Internal Rate of Return Example: A Guide for Real Estate Investors

- Ryan McDowell

- Dec 7, 2025

- 13 min read

Reading Time: 8 min | Good for: Novice Investors (A), Informed Principals (B)

TL;DR: Key Takeaways on IRR

What It Is: The Internal Rate of Return (IRR) is the single annualized interest rate an investment is projected to earn over its entire life, accounting for all cash inflows and outflows. Think of it as the project's personal growth rate.

Why It Matters: IRR allows you to compare wildly different investment opportunities (e.g., a quick flip vs. a 10-year hold) on a true apples-to-apples basis because it incorporates the crucial element of time.

How It's Calculated: While the manual formula is complex, investors use spreadsheet functions like for simple cases and for realistic scenarios with irregular cash flows—the gold standard in real estate.

Beyond the Number: A high IRR isn't everything. It must be analyzed alongside the project's risk profile and paired with other key metrics like the Equity Multiple to get a complete picture.

Before we jump into the number-crunching, let’s get a real feel for what the Internal Rate of Return (IRR) actually is.

Think of it as the personal interest rate your investment earns over its entire lifespan. It’s a single number that accounts for every dollar you put in, every dollar you get back, and when it all happens. A higher IRR simply means a more profitable deal, which is why it's such a go-to metric for comparing different opportunities.

What Is the Internal Rate of Return in Real Estate?

The Internal Rate of Return (IRR) is a metric that calculates the annualized, compounded return you can expect from an investment. Technically speaking, it’s the discount rate that makes the Net Present Value (NPV) of all cash flows (both in and out) equal to zero.

But let's put that in simpler terms.

Imagine you put $1,000 into a special bank account. Over five years, you make a few more deposits, take out some cash, and earn interest along the way. When you finally close the account, the IRR would be the one, single, fixed annual interest rate that bank would have needed to pay you to end up with the exact same amount of money.

This idea is incredibly powerful in real estate because deals are never as simple as "buy low, sell high." There’s always a stream of cash flows spread out over time:

Initial Outlay (Negative Cash Flow): Your down payment, closing costs, and any immediate renovation funds.

Operating Cash Flows (Positive or Negative): The net income from rent after all expenses are paid.

Capital Events (Negative/Positive): A cash call for a major repair, or a cash-out refinance.

Terminal Value (Positive Cash Flow): The big one—your net proceeds when you sell the property.

IRR is the magic wand that turns this messy, multi-year financial story into a single, clean, annualized percentage. It lets you compare wildly different projects—say, a quick one-year flip versus a ten-year stabilized apartment building—on a true apples-to-apples basis.

Novice Lens: Why IRR MattersDon't get tripped up by the financial jargon. At its heart, IRR answers one simple question: "What annual rate of return did my money actually earn while it was tied up in this project?" It's a much smarter way to look at performance than a basic profit percentage because it understands that a dollar today is worth more than a dollar tomorrow.

Historically, strong performance has made IRR a cornerstone metric for real estate investments. For instance, data from INREV (as of 2023) shows that certain vintage years of private real estate funds delivered average IRRs around 14%, highlighting the kind of returns this asset class can generate.

Calculating a Simple IRR With Consistent Cash Flows

The best way to really get a handle on a financial concept is to start with a simple, clean example. So for our first run-through, we're going to strip away all the usual complexities and focus on the pure mechanics of the Internal Rate of Return. Let’s walk through a hypothetical deal for a small, single-tenant office building with predictable and steady cash flows.

Imagine you get the chance to buy a small medical office building for $1,000,000. The tenant is a very stable healthcare practice locked into a long-term lease. Your underwriting shows that after covering all the operating expenses and property taxes, the investment will kick off $80,000 in positive cash flow every year for the next five years. At the end of that 5-year hold, you plan to sell the property, walking away with $1,200,000 after all closing costs.

This is the perfect scenario for our first IRR calculation because the cash flows are even and easy to follow.

Setting Up Your Cash Flows

The very first step in any IRR calculation is to map out your cash flows over time. Timing is everything here. In the world of real estate finance, "Year 0" is always the starting point—it represents the moment you write the check and the money leaves your bank account.

Here’s the cash flow stream for our office building deal:

Year 0: -$1,000,000 (Your initial purchase is a negative cash flow, or an outflow.)

Year 1: +$80,000 (Net operating income)

Year 2: +$80,000 (Net operating income)

Year 3: +$80,000 (Net operating income)

Year 4: +$80,000 (Net operating income)

Year 5: +$1,280,000 (This lumps together the final year's $80,000 income plus the $1,200,000 you get from the sale.)

Pay close attention to that final year. We're combining both the property's income and the sale proceeds into one number. That's a critical detail you have to get right for the calculation to be accurate.

Using the IRR Formula in a Spreadsheet

Look, you could solve for IRR with a pen, paper, and a lot of patience, but why would you? In reality, every investor on the planet uses a spreadsheet program like Microsoft Excel or Google Sheets. These tools have a built-in function that does all the heavy lifting instantly.

Finding the IRR is incredibly straightforward:

List out all the cash flows in order, either in a single column or a single row.

Type in the formula and simply select the entire range of your cash flows.

Just make sure your initial investment is entered as a negative number. That's key.

The spreadsheet spits out an IRR of 11.2%. What does that number actually tell you? It means this project is projected to generate an average annualized, compounded return of 11.2% over its five-year life. Just like that, you have a powerful benchmark to compare this deal against any other investment opportunity you might be considering, whether it's another property or something in a completely different asset class.

Modeling a Realistic IRR With Irregular Cash Flows

The simple office building example was a great warm-up, but let's be honest—real estate is rarely that neat. Value-add and opportunistic projects, the very strategies that can generate exceptional returns, are almost defined by their uneven, unpredictable cash flows.

This is where the standard formula in Excel hits a wall, and where a more powerful tool becomes absolutely essential for any serious investor.

Deal Lens: The Value-Add Multifamily Scenario

Let's model a more realistic internal rate of return example using a value-add multifamily property. Here, the cash flows aren't a tidy, repeating annuity. They fluctuate based on the business plan, creating a lumpy financial timeline that is far more typical of a sophisticated real estate investment.

Imagine Stiltsville Capital is acquiring a 50-unit apartment building for $5,000,000. The property is tired and rents are way below market. The game plan? Inject another $500,000 into renovations to modernize units, upgrade amenities, and push rents to their full potential.

This business plan creates a much more complex cash flow stream:

Initial Purchase: A $5,000,000 outflow right at the start.

Capital Call: A $500,000 outflow six months later to fund the renovations.

Fluctuating Income: Cash flow dips in the first year due to renovation disruption, then ramps up as upgraded units are leased at higher rates.

The Exit: The stabilized, high-performing asset is sold at the end of Year 4.

This is a classic value-add play, and its financial signature is irregularity.

Meet Your New Best Friend: The XIRR Formula

Because cash flows don't fall on perfect annual intervals (like that renovation capital call at month six), the standard function is the wrong tool for the job. It’s built on the assumption of equal time periods between each cash flow, an assumption that would completely distort our final number.

The solution is the XIRR function in Excel or Google Sheets. The 'X' handles irregular, specifically dated cash flows, making it the undisputed gold standard for real estate and private equity analysis.

Investor Takeaway: When you get a financial model from a sponsor, check if they are using XIRR. If the deal involves capital calls, refinances, or any cash flow event that doesn't happen neatly on January 1st each year, is the only function that gives you an accurate annualized return.

How to Structure the XIRR Calculation

Using is surprisingly simple. You just need two columns: one for the specific dates of each cash flow and one for the corresponding dollar amount. It’s a precise log of every dollar in and out, and exactly when it happened.

Here's how the cash flow for our value-add project would look in a spreadsheet:

Date | Cash Flow | Description |

|---|---|---|

1/1/2024 | -$5,000,000 | Initial Property Purchase |

7/1/2024 | -$500,000 | Capital Call for Renovations |

12/31/2024 | +$150,000 | Net Income - Year 1 (Lower due to vacancy) |

12/31/2025 | +$350,000 | Net Income - Year 2 (Stabilizing) |

12/31/2026 | +$450,000 | Net Income - Year 3 (Fully Stabilized) |

12/31/2027 | +$7,450,000 | Year 4 Income ($450k) + Sale Proceeds ($7M) |

The formula you'd pop into your spreadsheet is .

Using the values from our table, the function calculates an IRR of 18.7%.

This 18.7% figure gives us a true, time-weighted annualized return that accurately reflects every twist and turn in the investment's lifecycle. It correctly penalizes the project for requiring more capital mid-stream and rewards it for the large payout at the end. Mastering the calculation isn't just a good idea—it's a non-negotiable skill for accurately vetting any private real estate deal that comes across your desk.

How Leverage Amplifies Your Real Estate IRR

So far, the examples we’ve walked through have been on an “unlevered” basis. In simple terms, that means we analyzed them as if they were all-cash purchases.

But in the world of institutional real estate, that’s just not how major deals get done. The strategic use of debt, or leverage, is one of the most powerful tools for amplifying returns—and this is where IRR analysis really gets interesting.

Leverage lets you control a large, valuable asset with only a fraction of its total cost coming out of your own pocket. Think of it as using the bank's money to boost your own potential profits. When the return your property generates is higher than the interest rate on your loan, you create what's called positive leverage. The impact on your IRR can be dramatic.

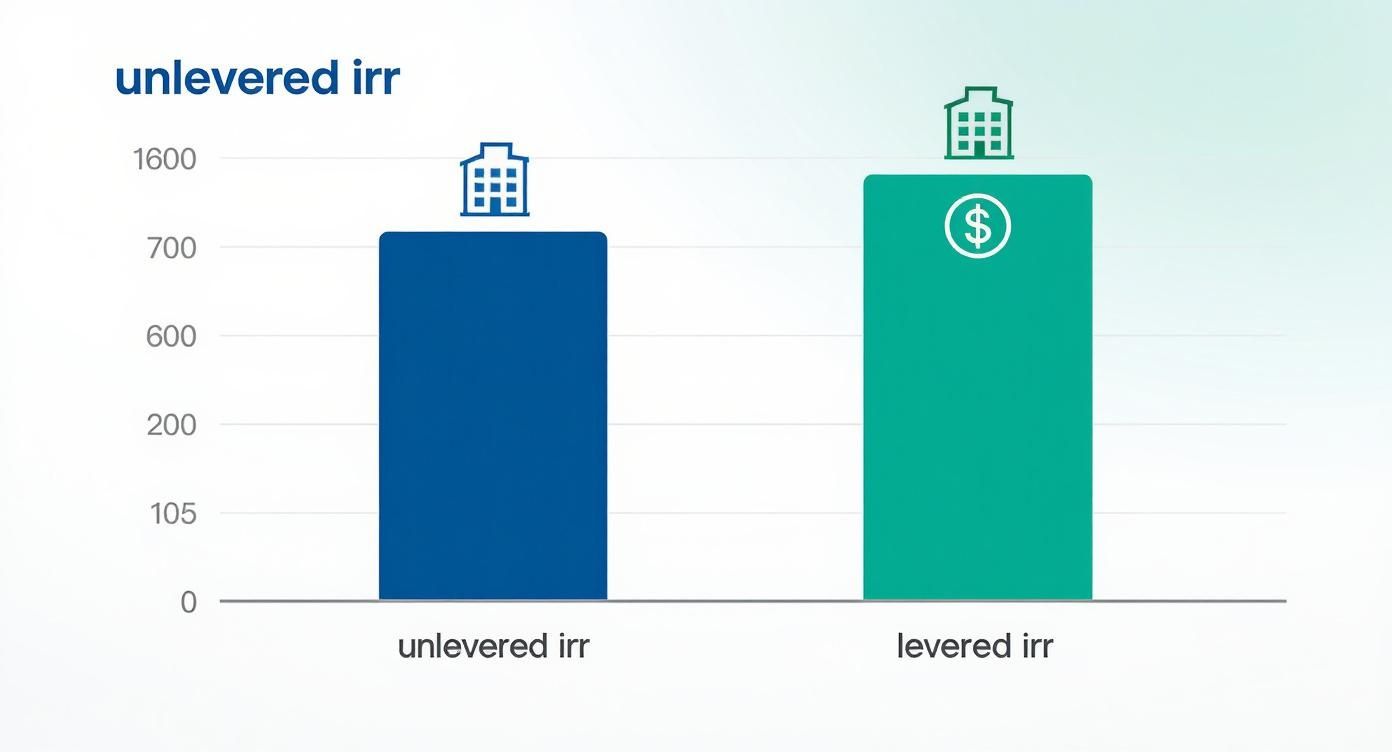

A Side-by-Side Example: Unlevered vs. Levered

To make this concept crystal clear, let's run a side-by-side internal rate of return example for the same exact asset—once with no debt (unlevered) and once with financing (levered).

Let's imagine we're acquiring a $10,000,000 multifamily property.

The Hold Period: 5 years.

The Exit: We plan to sell at the end of Year 5 for $12,500,000.

Now, let’s see how the numbers change when we introduce a loan. For a deeper dive into financing strategies, our guide to commercial real estate financing options for investors covers this in much more detail.

Scenario 1: The Unlevered (All-Cash) Purchase

In this scenario, you and your fellow investors pool together the full $10 million in cash. It's straightforward—all the net operating income from the property flows directly to you. The cash flow is simple and clean.

Scenario 2: The Levered (Financed) Purchase

Here, we'll take a more typical institutional approach. We secure a loan for 70% of the purchase price, or $7,000,000. This means the total equity required from investors is only $3,000,000. The catch? Each year, we must make debt service payments (principal and interest) before we can distribute any cash flow.

The difference this makes is huge.

As you can see, the levered IRR is significantly higher. Why? Because those returns are being generated from a much smaller initial investment of your own money.

Breaking Down the Cash Flows

Let’s get into the nitty-gritty of the numbers to see how this amplification really works. The table below gives you an illustrative breakdown of the annual cash flows for both scenarios. Pay close attention to how the initial investment in Year 0 is dramatically different, and how the annual cash flows in the levered case are reduced by the debt service payments.

Illustrative Levered vs. Unlevered IRR Comparison

Year | Unlevered Cash Flow | Levered Cash Flow (Post-Debt Service) | Notes |

|---|---|---|---|

0 | -$10,000,000 | -$3,000,000 | Initial Investment (Equity) |

1 | +$600,000 | +$180,000 | NOI minus Debt Service |

2 | +$620,000 | +$200,000 | NOI minus Debt Service |

3 | +$640,000 | +$220,000 | NOI minus Debt Service |

4 | +$660,000 | +$240,000 | NOI minus Debt Service |

5 | +$13,180,000 | +$6,360,000 | Sale Proceeds + Final NOI, Less Loan Payoff |

IRR | 9.9% | 23.1% |

The results are stark. The all-cash deal generates a respectable 9.9% IRR. That's not bad.

But by using sensible leverage, the IRR on the equity we invested skyrockets to 23.1%. We’ve more than doubled our annualized return simply by financing the acquisition strategically.

Advanced Lens: For Sophisticated InvestorsThis relationship between property-level returns and equity-level returns is the engine of private equity real estate. A sponsor's ability to secure favorable financing and manage the capital stack is just as critical as their ability to operate the property itself.

This powerful amplification is exactly why understanding the difference between levered and unlevered returns is non-negotiable for any serious real estate investor.

Looking Beyond IRR: An Investor's Checklist

A high Internal Rate of Return is undeniably attractive. It’s the headline number that grabs your attention in any pitch deck. But experienced investors know that while IRR is a powerful metric, it isn't the whole story—it has some critical blind spots. Relying solely on IRR is like judging a luxury car by its top speed. Sure, it’s an impressive number, but it tells you nothing about fuel efficiency, safety, or the total cost of ownership.

Questions to Ask Before Investing Based on IRR

Here are five diligence questions you should ask to look beyond the headline IRR and understand the true risk-return profile of a deal:

1. What are the key assumptions driving this IRR? (e.g., rent growth, exit cap rate). Are they conservative or aggressive compared to the market?

2. How does the IRR change in a downside scenario? Ask the sponsor to show you a sensitivity analysis. What happens if rent growth is slower or the exit cap rate is higher than projected?

3. What is the Equity Multiple? This metric shows total profit. A high-IRR deal over a short hold period might produce less total cash than a lower-IRR deal held for longer.

4. What is the deal's risk profile? A 20% IRR on a high-risk development project is not the same as a 15% IRR on a light value-add multifamily deal. Does the return justify the risk?

5. What is the assumed reinvestment rate? IRR's biggest flaw is that it assumes all cash distributions can be reinvested at the same high rate. This is rarely true and can overstate returns.

The Reinvestment Rate Assumption

The single biggest technical flaw in the IRR calculation is its built-in reinvestment assumption. The formula inherently assumes that all positive cash flows you receive during the hold period (like annual rental income) can be reinvested at the exact same rate as the project's final IRR.

This is almost never realistic. If a project has a stellar 22% IRR, the math assumes you can take every single distribution and immediately find another investment that also pays out exactly 22%. In the real world, consistently finding those kinds of opportunities is nearly impossible.

Pair IRR with Other Metrics

To get a complete, 360-degree view of an investment's potential, you should always analyze IRR alongside other key performance indicators. The two most important partners for IRR are the Equity Multiple and Net Present Value (NPV).

Equity Multiple (MOIC): This metric is beautifully simple: it tells you how many times over you get your money back. An equity multiple of 2.5x means for every $1 you put in, you got $2.50 back. It completely ignores the time value of money but gives you a crystal-clear measure of total profit.

Net Present Value (NPV): NPV tells you what all the future cash flows are worth in today's dollars, using a specific discount rate (your personal required rate of return). A positive NPV means the project is expected to beat your minimum return threshold.

Beyond doing the math by hand, sophisticated investors can use an AI Finance Investment Analyst agent to automate these complex analyses, helping to look beyond just the IRR. This holistic approach ensures you understand not just the speed of your returns (IRR), but also the total amount of profit you’ll make (Equity Multiple) and the true value it creates (NPV).

Common Questions about IRR in Real Estate

Let's wrap up with some of the most common questions that come up when investors start using IRR. Think of this as the practical Q&A session to clear up any lingering confusion and make sure you can apply these concepts with confidence.

What's the Real Difference Between IRR and ROI?

Return on Investment (ROI) is a blunt instrument—it tells you how much money you made relative to what you put in, but it completely ignores when you made it. A 50% return that took one year looks identical to a 50% return that took five years, and that's a huge blind spot.

Internal Rate of Return (IRR), on the other hand, is much sharper. It’s an annualized metric that has the time value of money baked right in. It gives you the compound annual growth rate, which is the only way to truly compare deals with different hold periods and cash flow schedules.

Can You Actually Get a Negative IRR?

You bet. A negative IRR simply means the investment lost money on a year-over-year basis. It’s a clear signal that the cash you got back was less than the cash you put in.

Essentially, the deal didn't just fail to produce a profit; it actually eroded your original capital at a compounded rate. It's not a result anyone wants, but it’s a brutally honest measure of an underperforming asset.

Why Is IRR the Go-To Metric in Private Equity Real Estate?

Private equity real estate deals are almost never straightforward. You have a big cash outlay at the start, maybe more cash calls for renovations down the line, followed by irregular rental income, and then a big payday when the property sells. It's a messy financial timeline.

IRR is the industry standard because it’s one of the few tools that can take that entire complicated journey and boil it down to a single, annualized number. It lets investors and sponsors compare wildly different projects—like a two-year value-add flip versus a ten-year ground-up development—on a true apples-to-apples basis.

What's Considered a "Good" IRR for a Real Estate Deal?

There's no magic number here. A "good" IRR is all about the risk you're taking to achieve it. The higher the risk, the higher the IRR needs to be to make the deal worthwhile. As a general rule, here’s what institutional investors often target:

Core Strategy (Low Risk): For stable, fully-leased properties, target IRRs are often in the high single digits to low double-digits (8-12%).

Value-Add Strategy (Medium Risk): For projects involving renovation or re-leasing, targets typically move into the mid-to-high teens (14-18%).

Opportunistic Strategy (High Risk): For ground-up development or major repositioning, investors expect IRRs of 20% or higher to justify the significant risk.

Take the Next Step

At Stiltsville Capital, IRR isn't just a number—it's a core part of the disciplined underwriting we perform on every deal. It helps us ensure that every opportunity is stress-tested to meet the risk-adjusted return targets our investors count on. Well-structured real assets can be a prudent, resilient component of a long-term wealth strategy.

If you’re an accredited investor curious to see how we apply these metrics to live, institutional-grade real estate opportunities, we invite you to schedule a confidential call with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments