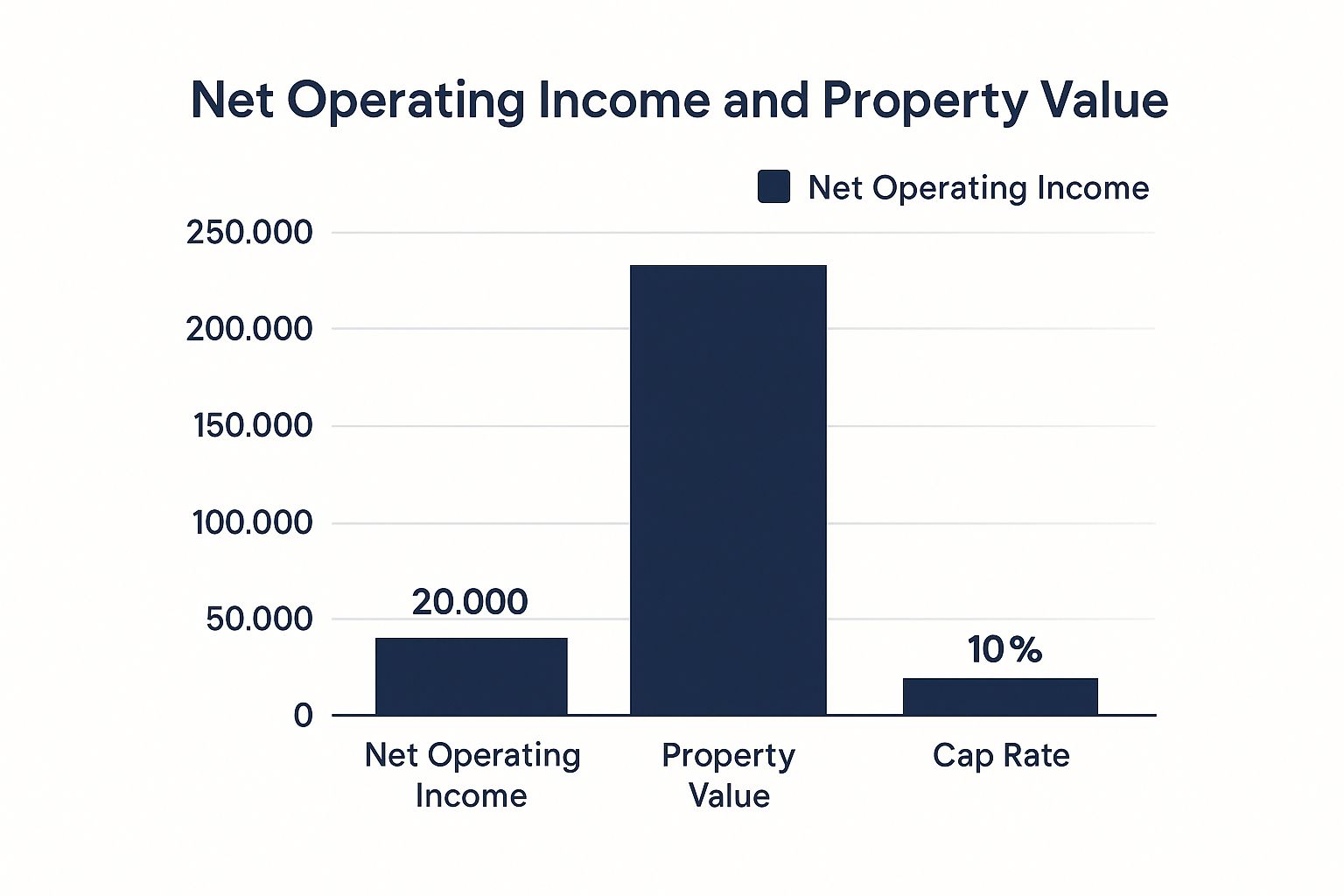

Calculating Your Annual Tax Savings

Once you have those figures, the math is straightforward. You divide the property's cost basis (the building's value only) by its useful life to find your annual depreciation expense.

The Simple Formula: (Cost Basis of Building / Useful Life) = Annual Depreciation Expense

This annual expense is deducted from your property's net operating income (NOI), lowering your taxable income. The cash you save depends on your marginal tax rate. The higher your tax rate, the more valuable the tax shield becomes.

Advanced Lens / The Tax Shield Formula: Annual Depreciation Deduction x Investor's Marginal Tax Rate = Annual Tax Savings For a commercial property with a building basis of $3.9 million, the annual straight-line depreciation is $100,000 ($3.9M / 39 years). For an investor in the 37% federal tax bracket, this deduction creates $37,000 in direct tax savings each year.

That's cash that would have gone to the IRS but now stays with you, ready to be reinvested. It’s a perfect example of how the tax shield on depreciation directly juices an investment's after-tax returns.

Supercharging Returns with Advanced Depreciation

While straight-line depreciation is a steady, reliable benefit, seasoned investors know how to pull those savings forward and seriously boost returns. This is where advanced strategies like bonus depreciation and cost segregation come into play, front-loading the tax shield into the most critical, early years of an investment.

Unlocking Immediate Value with Bonus Depreciation

Bonus depreciation is a powerful incentive that allows investors to deduct a large percentage of the cost of certain assets in the first year they are placed in service. This isn't about spreading deductions over decades; it’s about generating a massive tax shield on day one.

The Tax Cuts and Jobs Act (TCJA) of 2017 famously set this at 100% for eligible assets. While this powerful incentive is now phasing down, its impact was huge. You can discover more insights about the bonus depreciation phasedown on vedderprice.com.

Precision Savings with Cost Segregation

Cost segregation is a more detailed, engineering-based study that meticulously reclassifies a property's components into shorter depreciation schedules. Instead of treating an entire building as one asset with a 27.5 or 39-year life, a cost segregation study breaks it down:

Structural Components (39-year life for commercial): The building's skeleton—foundation, walls, roof.

Land Improvements (15-year life): Parking lots, fences, landscaping.

Personal Property (5-7 year life): Carpeting, cabinetry, decorative lighting, specialized electrical systems.

By shifting a portion of the building’s cost basis to these shorter-lived assets (which are often eligible for bonus depreciation), sponsors can dramatically accelerate deductions.

Investor Takeaway: Accelerating depreciation doesn't give you a bigger total deduction over the property's life, but it absolutely changes the timing. By front-loading deductions, a sponsor maximizes the time value of money, improves a project’s IRR, and frees up capital for reinvestment much sooner.

This strategic reallocation generates significant "paper losses" in the early years, which can slash or even eliminate your taxable income from the property.

Deal Lens: The Tax Shield in a Multifamily Acquisition

Theory is one thing, but seeing the numbers brings the power of the tax shield on depreciation into focus. Let's walk through a simplified, real-world example of a value-add multifamily deal.

Imagine a sponsor acquires a 100-unit apartment complex for $12 million. An appraisal values the land at $2 million, leaving a depreciable basis for the building and its components of $10 million. The property generates $500,000 in net operating income (NOI) in its first year.

Scenario 1: Standard Depreciation

Under the standard straight-line method for residential real estate (27.5-year life):

Annual Depreciation Expense: $10,000,000 / 27.5 = $363,636

Taxable Income: $500,000 (NOI) - $363,636 (Depreciation) = $136,364

Scenario 2: Accelerated Depreciation with Cost Segregation

A sophisticated sponsor commissions a cost segregation study, which reallocates the $10 million basis:

$7 million to 27.5-year property (the building's structure).

$3 million to 5-year property (carpeting, appliances, fixtures).

In Year 1, assuming 60% bonus depreciation (the 2024 rate) is available for the 5-year assets:

5-Year Bonus Depreciation: $3,000,000 x 60% = $1,800,000

Remaining 5-Year Depreciation (Straight-Line): ($3,000,000 - $1,800,000) / 5 = $240,000

27.5-Year Structure Depreciation: $7,000,000 / 27.5 = $254,545

Total Year 1 Depreciation: $1,800,000 + $240,000 + $254,545 = $2,294,545

That massive "paper loss" of over $2.2 million completely wipes out the $500,000 of taxable income, creating a substantial passive loss that investors can often use to offset other passive gains.

These powerful losses are passed directly to you on a Schedule K-1. To learn more, see our guide on how to read a K-1 for real estate investors.

Checklist: Questions to Ask a Sponsor About Their Depreciation Strategy

Not every sponsor approaches tax strategy with the same level of sophistication. Use these questions during due diligence to determine if a sponsor views the tax shield on depreciation as a core driver of value or just an accounting afterthought.

1. Do you plan to conduct a cost segregation study? If so, when? * Why It Matters: A sharp sponsor will have a clear timeline. Ideally, they'll conduct the study right after acquisition or major renovations to maximize its impact from day one. A vague answer is a red flag.

2. What percentage of the purchase price do you typically reallocate to shorter-lived assets? * Why It Matters: This reveals their experience. For multifamily, experienced sponsors often reclassify 20-30% of a building's cost basis. An answer in this range shows they have a track record of executing this strategy effectively.

3. How does your depreciation strategy align with the projected hold period? * Why It Matters: An aggressive, front-loaded depreciation strategy is ideal for a 3-5 year value-add project. A longer-term, core hold might have a different plan. This question uncovers if their tax plan is custom-fit to the business plan.

4. What is your plan for managing depreciation recapture upon exit? * Why It Matters: A forward-thinking sponsor is already planning for the tax bill at the sale. Their answer should touch on strategies like a 1031 exchange to defer taxes, proving they have a long-term, wealth-building mindset.

5. How are these tax benefits modeled in your investor return projections (e.g., IRR)? * Why It Matters: Sophisticated sponsors model returns on both a pre-tax and after-tax basis. Ask to see the after-tax projections, as this is where the true impact of the depreciation tax shield becomes clear and demonstrates a commitment to transparency.

Dealing with Depreciation Recapture and the 1031 Exchange

The tax shield from depreciation is powerful, but it's a deferral, not a permanent elimination. When you eventually sell an appreciated property, the IRS wants to "recapture" the tax savings you've enjoyed. This process is known as depreciation recapture.

In simple terms, the cumulative depreciation you claimed is taxed upon sale, typically at a maximum federal rate of 25%. While this sounds like a hit, it's a predictable part of the investment lifecycle that points toward one of real estate's most powerful wealth-building tools.

The Power of the 1031 Exchange

This is where the Section 1031 exchange becomes your best friend. This part of the U.S. tax code allows you to defer paying taxes on both your capital gains and depreciation recapture by rolling the proceeds into a "like-kind" property of equal or greater value.

Investor Takeaway: A 1031 exchange lets you turn a potential tax bill into your next down payment. Instead of cutting a check to the IRS, you reinvest that capital, allowing your entire pre-tax gain to keep working for you and compounding over time.

While the specific rules vary globally, the principle of using depreciation to lower tax bills and influence investment is a fundamental part of corporate tax planning worldwide. You can read more about potential tax law changes impacting these strategies on wegnercpas.com.

For family offices and high-net-worth investors, the 1031 exchange is the cornerstone of building a real estate dynasty. It creates a seamless bridge from one asset to the next, allowing you to build true generational wealth. To get a deeper dive, read our complete guide to deferring taxes with the 1031 exchange.

The Prudent Path Forward in Real Estate Investing

Understanding the tax shield on depreciation is more than an academic exercise; it's a critical component of prudent, long-term wealth strategy in real assets. While risks like illiquidity and execution are inherent in private real estate, a well-structured investment managed by a sophisticated sponsor can provide a powerful combination of income diversification, inflation hedging, and significant tax efficiency. By asking the right questions and partnering with operators who treat tax strategy as a primary value driver, you can ensure your capital is working as hard as possible to achieve your financial goals.

At Stiltsville Capital, building sophisticated tax strategies into our deals isn't an afterthought—it's central to maximizing your after-tax returns. Let us show you how our institutional-grade approach can make a real difference in your portfolio.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.