A Guide to Cash Flow for Real Estate Investors: The Definitive Guide for 2024

- Ryan McDowell

- Oct 11

- 11 min read

Reading Time 6 min | Good for: Novice & Informed Investors (A, B)

TL;DR: Key Takeaways

Cash flow is king: It's the net cash remaining after all expenses and debt service are paid, serving as the lifeblood of any real estate investment.

NOI is the core metric: Net Operating Income (NOI) measures a property's pure profitability before debt, making it the universal standard for comparing assets.

Value is actively created: Sophisticated sponsors don't just wait for market appreciation; they "force" value by increasing income (rent bumps, ancillary fees) and cutting costs (operational efficiencies).

Due diligence is non-negotiable: Scrutinizing a sponsor's assumptions on rent growth, vacancy, and capital expenditures is the single most critical step to protect your capital.

Before you get lost in a sea of spreadsheets, let’s get straight to what real estate cash flow actually is.

Think of it as the lifeblood of your investment property. It’s the cash left in your pocket after you’ve collected all the rent and paid all the bills—mortgage included. For any serious investor, from an individual to a multi-generational family office, positive cash flow is the name of the game. It’s what provides steady income, acts as an inflation hedge, and creates a much-needed cushion when the market gets a little rocky.

Market Why-Now: The Bedrock of Real Estate Investing

In a market where predictability is a rare commodity, the tangible, income-producing nature of real estate has become more attractive than ever. Family offices and high-net-worth investors continue to view real assets as a cornerstone for long-term wealth preservation. As of early 2024, a significant portion of family offices plan to maintain or increase their allocations to real estate, drawn by its potential for stable, inflation-adjusted income streams (Source: UBS Global Family Office Report, 2023).

Unlike stocks or bonds, real estate cash flow is tangible. It's predictable. Better yet, you can actively manage it to boost your returns. At its core, it’s your reward for providing a quality place for people to live or work. Our goal here is to build your confidence so you can evaluate any deal that comes your way, just as a professional investment committee would.

Key Metrics You Need to Know

Before we jump into any formulas, you have to speak the language. These are the terms that drive every institutional real estate conversation:

Gross Potential Income (GPI): This is the absolute maximum rent a property could bring in if it were 100% occupied all year, with every single tenant paying on time. It's the theoretical ceiling.

Net Operating Income (NOI): Think of this as the property's raw profitability before you factor in your mortgage or taxes. For a deeper dive, this guide on understanding Net Operating Income (NOI) in real estate is a great resource.

Cash-on-Cash Return: This metric gets right to the point. It answers the one question every investor asks: "For every dollar I put in, how much am I getting back each year?" It’s your annual pre-tax cash flow measured against your initial cash investment.

Getting a handle on how these numbers relate to each other is everything. If you want to go deeper, check out our guide on how cap rate and NOI lead to smarter real estate investing.

Novice Lens: Why It MattersThink of these terms like stats on the back of a baseball card. GPI is the player's home run potential, NOI is their actual batting average for the season, and Cash-on-Cash Return is how much they help your fantasy team win. Each tells a different but crucial part of the story.

The Core Formulas for Calculating Cash Flow

To really get a feel for a property's financial health, you have to know your way around the numbers. Figuring out cash flow for real estate isn't complicated; it's a logical process, like peeling back the layers of an onion to get to what matters most. It all starts with the property's absolute maximum potential income and then, step by step, we account for all the real-world costs.

This breakdown shows you exactly how sponsors project returns and uncovers a property's true profitability.

From Potential to Reality: Effective Gross Income

Every analysis kicks off with Gross Potential Income (GPI). Think of this as the total rent you'd collect if every single unit was rented out for the entire year without a single issue. But let's be real—perfect occupancy is a fantasy. We have to adjust for reality.

When you subtract an allowance for vacancy and credit loss (tenants who don't pay) from your GPI, you get the Effective Gross Income (EGI). This number is a much more realistic picture of the revenue you can actually expect to see in your bank account.

Finding Pure Profitability: Net Operating Income

Once you have your EGI, the next move is to subtract all the Operating Expenses (OpEx). These are the necessary, day-to-day costs of keeping the property up and running.

Property management fees

Insurance and property taxes

Utilities and routine maintenance

Landscaping and repairs

The number you're left with is the Net Operating Income (NOI), and it's arguably the single most important metric in real estate investing. NOI shows you the property's pure, unlevered profit before you even think about the mortgage. To really dive deep, check out our complete walkthrough on how to find Net Operating Income in our guide for real estate investors.

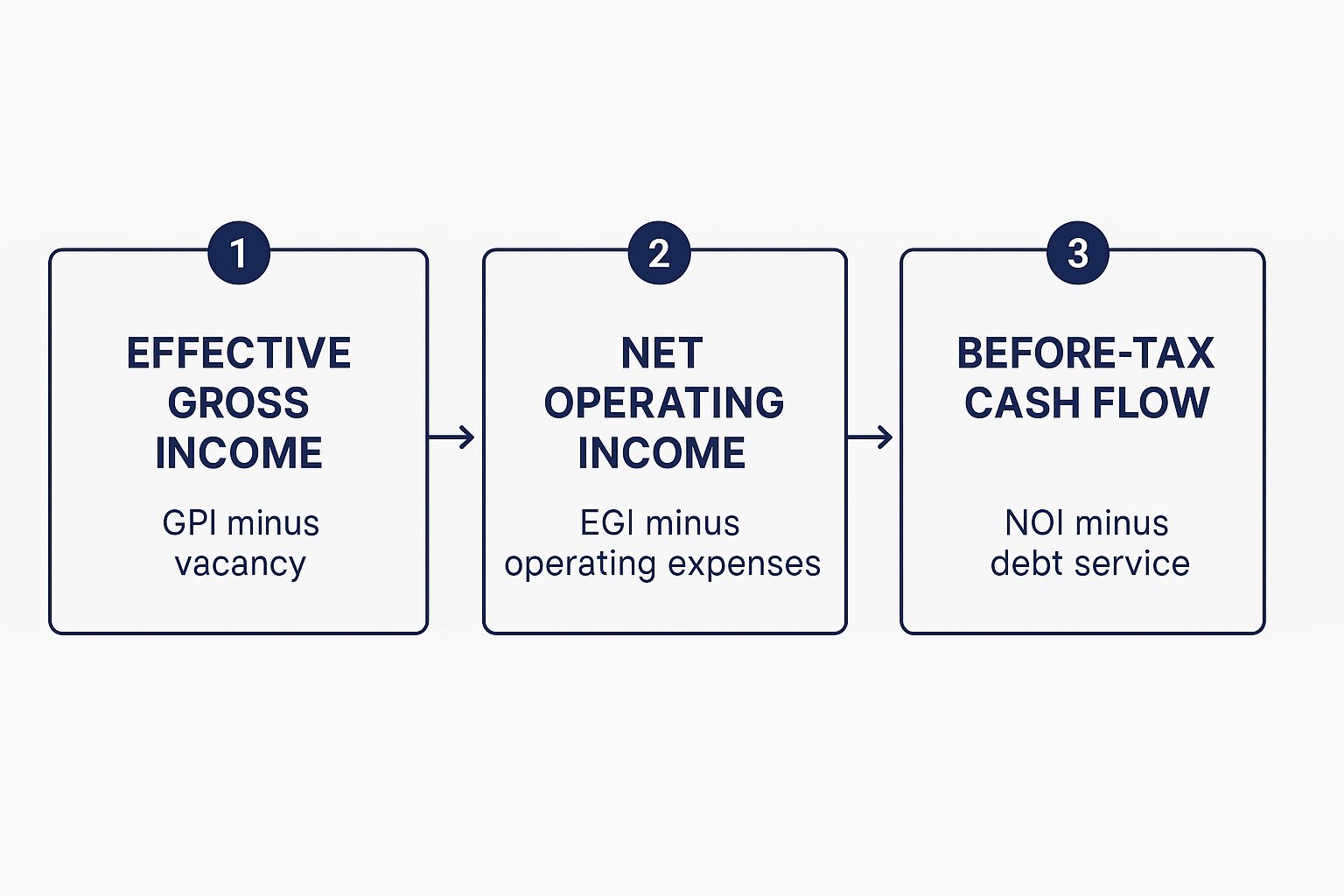

The chart below lays out this foundational cash flow waterfall, showing how income gets refined at each stage to really nail down profitability.

This visual makes it crystal clear how you get from that big gross income number down to the cash that’s available to pay the bank, underscoring just how critical managing expenses is for a healthy NOI.

The Investor's Take-Home: Before-Tax Cash Flow

NOI is great for judging how well the asset itself is performing, but it’s not the cash that actually lands in an investor’s pocket. For that, we need to subtract the total Debt Service—the principal and interest payments on the mortgage.

NOI - Debt Service = Before-Tax Cash Flow (BTCF)

This is the money that gets distributed to investors before income taxes are taken out. It’s the number that drives your cash-on-cash return, directly measuring the income your own invested cash is generating.

The Final Step: After-Tax Cash Flow

Last but not least, we account for taxes to get the After-Tax Cash Flow (ATCF). This final calculation involves subtracting the investor's tax liability from the BTCF. It’s heavily influenced by non-cash deductions like depreciation—a massive advantage for shielding income from taxes.

For a detailed look at how income and allowable expenses affect your property's cash flow, which is crucial for getting these calculations right, see the UK Property Rental Income Tax Explained for Landlords. Understanding these details is the key to maximizing what you actually keep.

Putting Cash Flow Projections into Practice: A Value-Add Multifamily Example

Formulas are great, but the real magic happens when you see cash flow work in a live deal. Let's walk through a classic scenario that experienced investors love: the value-add multifamily property.

This is the kind of deal where a savvy sponsor spots an overlooked, underperforming asset and executes a smart plan to crank up its financial performance and deliver solid returns to investors.

The Deal Lens: An Underperforming Asset

Picture this: a 100-unit apartment building purchased for $10 million. The property is tired. It's got dated interiors, rents well below the market rate, and sloppy management. This is the perfect setup for a value-add play.

On day one, the numbers—what we call the "pro-forma"—might look something like this (numbers are illustrative):

Current Average Rent: $1,000/month

Annual Gross Potential Income (GPI): $1,200,000

Vacancy & Credit Loss (8%): -$96,000

Effective Gross Income (EGI): $1,104,000

Operating Expenses (55% of EGI): -$607,200

Year 1 Net Operating Income (NOI): $496,800

The building is making money, sure, but it's leaking potential everywhere. Those high operating expenses and low rents are a major drag on its performance.

The After Scenario: Unlocking Hidden Value

This is where the sponsor’s business plan kicks in. The strategy is to inject capital for strategic improvements over two or three years—renovating units, upgrading common areas, and bringing in professional management to tighten up operations.

Investor Takeaway: The goal of a value-add strategy is "forced appreciation." Instead of just waiting for the market to lift the property's value, the sponsor actively creates new value through targeted improvements, directly increasing the cash flow.

After the work is done, the financial picture is dramatically different.

Modeling The Transformation

Let's say the sponsor invests $1.5 million into renovations. This allows them to raise rents and attract better, more reliable tenants. At the same time, the new management team cuts wasteful spending and runs the property more efficiently.

Here’s a simplified look at the numbers in Year 3, once the property is stabilized:

New Average Rent: $1,350/month (a 35% increase)

Annual GPI: $1,620,000

Vacancy & Credit Loss (5%): -$81,000 (Better units mean fewer empty ones)

EGI: $1,539,000

Operating Expenses (48% of EGI): -$738,720 (Now a smaller slice of a much bigger pie)

Year 3 Stabilized NOI: $800,280

That's a staggering 61% increase in Net Operating Income. This massive lift in the property's core profitability is what drives higher cash distributions for investors and a much higher price tag when it's time to sell. For sophisticated investors, a key piece of underwriting here is the exit cap rate assumption—using a conservative estimate here ensures the deal model can handle potential market shifts.

Strategies to Grow Real Estate Cash Flow

Figuring out your property's cash flow is one thing. Actually growing it is where the real magic happens. This is how the best real estate sponsors create serious value, turning a good deal into a great one.

They aren't just sitting back and hoping for the market to go up. Instead, they're actively pulling specific levers to push revenue higher while keeping a tight grip on expenses. It’s this hands-on, operational expertise that makes all the difference.

More Than Just Bumping Up the Rent

Sure, raising rents to what the market will bear is always part of the plan. But the savviest operators know there are other ways to fatten up the top line by adding new income streams that tenants are happy to pay for.

These little extras, known as ancillary income sources, can pack a surprising punch to a property’s Net Operating Income. Some common plays include:

Premium Parking: Charging a monthly fee for reserved or covered parking spots.

Storage Units: Turning that unused basement space into secure storage lockers for residents to rent.

Tech & Amenity Packages: Bundling things like high-speed internet, smart-home gadgets, or an in-unit washer and dryer for a simple, recurring fee.

Cutting Costs with Smarter Operations

Just as important is the constant push for efficiency. Squeezing costs has the exact same impact on NOI as boosting revenue. This is where a modern approach to management really shines.

Why It Matters: Every single dollar you save in annual operating costs can add $15 to $20 in property value, assuming a 5-6% cap rate. This direct line from smart spending to value creation is a fundamental principle for institutional-level real estate investors.

This could mean using technology for predictive maintenance or making smart, ESG-focused upgrades like installing energy-saving LED lights and low-flow toilets to cut utility bills. In a market where global deal activity is picking back up, being a top-notch operator is what sets you apart. You can dive deeper into how operational income growth is shaping investment decisions in the latest global private markets report.

Your Due Diligence Checklist for Analyzing Cash Flow

Verifying a sponsor's projections is single-handedly the most critical step in evaluating any real estate deal. A rosy pro-forma can make a mediocre asset look like a grand slam. Using a checklist shifts you from being a passive investor to an active analyst, giving you a structured way to ask the tough questions.

Key Questions to Ask a Sponsor

Before committing capital, you need clear, confident answers to these fundamental questions.

How do rent growth assumptions stack up against the market? Ask for the third-party market reports the sponsor used. If they're projecting 5% annual rent growth, but the submarket has historically only seen 2.5%, they better have a compelling, data-backed reason for that leap.

Is the vacancy assumption realistic? Check the sponsor's assumption (e.g., 5% vacancy) against the property’s actual historical performance (the T-12, or trailing twelve months of financials) and current submarket vacancy rates. An assumption that’s too low will inflate the entire cash flow picture.

Is the Capital Expenditure (CapEx) budget sufficient? Underestimating CapEx is one of the most common and costly mistakes. Review the Property Condition Assessment (PCA) to see if the budget truly covers big-ticket items like roof replacements or new HVAC systems.

How is debt service structured? Understanding the loan is non-negotiable. Is the interest rate fixed or floating? If it's a variable rate, is there an interest rate cap in place to protect against rising rates? As lenders remain selective, they are reserving capital for deals with solid fundamentals. You can learn more about how this resurgence in lending activity supports cash flows.

Investor Takeaway: Due diligence isn't about finding a "perfect" investment—they don't exist. It's about deeply understanding the risks you are taking. A sponsor who welcomes these questions and gives you transparent, data-driven answers is a sponsor you can build a relationship with.

For a much more exhaustive list of items to review, you can check out our ultimate commercial property due diligence checklist.

How to Navigate Common Cash Flow Risks

Every real estate deal comes with risks. But knowing what those potential headwinds are is the first step toward building a resilient portfolio. Disciplined, institutional-grade sponsors plan for the worst-case scenario.

While you can't eliminate every risk, smart operators have a playbook of proven tactics to protect a property’s cash flow.

Risk & Mitigation Table

Risk: Unexpected Vacancies * Mitigation: Conservative underwriting with a realistic vacancy percentage baked into the financial model, providing a buffer if occupancy dips.

Risk: Rising Interest Rates * Mitigation: For floating-rate loans, implementing an interest rate cap. This insurance policy puts a ceiling on how high the rate can climb, protecting investor distributions.

Risk: Sudden Capital Expenditures * Mitigation: A detailed Property Condition Assessment before closing helps accurately budget for future big-ticket repairs, so you aren't caught off guard by a costly emergency.

The broader economic picture always plays a role. We've recently seen global real estate transaction volumes dip slightly due to these concerns. You can get more insights on how global real estate markets are navigating these shifts on ubs.com.

Your Top Cash Flow Questions, Answered (FAQ)

Even after you’ve run the numbers, a few questions always seem to pop up when you're digging into a potential real estate deal. Let’s tackle some of the most common ones we hear from investors.

What is a good cash-on-cash return?

There’s no magic number. A "good" cash-on-cash (CoC) return really depends on the deal's strategy, risk, and market. For a stable, top-tier property in a prime location (a "core" asset), a CoC return in the 4-6% range can be a solid win. For a value-add or opportunistic project, you're taking on more risk, so you should expect a higher reward—often targeting 8-12% or more.

The key is matching the CoC return to the business plan. A lower return on a low-risk, stabilized asset can be fantastic, while a high return might not be enough to justify a complex, ground-up development.

How does depreciation affect my actual cash flow?

Depreciation is one of the most powerful tax advantages of real estate investing. It’s a non-cash expense, meaning it lowers your taxable income on paper, but no actual money leaves your bank account. While depreciation doesn't touch your before-tax cash flow, it can give a serious boost to your after-tax cash flow. By shrinking your tax bill, you get to keep more of the money the property earns. This "tax shield" is a powerful benefit that you just don't get with many other investments.

Can a property with negative cash flow be a good investment?

It sounds counterintuitive, but yes—in the right situation. A property with negative cash flow can still be a home-run investment, especially for ground-up development or a major renovation project. During construction, a property is all costs and no income. Investors in these deals aren't looking for monthly checks; their strategy is built on "forced appreciation." They're creating a massive amount of value that will pay off when they sell or refinance the finished, stabilized property. It's a higher-risk play that demands an experienced team with a crystal-clear vision and the capital to see it through.

At Stiltsville Capital, we believe well-structured real estate can be a prudent, resilient component of a long-term wealth strategy. We help accredited investors make sense of these details and find opportunities that fit their financial goals. If you're ready to see how a disciplined approach to real estate can build your portfolio, we invite you to schedule a confidential call with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments