A Guide to Commercial Real Estate Underwriting: The Investor's Deep Dive

- Ryan McDowell

- Jul 19, 2025

- 17 min read

Updated: Jul 31, 2025

Reading Time: 8 min | Good for: Novice Investors (A), Family Office Principals (B), Investment Committees (C)

Think of commercial real estate underwriting as a property's definitive financial physical. It's the critical moment when an investor sets aside the glossy marketing brochure and starts digging into the numbers to see what’s really going on under the hood. This meticulous deep dive is what transforms a speculative gamble into a smart, data-driven investment—the bedrock of institutional-grade real estate private equity.

TL;DR: The Bottom Line on Underwriting

What it is: Underwriting is the due diligence process of verifying a property's financial data, stress-testing its future potential, and identifying all associated risks before committing capital.

Why it matters: It replaces a seller's optimistic pro forma with a realistic, defensible financial model, forming the true basis for an investment decision and protecting investor capital.

Key metrics: Success hinges on four vitals: Net Operating Income (NOI), Capitalization (Cap) Rate, Debt Service Coverage Ratio (DSCR), and Loan-to-Value (LTV).

Investor takeaway: The quality of a sponsor's underwriting process is a direct reflection of their discipline and expertise. Asking tough questions about their assumptions is a non-negotiable part of your own due diligence.

What Is Commercial Real Estate Underwriting?

At its core, commercial real estate (CRE) underwriting is the discipline of verifying every claim made about a property's financial story and then building a realistic forecast of its future. It’s a meticulous due diligence process that shines a bright, objective light on both the potential risks and the true rewards of an investment.

This isn’t just about plugging numbers into a spreadsheet. It’s about building an airtight investment thesis—one grounded in hard data, market realities, and conservative, common-sense assumptions. For investors new to the space, this is the most critical first step; for seasoned pros and family offices, it's the very foundation of growing and protecting capital.

Core Objectives of The Underwriting Process

Underwriting is really about answering a few fundamental questions that every prudent investor needs to ask before putting capital on the line:

Is the story true? Does the property’s current income and expense report match what the seller claims? This means combing through rent rolls, utility bills, and maintenance contracts with a fine-tooth comb.

What will the future look like? Based on local market data and economic trends, what’s a realistic projection for rental income, vacancies, and operating costs over the next five to seven years?

What could go wrong? We need to identify potential pitfalls. This could be market risk (like a major local employer shutting down), property-specific risk (an ancient roof that needs replacing), or financing risk (what happens if interest rates spike?).

What's a fair price? After all the analysis, what is this property really worth? Answering this honestly is how you avoid overpaying—the fastest way to kill your returns before you even start.

Why It Matters for Investors (A, B): The underwriting model becomes the single source of truth for the deal. It’s a living document that translates an investor's strategy—whether it's a simple cosmetic update or a full-blown redevelopment—into a clear financial story, showing exactly how money invested today is expected to generate returns tomorrow.

The ultimate goal is to move from the seller’s often-optimistic pro forma to your own realistic, "underwritten" financial model. This disciplined approach gives you the clarity to make smart decisions, secure the right financing, and negotiate from a position of strength.

Without rigorous underwriting, you’re just guessing. With it, you’re protecting your capital by stress-testing the investment before you sign on the dotted line.

The Pillars of CRE Underwriting Analysis

To truly understand a deal, underwriting focuses on a few key pillars. Think of these as the different lenses you use to inspect an investment property, each revealing a critical piece of the puzzle. Together, they paint a complete picture of the opportunity and its associated risks.

Property-Level Analysis: This examines the physical and operational health of the asset itself. Key Question: Does this property have good bones, or are there hidden problems waiting to surface?

Market Analysis: This assesses the strength and direction of the local economic environment. Key Question: Is this property located in a market with tailwinds (like job growth) or headwinds (like new, competing supply)?

Financial Analysis: This scrutinizes the historical performance and future cash flow potential. Key Question: Do the numbers work, and are the projections for future income realistic and defensible?

Sponsor & Deal Structure Analysis: This evaluates the experience of the team and the terms of the investment. Key Question: Do we have the right team and an aligned, equitable structure to execute the business plan successfully?

By examining each of these pillars, you move from a surface-level impression to a deep, fundamental understanding of the investment. This structured approach ensures no stone is left unturned and is essential for making sound, confident decisions.

The Key Metrics That Drive Underwriting Decisions

Successful commercial real estate underwriting isn't about relying on gut feelings. It’s about translating a property's story into a clear, verifiable financial narrative. The language of this narrative is written in just a handful of critical metrics.

Getting a handle on these key figures is non-negotiable for any serious investor. They reveal the true health, risk profile, and ultimate potential of a deal. Think of them as the vital signs a doctor checks—each one tells a specific part of the story, and together, they paint a complete picture of an asset's financial condition.

Net Operating Income (NOI)

Imagine Net Operating Income (NOI) as the property's gross annual profit before debt. It’s the total income the property brings in from all sources (like rent and fees) after you subtract all the necessary operating expenses. These are the costs to keep the lights on—things like property taxes, insurance, maintenance, and management fees.

What's crucial here is that NOI is calculated before you factor in mortgage payments (debt service) or income taxes. This gives you a pure measure of the property's ability to generate cash on its own, regardless of how it's financed. A strong and growing NOI is the absolute bedrock of a property's value.

Novice Lens (A): A positive NOI is the first hurdle any deal must clear. If a property can't even cover its own operating costs before the mortgage is paid, it's a financial drain, not an investment.

Capitalization (Cap) Rate

If NOI is the property's profit, the Capitalization (Cap) Rate is its market-driven report card. It shows you the property's potential annual return as a percentage of its current value, assuming you paid all cash. The formula is simple: Cap Rate = NOI / Property Value.

A lower cap rate usually points to a higher valuation and lower perceived risk—think of a brand-new building in a prime location with a long-term lease to a Fortune 500 company. On the flip side, a higher cap rate can suggest more risk or lower growth potential, but it might also mean a better immediate return. It's the go-to metric for comparing different investment opportunities in the same market.

Debt Service Coverage Ratio (DSCR)

This one is the lender's absolute favorite. The Debt Service Coverage Ratio (DSCR) measures the property's ability to cover its mortgage payments with the cash it generates. You calculate it by dividing the Net Operating Income (NOI) by the total annual debt service (which includes both principal and interest payments).

A DSCR of 1.0x means the property makes just enough money to pay its mortgage, leaving zero room for error. That's way too close for comfort. Lenders almost always require a DSCR of 1.25x or higher, which means the property's NOI is 25% greater than its mortgage payments. That buffer is your safety net for unexpected vacancies or rising costs.

Loan-to-Value (LTV)

Loan-to-Value (LTV) tells you how much of the deal is financed with debt versus your own cash (equity). It’s calculated by dividing the total loan amount by the property’s appraised value. So, an $8 million loan on a $10 million property gives you an 80% LTV.

LTV is the primary gauge of leverage risk. A higher LTV means more debt and less of your own skin in the game. This can amplify your potential returns, but it also magnifies the risk if the property’s value drops or cash flow stumbles. Conservative underwriting often means using lower LTVs to create a bigger equity cushion, making the investment much more resilient. This is a foundational concept for anyone learning how to invest in commercial real estate for the long haul.

Putting It All Together: A Quick-Reference Table

These metrics don't operate in a vacuum; they tell a story together. A sponsor might push for a higher LTV to boost returns, but only if the DSCR is exceptionally strong, ensuring there's plenty of cash to service the larger loan. To help you keep them straight, here’s a quick-reference table of the essentials.

Essential Underwriting Metrics You Should Know | ||

|---|---|---|

Metric | Simple Formula | What It Measures |

Net Operating Income (NOI) | Gross Income - Operating Expenses | The property's raw profitability before debt. |

Capitalization (Cap) Rate | NOI / Property Value | The unlevered annual return; a market benchmark for risk and value. |

Debt Service Coverage Ratio (DSCR) | NOI / Total Debt Service | The property's ability to cover its mortgage payments; a lender's key risk metric. |

Loan-to-Value (LTV) | Loan Amount / Property Value | The amount of leverage used; a key indicator of financing risk. |

By mastering how these four pillars interact, you can start to confidently dissect any deal that comes across your desk and make truly informed, data-driven decisions.

The Underwriting Process Step by Step

Think of commercial real estate underwriting less as a single task and more as a multi-stage journey. It’s a disciplined process that takes a potential deal from a promising idea to a fully vetted, investment-grade asset. Each step is designed to peel back another layer of the onion, systematically reducing uncertainty and building confidence in the investment.

For investors, understanding this sequence is key. It shows how a sponsor meticulously moves from a high-level opportunity to the granular details. By the time a deal gets the green light, it has been thoroughly pressure-tested from every angle imaginable.

Stage 1: Initial Deal Screening

The process starts with a wide funnel. For every deal that moves forward, a sponsor might have already sifted through dozens of others. This initial screening is a rapid-fire assessment designed to quickly weed out opportunities that don't fit the firm's core strategy.

At this stage, we're asking a few key questions:

Does it fit our mandate? Is it the right property type, in the right market, and at the right deal size?

Is the story compelling? Is there a clear, believable angle for creating value here?

Are the initial numbers reasonable? At a glance, do the seller’s asking price and stated income seem to be in the right ballpark?

Deals that pass this quick "sniff test" move on to the next, more rigorous stage.

Stage 2: In-Depth Financial Modeling

This is where the real work begins. We take the seller’s pro forma—which is almost always an optimistic forecast—and rebuild it from the ground up using conservative, verifiable assumptions. Every single line item, from rental income to maintenance costs, gets scrutinized and adjusted.

Insight Edge: Forward-thinking firms are now using advanced analytics to supercharge this stage. These tools can scan millions of data points on local market rents, operating expense comparables, and even demographic shifts to build more precise and dynamic financial models. It’s a move beyond static spreadsheets to create a much more robust forecast.

The result is a detailed, multi-year cash flow projection that becomes the financial backbone of the entire deal.

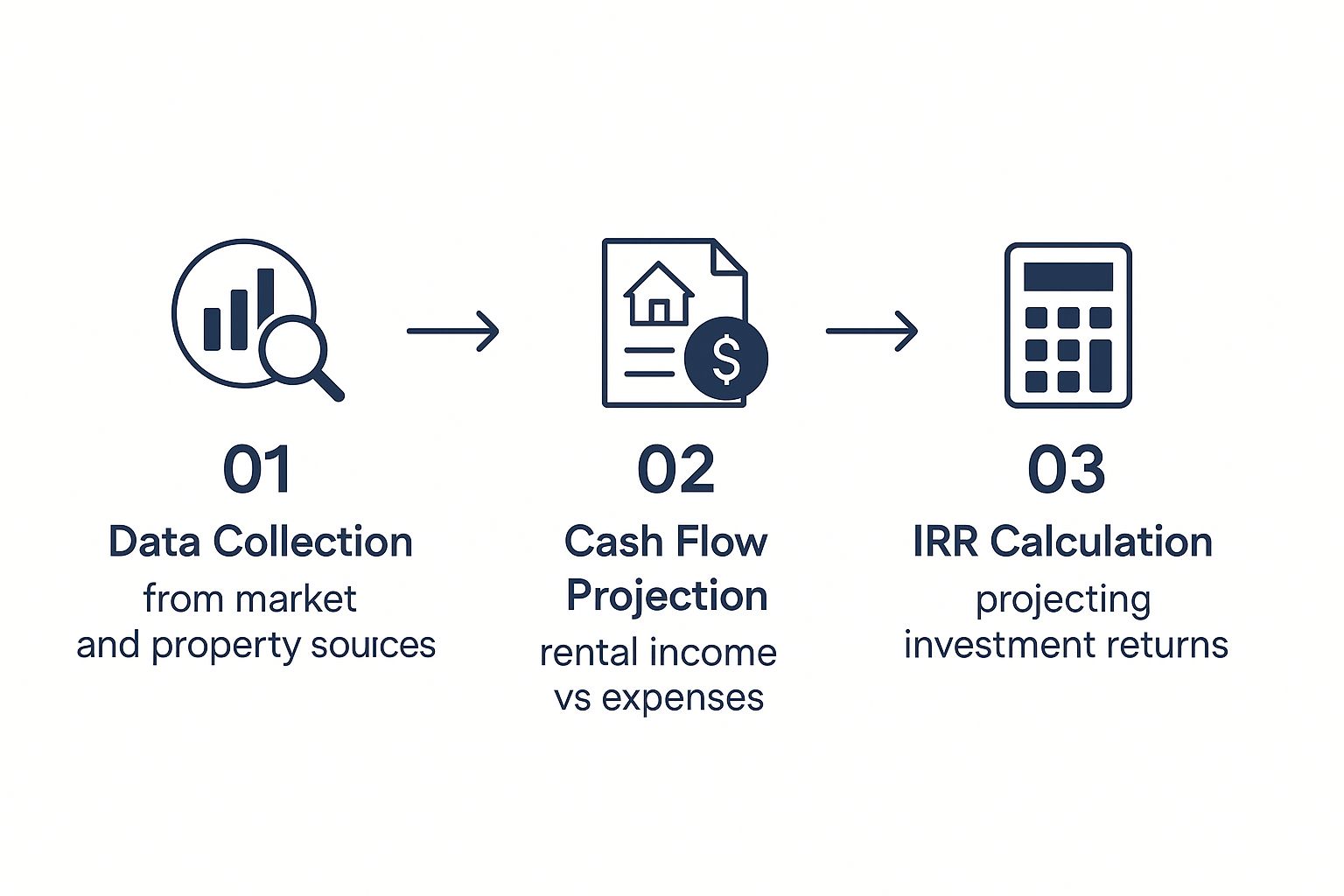

This infographic simplifies how that core financial flow works, showing how raw data is transformed into a projection of investment returns.

Stage 3: Market and Submarket Analysis

No property exists in a vacuum. This stage is all about a deep dive into the health of the surrounding market and the immediate neighborhood. Analysts look at everything from job growth and population trends to new construction in the pipeline and local infrastructure projects.

The goal is to answer a simple question: are we investing in a market with tailwinds or headwinds? A fantastic property in a declining market is often a losing proposition. On the flip side, a good property in a thriving market can see its value lifted by the rising tide around it.

Stage 4: Physical and Environmental Due Diligence

While analysts are crunching numbers, we have boots on the ground. This stage involves a thorough physical inspection of the property. Engineers check the roof, HVAC systems, plumbing, and structural integrity. At the same time, environmental consultants test for things like soil contamination or hazardous materials like asbestos.

These inspections are critical for uncovering hidden costs that could derail a budget. A surprise $500,000 roof replacement can instantly change the economics of a deal. This is how you prevent expensive surprises down the road.

Stage 5: Legal and Title Review

Parallel to the physical inspections, the legal teams get to work. They review the property’s title to ensure there are no outstanding claims or liens—what we call "clouds" on the title—that could jeopardize ownership.

Lawyers also scrutinize zoning regulations to confirm the property can be operated (or redeveloped) as planned. They'll pore over existing tenant leases, service contracts, and any other legal agreements that will transfer with the property.

Stage 6: The Final Investment Committee Memo

This is the grand finale, the culmination of all the preceding steps. The deal team synthesizes every piece of analysis—financial models, market research, inspection reports, and legal reviews—into a single, comprehensive document known as the Investment Committee Memo (ICM).

The ICM tells the complete story of the deal. It lays out the investment thesis, details the business plan, outlines all the risks and how we plan to mitigate them, and presents the final projected returns. This memo is then presented to the firm's investment committee for a final go/no-go decision. This rigorous process is one of the key factors in navigating the various challenges confronting commercial real estate investors in any market cycle, ensuring that only the most thoroughly vetted and defensible opportunities receive funding.

Deal Lens: Underwriting a Value-Add Multifamily Property

Theory is one thing, but seeing commercial real estate underwriting in action is another entirely. To bring these concepts down to earth, let’s walk through a simplified example of a value-add multifamily deal. We'll see exactly how a sponsor's strategy translates into projected returns for investors.

Let's imagine a sponsor has found "The Cypress," a 100-unit apartment complex built in the 1990s. The property is a bit tired, but it's located in a solid, growing submarket. The current owner has let updates slide, and the rents are sitting below market value. This is a classic value-add opportunity.

The Property Today: The 'As-Is' Scenario

First, the underwriting team has to get a crystal-clear picture of the property's current financial health. This is the baseline, the "before" photo from which all future value is measured.

Average Current Rent: $1,200 per unit/month

Occupancy: 95% (meaning 95 of 100 units are rented)

Annual Gross Potential Rent: $1,440,000 (100 units x $1,200 x 12 months)

Less Vacancy Loss (5%): -$72,000

Effective Gross Income (EGI): $1,368,000

Annual Operating Expenses (45% of EGI): -$615,600

Current Net Operating Income (NOI): $752,400

This current NOI is the starting block for the entire underwriting process.

The Value-Add Business Plan

Now for the fun part. The sponsor’s game plan is straightforward: invest capital to modernize the property and, in turn, justify higher rents. This isn't just a hopeful guess; it's backed by hard market data showing that newly renovated units in this same area are leasing for a significant premium.

The capital improvement plan includes:

Renovating 75% of the unit interiors (new kitchens, flooring, modern fixtures).

Upgrading common areas like the lobby, gym, and pool.

Adding a brand-new amenity, like a dog park or a package locker system.

The total projected budget for this transformation is $1.5 million. The next step is to model exactly how this investment will pay off.

The Property Tomorrow: The 'As-Stabilized' Projection

Fast forward 24 months. The renovation work is done, and the property is now "stabilized" at its new, higher value. The underwriting model projects what the future financial performance will look like.

Average Post-Renovation Rent: $1,450 per unit/month (a $250 per-unit bump)

Occupancy: 95% (maintained through professional management)

New Annual Gross Potential Rent: $1,740,000

Less Vacancy Loss (5%): -$87,000

New Effective Gross Income (EGI): $1,653,000

Operating Expenses (stabilized at 42% of EGI): -$694,260 (Slightly higher in dollars due to the improved quality, but more efficient as a percentage of income.)

Projected 'As-Stabilized' NOI: $958,740

Investor Take (B, C): This projected jump in NOI from $752,400 to $958,740—a lift of over $206,000 every single year—is the direct result of the executed business plan. This is the heart and soul of value creation in real estate.

This kind of disciplined, numbers-driven approach is absolutely essential, especially as lending dynamics evolve. As reported by Agora, while the total number of commercial real estate deals has fluctuated, the median transaction size for multifamily properties has actually risen by 6.3% year-over-year (as of Q1 2024). This tells us that underwriting needs to be more rigorous than ever to back these larger, more complex financing deals. You can find more insights on these commercial real estate lending trends on agorareal.com.

By building a financial story from the ground up—validating the current state, defining a clear plan, and conservatively projecting the future—sponsors can confidently show how an investment will generate real wealth for its partners. It’s this meticulous process that turns a tired property into a high-performing asset.

How to Assess and Mitigate Investment Risk

Disciplined commercial real estate underwriting is really a masterclass in risk management. It's about looking a deal square in the eye and asking, "What could go wrong here?" And maybe more importantly, "What's our plan when it does?" This focus on spotting and neutralizing threats is what separates a speculative gamble from a truly institutional-quality investment.

A smart sponsor builds a resilient investment thesis by tackling the most common risks head-on, long before they have a chance to become real problems. This isn’t about just hoping for the best; it’s about preparing for the worst with a clear, data-driven strategy for every potential bump in the road.

Risk & Mitigation Table

RISK: Market Downturns * The Threat: Economic cycles are a reality. A wider economic slowdown can lead to lower occupancy and pressure on rents. * The Mitigation: Rigorous sensitivity analysis is key. We model downside scenarios (e.g., a 10% drop in rents, a 15% drop in occupancy) to ensure the property’s cash flow can still cover its debt and essential bills, even in a rocky market.

RISK: Tenant Departure * The Threat: The departure of a major tenant, especially in an office or retail property, can deliver a major blow to Net Operating Income (NOI). * The Mitigation: We dig deep into the tenant roster and lease terms. We look for a long Weighted Average Lease Term (WALT), diverse tenant mix to avoid concentration risk, and strong credit quality from tenants.

RISK: Interest Rate Spikes * The Threat: Sudden spikes in interest rates can eat into returns, particularly for projects with floating-rate debt. * The Mitigation: We prioritize fixed-rate financing whenever possible to provide cost certainty. If using floating-rate debt, we may purchase an interest rate cap to limit the upward exposure. To get a better feel for how financing costs and property values are connected, check out our analysis on how lower interest rates can be a catalyst for commercial real estate.

RISK: Construction Overruns * The Threat: For new developments or major renovations, construction delays and cost overruns are always looming threats. * The Mitigation: A solid contingency budget—typically 5-10% of the total construction cost—is baked into the underwriting to absorb surprise expenses without derailing the project. This disciplined planning is critical.

Investor Checklist: Questions to Ask a Sponsor About Their Underwriting

The quality of a sponsor's commercial real estate underwriting is what separates the disciplined operators from the hopeful speculators. As an investor, your job is to pressure-test their assumptions. Asking sharp, specific questions doesn't just get you better answers—it signals that you’re a serious and informed partner.

Think of it as looking under the hood of a car before you buy it. A confident sponsor with a solid, defensible model will welcome the scrutiny. One with a flimsy, aggressive pro forma might get defensive.

Here’s a practical checklist to help you cut through the sales pitch and really see what’s driving their financial projections.

Assumptions and Projections

The heart of any underwriting model is its assumptions about the future. This is where a sponsor’s optimism—or their discipline—truly shines. Your goal here is to understand the "why" behind their numbers.

Rent Growth: "What are your specific rent growth assumptions for Year 1, Year 2, and beyond? How do these figures stack up against third-party market reports from sources like CoStar or CBRE for this exact submarket and asset class?"

Exit Cap Rate: "Your model shows an exit cap rate of 5.5%. What's the average cap rate for similar, stabilized properties that have sold in this area over the last 12 months? What makes you confident the cap rate environment will still be favorable when we plan to exit?"

Operating Expenses: "How do your projected operating expenses per unit compare to this property's actual historicals from the last two years? Can you walk me through any significant differences?"

Risk and Sensitivity Analysis

A great model doesn't just map out a path to success; it prepares for detours and roadblocks. How willing a sponsor is to show you their stress tests speaks volumes about their approach to risk.

Advanced Lens (C): A deal that only works in a perfect world isn't an investment; it's a lottery ticket. The most important question isn't "What's the upside?" but "What happens if things don't go exactly as planned?"

Push them to show you the downside scenarios they’ve already modeled out. A good operator will have them ready.

Interest Rates: "Can you show me the sensitivity analysis for a 1% and 2% jump in interest rates? At what point would the deal no longer hit its projected returns or struggle to cover debt service?"

Vacancy: "What happens to the cash flow and DSCR if a major tenant leaves or if economic vacancy climbs 10% higher than you've projected?"

Capital Costs: "Your renovation budget seems tight. What kind of contingency for cost overruns have you baked into the underwriting? What’s the plan if construction costs come in 15% over budget?"

Asking these tough questions is a non-negotiable part of your own due diligence. They empower you to validate a sponsor’s strategy and make sure your capital is being managed with the institutional-grade discipline it deserves.

Frequently Asked Questions (FAQ)

Even with a solid grasp of the basics, commercial real estate underwriting is a field where the details can make or break a deal. It's a complex process, and it's natural for questions to arise. To help you connect the dots, here are answers to some of the most common queries we hear from investors.

How does underwriting differ for multifamily vs. office properties?

While the goal is always the same—to figure out if an asset will be profitable—the approach changes depending on the property type. Think of it like a mechanic inspecting a sports car versus a heavy-duty truck. Both have engines, but you’re looking for different things.

Multifamily underwriting is all about the residents. You're laser-focused on per-unit rent, turnover rates, and local demographics like job growth. What amenities will keep people renewing their leases? That's a key question.

Office underwriting, on the other hand, shifts the focus to the businesses leasing the space. Here, you're examining the financial strength of your tenants and the length of their leases (measured by the Weighted Average Lease Term, or WALT). You also have to project the future costs of tenant improvements and leasing commissions to keep those spaces filled.

What’s the difference between 'as-is' and 'as-stabilized' value?

This is a critical distinction, especially for a value-add project or new development. The gap between these two numbers is essentially how you measure the success of the business plan.

"As-is" value is what a property is worth right now—warts and all. It’s based on its current income, occupancy, and physical condition.

"As-stabilized" value is the forecast of what that same property could be worth after the sponsor's business plan is complete and the asset is performing at its full potential (e.g., renovations are done, occupancy hits the target, and rents are at market rates). The underwriting model's primary job is to predict this future value.

How conservative should underwriting assumptions be?

This question gets right to the heart of an investment sponsor's philosophy and is a huge tell about their approach to risk. There’s no single right answer, but the methodology is everything. A top-tier sponsor will always ground their assumptions in hard data—from third-party market reports and the property’s own history—and then stress-test them. Wildly optimistic guesses on rent growth or an exit sale price are major red flags. You should always be able to ask, "Where did you get that number?" and get a clear, defensible answer. Discipline in these assumptions is the hallmark of a trustworthy partner.

Take the Next Step

Disciplined underwriting is at the core of every successful real estate investment, providing the foundation for long-term wealth preservation and growth. Ready to see how institutional-grade underwriting can open up new opportunities for your portfolio? The team at Stiltsville Capital is here to provide the clarity and access you need.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments