Mezzanine Financing: A Clear Definition for Real Estate Investors

- Ryan McDowell

- Oct 5

- 12 min read

Reading Time: 7 min | Good for: Novice Investors (A), Family Offices (B)

Mezzanine financing often sounds more complex than it is. In simple terms, it's a hybrid form of capital—a unique blend of debt and equity features. Its primary role in real estate is to bridge the funding gap between a senior bank loan and a developer's own equity, unlocking deals that might otherwise be out of reach.

For investors, understanding this definition is the first step toward accessing a unique risk-return profile that sits comfortably between the safety of traditional debt and the high-growth potential of equity.

TL;DR: Mezzanine Financing in a Nutshell

What it is: A hybrid of debt and equity that sits in the middle of the capital stack, subordinate to senior debt but senior to common equity.

Who it's for: Real estate sponsors who need to fill a funding gap without diluting their ownership, and investors seeking higher, equity-like returns with more downside protection.

Why it matters now: As traditional lenders remain cautious, the demand for flexible capital like mezzanine financing is growing, offering a powerful tool for value-add and development projects.

Understanding Mezzanine Financing in the Capital Stack

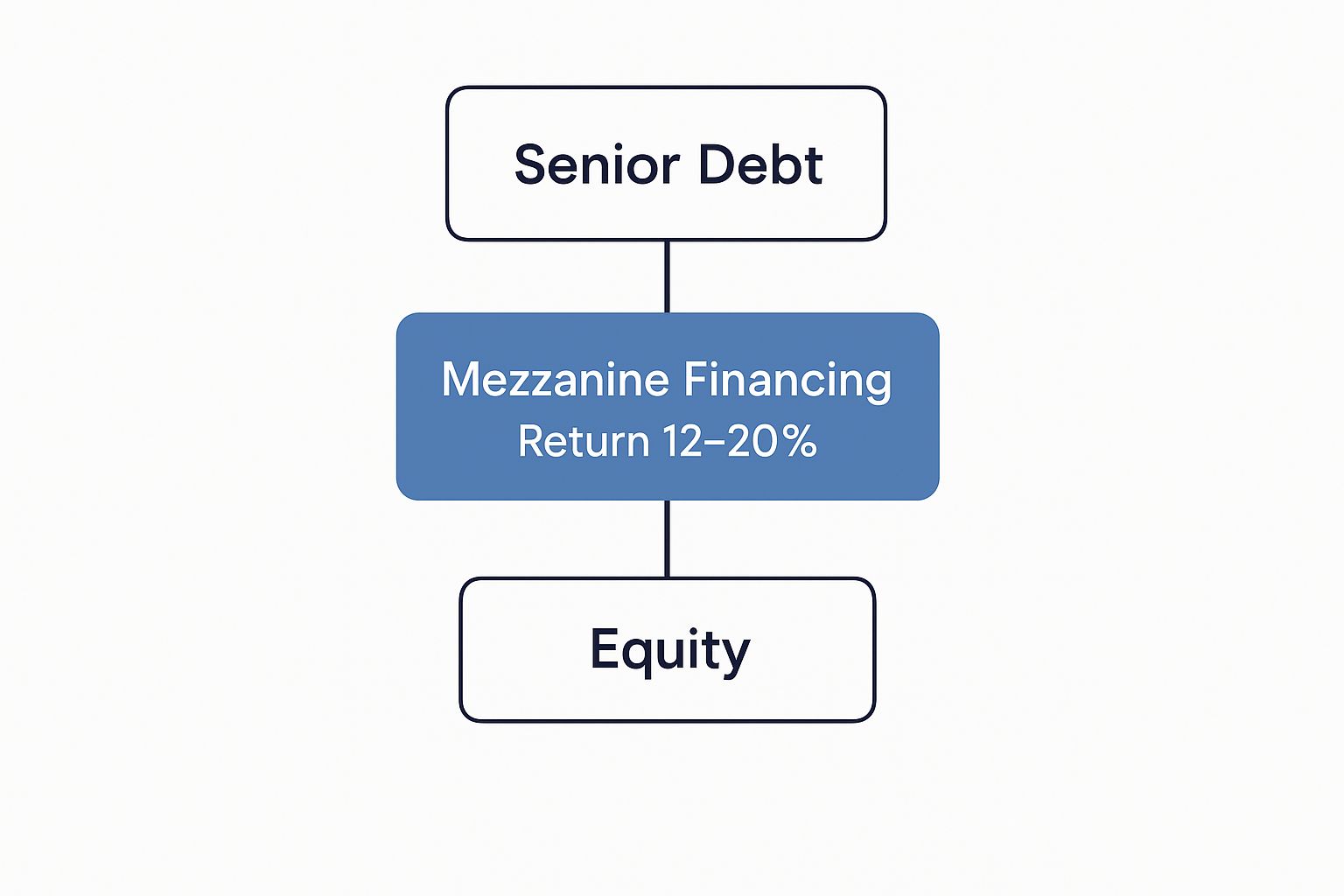

To truly grasp the definition of mezzanine financing, you must visualize the "capital stack"—the layered structure of funding for a real estate project. Think of it like the floors in a building.

At the bottom, on the ground floor, is senior debt. This is your traditional bank loan. It's the most secure position because, in a foreclosure, the bank is paid back first. Up top, in the penthouse, you have the sponsor's common equity. This is the riskiest position but also holds the greatest potential for reward.

Mezzanine financing occupies the middle floors. It is inherently riskier than senior debt because it is only repaid after the bank is made whole. However, it's safer than the penthouse equity because it has a priority claim on cash flow before equity investors receive their returns. This "in-between" position gives it a distinct risk-return profile.

The Capital Stack Hierarchy

This layered structure creates a crystal-clear pecking order for repayment. The infographic below provides a great visual of where mezzanine financing sits, acting as the crucial bridge between senior debt and equity.

As you can see, moving down the stack from senior debt to equity means taking on more risk in exchange for the chance at higher returns. Mezzanine financing strikes a compelling balance right in the middle, typically targeting returns in the 12-20% range.

Novice Lens: Why it MattersThink of mezzanine financing as the strategic partner that makes a great project possible. Without it, a developer might not have enough capital to acquire a property or complete a renovation, causing a promising deal to stall. For passive investors, it offers a way to access equity-like returns but with more downside protection than a pure equity position.

Mezzanine Financing vs. Senior Debt vs. Equity at a Glance

Comparing mezzanine financing directly with its neighbors in the capital stack clarifies its role. Each layer serves a distinct purpose and comes with its own cost and priority.

Attribute | Senior Debt | Mezzanine Financing | Common Equity |

|---|---|---|---|

Repayment Priority | Highest (Paid first) | Middle (Paid after senior debt) | Lowest (Paid last) |

Typical Returns | Low (e.g., 5-8%) | Moderate-High (e.g., 12-20%) | Highest (e.g., 20%+) |

Collateral | Secured by the property itself (first mortgage) | Secured by a pledge of company shares | Unsecured |

Risk Level | Lowest | Moderate | Highest |

This side-by-side view makes it clear: senior debt is about safety and steady, lower returns. Common equity is about taking a big swing for the highest potential payoff. Mezzanine financing carves out its niche by offering an attractive, risk-adjusted return right between the two.

The Strategic Role of Mezzanine Capital

To understand mezzanine financing today, it helps to look at its origins. Think of it less as a line item on a spreadsheet and more as a clever solution to a very specific problem: the funding gap that conservative senior lenders almost always leave behind.

Mezzanine financing gained prominence during the U.S. leveraged buyout boom of the 1980s before migrating to Western Europe. It has since exploded into an industry valued at over $100 billion in developed markets, according to the Global Private Capital Association. Initially funded by insurance companies, it quickly attracted other large institutional investors.

At its heart, it's a form of subordinated debt—it sits below senior loans but above equity in the repayment pecking order. Its history reveals its core function: providing flexible, event-driven capital for growth, acquisitions, and development when traditional loans fall short.

Bridging the Funding Gap

Senior lenders like banks are famously risk-averse. They typically cap their loans at a conservative loan-to-value (LTV) or loan-to-cost (LTC) ratio, often around 60-70%. This leaves a significant funding gap for a sponsor to fill, usually with equity.

This is exactly where mezzanine capital becomes a strategic tool. By sliding into that crucial middle layer of funding, it offers sponsors serious advantages:

Preserve Equity: Instead of bringing in more equity partners and diluting their ownership, sponsors can use mezzanine debt to complete larger deals while retaining more of the upside.

Increase Buying Power: Access to this extra layer of financing allows sponsors to pursue more—or much larger—opportunities than their own equity would permit.

Execute Quickly: Mezzanine lenders are typically more agile than traditional banks. In a competitive market, the ability to close a deal quickly can be a decisive advantage.

For global investors, the slower adoption of mezzanine structures in some emerging markets highlights differences in financial ecosystems, risk appetites, and legal frameworks. Mezzanine capital truly shines in markets with mature credit systems and predictable legal recourse, making its presence a strong signal of a sophisticated investment landscape.

Decoding the Hybrid Nature of Mezzanine Debt

The true power of mezzanine financing lies in its hybrid structure. It’s not quite traditional debt, and it’s not pure equity—it’s a potent blend of both, creating a uniquely flexible way to fund a project.

Unlike a senior loan secured by a first mortgage on the property, mezzanine debt is secured by a pledge of ownership shares in the company that owns the real estate. This subordinate position means mezzanine lenders take on more risk, and they are compensated accordingly.

That compensation typically comes in two forms: a higher interest rate and a share of the upside.

The Cost of Capital

Given its position in the capital stack, mezzanine financing naturally carries higher interest rates than senior debt. The good news for borrowers is that this interest can be structured in ways that preserve project cash flow.

Current-Pay Interest: A portion of the interest is paid monthly from the property's operating cash flow, similar to a traditional loan.

Paid-in-Kind (PIK) Interest: This is the clever part. PIK interest accrues and is added to the loan balance, only becoming due when the property is sold or refinanced. This keeps cash in the project when it's needed most during a renovation or lease-up phase.

You'll typically see interest rates for mezzanine loans ranging from 9% to 30% annually, with most deals landing in the 12% to 20% sweet spot. This premium reflects the lender's risk, as they are paid only after the senior lender is made whole.

The Equity Kicker

The second, and arguably most exciting, component of the return is the "equity kicker." This feature gives mezzanine financing its equity-like upside potential and rewards the lender for taking on added risk. It can be structured as warrants or a conversion feature, giving the lender a small ownership stake in the project's success.

Novice Lens: Think of the equity kicker like a performance bonus. The lender gets their regular interest payments (their "salary"), but if the project is a home run, they also get a share of the profits—the bonus—for helping to make it happen.

For sophisticated sponsors, this structure offers significant advantages. The interest on a mezzanine loan is generally tax-deductible, making it a more capital-efficient funding method compared to raising pure equity.

This hybrid approach shares some DNA with another powerful tool in the capital stack, which you can read about in our guide to real estate preferred equity. Ultimately, it’s about giving sponsors the flexibility to build a capital stack that maximizes both performance and after-tax returns.

How Mezzanine Financing Works: A Practical Example

Theory is one thing, but seeing mezzanine financing in action is where it clicks. Let's walk through an illustrative real estate deal to see how the capital stacks up.

Imagine a sponsor is acquiring a $50 million value-add multifamily property. It’s a classic opportunity: a well-located but dated apartment complex with a solid plan to renovate units, improve management, and raise rents to market rates. The only hurdle is securing the full purchase price.

Deal Lens: A Multifamily Acquisition

In a typical scenario, a bank is comfortable lending 60% of the total cost, but not a penny more. This lending limit creates a significant funding gap. You can find a complete rundown of different funding methods in our guide on how to finance investment property.

Here’s the capital stack for our $50 million project:

Senior Debt: A bank provides a $30 million loan (60% of the total cost). This is the safest loan, secured directly by the property in first position.

Sponsor Equity: The sponsor contributes $10 million of their own capital (20%). This is the "skin in the game" money, carrying the most risk but also offering the greatest potential reward.

The Funding Gap: This leaves a $10 million shortfall (20%). Without this final piece, the deal dies.

This is precisely where mezzanine financing plays the hero. A mezzanine lender steps in to provide the missing $10 million, bridging the gap between the bank loan and the sponsor's contribution. This allows the sponsor to close the deal without bringing in more equity partners and diluting their ownership stake.

Following the Money: The Cash Flow Waterfall

Once the deal closes and the renovation begins, the property starts generating cash from rental income. That cash is paid out in a strict order, often called the "waterfall."

First, Senior Debt: The first dollars of profit are used to pay the interest on the $30 million senior loan. The bank always gets paid first.

Second, Mezzanine Debt: After the bank is paid, the next slice of cash goes to the mezzanine lender to cover their interest payments.

Third, Equity Investors: Any remaining cash flow is distributed to the sponsor and their equity partners.

This hierarchy is logical—the lenders taking less risk are paid before those taking on more.

Realizing the Return: The Exit Strategy

Fast-forward three years. The sponsor has executed the business plan perfectly. The property is stabilized, renovated, and now worth $70 million. It's time to sell.

The $70 million in sales proceeds flow through the same waterfall:

The senior lender gets their $30 million principal back first.

Next, the mezzanine lender is repaid their $10 million principal, plus any accrued interest and their equity kicker.

The remaining $30 million is pure profit for the equity investors—a fantastic return on their original $10 million investment.

This example highlights the power of mezzanine debt. It made an otherwise impossible deal possible, protected the sponsor's equity, and delivered a solid, risk-adjusted return for the mezzanine lender upon a successful exit.

When to Use Mezzanine Financing

Knowing the definition of mezzanine financing is one thing; knowing when to deploy it is what separates sharp investors from the pack.

This type of capital isn't a one-size-fits-all solution, but in the right situation, it’s a powerful tool for growth. It shines brightest when traditional financing gets you close but doesn’t quite cross the finish line.

Mezzanine financing is most often the key to bridging that final funding gap. This gap typically appears when a project requires more leverage than a senior lender is comfortable providing—they usually draw the line at 60-70% of the total cost. You can dive deeper into the different layers of capital in our guide to commercial real estate financing options for investors.

Key Strategic Scenarios

Certain situations are practically designed for mezzanine capital, allowing sponsors to pursue ambitious plans without excessive equity dilution.

Value-Add Acquisitions: An investor identifies a property with significant upside but needs capital for both the purchase and the renovation. Mezzanine financing can fill that gap, funding the improvements that justify higher rents and a greater property valuation.

Ground-Up Development: Development projects are notorious for cost overruns. Mezzanine debt can provide the final injection of capital needed to complete construction and lease up the property to a stabilized point where it can be refinanced with cheaper, long-term debt.

Shareholder Buyouts or Recapitalizations: When a partner wants to exit, mezzanine financing provides the liquidity to buy out their stake without forcing a premature sale of the asset, thereby preserving the long-term vision.

Speed is Everything: In a competitive market, closing a deal quickly is a massive advantage. Mezzanine lenders are often far more agile than large banks, enabling sponsors to act on time-sensitive opportunities.

Market Signal Box: Why Now?Demand for flexible capital like mezzanine financing tends to spike when traditional lending markets tighten. As factors like inflation and rising interest rates make bank loans harder to obtain, mezzanine becomes a go-to solution. The global mezzanine finance market is projected to grow at an annual rate of 7.9%, reaching an estimated $420 billion by 2034, as of early 2024.Investor Take: This trend signals the enduring importance of mezzanine financing in the current economic climate, creating opportunities for investors who understand its strategic value. Source: this detailed market examination.

Investor Checklist: Questions to Ask a Sponsor

Moving from theory to practice with mezzanine financing requires a disciplined due diligence process. Before committing capital, savvy investors put both the deal and the sponsor under a microscope. This checklist provides a framework of critical questions to ask any sponsor presenting a mezzanine opportunity.

Think of this less as a simple list and more as the start of a deep conversation about risk, alignment, and execution capability.

Vetting the Sponsor and the Strategy

The quality of the operator—the sponsor—is paramount. Their track record, particularly with similar projects through various market cycles, speaks volumes about their ability to deliver on the proposed business plan.

Sponsor Experience: What is your track record with this specific asset class and strategy? Can you provide case studies, including deals that faced challenges?

Alignment of Interests: How much of your own capital is invested alongside ours? We want to see significant "skin in the game."

Financial Assumptions: Walk us through your proforma. How do your projections for rent growth, exit cap rate, and operating expenses compare to current market data?

Exit Strategy: What is Plan A for the exit, and what are the contingency plans? What specific market conditions are required for each to succeed?

Scrutinizing the Loan and Legal Structure

The devil is in the details, and in mezzanine deals, those details reside in the loan documents. Understanding your rights and your position relative to the senior lender is non-negotiable.

For a deeper look into how these investments are often pooled, see our guide to mezzanine debt funds for sophisticated investors.

Senior Loan Terms: What are the terms of the senior debt? Is it a fixed or floating rate? What are the key covenants and the maturity date?

Intercreditor Agreement: May we review the intercreditor agreement? We need to understand our specific cure rights if the borrower defaults on the senior loan.

Equity Kicker: How is the equity kicker structured? Is it in the form of warrants, a conversion option, or a percentage of profits?

Mezzanine Financing FAQs

Even with a solid understanding of the basics, it’s natural to have questions about how mezzanine financing works in the real world. Here are answers to some of the most common inquiries.

What is a typical deal size for mezzanine financing?

While there is no single magic number, mezzanine financing typically appears in commercial real estate deals with a total capitalization of $10 million or more. Lenders often have a minimum check size, making this financing a better fit for larger, institutional-quality projects like new multifamily developments, major office renovations, or hotel acquisitions. For smaller deals, the legal and administrative costs can sometimes outweigh the benefits.

What are the main risks for a mezzanine lender?

The primary risk for a mezzanine lender is their subordinate position in the capital stack. If a project fails and ends in foreclosure, the senior lender must be paid back in full before the mezzanine lender receives any proceeds.

To mitigate this risk, prudent lenders focus on:

Sponsor Quality: Backing experienced sponsors with a proven track record of executing similar business plans.

Asset Quality: Ensuring the underlying property is solid, with a clear path to generating sufficient cash flow to service all debt.

Cure Rights: Negotiating the right to "cure" a default on the senior loan—effectively making the payment themselves to prevent foreclosure and protect their investment.

How does an intercreditor agreement work?

Think of the intercreditor agreement as the formal rulebook governing the relationship between the senior lender and the mezzanine lender. This critical legal document prevents chaos if things go wrong.

It explicitly outlines the repayment waterfall, making it crystal clear that the mezzanine lender’s claims are subordinate to the senior lender's. Crucially, it also defines the mezzanine lender's cure rights, required notice periods, and any standstill provisions that apply during a default.

Can a mezzanine loan be paid off early?

Yes, but it often comes at a cost. Most mezzanine loans include prepayment penalties or yield maintenance clauses. These are designed to ensure the lender receives the full return they underwrote when they made the loan. For a borrower, this means an early exit must be carefully calculated. While possible, the financial sense of it must be weighed against any penalties—a key point to negotiate upfront.

Ready to explore how sophisticated strategies like mezzanine financing can fit into your portfolio? At Stiltsville Capital, we believe that well-structured real assets can be a prudent, resilient component of a long-term wealth strategy. We help investors navigate these opportunities with institutional discipline and a sharp focus on creating lasting value.

Schedule a confidential call to discuss your investment goals with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments