The Tax Deferred Exchange: A Guide to Compounding Real Estate Wealth

- Ryan McDowell

- Sep 10, 2025

- 16 min read

Reading Time 7 min | Good for: Novice Investors (A), Family Offices (B)

Imagine upgrading your real estate portfolio without an immediate tax bill slowing you down. That's the core power of a tax deferred exchange, better known as a §1031 exchange. Think of it as a strategic reinvestment tool that lets you swap one investment property for another, all while pushing capital gains taxes down the road. This move preserves your capital and maximizes your purchasing power, letting you build your portfolio more aggressively.

TL;DR: Key Takeaways

What it is: A tax deferred exchange (§1031) allows you to sell an investment property and reinvest the full proceeds into a new one, postponing capital gains taxes.

Why it matters: It accelerates wealth creation by allowing 100% of your capital to stay invested and compound, enabling you to acquire larger or better-performing assets.

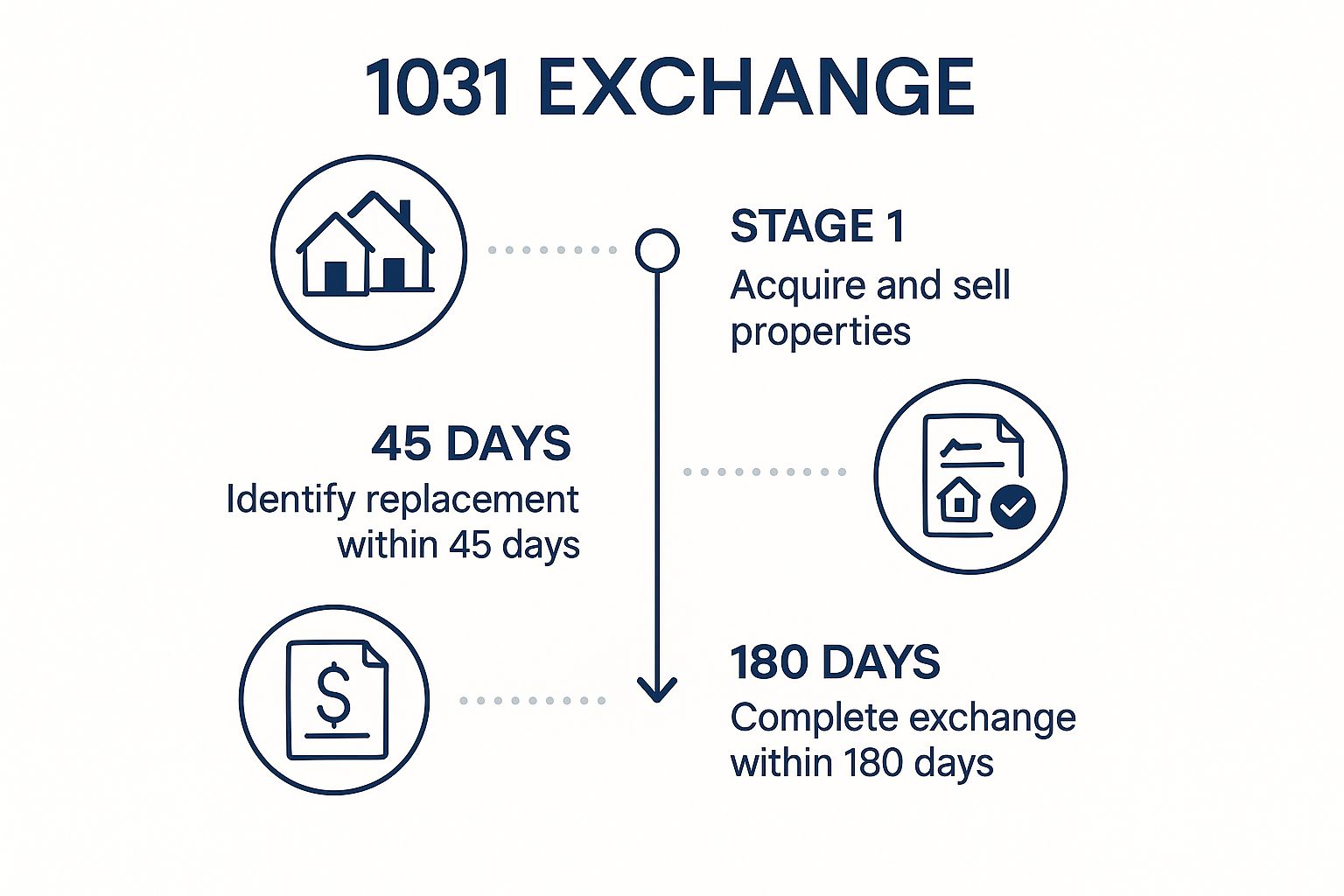

How to do it: You must follow strict IRS timelines (45 days to identify, 180 days to close) and use a Qualified Intermediary to handle the funds.

How a Tax Deferred Exchange Builds Wealth

For any serious real estate investor, the tax deferred exchange is a cornerstone strategy for scaling a portfolio efficiently. At its heart, the mechanism lets you roll the full value from the sale of one property directly into the purchase of another, postponing the capital gains tax you’d otherwise have to pay right away.

Let's be clear: this isn't tax avoidance; it's tax deferral. The tax obligation doesn't just vanish—it gets kicked into the future. This allows 100% of your sale proceeds to keep working for you today, creating a powerful compounding effect that can seriously accelerate how quickly you build wealth.

The Compounding Advantage of Deferral

Here’s a simple analogy. If you sell your sedan for a profit and immediately use all that money—including your profit—to buy a bigger SUV, a §1031 exchange is like making that trade without having to hand over a cut of your profit to the government first. You get to use the full value for your upgrade.

That preserved capital becomes a massive advantage. Instead of losing 15% to 20% (or more) of your gains to federal and state taxes after a sale, that money stays invested and keeps generating returns. Do that over multiple transactions, and the difference is huge.

It's no wonder investors use this strategy to:

Increase Purchasing Power: By reinvesting the full, pre-tax proceeds, you can afford larger, higher-value, or better-performing assets than you could if taxes took a bite out of your capital.

Scale Portfolios Faster: Each deal builds on the full value of the last one. This creates a compounding growth curve that leaves the traditional "sell, pay tax, then reinvest" cycle in the dust.

Diversify Holdings: An exchange can be used to pivot your portfolio into different types of assets or geographic markets without triggering a taxable event. For instance, you could exchange a high-maintenance rental house for a passive stake in an institutional-quality medical office building.

Novice Lens / Why it Matters: For newer investors, this means you can climb the property ladder much more quickly. For a family office or CIO, it's a critical tool for managing a portfolio efficiently, repositioning assets, and preserving wealth over the long haul.

A Strategic Reinvestment Tool

Ultimately, the tax deferred exchange is far more than just a tax-saving trick; it’s a fundamental part of a dynamic real estate investment strategy. It gives you the flexibility to adapt to market shifts, upgrade the quality of your properties, and even transition from active to passive management—all while keeping your capital fully deployed and working for you.

For a deeper dive into the mechanics, you can explore our comprehensive guide on **what a 1031 exchange is** and how it compounds wealth. By understanding and properly executing this strategy, you can unlock some serious potential for portfolio growth.

Mastering the Critical Exchange Timelines

When it comes to a successful tax-deferred exchange, the clock is everything. The timelines are strict, non-negotiable, and failing to meet them is the fastest way to blow up the entire transaction and trigger a nasty tax bill. For investors, getting this framework right isn't just important—it's the whole ballgame.

The countdown starts the second the sale of your original property closes. From that day forward, two critical clocks start ticking at the same time. And they are absolute. There are no extensions for weekends, holidays, or a sudden market downturn.

The 45-Day Identification Period

First up, you have exactly 45 calendar days to formally identify potential replacement properties. This isn't just about window shopping; you have to submit a signed, written declaration to your Qualified Intermediary. That deadline is notoriously tight, which is why savvy investors start lining up potential deals long before their original property is even sold.

To give you some flexibility while keeping you compliant, the IRS gives you three ways to identify your next property:

The 3-Property Rule: This is the most common and straightforward path. You can identify up to three potential properties, no matter what they cost. For most exchanges, this gives you more than enough options to get a deal done.

The 200% Rule: If you need more properties in your pipeline, this rule lets you identify any number of them, as long as their total market value doesn't top 200% of what you sold your property for. Sell a building for $2 million? You could identify five properties with a combined value of up to $4 million.

The 95% Rule: This is the most flexible but also the riskiest option by far. You can identify as many properties as you want, but you have to close on at least 95% of the total value you identified. It's rarely used because of how tough that is to pull off, saved only for complex deals where the investor is almost certain they can close on nearly everything.

The 180-Day Closing Period

The second deadline runs at the same time as the first. You have a total of 180 calendar days from the day you sell your property to complete the purchase of one or more of the properties you identified.

Let's be clear: this isn't 45 days plus another 180. The 180-day clock starts on the very same day as the 45-day clock. This means once your identification period ends, you have the remaining 135 days to handle due diligence, line up your financing, and get to the closing table.

This timeline lays out the key stages so you can see how the countdown works.

As you can see, the whole process, from selling to buying, has to wrap up within a tight six-month window, with that critical identification milestone hitting very early on.

The Role of the Qualified Intermediary

Trying to navigate these timelines on your own is impossible without a Qualified Intermediary (QI), sometimes called an Accommodator. A QI is a required, independent third party whose job is to manage the exchange and make sure it follows every IRS rule.

Their most important job is to keep you from having "constructive receipt" of your money. If the cash from your sale hits your bank account, even for a second, the exchange is dead on arrival. Instead, the QI holds your funds in escrow after the sale and then wires them directly to the seller of your new property when you're ready to close.

Advanced Lens / Why it Matters: Picking a reputable, experienced QI is non-negotiable. They are the gatekeepers of your tax-deferred exchange, handling the legal documents, securing your funds, and ensuring every step you take meets the strict deadlines and regulations.

Recent policy changes really highlight how crucial good record-keeping is. In recent tax developments, the IRS actually expanded what counts as a "like-kind" property, but they also beefed up the reporting on Form 8824. They now demand stricter proof of your deadlines and compliance to ensure everything is above board. You can read more about these global tax transparency efforts on oecd.org.

Decoding the Like-Kind Property Rule

One of the most powerful—and most misunderstood—parts of a tax-deferred exchange is the “like-kind” property rule. It’s a common myth that you have to swap an identical property for another, like trading one apartment building strictly for a different apartment building.

That’s just not the case. This misconception holds investors back, but the reality is far more flexible and opens up a world of possibilities for repositioning your real estate portfolio.

Defining Like-Kind in Real Estate

So, what does “like-kind” actually mean in a §1031 exchange? It’s not about the property’s grade or quality. It’s about its fundamental nature or character. The IRS rule is surprisingly broad: any real property held for productive use in a business or for investment is considered like-kind to any other real property held for the same purpose.

This means you can exchange across totally different real estate asset classes. Think about it: you could sell a portfolio of single-family rentals and exchange into a commercial retail center. Or, you could sell a plot of raw, undeveloped land and acquire an industrial warehouse.

The only real catch is that both the property you sell and the property you buy must be for investment or business use. Your personal residence doesn't count.

Novice Lens / Why it Matters: This flexibility is the strategic engine of the tax-deferred exchange. It allows you to shift your portfolio from a high-maintenance asset to a passive one, from a low-growth market to a high-growth one, or from one property type to another, all without triggering an immediate tax event.

Valid vs. Invalid Exchanges

To make this crystal clear, let's look at a few examples. Understanding these distinctions is critical to making sure your exchange is compliant and your tax deferral is protected.

The table below breaks down what works and what doesn't.

Valid vs. Invalid Like-Kind Exchanges

Example Exchange Scenario | Is it a Valid Like-Kind Exchange? | Reasoning |

|---|---|---|

Exchanging a duplex for a medical office building. | Yes | Both are real properties held for investment purposes, so they are considered like-kind despite being different asset types. |

Exchanging a primary residence for a vacation rental. | No | A primary residence is personal-use property, not an investment property, and therefore does not qualify for a tax-deferred exchange. |

Exchanging a U.S. warehouse for undeveloped land in Germany. | No | The rule is strict: property in the United States can only be exchanged for other property located within the United States. |

Exchanging a retail storefront for an interest in a Delaware Statutory Trust (DST). | Yes | The IRS recognizes a beneficial interest in a DST holding real estate as a valid like-kind replacement property. |

As you can see, the definition is broad but has firm boundaries, especially when it comes to personal use and international properties.

Advanced Options for Sophisticated Investors

For accredited investors, family offices, and institutional players, the like-kind rule opens the door to some truly sophisticated, hands-off investment structures. Instead of buying another physical property yourself, you can complete a tax-deferred exchange into a fractional ownership vehicle.

Two of the most common structures are:

Delaware Statutory Trusts (DSTs): This is a popular route for investors who want to go from active landlord to completely passive investor. A DST allows you to acquire an interest in a trust that owns a portfolio of institutional-grade, professionally managed properties—all without a taxable event.

Tenants-in-Common (TICs): A TIC structure lets you own an undivided fractional interest in a larger property alongside other co-owners. While this route offers more direct control than a DST, it also comes with more shared responsibilities.

These advanced strategies offer a powerful way to diversify a portfolio, get access to higher-quality assets, and completely eliminate the day-to-day headaches of property management, all while keeping your capital gains deferred.

How to Avoid Taxable Boot in Your Exchange

When you're doing a 1031 exchange, the name of the game is to defer 100% of your capital gains tax. But there's a catch, a sneaky little thing the IRS calls "boot." Think of it as anything you receive in the exchange that isn't "like-kind" property. If you end up with boot, you’re looking at a tax bill.

Frankly, understanding and sidestepping boot is what separates a flawless, fully tax-deferred exchange from one that lands you an unexpected invoice from Uncle Sam. It’s the most common pitfall investors stumble into.

Understanding the Two Types of Boot

Boot can creep into your deal in two main ways: as cash or as debt relief. Spotting them is the first step to keeping your exchange clean.

Cash Boot: This one is pretty straightforward. It’s any cash you walk away with from the sale of your old property. This happens if you don't reinvest every single dollar of your proceeds into the new property. It can also include personal property sold with the building, like furniture or equipment.

Mortgage Boot (Debt Relief): This one is a bit more subtle. Mortgage boot happens if the mortgage on your new property is less than the mortgage you paid off on the old one. The IRS sees this reduction in debt as a financial gain for you, and they’ll tax it accordingly.

To pull off a fully tax-deferred exchange, you have to buy a replacement property of equal or greater value, roll all your cash proceeds into it, and take on an equal or greater amount of debt.

Deal Lens Example: Calculating Boot

Let's run the numbers on a real-world scenario to see how easily boot can pop up and create a tax liability. This is exactly why meticulous planning is a must.

Imagine you sell an investment property with these figures:

Sale Price: $1,000,000

Mortgage Payoff: $400,000

Sale Proceeds (Equity): $600,000

You then find a replacement property and close the deal:

Purchase Price: $900,000

New Mortgage: $350,000

Cash Invested: $550,000

In this case, you've accidentally created both cash and mortgage boot:

Cash Boot: You had $600,000 in proceeds but only reinvested $550,000. That leftover $50,000 is cash boot and is now taxable.

Mortgage Boot: Your new loan is $350,000, which is $50,000 less than your old $400,000 mortgage. That $50,000 in "debt relief" is mortgage boot.

Your total taxable boot here is $100,000 ($50,000 cash + $50,000 mortgage). While you still deferred a big chunk of your gain, this oversight just triggered a taxable event that could have been avoided.

Novice Lens / Why it Matters: For new investors, the lesson is clear: always aim to "trade up." For seasoned pros, this shows just how critical it is to structure the capital stack on the new deal to match or exceed the old one perfectly. Sometimes, bringing a little extra cash to the closing table is all it takes to offset mortgage boot and keep the full deferral intact.

The concept of a tax deferred exchange isn't new; it started back in the 1920s to encourage reinvestment in property. It's still a powerhouse strategy today, with IRS data showing thousands of these deals happen every year, moving billions in assets. You can find more details about this long-standing tax provision on treasury.gov.

For a complete walkthrough of the entire process, check out our guide on how the 1031 exchange compounds real estate wealth.

Advanced Exchange Strategies for Sophisticated Investors

Once you’ve mastered the standard delayed exchange, a whole new world of sophisticated strategies opens up. These advanced structures aren't just about kicking the tax can down the road; they're powerful tools for savvy investors looking to reshape their portfolios, swap high-maintenance properties for passive, institutional-grade assets, or even build value from the ground up.

A typical exchange is straightforward: you sell, then you buy. But what happens when the market doesn't play by those rules? Sometimes you need to lock down a high-demand property before selling your old one, or maybe you see a diamond in the rough that needs significant work. That’s where these advanced options come in.

The Reverse Exchange

Ever find the perfect replacement property before you’ve even listed your current one? In a hot market, waiting to sell could mean losing the deal of a lifetime. That's the exact problem the Reverse Exchange was designed to solve.

Just like the name implies, it flips the entire process on its head. You get to acquire your new property first and sell your original one later.

So, how does this work without breaking the cardinal rule of not owning both properties at once? The magic is in a third-party entity called an Exchange Accommodation Titleholder (EAT). Your Qualified Intermediary sets up the EAT to temporarily "park" the title to either your old property or the new one you're buying. This clever workaround keeps you compliant while giving you the agility to pounce on an opportunity.

The timelines are just as strict, only in reverse. The clock starts ticking the moment the EAT takes title to the parked property. You get 45 days to officially identify the property you plan to sell and a total of 180 days to get it sold and close the loop.

The Improvement Exchange

Here’s another game-changer: the Improvement Exchange. You might also hear it called a construction or build-to-suit exchange. This structure lets you use your tax-deferred funds not just to buy a new property, but also to pay for major renovations or even new construction on it.

It's a dream come true for value-add investors. Imagine selling a stable apartment complex and rolling the proceeds into buying a rundown property, then funding a massive overhaul to boost its value—all using pre-tax dollars.

The mechanics are similar to a Reverse Exchange. An EAT holds the title to the new property while all the improvement work is being done, and your exchange funds are used to pay the contractors. The key rule here is that to fully defer your taxes, the value of the replacement property after all the improvements must be equal to or greater than the value of the property you sold.

These advanced strategies are incredibly powerful, but they are also more complex and carry higher costs than a standard exchange. Getting them right requires real expertise. To see how these tools fit into a larger wealth-building strategy, check out our **ultimate guide to real estate tax benefits**.

Market Signal Box: Exchange Trends (as of Q2 2024)Latest Data: Analysis from market intermediaries shows a recent uptick in specialized transactions like reverse and improvement exchanges. This is largely a response to tight inventory and a challenging financing climate, which is pushing investors to get more creative.Interpretation: The traditional "sell then buy" model isn't always viable in competitive markets. Smart investors are using these advanced structures to secure deals and manufacture their own value through development.Investor Take: This trend points to a broader shift toward more hands-on portfolio management. Simultaneously, we're seeing a surge in the use of passive investment vehicles like Delaware Statutory Trusts (DSTs) within exchanges. It shows investors want two things: flexibility to make strategic moves and options to shed management headaches. You can dig deeper into these **2025 exchange market trends at ipx1031.com**.

Investor Checklist: Questions to Ask Before Your Exchange

Executing a 1031 exchange takes precision and a proactive mindset. It's one thing to understand the theory, but putting it into practice is where things get real. Think of this checklist as your roadmap, framed as key questions to ask your professional team—your Qualified Intermediary (QI), attorney, and tax advisor—to make sure every detail is nailed down for a seamless transaction.

Vetting Your Qualified Intermediary

Your QI is the absolute linchpin of your exchange. Bringing the wrong one on board can torpedo the entire deal, so doing your homework isn't just a suggestion—it's non-negotiable.

How are my exchange funds secured? You need to know about their internal controls, fidelity bonding, and professional liability (Errors & Omissions) insurance. Your money should be held in a segregated, qualified trust or escrow account, never commingled with the QI’s own operating funds.

What's your track record and reputation? Ask how many exchanges they handle each year and don't be shy about asking for references. A seasoned QI brings a ton of expertise to the table, which is invaluable if things get complicated.

Are you part of the Federation of Exchange Accommodators (FEA)? Membership in the FEA is a good sign they’re committed to industry ethics and best practices.

Preparing Your Legal and Tax Framework

Getting your legal and tax ducks in a row from the very beginning can save you from incredibly costly mistakes later on. A single misstep here could blow up your entire exchange.

Does my sale agreement have a cooperation clause? Your attorney needs to make sure the sale contract for your relinquished property includes language that requires the buyer to cooperate with your 1031 exchange. This comes at no extra cost or liability to them and is a standard—but essential—clause.

Have we triple-checked the "same taxpayer" rule? Your tax advisor must confirm that the entity selling the old property is the exact same one buying the new one. Trying to change how you hold the title mid-exchange, like switching from your personal name to an LLC, is a classic way to disqualify the transaction.

How will we handle prorations and closing costs? Not every closing cost can be paid with exchange funds without creating a taxable event (known as "boot"). Go over the settlement statements with your advisor to sort out which costs are allowed and which ones you'll need to cover with cash from your pocket.

Executing Your Identification and Closing Strategy

The tight deadlines of a tax deferred exchange demand that you be prepared. Waiting for the clock to start ticking is a surefire recipe for disaster.

Investor Takeaway: The single biggest mistake investors make is failing to plan for the 45-day identification period. You should start looking for replacement properties months before you even think about listing your current asset.

A solid execution strategy should answer these questions:

What’s our number one replacement property target? Have your top choice fully vetted and, if at all possible, under contract before that 45-day clock even starts.

What are our backup options? You should always identify at least one or two other solid backup properties on your formal list. Markets shift, and deals fall apart when you least expect them to.

Is our financing locked and loaded? Loan delays are one of the most common reasons investors miss the 180-day closing deadline. Make sure your lender understands the rigid timeline and is ready to move fast.

FAQ: Common Tax Deferred Exchange Questions

When you're navigating the ins and outs of a tax-deferred exchange, a few practical questions always seem to pop up. Let's tackle some of the most common ones to help you structure your deal correctly and sidestep those all-too-common pitfalls.

Can I Do a 1031 Exchange on My Primary Home?

In a word, no. A tax-deferred exchange is built exclusively for properties "held for productive use in a trade or business or for investment." Your family home is considered personal-use property, so it doesn't fit the bill under the IRS's strict guidelines.

Things can get a little murky, though, with mixed-use properties. Say you own a duplex, live in one half, and rent out the other. Or maybe you've converted a primary residence into a full-time rental. These situations demand careful planning and rock-solid documentation, making a conversation with your tax advisor an absolute must.

What Happens if I Miss the 45-Day Deadline?

The 45-day identification deadline is ironclad. There are no extensions and no second chances. If you miss it, your exchange is immediately terminated.

From there, the transaction is treated just like a standard sale. Your Qualified Intermediary will return your funds, and you’ll be on the hook for capital gains taxes from the sale of your original property. The opportunity to defer is gone for good. This is exactly why identifying several solid backup properties is such a crucial part of any smart exchange strategy.

Can I Do a Partial Exchange and Take Some Cash Out?

Yes, you absolutely can. This is a popular move called a partial exchange, and it gives investors some valuable flexibility. You can still successfully defer taxes on the portion of the funds you roll into a new like-kind property.

Just remember, any proceeds you don't reinvest are considered taxable "boot." This includes cash you pocket from the sale or any reduction in your mortgage debt. While you won't get the full tax deferral, it's a great option if you need to pull out some cash while still shielding the majority of your gains.

A successful tax-deferred exchange is all about careful planning and expert guidance. Well-structured real assets can be a prudent, resilient component of a long-term wealth strategy. At Stiltsville Capital, we help accredited investors navigate these complexities to build and preserve wealth through strategic real estate allocations. Schedule a confidential call to explore how our institutional-grade offerings can fit into your long-term financial strategy.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments