A Guide to Real Estate Investment in Texas for Sophisticated Investors

- Ryan McDowell

- Oct 12

- 12 min read

Reading Time: 8 min | Good for: Novice (A), Informed (B)

TL;DR: Key Takeaways For Investors

Dynamic Demand Drivers: Texas benefits from a powerful combination of corporate relocations and robust population growth, creating consistent demand for housing, commercial space, and infrastructure.

Diversified Economic Engine: Beyond its energy roots, Texas is now a global hub for technology, healthcare, and logistics. This economic diversity provides resilience against single-sector downturns.

Strategic Opportunity: The most compelling opportunities are often found in dominant sectors like multifamily and industrial logistics, and in high-growth niche areas like data centers and medical office buildings.

Sponsor Diligence is Crucial: Partnering with an experienced local sponsor is key. Thoroughly vet their track record, underwriting assumptions, and alignment of interests before investing.

Why Texas Real Estate Continues to Attract Smart Capital

For sophisticated investors and family offices, putting capital to work in Texas real estate isn't just a trend—it's a strategic move into a market built on a rock-solid foundation of economic growth and relentless demand. The state’s powerful mix of corporate relocations, a constant influx of new residents, and a famously business-friendly environment creates a uniquely fertile ground for institutional-grade opportunities across every property type.

For decades, Texas has been more than just a flash-in-the-pan growth story; it’s evolved into a mature, diversified economic engine that consistently pulls in capital from around the world. The best way to think about the Texas economy is that it isn’t reliant on a single fuel source. It’s powered by a potent blend of industries—from tech and finance to energy and healthcare—that continuously drives demand for all classes of real estate.

This sustained economic momentum creates real, tangible investment fundamentals. It’s a simple ripple effect. When a major corporation moves its headquarters to Dallas or a new manufacturing plant opens near Houston, it does more than just make headlines. It creates high-quality jobs, which in turn fuels demand for apartments, necessity-based retail, and the industrial warehouses that keep the supply chain moving.

But here’s the thing—successful investing in Texas requires looking past the positive headlines. It demands a disciplined, almost surgical approach to underwriting and a real understanding of what’s happening on the ground in specific submarkets. The opportunities in Austin are fundamentally different from those in Dallas-Fort Worth or San Antonio. You can’t paint the whole state with one brush.

This is where having an experienced partner becomes absolutely critical. A seasoned team with deep local roots can spot mispriced assets and unlock value that others miss. For an investor, that means getting access to deals that aren't just riding a broad trend but are carefully structured to capitalize on specific, localized opportunities—a cornerstone of the benefits of real estate investing for building generational wealth.

The Market Why-Now: Understanding The Texas Economic Engine

To really get why investing in Texas real estate is such a smart move, you have to look under the hood at its incredibly powerful and diverse economy. The state's property market isn't just about flashy corporate relocations grabbing headlines; it’s fueled by a direct, powerful link between job creation, GDP growth, and a population that just keeps on growing.

Think of it like this: a booming economy is high-octane fuel for property demand. When a new tech campus opens its doors in Austin or a logistics giant expands near Dallas, it sets off a huge ripple effect. Those new—often high-paying—jobs pull in skilled workers from all over, and every single one of them needs a place to live, a place to shop, and access to services. This is what directly drives demand for everything from multifamily apartments to retail centers and medical offices.

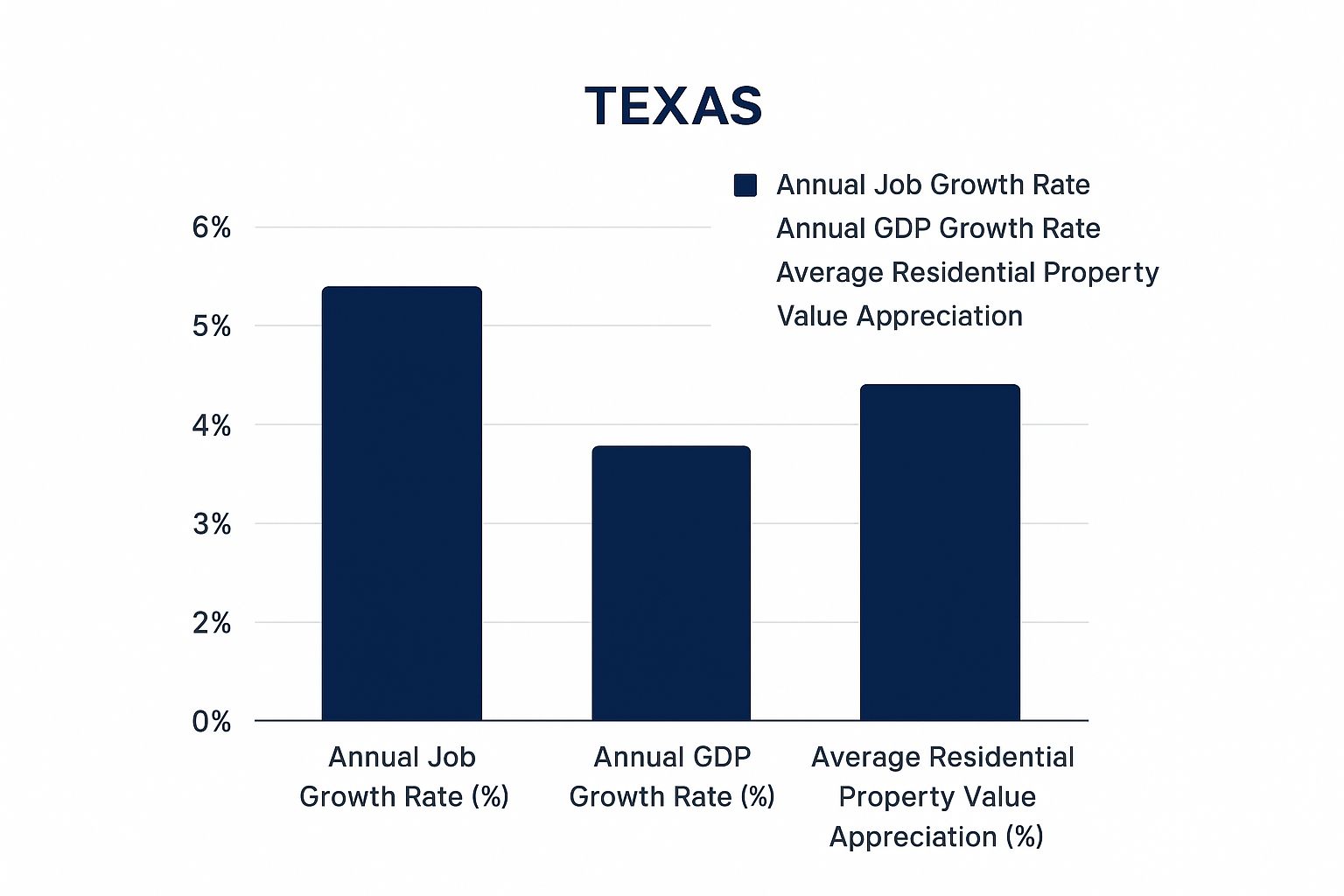

The infographic below really brings to life the connection between these key economic stats and the health of the real estate market.

You can see pretty clearly how positive job and GDP growth create a rising tide that lifts property values all across the state.

The Power of A Diversified Economy

Unlike other states that are basically a one-trick pony, relying on a single industry, Texas has an economy that fires on all cylinders. That diversification is a massive advantage for real estate investors because it spreads out the risk. If one sector takes a hit, another is often there to pick up the slack, creating a much more stable foundation for long-term growth.

The key industries keeping things humming include:

Energy: Still a global giant, of course, but Texas's energy sector has also pivoted, with a major focus now on renewables and new technology.

Technology & Innovation: "Silicon Hills" in Austin and the tech corridors in Dallas and Houston are magnets for top talent and venture capital.

Healthcare & Life Sciences: Texas is home to the world's largest medical center, making it a true powerhouse in healthcare and driving big demand for medical office buildings and research facilities.

Logistics & Distribution: Its prime central location and top-notch infrastructure make Texas a critical hub for national and international trade, which means a nearly insatiable demand for modern warehouse space.

This economic muscle translates into real-world results for investors. According to data as of Q2 2024, the Texas real estate market is propped up by an employment rate holding strong around 4.5%. Wage growth is on the rise at about 3.2%, and the state's steady GDP growth of 2.5% points to a stable environment that’s perfect for real estate investment. On top of that, rental demand is high, and with a moderate supply, vacancy rates are staying low at around 5%. You can dive deeper into the latest Texas real estate market trends at Rentastic.io.

Novice Lens: Why It MattersThink of a diverse economy like a well-balanced stock portfolio. You wouldn't put all your money into one stock, right? When one part of the Texas economy (like oil and gas) slows down, another (like tech or healthcare) can ramp up. This stability means more consistent job growth, which means more people needing apartments and services. For an investor, that creates reliable demand and more predictable returns.

Connecting Economic Trends to Asset Performance

For an investor, the real trick is to connect these big-picture economic trends to specific real estate opportunities on the ground. For instance, strong wage growth in the tech sector directly translates to the ability to support higher rents in luxury apartment buildings. In the same way, an aging population means more people need outpatient medical care, making medical office buildings a really compelling investment.

By understanding how the Texas economy actually works, you can make much smarter decisions and pinpoint the sectors and locations that are set up for real, sustainable growth. It's not just about chasing the latest hot trend; it’s about investing in a market that has proven, time and again, its ability to create and hold value for the long haul.

Navigating Key Texas Real Estate Markets

While the big-picture story of Texas is compelling, smart real estate investing happens at the street level. You have to get granular. The opportunities in Houston, for example, look nothing like those in Austin. The real action is concentrated in what we call the “Texas Triangle,” the economic megaregion connecting Dallas-Fort Worth, Houston, Austin, and San Antonio.

This is where the vast majority of the state's people and economic muscle are clustered, creating a high-octane environment for investment-grade assets. But here’s the key: each corner of the Triangle has its own unique economic personality and demographic pulse. That means the most promising property types change from city to city.

A one-size-fits-all approach is a recipe for failure here. A winning strategy means digging into the unique risk and return profile of each market and matching it to your own portfolio goals.

The Dallas-Fort Worth Metroplex: An Economic Juggernaut

Dallas-Fort Worth (DFW) is the undisputed heavyweight of the Texas economy. Its biggest strength is its incredible diversification. With major players in finance, corporate services, tech, and logistics, DFW has built-in resilience that creates broad-based demand for commercial real estate. The Metroplex is a magnet for corporate relocations, home to more than two dozen Fortune 500 headquarters. For a deeper dive, this comprehensive guide to Dallas real estate investing offers an excellent overview of the market dynamics.

Houston: The Energy and Medical Capital

Houston's economy was forged in the energy sector, but it has wisely diversified in recent decades. The Texas Medical Center—the largest medical complex on the planet—is a monster demand driver for everything from medical office buildings and life science facilities to housing for its massive workforce. The Port of Houston, one of the nation's busiest, cements the city's role as a global trade hub.

Insight Edge: Infrastructure Unlocks ValueA key tell for future growth is major infrastructure spending. Take the ongoing expansion of the Port of Houston, which is set to dramatically increase its capacity. This project will directly pump value into industrial properties in the eastern submarkets, creating a clear, long-term opportunity for investors who can snag well-positioned assets before everyone else catches on.

Austin and San Antonio: The Innovation Corridor

The I-35 corridor running from Austin down to San Antonio is buzzing with technology, government, and a population that just won't stop growing. Austin, the famed "Silicon Hills," is a global tech hub that pulls in a young, educated workforce, creating an almost insatiable demand for multifamily housing. San Antonio brings a more stable, diversified profile, anchored by major military installations and a booming cybersecurity industry. To really dig into how to size up these different plays, a structured framework is key; you can see ours by reviewing our guide on how to evaluate investment opportunities.

Major Texas Metro Real Estate Market Snapshot

This table offers a comparative look at the key investment markets in Texas, breaking down what makes each one tick—from economic drivers to the property sectors with the most potential.

Metro Area | Primary Economic Drivers | Dominant Property Sectors | Illustrative Investment Strategy |

|---|---|---|---|

Dallas-Fort Worth | Corporate HQs, Finance, Logistics, Tech | Industrial, Multifamily, Data Centers | Value-add industrial development near key transportation arteries. |

Houston | Energy, Healthcare, Global Trade, Mfg. | Industrial, Medical Office, Multifamily | Acquiring and modernizing Class B medical office buildings near the Texas Medical Center. |

Austin | Technology, Higher Education, Government | Multifamily, Industrial, Creative Office | Ground-up development of multifamily properties in high-growth suburban submarkets. |

San Antonio | Military, Cybersecurity, Healthcare, Tourism | Industrial, Multifamily, Medical Office | Stabilized workforce housing acquisition, targeting areas with strong employment fundamentals. |

Finding Opportunity In Dominant Property Sectors

Knowing the big-picture trends in Texas is step one. Step two is getting granular and identifying which property types are perfectly positioned to ride those powerful economic and demographic waves. While you can find deals anywhere if you look hard enough, a few sectors are just plain outperforming because of demand drivers unique to the Lone Star State.

For any serious investor, a real estate investment in Texas strategy means digging into the why behind a sector's momentum. It’s not enough to hear that industrial is hot. You need to connect the dots and see how e-commerce fulfillment and cross-border trade with Mexico create an almost bottomless demand for modern warehouses.

Multifamily: The Unrelenting Demand For Housing

The Texas population boom is the single biggest engine for the multifamily sector. Every company that relocates here, every new job created—that’s another person or family needing a place to live. The supply and demand picture is especially interesting right now. In 2024, Texas saw a massive wave of new apartment construction, with over 116,000 new units hitting the market. But the story changes dramatically in 2025. Projections show that number getting cut nearly in half, down to around 55,000 units.

This sharp drop in new supply, coupled with relentless demand for housing, is set to keep the rental market tight. You can dig deeper into these numbers in the Texas Real Estate Research Center's 2025 forecast (as of February 2025).

Industrial And Logistics: The Backbone Of Commerce

Texas is, without a doubt, the logistical heart of North America. A central location, a web of major highways, massive ports like Houston, and a shared border with Mexico make the state an absolutely essential hub in the global supply chain. When you layer the explosion of e-commerce on top of that geographic advantage, you get a voracious appetite for modern industrial and logistics space.

Deal Lens Example: A Value-Add Multifamily PlayImagine we acquire a 200-unit apartment complex from the 1990s in a thriving Dallas suburb. It’s in a great spot, but the units are tired and the rents are lagging.* The Strategy: This is a classic value-add play. We'll put $2 million ($10,000 per door) into capital improvements—think new quartz countertops, smart home tech, and a full refresh of the pool and clubhouse.* The Result: These modern upgrades allow us to raise average monthly rents by $200 per unit. That bump flows directly to the property's Net Operating Income (NOI), which dramatically increases what the property is worth when we eventually sell. This is exactly how a well-executed strategy generates a strong Internal Rate of Return (IRR) for our investors.

Niche Sectors Gaining Momentum

Beyond the two titans of multifamily and industrial, a few specialized sectors are also thriving, powered by Texas's specific economic strengths.

Data Centers: Our digital world—from cloud computing to AI—runs on physical hardware. Texas has the affordable land, reliable power grid, and business-friendly climate to be a top destination for data center development, especially around Dallas-Fort Worth.

Medical Office Buildings (MOBs): With an aging population and world-renowned healthcare hubs like the Texas Medical Center in Houston, the demand for outpatient clinics and specialized medical offices is rock-solid. These buildings often come with the security of long-term leases from stable healthcare systems.

How To Structure Your Texas Real Estate Investment

Once you’ve zeroed in on the right opportunities in Texas, the next big question is how to put your capital to work. Getting the structure right is just as critical as picking the right property. For most high-net-worth investors and family offices, the most efficient path is passive investing through a professional sponsor. This approach provides access to institutional-quality deals and expert management without the day-to-day operational burden.

The Power Of Partnering With A Sponsor

For savvy investors, teaming up with an experienced sponsor or private equity firm is the secret to accessing the best deals. A good sponsor manages the entire process, from finding and vetting the property to running it and eventually selling it for a profit. This model delivers serious advantages:

Access to Better Deals: Top sponsors find off-market opportunities you’d never see on your own.

Professional Management: They bring a level of diligence and operational skill that maximizes an asset’s potential.

Diversification: You can spread your capital across multiple deals, sponsors, and property types.

Investor Checklist: Questions To Ask Any Sponsor

Doing your homework on a potential sponsor is non-negotiable. Any sponsor worth their salt will welcome these questions. For background, our guide to private equity real estate fund structures offers great context.

Track Record: Can you walk me through your past deals—both the wins and the losses?

Market Expertise: What’s your specific experience in this Texas submarket and with this asset class?

Underwriting Assumptions: How are you projecting rent growth, exit cap rate, and expenses?

Alignment of Interests: How much of your own capital is in this deal?

Fee Structure: Can you provide a clear breakdown of all fees?

Capital Stack: What is the debt structure and what are the loan terms?

Business Plan: What’s the exact value-add plan and your projected timeline?

Risk Mitigation: What are the biggest risks and what are your plans to mitigate them?

Exploring proven wealth building strategies can help you see how a Texas property can become a core piece of your long-term financial plan.

Risk & Mitigation in the Texas Market

A maturing market means we need to have a clear-eyed view of potential bumps in the road. Smart investors don't just chase the upside; they plan for the downside.

Risk: Rising Property Taxes * Mitigation: A sharp sponsor will aggressively appeal tax assessments annually and build conservative tax estimates into their pro forma from day one, ensuring potential hikes are already accounted for.

Risk: Interest Rate Sensitivity * Mitigation: Using smart leverage is key. Locking in fixed-rate debt whenever possible shields a project from volatility. Stress-testing a deal against higher-rate scenarios is standard practice for institutional-grade underwriting.

Risk: Pockets of Oversupply * Mitigation: Deep submarket analysis is the best defense. A sponsor with on-the-ground intelligence can identify areas with durable demand and avoid those facing a temporary glut of new construction.

At the end of the day, the future of the Texas market belongs to those who can see past the headlines, understand the core fundamentals, and execute a disciplined plan. For smart, well-capitalized investors, the chance to build real, long-term wealth in Texas is as strong as ever.

FAQ: Common Questions About Texas Real Estate Investing

What is the primary advantage of investing in Texas real estate versus other states?

The advantage is a powerful trifecta: a pro-business climate (including no state income tax), relentless growth from diverse industries, and a booming population. This combination creates a deep, constant demand for all property types, providing a sturdy foundation for both long-term appreciation and steady cash flow.

As a passive investor, how should I vet a real estate sponsor for a Texas deal?

Your due diligence should be laser-focused on three things: their local track record in the specific submarket and asset class; their underwriting discipline, including conservative assumptions for rent growth and exit cap rates; and a clear alignment of interests, meaning they have significant "skin in the game" by investing their own capital alongside yours.

What are the specific risks I should be aware of in the Texas market?

Two risks demand close attention: high property taxes, which can impact net operating income, and the potential for temporary oversupply in certain fast-growing submarkets. An experienced local sponsor mitigates these risks by aggressively appealing taxes, using moderate leverage, and performing granular submarket analysis to avoid overbuilt areas.

Which property types are showing the most promise in Texas right now?

Industrial and logistics properties remain a top performer, fueled by e-commerce and Texas's role as a distribution hub. Multifamily also remains a powerhouse, driven by job and population growth. Niche sectors like data centers and medical office buildings are also gaining significant traction due to specific economic and demographic trends in the state.

At Stiltsville Capital, we connect accredited investors with institutional-grade real estate opportunities in high-growth Sunbelt markets. Well-structured real assets can be a prudent, resilient component of a long-term wealth strategy. If you’re ready to see how a disciplined investment in Texas real estate can strengthen your portfolio, we invite you to schedule a confidential call.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments