How to Calculate Cap Rates in Real Estate: A Definitive Guide for Investors

- Ryan McDowell

- Sep 9, 2025

- 13 min read

Reading Time: 7 min | Good for: A, B

Figuring out a property’s cap rate is actually pretty straightforward. You take the Net Operating Income (NOI) and divide it by the property's current market value. It's a simple formula, but it gives you a powerful, quick look at an asset's unlevered annual return. That makes it a go-to tool for sizing up different investment opportunities.

TL;DR: Key Takeaways

The Formula: Cap Rate = Net Operating Income (NOI) / Property Market Value. This shows an unlevered, first-year return.

Why It Matters: It’s a clean, fast way to compare the raw income potential of different properties, regardless of financing.

What It Signals: Lower cap rates usually mean lower risk and a higher price. Higher cap rates suggest higher risk but potentially greater returns.

Next Step: Once you understand the cap rate, the next step is to evaluate how it fits within your broader portfolio goals for income, growth, and risk.

What Is a Cap Rate and Why Does It Matter for Investors?

Think of the capitalization rate—or "cap rate"—as the North Star for real estate investors. It gives you an instant snapshot of a property’s potential profitability before you even think about financing. It cuts right through the noise of different debt structures to show you the raw, income-generating power of the asset itself.

For someone new to the game (Persona A), it’s the cleanest way to answer the big question: "For every dollar invested in this property, how much income does it generate annually before debt payments?" This metric levels the playing field, letting you fairly compare a multifamily complex in Austin with a medical office building in Miami.

For seasoned pros—family office principals and CIOs (Personas B & C)—the cap rate is a vital benchmark. It helps them gauge risk and opportunity across different markets and property types. A lower cap rate often signals a higher-quality, lower-risk asset in a prime location. A higher cap rate, on the other hand, might point to more risk, but also the potential for a much bigger payday in a value-add or opportunistic strategy.

The Core Formula Explained

At its heart, the calculation is a simple ratio. The formula is: Cap Rate (%) = NOI ÷ Market Value.

The NOI is the income a property brings in after you've paid all the direct operating expenses—things like property taxes, insurance, and maintenance. Crucially, this is before you factor in mortgage payments and income taxes. This simplicity is what makes the cap rate a cornerstone metric in real estate analysis. You can get a deeper dive into the formula's components over at Wall Street Prep.

To get a clearer picture, let's break down the two main ingredients you'll need.

Cap Rate Formula Components at a Glance

Component | Definition | What It Tells You |

|---|---|---|

Net Operating Income (NOI) | A property's total income minus all reasonable operating expenses (excluding debt service and income taxes). | This is the pure, unfiltered profitability of the property itself. It shows how well the asset is performing on its own. |

Market Value | The current price a property would likely sell for on the open market. | This represents the total capital investment required to purchase the asset at today's prices. |

Knowing these two numbers gives you the power to calculate the cap rate and start comparing deals like a pro.

Why It Matters (for Novices): The cap rate is an "unlevered" metric, meaning it ignores financing. This is crucial because it allows you to assess the raw performance of the asset itself, independent of the debt structure an individual investor might use.

Key Applications for Investors

Knowing the formula is one thing, but knowing how to use it is what separates smart investors from the rest of the pack. Here are a few ways experienced investors put cap rates to work:

Quickly Screening Opportunities: Cap rates let you sift through dozens of potential deals fast. You can immediately filter out properties that don't meet your baseline return goals and focus your energy on the ones that do.

Assessing Market Trends: Are cap rates in a market "compressing" (going down) or "expanding" (going up)? Tracking this tells you a lot about property value trends and what other investors are willing to pay.

Benchmarking Performance: The cap rate lets you compare a property you're eyeing against similar ones that have recently sold. This is your reality check—it helps you figure out if the seller's asking price is actually reasonable.

Calculating Net Operating Income: The Bedrock of Your Analysis

If there's one thing you need to get right, it's your Net Operating Income (NOI). It's the absolute foundation of an accurate cap rate calculation. Garbage in, garbage out—it’s as simple as that.

Think of NOI as the property's pure, unadulterated profit before any debt is factored in. It’s the true engine of your return, so let's get it right. The process starts by looking at a property's total potential earnings and then methodically whittling it down to a realistic, defensible number. This isn't just an academic exercise; it's the foundation of a sound investment.

From Gross Potential to Effective Income

First, you start with the Gross Potential Income (GPI). This is the rosiest scenario imaginable—what the property could earn if every single unit were rented at full market rate for the entire year, with zero vacancies or defaults. It’s an optimistic, but necessary, starting point.

From there, we have to inject a heavy dose of reality. No property in the real world maintains 100% occupancy and collections forever. You need to subtract an allowance for Vacancy and Credit Loss, which gives you the Effective Gross Income (EGI).

Pro Tip for Novices: Don't just guess at a vacancy rate. Look at the property's actual historical performance. If you don't have that, consult market reports from major firms like CBRE or JLL for that specific submarket and property type. A 5% vacancy rate is a common placeholder, but real, local data is always better.

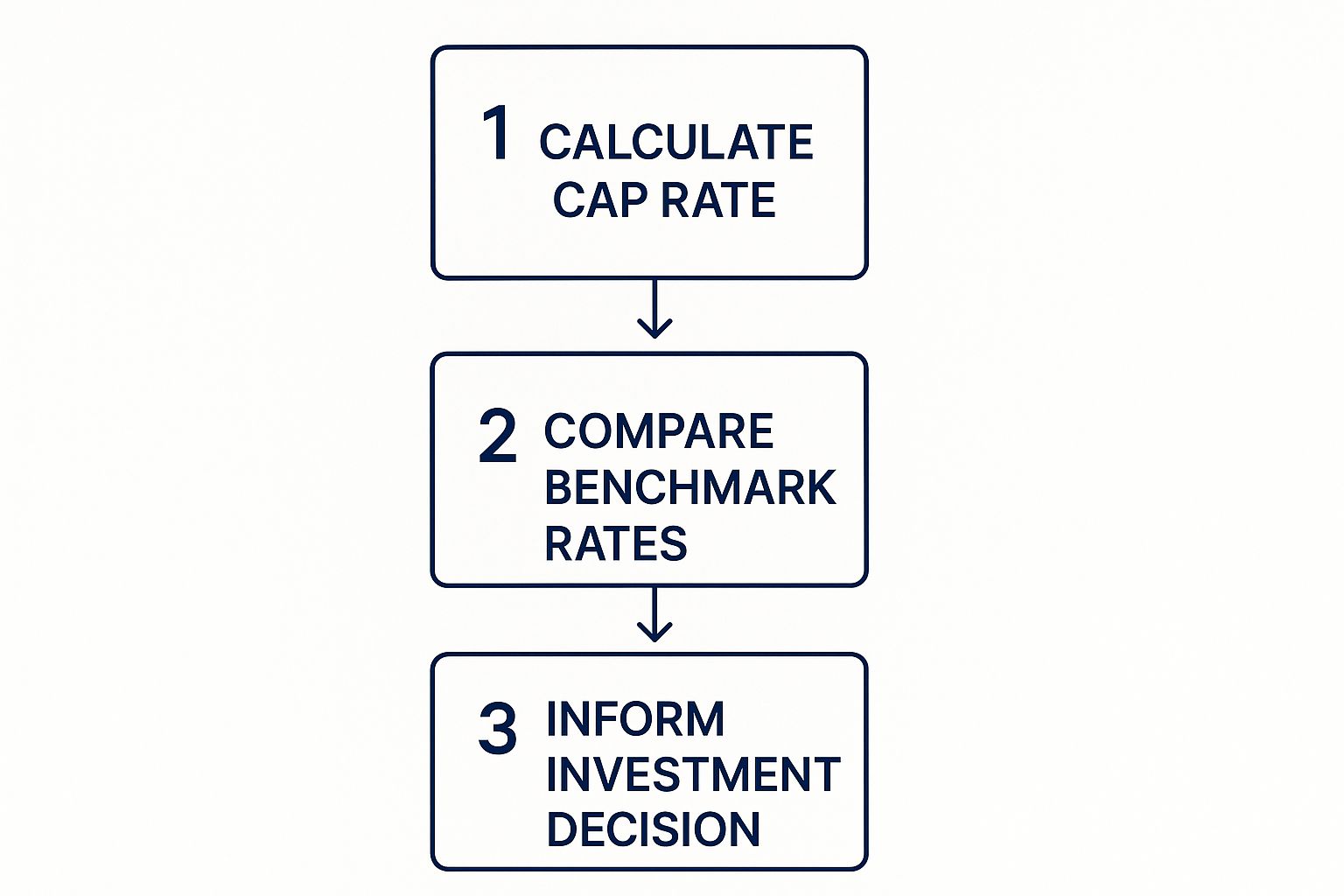

This visual shows exactly how calculating the cap rate fits into the bigger picture of investment analysis.

As you can see, getting the cap rate right is the essential first move that lets you compare opportunities and make a final decision.

Subtracting True Operating Expenses

Once you have your EGI, it’s time to subtract all the legitimate operating expenses. These are the real, day-to-day costs required to keep the property running and the rent checks coming in. For a deep dive, check out our detailed guide on [how to find Net Operating Income](https://www.stiltsvillecapital.com/post/how-to-find-net-operating-income-a-clear-guide-for-real-estate-investors).

Here are the usual suspects:

Property Taxes: A non-negotiable expense based on the assessed value.

Property Insurance: Essential coverage for liability, fire, and other potential disasters.

Utilities: Any costs not passed directly to tenants, like electricity for common areas.

Repairs & Maintenance: The routine upkeep for plumbing, HVAC, landscaping, and all the little things that break.

Management Fees: Typically a percentage of EGI paid to a third-party manager to handle the headaches for you.

Add all those up, subtract them from your EGI, and you're left with the Net Operating Income. This is the cash flow available to pay your mortgage and, hopefully, put some money in your pocket.

What to Exclude from Operating Expenses

Knowing what not to include is just as important as knowing what to include. A lot of investors trip up here, which leads to an inflated and dangerously misleading NOI.

You absolutely must exclude these from your calculation:

Debt Service: Your mortgage payments (principal and interest) are financing costs, not operational ones.

Capital Expenditures (CapEx): Big-ticket items that extend the property's life, like a new roof or a full HVAC system replacement, are capitalized—they aren't part of the annual NOI.

Tenant Improvements (TIs): The money you spend to customize a space for a new commercial tenant.

Leasing Commissions: The fees paid to brokers for landing you those new tenants.

Advanced Lens (For Persona C): When we're underwriting a deal, we always "normalize" the expenses. If property taxes look suspiciously low, it's probably because they haven't been reassessed since the last sale. We adjust them to reflect what they'll actually be post-acquisition. The same goes for maintenance—if the current owner has been deferring costs, we budget for a higher, more realistic long-term average to avoid nasty surprises down the road.

Finding Market Value to Finalize Your Calculation

Once you've got a solid Net Operating Income (NOI), you're almost at the finish line. The last piece you need for the cap rate formula is the property’s current market value. And we don’t just mean the seller’s asking price—we need to figure out what the asset is really worth in today’s market. Smart investors have a few trusted methods to nail down this number.

The whole point is to land on a defensible value that reflects current conditions. That’s how you make sure your cap rate calculation is both accurate and reliable.

Using Comps: The Comparative Market Analysis

The most common and, frankly, most intuitive method is the Comparative Market Analysis (CMA). You've probably heard it called "running comps." This is where you dig into recently sold properties that are as similar as possible to the one you're looking at—same location, size, age, condition, and property type.

By analyzing what those properties actually sold for, you can establish a very strong baseline for your target property's value. Think of it as the real estate equivalent of checking what your neighbor’s house sold for before listing your own. It's a powerful reality check because it’s grounded in real, recent market transactions, not just an optimistic asking price.

The Cost and Income Approaches

There are a couple of other valuation methods that offer a valuable perspective, especially for certain types of properties.

The Cost Approach figures out a property's value by estimating what it would cost to build a similar property from the ground up today, then subtracting depreciation. This method is most useful for brand-new developments or truly unique properties where finding good comps is next to impossible.

The Income Approach, on the other hand, is directly tied to our cap rate discussion. You can actually work backward with it. If you know the typical cap rate for similar properties in the area, you can determine a property's value by flipping the formula: Value = NOI / Market Cap Rate. Investors love this tool because it ties a property's value directly to its income-generating power.

To dive deeper into all these methods, check out our complete [guide to real estate property valuation methods for investors](https://www.stiltsvillecapital.com/post/a-guide-to-real-estate-property-valuation-methods-for-investors).

Tying It All Together: A Practical Example

Let’s bring this all home with an illustrative example.

Property Type: 20-unit multifamily building

Gross Potential Income: $240,000 (20 units x $1,000/month x 12 months)

Vacancy & Credit Loss (5%): -$12,000

Effective Gross Income (EGI): $228,000

Operating Expenses (45% of EGI): -$102,600

Net Operating Income (NOI): $125,400

After running a thorough CMA and analyzing the market, we determine its current market value is $2,200,000.

Now we can finally plug in the numbers:

Cap Rate = $125,400 (NOI) / $2,200,000 (Market Value) = 0.057 = 5.7%

This 5.7% cap rate represents the unlevered annual return you can expect from this asset. It's the critical number you’ll use to stack this deal up against other investment opportunities.

Investor Checklist: Questions to Ask a Sponsor

When a sponsor presents a deal, don't just take their NOI and value assumptions at face value. You need to dig in and understand how they got their numbers.

What comparable sales did you use to determine the property’s value, and how recent are they?

Can you share the trailing 12-month (T12) operating statement so I can verify the NOI calculation?

What vacancy rate and credit loss assumptions are you using in your pro-forma?

Have you factored in a potential property tax reassessment after the sale?

What are your underlying assumptions for rent growth and the exit cap rate in the financial model?

How to Read the Market Through Cap Rates

Getting the cap rate number is just simple math. The real skill—the part that separates seasoned pros from the newcomers—is knowing what that number is actually telling you.

There's no magic "good" cap rate you can find in a book. It's a living, breathing metric that shifts with the market's mood, reflecting the constant tug-of-war between risk and reward.

Think about it this way: a brand-new, fully-leased apartment building in a hot Sunbelt market will have a very different cap rate than a 20-year-old retail strip with shaky tenants in a less vibrant town. The apartment building feels safe and has growth potential, so investors will pay more for it, which pushes the cap rate down. The retail strip? It’s riskier, so buyers will demand a higher potential return for taking on that uncertainty, pushing the cap rate up.

The Push and Pull of Risk and Return

At its heart, the cap rate is a quick gut check on risk and value. If you can master this one concept, you’re already ahead of the game. It’s an inverse relationship:

Lower Cap Rates: These usually signal a safer, more stable investment. Think of a medical office fully leased to a major hospital system on a long-term contract. The income is about as reliable as it gets. Because it’s a secure bet, investors line up to buy it, bidding up the price and compressing the cap rate.

Higher Cap Rates: This is where things get interesting. A higher cap rate points to more perceived risk, but it also screams potential for a bigger payoff. This is the territory of value-add deals—properties with deferred maintenance or below-market rents that need an operator to come in and turn things around. The higher cap rate is your compensation for taking on that operational headache.

Investor Takeaway: Don't just chase the highest cap rate you can find. Stop and ask why it's so high. Is it a hidden gem waiting to be polished, or is it a sign of deep-rooted problems with the property, its tenants, or the neighborhood?

What’s Happening in the Broader Economy?

No property exists in a vacuum. Big-picture economic forces like interest rates, inflation, and job growth are always putting pressure on cap rates. When the Federal Reserve hikes interest rates, borrowing money gets more expensive. Suddenly, investors need a higher return from a property to make it worth their while compared to just parking their cash in a safe Treasury bond. This can push cap rates upward across the board.

For a deeper dive into what makes a cap rate truly attractive in different scenarios, check out our guide on **what is a good cap rate for real estate investors**.

Digging Deeper: Advanced Cap Rate Analysis and Common Pitfalls

If you want an institutional edge in underwriting, you have to move beyond the basic formula. The most sophisticated analysis looks at the entire lifecycle of an investment, and that means understanding the crucial difference between the cap rate on day one and the cap rate on the day you sell.

The going-in cap rate is what we've been talking about so far—it’s based on your purchase price and the property's initial NOI. But any solid financial model has to project an exit cap rate (also called a terminal cap rate), which is the cap rate you anticipate when you eventually sell the property years from now. This single number is a huge driver in forecasting the property's future sale price and, ultimately, your total return.

Going-In vs. Exit Cap Rates

Here’s a pro tip: prudent underwriting almost always assumes an exit cap rate that is slightly higher than the going-in rate. This isn’t pessimism; it’s about building a conservative cushion into your projections. Assuming a higher exit cap rate means you’re planning for a lower future sale price relative to the income, which protects you if the market softens or interest rates tick up.

For instance, if you buy a property at a 5.5% cap rate today, you might model a sale in five years at a 6.0% exit cap rate. This kind of disciplined approach helps ensure your deal can handle future market shifts and still hit its return targets.

Insight Edge: A sponsor's exit cap rate assumption is a dead giveaway of their discipline. If their exit cap is lower than the going-in rate, you need to press them. Make them justify that optimism with hard data explaining why they expect market conditions to improve so dramatically.

The Band of Investment Technique

But what happens when you can't find clean market comps to guide you? This is where the band of investment technique comes in. It’s a powerful way to build a cap rate from the ground up by blending the cost of both debt and equity. Think of it like a Weighted Average Cost of Capital (WACC) framework, combining what the lender needs with what the equity investors expect.

Let's say a property is financed with 80% debt at a mortgage constant of 8.59% and 20% equity that requires a 15% return. The cap rate is simply the weighted average of the two. As PropertyMetrics explains in a detailed breakdown, the resulting cap rate would be 9.87%—a figure derived directly from the deal's real-world capital structure.

This method is invaluable when you’re looking at deals in niche markets or for unique assets where direct parallels are hard to find. It grounds your valuation in the actual cost of the capital needed to close the deal.

FAQ: Your Cap Rate Questions Answered

Even once you get the hang of the cap rate formula, real-world questions always pop up. This is where the theory meets the road. Let's tackle some of the most common questions investors have.

What's the real difference between Cap Rate and ROI?

This is a big one, and it's crucial to get right. The cap rate is about the property itself, completely ignoring any loans. It’s an unlevered metric. On the other hand, Return on Investment (ROI)—specifically your cash-on-cash return—is all about your specific deal and how much cash you put in. It’s a levered metric that accounts for your financing.

Cap Rate = NOI / Property Value (Tells you how the asset performs on its own.)

Cash-on-Cash Return = Annual Pre-Tax Cash Flow / Total Cash Invested (Tells you how your money is performing.)

A property could have a 6% cap rate, but after you layer on some smart financing, your actual cash-on-cash return might jump to 10% or even higher.

How do interest rates affect cap rates?

They're definitely connected, but it's not always a perfect one-to-one relationship. When interest rates go up, the cost of borrowing money gets more expensive, which naturally puts pressure on cap rates to rise as well. When safer investments like Treasury bonds start paying out more, real estate has to offer a better return to be worth the extra risk and hassle. As the team at Adventures in CRE points out, cap rates have always moved in response to these bigger economic tides.

The Bottom Line: Never look at a cap rate in a bubble. A 6% cap rate in a world where the 10-year Treasury is at 1.5% feels fantastic. That same 6% cap rate feels a lot less exciting when the 10-year is at 4.5%. What really matters is the spread—the gap between the cap rate and the risk-free rate.

Is a higher or lower cap rate better?

The honest answer? It completely depends on what you're trying to achieve.

A lower cap rate is what every seller dreams of because it means their property is worth more. For a buyer, it usually points to a high-quality, stable asset in a great location—think less risk, steady income, but probably lower immediate returns.

A higher cap rate is typically what buyers are hunting for. It suggests a lower purchase price for the income you're getting. This often signals a "value-add" play—a property with more risk but also more upside if you can turn it around through smart management.

Ultimately, the best cap rate is the one that aligns with your personal risk tolerance and what you want to accomplish with your investment. Well-structured real assets can be a prudent, resilient component of a long-term wealth strategy, and understanding metrics like the cap rate is the first step toward making informed decisions.

At Stiltsville Capital, we look past the surface-level numbers to underwrite opportunities with the discipline and depth of an institutional investor. If you're an accredited investor looking for access to curated commercial real estate deals in high-growth markets, we should talk.

Schedule a confidential call with our team to explore if our offerings are the right fit for your portfolio.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments