What Is Crowdfunding Real Estate? A Guide for Thoughtful Investors

- Ryan McDowell

- Jul 28, 2025

- 12 min read

Reading Time: 7 min | Good for: Novice (A), Informed (B)

TL;DR: Key Investor Takeaways

What It Is: Real estate crowdfunding pools capital from multiple investors online to collectively buy into large-scale commercial properties, like apartment complexes or data centers, that were once only accessible to major institutions.

How It Works: A professional real estate firm (the "sponsor") finds, manages, and executes the business plan for a property. You invest passively alongside other accredited investors, typically through a dedicated LLC for that specific asset.

Why It Matters: This model grants access to institutional-quality deals, offers built-in diversification across property types and locations, and provides passive income potential without the headaches of direct property management.

Next Step: Understand the difference between owning a piece of the property (equity) versus lending money to the project (debt) to align your investment with your personal risk and return goals.

A Modern Approach to Property Investing

So, what is real estate crowdfunding, really? At its heart, it's a technology-enabled evolution of a timeless investment strategy: group investing. Instead of needing millions to acquire a commercial building yourself, you can invest a more accessible amount alongside a "crowd" of fellow investors, gaining fractional ownership in a high-value asset.

This isn't some fleeting trend. It’s a structural shift making an age-old asset class more efficient and accessible. A professional real estate private equity firm, known as a sponsor or operator, does the heavy lifting. They are the seasoned experts who source the property, perform intensive due diligence, arrange financing, and manage the asset from acquisition to exit—whether that involves renovating an underperforming building or developing a new one from the ground up.

Crowdfunding vs. Traditional Ownership: A Snapshot

For investors who are short on time but long on ambition, this model changes the game. It removes the traditional barriers of massive capital requirements and the need for hands-on operational expertise.

The table below breaks down the key differences, giving you a quick snapshot of how they stack up.

Feature | Real Estate Crowdfunding | Traditional Direct Investment |

|---|---|---|

Minimum Capital | Relatively low (thousands, not millions) | High (often entire property value) |

Management | Passive (professionally managed by a sponsor) | Active (direct landlord responsibilities) |

Deal Access | Vetted, institutional-quality opportunities | Self-sourced, requiring deep market knowledge |

Diversification | Easy to spread capital across many deals | Difficult and capital-intensive |

Expertise | Leverages sponsor's professional experience | Relies entirely on your own expertise |

As you can see, the crowdfunding model offers a fundamentally different path into real estate—one that prioritizes access, professional management, and diversification without requiring a massive personal war chest.

How Real Estate Crowdfunding Actually Works

Ever wondered what happens to your capital after you click the ‘invest’ button on a platform? It's a disciplined and transparent process designed to efficiently channel capital from investors like you into promising property deals.

It all begins with an experienced real estate firm—the sponsor. These are the boots-on-the-ground experts who uncover a compelling opportunity, perhaps an apartment community in a growing suburb, a logistics warehouse near a major port, or a parcel of land ideal for a new medical office building. The sponsor conducts exhaustive due diligence, stress-tests financial models, and builds a robust business plan for creating value.

The Investment and Management Cycle

Once a deal is approved internally, it is presented to investors, often through a secure online portal. This is where you, the investor, enter the picture. You can review the complete investment package, including the Private Placement Memorandum (PPM), which details the strategy, timeline, potential returns, and all associated risks. If the opportunity aligns with your portfolio goals, you commit capital alongside a pool of other accredited investors.

This "crowd" of capital is then consolidated into a newly formed legal entity, typically a single-purpose Limited Liability Company (LLC), created exclusively for that property. This structure is a critical risk mitigant, as it legally separates each investment—the performance of one deal will not affect another in your portfolio. The sponsor uses this pooled equity, usually combined with a senior loan from a bank, to acquire and manage the property according to the business plan.

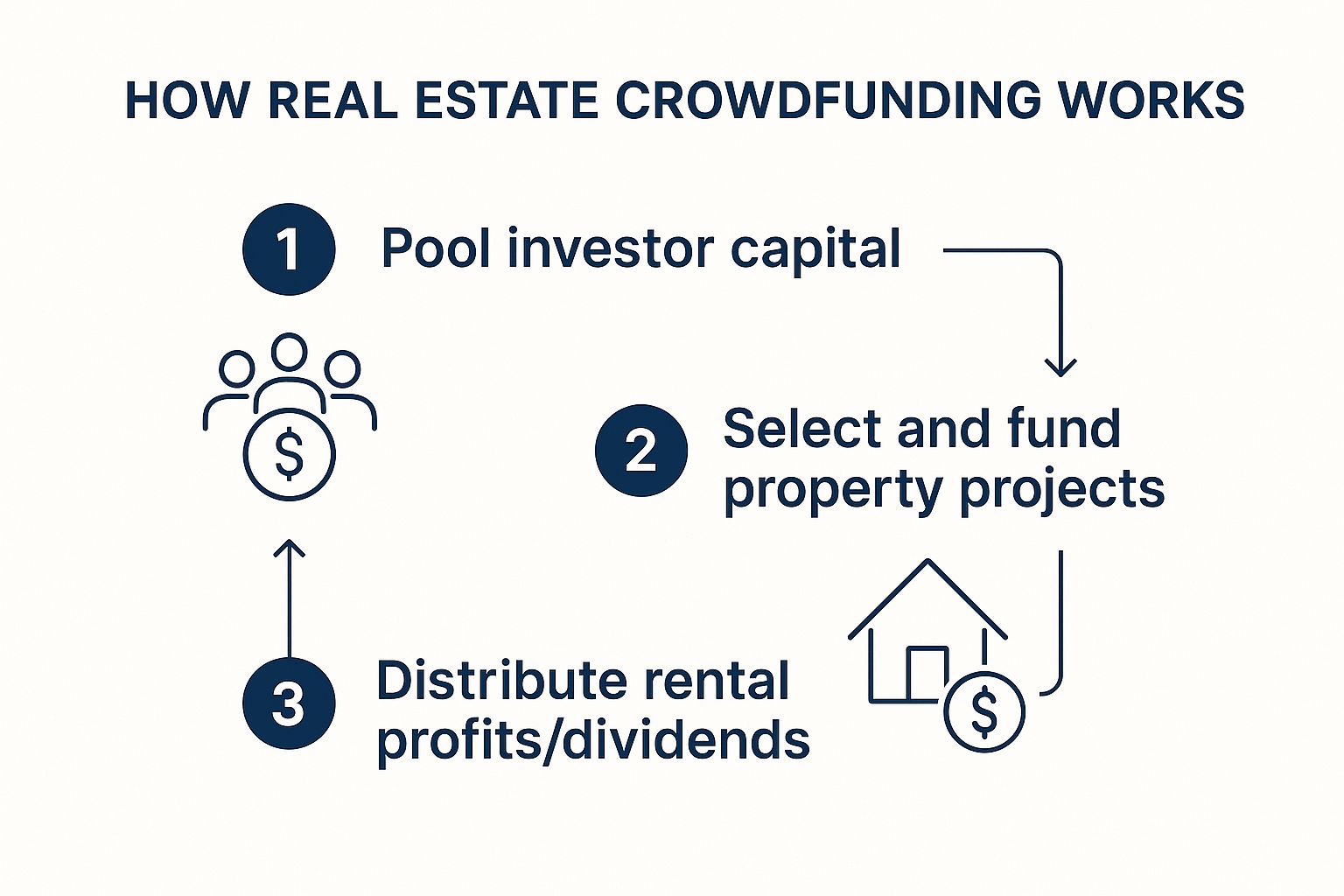

This diagram illustrates the journey from capital formation to value realization.

It’s a powerful cycle: your individual investment joins forces with others to fund a significant project, which in turn is managed to generate returns that flow back to you.

Novice Lens: Equity vs. Debt Deals

Why It Matters: When you invest, your money will typically go into one of two main structures: equity or debt. It's absolutely critical to know the difference, as it defines your position in the capital stack and your potential for risk and reward. * Equity Crowdfunding: Think of this as buying a small ownership stake in the property itself. You become a part-owner. Your goal is to receive a share of the rental income and participate in the profits when the property is sold. The potential for higher returns is directly tied to the success of the project. * Debt Crowdfunding: Here, you act more like the bank, lending money to the project. In return, you receive fixed interest payments over a defined term. Returns are generally lower and capped, but your investment is secured by the real estate asset, making it a more conservative position.

Finally, after the planned holding period (typically 3-7 years), the sponsor executes the exit strategy by selling the property. After paying off the loan and any fees, the remaining proceeds are distributed to you and the other equity investors, returning your initial capital plus your share of the profits.

Why Smart Investors Are Choosing Crowdfunding

The rise of real estate crowdfunding is not a fleeting trend—it’s a fundamental market evolution driven by sophisticated investors seeking smarter portfolio construction. Whether you're a family office principal or an individual accredited investor, this model systematically dismantles the old barriers to entry. It’s all about achieving efficiency, access, and diversification.

At its core, the appeal is simple: it solves multiple portfolio challenges at once. Instead of concentrating a large sum into a single asset, you can allocate smaller amounts across a variety of properties, strategies, and geographies. This built-in diversification is a cornerstone of prudent risk management, allowing you to build a resilient real estate portfolio without sacrificing upside potential.

Unlocking Institutional-Grade Opportunities

Perhaps the most significant advantage is gaining a seat at a table that was once reserved for the largest institutions. Crowdfunding platforms connect you with professional sponsors who source and structure institutional-quality projects—from multifamily developments to mission-critical data centers.

This means you benefit from the same rigorous underwriting and operational expertise as the pros. The day-to-day burdens of property management, from lease negotiations to capital improvements, are handled by the sponsor. Your role is that of a passive investor, freeing you to focus on your broader financial strategy while your capital is put to work in tangible, income-producing assets. To see how this fits into a broader wealth strategy, check out our **guide to commercial real estate private equity**.

Market Signal Box

Latest Data Point: The global real estate crowdfunding market is forecast to expand from $17.15 billion in 2023 to $98.67 billion by 2030, reflecting a compound annual growth rate (CAGR) of 28.4%. (Source: Fortune Business Insights, as of March 2023) Interpretation: This exponential growth is not speculative hype. It reflects a durable shift as investors recognize the power of a model that delivers diversification, professional management, and access to an asset class known for its income generation and inflation-hedging characteristics. Investor Take: The expanding market means more opportunities, but also a greater need for rigorous due diligence. Partnering with experienced sponsors who have a proven track record is more critical than ever.

Finding Your Fit: The Different Crowdfunding Models

Jumping into real estate crowdfunding isn't a one-size-fits-all decision. The type of investment you choose must align with your financial goals, risk tolerance, and investment horizon.

At a high level, opportunities are structured as either equity or debt. The one you pick is a critical decision—it's the difference between being a property owner who shares in the upside (and downside) or acting like a lender earning a fixed return. Let's break them down.

Equity Crowdfunding: Your Slice of the Pie

With equity crowdfunding, you’re not just investing in a project; you’re buying a piece of it. You become a part-owner, usually by holding an interest in an LLC created specifically for that asset. Think of it as owning a small, passive stake in an actual building.

Your success is tied directly to the property's performance. You typically earn returns in two ways:

Cash Flow: A share of the net rental income, often distributed to investors on a quarterly basis.

Appreciation: A share of the profits when the property is sold, hopefully at a higher value.

In equity deals, you'll often encounter a preferred return. This is a threshold annual return (e.g., 8%) that investors receive before the sponsor begins to share in the profits. It’s a key structural feature that aligns the interests of the investor and the manager.

Debt Crowdfunding: Playing the Bank

Here, your return is a predetermined, fixed-interest payment over a set term, often short-term (6 to 18 months). Because you're not an owner, you don't participate in appreciation if the property's value soars—but you also have a more predictable return stream and a more senior position in the capital stack.

The key metric to watch in debt deals is the loan-to-value (LTV) ratio. An LTV of 65%, for example, means your loan represents only 65% of the property's appraised value. A lower LTV provides a larger equity cushion, which acts as a safety net for your capital. Investor demand for both models is fueling some serious growth in the market. Projections show the real estate crowdfunding space ballooning from USD 48.81 billion to an incredible USD 2,175.95 billion. You can read more about this remarkable growth trajectory on custommarketinsights.com.

Advanced Lens: Understanding Preferred Equity For more sophisticated investors, a hybrid structure called preferred equity can be an attractive option. It sits between senior debt and common equity in the capital stack. This position is riskier than senior debt (it gets paid back after the bank) but safer than common equity. In exchange for this risk, preferred equity investors typically earn a higher fixed return than debt investors and may also receive a small share of the profits, known as an "equity kicker." It's a tool for fine-tuning your risk-adjusted return profile.

Understanding and Managing Key Investment Risks

Every prudent investment decision begins with a clear-eyed assessment of risk. In real estate crowdfunding, the goal isn't to avoid risk entirely—that's impossible. It's to understand it, measure it, and partner with sponsors who have a disciplined strategy to manage it.

This balanced, institutional-grade perspective is what separates successful long-term investors from speculators. We will tackle the primary risks head-on and, more importantly, discuss actionable ways to mitigate them.

Risk & Mitigation: A Practical Framework

Risk: Illiquidity * Your investment is tied to a physical asset. You cannot sell it in seconds like a public stock. Most private real estate investments have a holding period of 3-7 years.

Mitigation: Asset-Liability Matching * This one is straightforward. Only allocate capital that you are comfortable having committed for the entire projected term. Match the investment's timeline to your personal liquidity needs and view it as a long-term component of your overall portfolio.

Risk: Sponsor Risk * You are not just investing in a building; you are backing a sponsor's business plan. This is the risk that the management team lacks the experience, discipline, or integrity to execute that plan successfully.

Mitigation: Rigorous Sponsor Due Diligence * This is where your diligence is most critical. Scrutinize the sponsor’s track record. Have they successfully navigated similar projects through a full economic cycle? How much of their own capital ("skin in the game") is invested alongside yours? A well-capitalized sponsor with deep experience is your most important partner. For a deeper look into how these deals are structured financially, our **guide to commercial real estate financing options** offers valuable context.

Risk: Market & Asset-Specific Risk * Even the best sponsor can face headwinds from broad economic shifts (e.g., interest rate hikes) or challenges specific to a single property.

Mitigation: Thoughtful Diversification * Diversification remains your most powerful defense. Spreading capital across different sponsors, property types (multifamily, industrial, data centers), and geographic regions helps build a resilient portfolio that isn’t over-exposed to the failure of any single asset or strategy.

Your Investor Checklist for Vetting Opportunities

In any investment, knowing which questions to ask puts you miles ahead of the pack. This checklist is your practical framework for first-pass due diligence, helping you quickly cut through the marketing noise and evaluate a real estate crowdfunding opportunity.

A methodical approach is more important than ever. As the market grows—with projections showing a 12.8% CAGR—a flood of new opportunities will appear. A solid vetting process is what separates a prudent investment from a speculative gamble. You can see more on the sector's growth from Polaris Market Research.

Questions to Ask the Sponsor

The sponsor is your most critical partner. Vet them accordingly.

Track Record: Have they successfully executed this exact strategy before? Ask for a detailed track record, including projects in the same asset class and market. A transparent sponsor will discuss both their wins and the lessons learned from deals that underperformed.

Alignment of Interests: How much of their own capital is invested in the deal? Significant "skin in the game" is a powerful indicator of the sponsor's conviction and alignment with investors.

Communication & Reporting: What is their plan for investor communication? Look for a commitment to regular, detailed reporting on operational performance, budgets, and timelines.

Questions to Ask About the Deal

This is where you kick the tires on the business plan itself.

Underwriting Assumptions: Are their projections for rent growth, occupancy, and exit capitalization (cap) rate conservative and grounded in current market data? Or are they overly optimistic?

Contingency & Reserves: Does the budget include a healthy contingency reserve for unexpected construction costs or operational shortfalls? This is a hallmark of an experienced operator.

Exit Strategy: Is there a clear, primary exit plan? More importantly, are there credible secondary and tertiary plans if market conditions change?

Questions to Ask About the Structure

Get into the fine print to understand how and when you get paid.

Fee Transparency: Are all fees clearly disclosed and easy to understand? Demand a simple breakdown of acquisition, asset management, and disposition fees.

Distribution Waterfall: How are profits split after investors receive their preferred return? Ensure the "waterfall" structure is fair and rewards the sponsor for performance, rather than just participation.

For a comprehensive dive into the entire diligence process, explore our **guide to commercial real estate due diligence**.

Common Questions We Hear from Investors

As you explore real estate crowdfunding, practical questions will naturally arise. It’s one thing to understand the concept, but another to feel confident in the mechanics of investing. Let’s tackle some of the most frequent questions we receive from investors.

Do I Need to Be an Accredited Investor?

This is a critical first question, and the answer is: for most institutional-quality deals, yes.

The U.S. Securities and Exchange Commission (SEC) has rules to protect investors, and the majority of high-quality private real estate offerings are structured under Regulation D, Rule 506(c). This regulation requires all participants to be verified accredited investors.

What does "accredited" mean? Generally, you qualify under this definition if you meet one of the following criteria: an annual income over $200,000 (or $300,000 jointly with a spouse) for the last two years with the expectation of the same for the current year, OR a net worth exceeding $1 million, excluding the value of your primary residence.

While other offering types (like Regulation A+) are open to all investors, they typically involve different types of assets and risk-return profiles. At Stiltsville Capital, we focus on institutional-grade offerings exclusively for accredited investors to ensure all partners share a common understanding of the strategies involved.

What Are the Typical Investment Minimums?

You will find a wide spectrum here. Some retail-focused platforms allow you to start with as little as $500 or $1,000.

However, for the institutional-quality private placements we focus on, minimums are necessarily higher—typically in the $25,000 to $100,000 range, and sometimes more. This higher threshold is not about exclusivity for its own sake; it’s about creating a focused group of sophisticated partners who are making a meaningful allocation and are deeply aligned with the long-term business plan.

How Are Taxes Handled for These Investments?

This is a key area where real estate investing differs from public market stocks. When you invest in an equity crowdfunding deal, you become a partner in an LLC. Consequently, you will not receive a simple 1099-DIV form.

Instead, each year you will receive a Schedule K-1 tax form. This document reports your share of the property's income, deductions, gains, and losses. A significant benefit here is the "pass-through" of depreciation, a non-cash expense that can help shelter rental income from taxes, making the investment highly tax-efficient. As always, you should consult with your tax advisor to understand how a K-1 will integrate into your personal tax situation.

How Long Is My Money Invested?

Patience is a virtue in real estate. It is an inherently illiquid, long-term asset class, which means your capital is committed for the life of the project. For most value-add or development projects, you should anticipate a holding period of three to seven years.

Shorter-term debt investments might conclude in just 6-18 months. The most important discipline is to confirm the deal's projected timeline upfront and ensure it aligns with your own financial plan and liquidity needs before you commit.

Navigating the world of passive real estate investing requires a partner with deep expertise and an unwavering commitment to transparency and alignment of interests. At Stiltsville Capital, we provide accredited investors with access to exclusive, institutional-grade commercial real estate opportunities designed to build and preserve long-term wealth.

If you are ready to explore how a disciplined allocation to private real estate can strengthen your portfolio, we invite you to schedule a confidential call with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments