A Guide to Value Add in Real Estate For Smarter Investing

- Ryan McDowell

- Dec 12, 2025

- 16 min read

Reading Time 6 min | Good for: A, B

TL;DR: Key Takeaways on Value-Add Real Estate

What It Is: Value-add real estate isn't just a cosmetic flip; it's a strategic business plan to acquire an underperforming property and "force appreciation" by increasing its Net Operating Income (NOI).

How It Works: Investors create value through a combination of physical renovations, operational efficiencies (like professional management), and strategic repositioning to justify higher rents and increase property value.

Who It's For: This strategy fits investors seeking higher returns than stable "core" assets without the ground-up risk of development. It's ideal for those with a 3-7 year investment horizon.

Investor Action: The key to success is partnering with an experienced sponsor. Your due diligence should focus on their track record, alignment of interest ("skin in the game"), and communication.

The Market Why-Now

The real estate sector is a massive engine of the U.S. economy. According to data from Trading Economics, the value added by real estate and rental leasing was a staggering $3.26 trillion in Q2 2023. Within this vast market, the value-add strategy is gaining traction. As interest rates stabilize and construction costs remain high, improving existing assets often presents a more compelling risk-adjusted return than building new. Many global family offices continue to increase allocations to private real estate to hedge against inflation and diversify their portfolios.

When you hear "value-add" in real estate, don't just think of a simple flip. It's less about slapping on a new coat of paint and more about executing a full-blown business turnaround for a property.

The goal is to find an asset that’s falling short of its potential—maybe an older apartment complex with dated units and sloppy management—and then systematically unlock its hidden value.

The Core Concept of Value Add Real Estate

Instead of just buying a property and hoping the market lifts its value, the value-add strategy is all about forcing appreciation. It's a hands-on approach where we actively increase a property's Net Operating Income (NOI), which in turn directly boosts its market value.

This strategy carves out a sweet spot on the risk-reward spectrum. It offers much more upside than buying a stable, fully-leased "core" property but avoids the high-stakes gamble of building something from the ground up.

This proactive approach is a powerful engine for wealth creation in real estate. To put it in perspective, the real estate and rental sector's contribution to U.S. GDP was $3,260.1 billion in the second quarter of 2023, according to Trading Economics.

Forcing Appreciation vs. Passive Growth

Here's the key difference: a value-add investor creates their own luck. Passive strategies are completely dependent on outside forces, like a neighborhood suddenly becoming trendy or market rents shooting up across the city.

In contrast, a value-add plan is designed to make money by improving the property itself.

Investor Takeaway: While a rising market is always a nice tailwind, a true value-add deal is structured to create profit even if the market stays completely flat. The returns are driven by executing the plan, not by market timing.

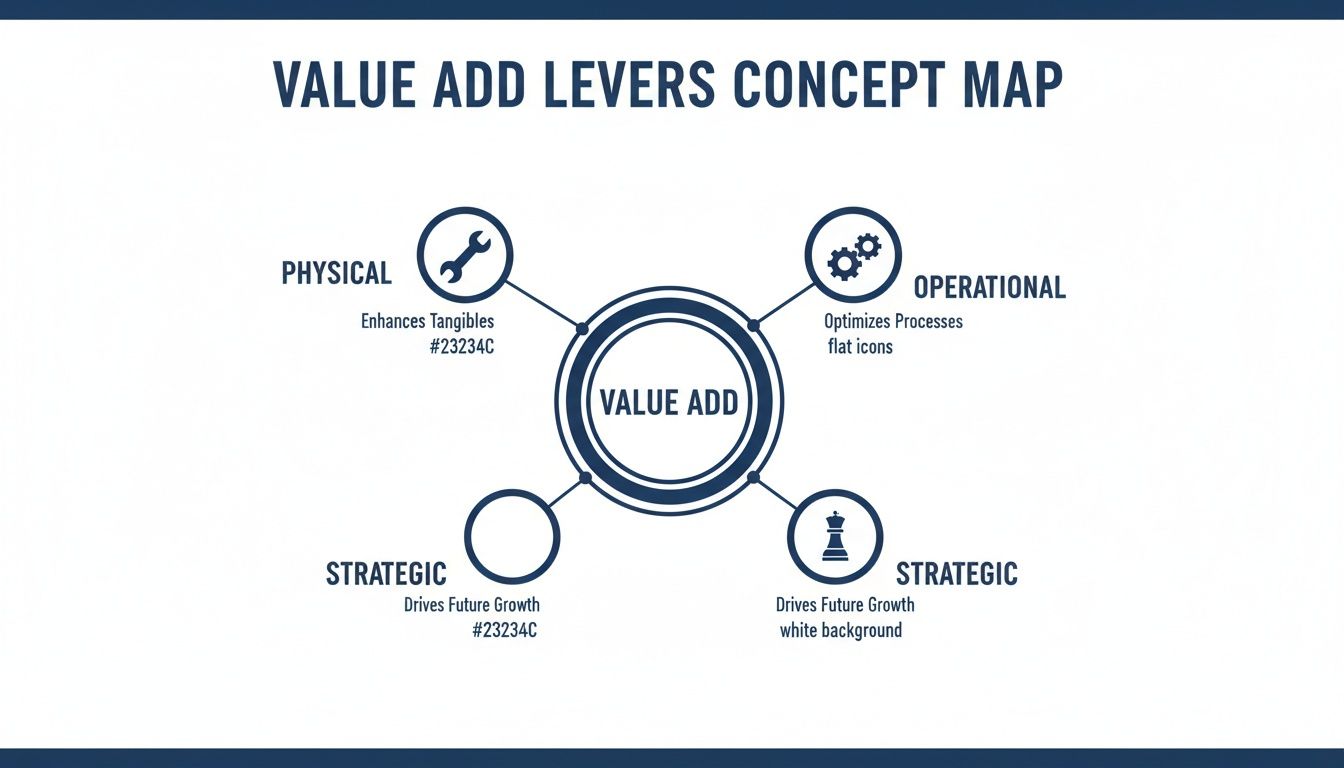

The Three Levers of Value Creation

Success in this game really comes down to mastering three fundamental levers that drive a property's income and ultimate worth:

Physical Upgrades: This is about smart capital spending (CapEx). We're talking about renovations that tenants will actually pay more for, directly increasing a property's appeal and justifying higher rents.

Operational Improvements: This is the behind-the-scenes work. It means tightening up day-to-day management to cut unnecessary costs and find new revenue streams, boosting the bottom line.

Strategic Repositioning: This is about changing the property's story. It could mean rebranding an apartment community to attract a more affluent tenant or shifting the entire identity to better fit a changing neighborhood.

By pulling these levers, an investor can take a C-class asset and turn it into a stabilized, A-class performer, creating a significant amount of equity along the way.

The Four Pillars of Creating Value in Commercial Real Estate

A great value-add deal isn't about one magic bullet; it's a coordinated game plan executed on multiple fronts. The best strategies systematically improve a property's financial performance by pulling several distinct, powerful levers at once. Think of it as a business turnaround where every piece—the physical building, the day-to-day operations, and the marketing—has a clear role in boosting the bottom line.

These levers are how smart investors force appreciation. Instead of just waiting for the market to lift all boats, they create their own equity. Getting a handle on these four pillars is the key to understanding a sponsor's strategy and seeing the true potential in a deal.

This map breaks down the primary levers we pull, grouping them into physical, operational, and strategic initiatives.

As you can see, a solid value-add plan is about more than just construction. It's about blending tangible upgrades with smarter management to completely transform a property's place in the market.

Pillar 1: Physical Renovations and CapEx

This is the most visible and tangible part of any value-add project. It involves strategically injecting capital—what we call Capital Expenditures or CapEx—to physically upgrade the property. And no, we’re not just talking about a fresh coat of paint.

The whole point is to invest in improvements that tenants will happily pay a premium for, giving you a direct justification for higher rents. Smart CapEx spending generates a real, measurable return on investment by turning a tired, dated property into a place people are excited to live.

Common high-impact renovations often include:

Interior Unit Upgrades: Modernizing kitchens with new countertops and stainless-steel appliances, adding in-unit laundry, or ripping out old carpet for new flooring can command significant rent bumps.

Exterior and Curb Appeal: Fresh paint, modern signage, and professional landscaping create a powerful first impression that attracts better tenants right from the start.

Amenity Enhancements: Adding or overhauling amenities like a fitness center, dog park, or modern clubhouse can completely elevate the community's profile.

Systems Modernization: Upgrading major systems like HVAC or installing new windows isn't just about tenant comfort—it can also slash long-term operating costs.

These physical changes lay the foundation for the entire business plan. They create a product that can finally compete at a higher level.

Pillar 2: Operational and Management Efficiencies

This pillar is all about unlocking the "hidden" profits by installing professional, best-in-class property management. You’d be surprised how many underperforming properties are owned by folks who just don't have the scale, technology, or expertise to run them efficiently.

A sophisticated sponsor can often create a ton of value just by improving how the property is run day-to-day. It’s about making the asset operate like a well-oiled machine, maximizing every dollar of revenue and cutting out the waste.

Novice Lens: What is Net Operating Income (NOI)?NOI is a property’s total income minus all its operating expenses (like taxes, insurance, and maintenance), but before mortgage payments. It's the purest measure of a property's profitability. A higher NOI means a more valuable asset. Why it matters: The entire value-add strategy is designed to increase NOI. Every dollar of new, sustainable income added through renovations or efficiencies directly increases the property's sale price.

Key operational improvements typically involve:

Reducing Vacancy: Kicking off aggressive, targeted marketing campaigns to attract qualified tenants and fill empty units fast.

Optimizing Expenses: Renegotiating vendor contracts for things like landscaping or trash removal and appealing property tax assessments to lower fixed costs.

Implementing Utility Bill-Backs: Introducing systems where tenants pay their fair share of utilities, moving a huge expense off the owner’s books.

Boosting Ancillary Income: Finding new revenue streams like adding fees for covered parking, renting out storage units, or offering community-wide internet packages.

Pillar 3: Leasing and Tenant Repositioning

This is where strategy meets action. It's all about actively managing the property's rent roll to systematically increase income. This goes hand-in-hand with the physical renovations—once the units are upgraded, you can start pushing rents to their true market potential.

It’s a methodical process. As existing leases expire, tenants might be offered a move to a renovated unit at a higher rent. When someone moves out, their old unit gets the full renovation and is leased to a new tenant at the full, post-upgrade market rate.

Over time, you "burn off" all the old, below-market leases and bring in a new base of higher-paying tenants. This has a dramatic effect on the property's gross potential rent and, in turn, its overall valuation.

Pillar 4: Strategic Rebranding and Repositioning

The final pillar is about fundamentally changing the property's identity and how it’s perceived in the market. This is where all the other pieces come together to create a new story for the asset. A successful repositioning can take a property from a C-class asset to a solid B-class competitor, attracting a more stable, affluent tenant base.

This is much more than a new name and a slick logo. It’s a comprehensive marketing effort to broadcast the property's transformation to the public, leasing agents, and prospective renters.

To really nail the landing and maximize the final sale price, bringing in professional real estate stagers can be a game-changer. By showcasing the renovated units in their best possible light, staging helps potential tenants and future buyers visualize the premium lifestyle, which can accelerate lease-up and justify the higher price point.

How to Underwrite a Value-Add Real Estate Deal

A successful value-add in real estate isn't built on hope; it's built on a foundation of disciplined, conservative financial analysis. That’s where underwriting comes in. It's the process of digging into the numbers to stress-test assumptions, verify a deal's potential, and forecast what investors can actually expect to earn.

Think of it as creating a financial blueprint for the property's turnaround. We start with the "as-is" numbers—how the property is performing right now—and then model the "to-be" scenario, projecting exactly how our value-add plan will transform its financial future. This step is absolutely non-negotiable for protecting our investors' capital.

Projecting the Future Net Operating Income

The single most important number in any value-add deal is the projected Net Operating Income (NOI). Simply put, NOI is a property’s total income minus all its operating expenses. It's the primary driver of a commercial property’s value. A higher NOI means a more valuable asset. Period.

Our entire business plan is designed to do one thing: significantly increase the property's stabilized NOI. We model this out by focusing on two key levers:

Boosting Revenue: This means projecting higher rents from renovated units and adding new income streams, like charging for reserved parking or billing back utilities.

Cutting Expenses: We also forecast cost savings from making the property run smarter. This could mean lower utility bills from new, efficient HVAC systems or simply renegotiating better contracts with our vendors.

Getting into the weeds on these numbers is essential. You can learn more about how it all works in our guide on how to find Net Operating Income.

Understanding the Cap Rate Spread

A crucial concept in value-add underwriting is the "spread" between the cap rate at purchase and the projected cap rate once the property is stabilized. The capitalization rate (cap rate) is a quick way to gauge value, calculated by dividing a property's NOI by its market price. A lower cap rate means a higher valuation.

When we buy an underperforming property, it usually trades at a higher cap rate because its income is low for its price. After we execute our business plan and boost the NOI, the property's value goes up, and its cap rate "compresses," or gets lower.

Insight Edge: Stress-Testing the ModelConservative underwriting isn’t about hoping for the best; it’s about preparing for the worst. Experienced sponsors build downside scenarios into their financial models. What if rent growth is half of what’s projected? What if construction costs run 15% over budget? A resilient deal should still deliver acceptable returns even under these stressed conditions, ensuring there's a margin of safety for investor capital.

Understanding what is Cap Rate in real estate investing is fundamental. The difference between the "going-in" cap rate and the lower "exit" cap rate is that spread—it’s a direct measure of the value we've created.

Forecasting Investor Returns

Once we've projected the future NOI and exit value, the final step is to model the returns for our limited partners (LPs). This involves forecasting cash flows over the entire life of the investment, from the day we buy it to the day we sell.

We use two primary metrics to measure the success of an investment:

Internal Rate of Return (IRR): This is the annualized rate of return. It's a powerful metric because it accounts for the time value of money—it knows that a dollar in your pocket today is worth more than a dollar you'll get tomorrow.

Equity Multiple (EM): This is a simpler gut-check. It shows how many times you get your initial investment back. An equity multiple of 2.0x means you doubled your money.

A rock-solid underwriting model lays out every single assumption—from rent growth percentages to renovation timelines—and backs them up with hard market data from trusted sources like CoStar or CBRE. This is how we ensure our projections are grounded in reality, not wishful thinking.

Putting It All Together: A Value-Add Deal in Action

Theory is one thing, but seeing how the numbers work on a real-world deal is where the power of a value-add in real estate strategy really hits home. Let's walk through a hypothetical project to see how an experienced sponsor can take a tired, underperforming property and manufacture new value from the ground up.

We'll use a classic example: a 200-unit, B-minus grade apartment complex in a growing Sunbelt market. This is the kind of bread-and-butter deal where a smart business plan can create serious returns.

The 'Before' Picture: An Opportunity in Disguise

Our target property is a 200-unit garden-style apartment community built back in the late 1990s. It’s in a great location but is showing its age. Worse, it’s being run by a "mom-and-pop" owner who hasn't kept up with the times.

This creates a few obvious opportunities for improvement:

Below-Market Rents: The average rent is stuck at $1,200 a month. Meanwhile, similar but renovated properties just down the street are easily getting $1,500. That's a huge gap.

Dated Interiors: We're talking laminate countertops, old appliances, and worn-out carpets. It's a look that just doesn't fly with today's renters.

Inefficient Operations: The owner is self-managing, which means marketing is poor and expenses are bloated. They don't have the professional systems or vendor relationships to run the property efficiently.

All these issues are dragging down the property's Net Operating Income (NOI) and, by extension, its value. It’s the perfect candidate for a value-add playbook.

The Game Plan: A 36-Month Transformation

Once we acquire the property, we hit the ground running with a detailed business plan designed to fix every one of these problems over the next 36 months.

1. Smart Capital Improvements (CapEx):We’ve budgeted $2,000,000 total—or $10,000 per unit—for upgrades. This isn’t just about spending money; it's about making targeted investments that directly lead to higher rents and a better living experience.

Inside the Units: All 200 apartments will get a modern facelift—new quartz countertops, stainless steel appliances, durable vinyl plank flooring, and updated lighting.

Curb Appeal: We'll repaint the exteriors, install new signage, and refresh the landscaping. First impressions matter.

Better Amenities: That old, unused tennis court? It’s becoming a community dog park and BBQ area—amenities that actually attract tenants.

2. An Operational Overhaul:Right away, we bring in our professional, in-house property management team. This is where a lot of the "hidden" value is unlocked. Managing an asset correctly is a science, and for investors who want to go deeper, we've broken down our approach in 9 real estate asset management best practices for superior returns.

Our team will immediately:

Launch a professional digital marketing campaign to get rid of vacancies.

Implement a RUBS program to bill back tenants for utilities.

Renegotiate every vendor contract to slash operating expenses by at least 5%.

The 'After' Projections: Quantifying the Value Creation

Executing this plan completely changes the property's financial story. By boosting rental income and cutting unnecessary costs, we dramatically increase the Net Operating Income.

Deal Lens Example: Manufacturing EquityA successful value-add project doesn't happen by accident. It's the direct result of a meticulously planned and professionally executed business plan that turns specific problems into profitable opportunities. This example turns strategy into real numbers.

To show you exactly what this looks like, the table below provides a simplified pro forma of the project. It turns our strategy into real numbers, illustrating how we actively force appreciation and create equity for our investors.

Illustrative Value Add Multifamily Project Pro Forma

This table outlines the financial transformation of a hypothetical 200-unit multifamily asset, showing key metrics before the value-add plan, the capital invested, and the projected stabilized outcome. All numbers are illustrative.

Metric | Before Acquisition | Value-Add Investment | After Stabilization (Projected) |

|---|---|---|---|

Number of Units | 200 | N/A | 200 |

Purchase Price | $28,000,000 | N/A | N/A |

Renovation & CapEx Budget | N/A | $2,000,000 | N/A |

Total Project Cost | N/A | N/A | $30,000,000 |

Average Monthly Rent/Unit | $1,200 | N/A | $1,500 |

Annual Gross Potential Rent | $2,880,000 | N/A | $3,600,000 |

Net Operating Income (NOI) | $1,680,000 | N/A | $2,160,000 |

Going-In Cap Rate | 6.00% | N/A | N/A |

Projected Stabilized Value | N/A | N/A | $43,200,000 |

Stabilized Cap Rate | N/A | N/A | 5.00% |

Gross Value Creation | N/A | N/A | $13,200,000 |

By investing $2 million into a well-located but underperforming asset, we project the creation of over $13 million in new value. This is the essence of the value-add strategy: buying based on current performance and selling based on future potential that we create ourselves.

Navigating and Mitigating Risks in Value Add Investing

While the upside of a sharp value-add strategy is exciting, any seasoned investor knows you have to measure the potential reward against the risk. Every investment has its hurdles, but in the value-add world, those risks are specific—and more importantly, manageable with the right expertise.

Understanding these challenges is step one. Knowing how a smart sponsor actively plans for and mitigates them is how you invest with real confidence. The goal isn't to dodge risk entirely (that would mean dodging returns, too) but to see it coming, plan for it, and neutralize threats before they can derail the business plan.

Construction and Renovation Risk

Risk: Cost overruns and project delays from unexpected issues or supply chain disruptions can eat into projected returns.

Mitigation: An experienced sponsor builds in a renovation contingency (typically 5-10% of the budget) and may use a Guaranteed Maximum Price (GMP) contract with the general contractor to transfer cost risk.

Leasing and Market Risk

Risk: A local economic downturn or new competition could lead to a slower lease-up or lower-than-projected rental rates, impacting revenue.

Mitigation: This is countered by deep submarket analysis before acquisition, using real-time data from sources like CoStar to validate demand. Financial models are also stress-tested for downside scenarios.

Execution and Sponsor Risk

Risk: The business plan is only as good as the team executing it. An inexperienced operator can fail to manage construction, marketing, and property operations effectively.

Mitigation: This is arguably the most critical variable. Mitigation comes from partnering with a sponsor with a proven, verifiable track record in similar projects. Diligence on the sponsor's past performance and operational depth is non-negotiable.

How to Get in on a Value-Add Real Estate Deal

So, you understand the strategy. The next logical step is figuring out how to participate in the wealth creation yourself. For accredited investors, the most common way to access institutional-quality value add in real estate is by partnering with a specialized sponsor, either through a private real estate fund or a single-asset syndication.

This structure lets you invest passively as a Limited Partner (LP). You commit the capital, and the sponsor—the General Partner (GP)—handles everything else: finding the deal, acquiring it, managing the renovation, and eventually selling the property. This professional oversight is exactly why many family offices and high-net-worth individuals are drawn to this approach. We break this structure down further in our guide to passive investing for Limited Partners.

Just know that these aren't get-in-and-out investments. You should expect a typical hold period of 3-7 years. That timeline gives the sponsor the runway needed to execute their business plan, stabilize the property, and position it for a profitable exit.

Your Diligence Checklist: Questions to Ask a Sponsor

Before you even think about wiring funds, you have to do your homework on the sponsor. A great deal in the hands of a bad operator can turn sour fast. Arm yourself with these essential questions:

Track Record: Can you show me case studies of similar value-add projects you’ve completed, from purchase to sale? What were your projected returns, and what did you actually deliver to investors?

Alignment of Interest: How much of your own money is in this deal alongside mine? A sponsor with significant "skin in the game" is a powerful sign of confidence.

Contingency Planning: What’s your contingency budget for construction delays or cost overruns? How have you stress-tested your financial model if rents soften or the market turns?

Communication Standards: How often will I hear from you? Will there be quarterly reports and annual K-1s? Who is my direct point of contact if I have a question?

Fee Structure: Lay it all out for me. I want to see a transparent breakdown of every fee—acquisition, asset management, and the profit-sharing "promote" structure.

Remember, you aren't just investing in a building. You're investing in the team that's running the show.

Fitting Value-Add into Your Portfolio

Value-add real estate can be a powerful engine within a diversified portfolio, offering a unique blend of income and growth. The beauty of the strategy is that it forces appreciation instead of just hoping the market goes up. That makes it a proactive way to build wealth.

Real estate makes up a massive two-thirds of global real assets, making it an undeniable cornerstone of wealth. But here’s a telling statistic from McKinsey: only 21% of recent real estate net worth gains came from active investment like renovations. This really highlights how value-add strategies punch above their weight, creating wealth that goes far beyond passive market appreciation. You can dig into the full research on how wealth is created on mckinsey.com. Well-structured real assets can be a prudent, resilient component of a long-term wealth strategy.

Frequently Asked Questions

Let's tackle some of the most common questions that come up when investors are first exploring value-add real estate. We'll keep the answers straightforward to clear up any confusion and build on what we've already covered.

What's the Typical Hold Period for a Value-Add Deal?

Most value-add projects are designed around a 3 to 7-year hold period.

This isn't an arbitrary number. It gives the sponsor enough time to get the deal done right—from acquiring the property and executing the renovation plan to stabilizing the asset with higher-paying tenants and marketing it for a profitable sale.

How Is This Different from Flipping a House?

It’s a great question, as both involve making improvements. The real difference comes down to scale, strategy, and timeline. Flipping is a sprint; value-add is more of a middle-distance race.

Flipping is usually a short-term play, often just a few months, focused on cosmetic fixes to a single-family home for a quick resale.

Value-add real estate, on the other hand, is a longer-term commercial investment. It’s driven by a detailed, multi-year business plan to systematically boost a property’s Net Operating Income (NOI) through strategic renovations, smarter operations, and repositioning the asset in its market. The end goal is to create a stabilized, high-performing commercial property.

Do Value-Add Deals Generate Cash Flow During Renovations?

Yes, they often can, which is one of the strategy’s key attractions. While the cash flow might be modest at the beginning, most value-add deals are acquired with existing tenants already in place.

As the sponsor methodically renovates units when they become vacant, the property's overall income stream steadily climbs. This growing income can support regular distributions to investors long before the final sale, providing a blend of cash flow and eventual appreciation.

At Stiltsville Capital, our entire focus is on finding and executing these kinds of high-potential value-add opportunities for our accredited investor partners.

If you’re ready to see how this strategy could fit into your own portfolio, we invite you to schedule a confidential call with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments