- Ryan McDowell

- Oct 23

- 16 min read

Reading Time: 8 min | Good for: Novice Investors (A), Informed Principals (B)

Imagine the public stock market is like a massive concert at Madison Square Garden—anyone with a few bucks can grab a ticket. A Regulation D private placement, on the other hand, is like getting an exclusive, backstage pass to a private show with your favorite band. It's the primary way savvy investors access institutional-quality private deals, especially in high-potential commercial real estate.

TL;DR: What You Need to Know

What it is: Regulation D (Reg D) is an SEC framework that lets companies raise capital from investors privately, avoiding the cost and complexity of a public offering.

Who it's for: Primarily for "accredited investors" who meet specific income or net worth thresholds, giving them access to deals not available on public markets.

Why it matters: Reg D offerings can provide true portfolio diversification, higher return potential, an inflation hedge, and significant tax advantages through direct real estate ownership.

Getting to Know the Regulation D Framework

At its heart, Regulation D is a set of rules from the U.S. Securities and Exchange Commission (SEC) that creates a "safe harbor" from the incredibly expensive and lengthy registration process required by the Securities Act of 1933. This framework lets companies, or "issuers," raise capital from investors far more efficiently than they could with a full-blown public offering like an IPO.

For the company raising the money (the "sponsor" or "issuer"), this means less red tape and much faster access to the funds they need for a project, like building a new apartment complex or acquiring a data center. They can offer securities—think equity shares in a property or membership interests in an LLC—directly to a handpicked group of investors.

So, why should you care? Because Regulation D unlocks a universe of investment opportunities you simply can't find on public stock exchanges. These deals often have return profiles and risk factors that don't swing with the daily drama of the stock or bond markets.

Why This Exemption Should Matter to You

Diving into a regulation d private placement can add serious strategic advantages to your portfolio—advantages that are tough to get from public markets alone. This is exactly why high-net-worth individuals and family offices consistently allocate capital to private real estate.

Here are a few of the key perks:

Real Portfolio Diversification: Private real estate provides exposure to a tangible asset. Its performance is driven by factors like rental income and property appreciation, not just the mood swings of the public market.

A Shot at Higher Returns: By entering a deal at an earlier stage, you have the potential to capture value that often gets diluted by the time a company or asset goes public.

A Solid Inflation Hedge: Real estate can be a powerful shield against inflation. As costs rise, so do rents and property values, which can protect your purchasing power.

Serious Tax Efficiency: Direct real estate ownership comes with significant tax benefits. Depreciation, for example, can help shelter income and boost your after-tax returns.

The entire system is built on a crucial distinction the SEC makes: the difference between a retail investor and someone who has the financial capacity and know-how to handle investments without the full protections of public disclosures. This is where the concept of the "accredited investor" comes in—they are the main audience for these exclusive deals.

This status acts as a gatekeeper, ensuring participants can handle the risks associated with private, illiquid investments. For investors who want to dig deeper, it's worth exploring specific instances and discussions surrounding Regulation D. Understanding this framework is your first real step toward accessing the world of institutional-grade private placements.

Comparing Rule 506(b) and Rule 506(c) Offerings

When you step into the world of private placements under Regulation D, you'll quickly encounter two main paths for raising capital: Rule 506(b) and Rule 506(c). While they both lead to the same destination—funding a private deal—they offer completely different journeys for sponsors and investors alike.

Think of them as two types of exclusive events.

Rule 506(b) is the traditional, quiet, invitation-only gathering built on trust and established connections. Rule 506(c), on the other hand, is like a highly publicized charity gala—still exclusive, but openly advertised to attract the right crowd. Knowing the difference is crucial for understanding what to expect when you see a deal.

This decision tree helps visualize that first fork in the road, where your accredited status often determines your access.

As you can see, being an accredited investor unlocks the private markets where these Regulation D offerings live.

Rule 506(b): The Quiet Offering

Rule 506(b) has been the workhorse of private placements for decades. Its defining feature is a strict ban on general solicitation—meaning a sponsor can't blast out emails, post on social media, or otherwise publicly announce they're raising money.

Instead, they must rely on pre-existing, substantive relationships to connect with potential investors. This relationship-first model has a few key implications for you:

You’ll probably hear about a 506(b) deal through your personal network, a financial advisor, or a firm you’ve invested with before.

The deal can include an unlimited number of accredited investors.

It can also allow up to 35 sophisticated non-accredited investors to participate. A "sophisticated" investor is someone the SEC deems capable of evaluating the risks, even without meeting the accredited income or net worth thresholds.

Because the offering is built on existing relationships, verifying your accredited status is usually straightforward. You’ll likely just complete a self-certification questionnaire. The sponsor can take your word for it, which keeps the paperwork light on your end.

Rule 506(c): The Public Offering

Everything changed when the JOBS Act of 2012 introduced Rule 506(c). This rule gave sponsors the green light to use general solicitation and advertising to find investors. It was a massive shift.

Now, you might see a 506(c) offering advertised on a website, discussed in a podcast, or featured in an industry newsletter. But this freedom to advertise comes with a critical trade-off designed to protect everyone involved.

Why it matters: Under Rule 506(c), the sponsor can advertise to the general public, but every single investor must be accredited, and the sponsor must take "reasonable steps" to prove it.

This verification is a much bigger deal than the simple questionnaire used in 506(b) deals. It's not just a formality; it's a core requirement.

To give you a clearer picture, here’s a quick rundown of how the two rules stack up from an investor’s point of view.

Rule 506(b) vs Rule 506(c) At a Glance for Investors

Feature | Rule 506(b) (The 'Quiet' Offering) | Rule 506(c) (The 'Public' Offering) |

|---|---|---|

Advertising | Strictly prohibited. No public marketing allowed. | Permitted. Can be advertised online, in print, etc. |

How You'll Find It | Through personal connections or existing relationships. | You might see it online, on social media, or at events. |

Investor Requirements | Unlimited accredited investors and up to 35 sophisticated non-accredited investors. | 100% accredited investors. No exceptions. |

Verification Process | Simple self-certification questionnaire. | Rigorous verification requiring proof of income or net worth. |

Your Paperwork | Minimal. You just check a box confirming your status. | More involved. You'll need to provide documents like W-2s, bank statements, or a letter from a CPA/attorney. |

This table boils it down, but the key takeaway is that the freedom to advertise a 506(c) deal is paid for with a much stricter, more invasive verification process for you as the investor.

What Does Verification Look Like for You?

If you’re investing in a 506(c) offering, get ready to provide concrete proof of your accredited status. The SEC gives sponsors a few ways to do this, and they almost always involve documentation.

Income Verification: You may need to supply copies of IRS forms like your W-2s, 1099s, or K-1s for the past two years.

Net Worth Verification: This usually means providing recent bank statements, brokerage statements, or even a credit report to show your assets and liabilities.

Third-Party Confirmation: A popular and less intrusive option is getting a signed letter from a licensed attorney, CPA, or registered investment adviser confirming they’ve verified your status within the last three months.

It might feel a bit invasive, but this is standard procedure for any legitimate 506(c) deal. Good sponsors use secure online portals to handle this confidentially. This rigorous process protects the integrity of the deal and ensures everyone at the table meets the SEC’s requirements.

Knowing which type of offering you’re looking at sets the right expectations from the start. For more on how sponsors put these deals together, check out our guide on how to raise capital for real estate.

How to Qualify as an Accredited Investor

To participate in the world of Regulation D private placements, you generally need to be an accredited investor. This isn't just a fancy label—it's a specific designation from the SEC that acts as a form of investor protection. The thinking is simple: if you meet certain financial benchmarks, you're presumed to have the financial sophistication and capacity to handle the risks that come with private investments, all without the detailed disclosures required in public markets.

Understanding these qualifications is your key to unlocking access to deals from firms like Stiltsville Capital and other institutional-grade sponsors. Let's break down the most common ways you can clear the bar.

The Financial Thresholds for Individuals

The SEC has laid out clear financial tests for individuals. The good news? You only need to meet one of them, not both.

The Income Test: You need an individual income over $200,000 for the last two years, or a joint income with your spouse over $300,000 for those same two years. Crucially, you must also have a reasonable expectation of hitting that same income level in the current year.

The Net Worth Test: Your individual net worth, or joint net worth with your spouse, must be more than $1 million. For many investors, this is the most straightforward path to becoming accredited.

There's a critical detail you can't overlook when calculating your net worth, and it has to do with your home.

Key Nuance: Calculating Net WorthThe SEC specifically carves out the value of your primary residence from the net worth calculation. So, if you have a mortgage, you can exclude that debt up to your home's fair market value. But if your mortgage debt is more than what your home is worth, that extra amount has to be counted as a liability.

This rule ensures an investor's status isn't just propped up by a hot real estate market. It's about having real, investable assets.

Beyond Income and Net Worth

The SEC knows that financial savvy isn't just about dollars and cents. They've expanded the definition to include people with specific professional know-how.

This modern take acknowledges that certain professionals are, by the very nature of their work, perfectly capable of weighing the risks and rewards of a regulation d private placement.

Here are the other ways you can qualify:

Licensed Financial Professionals: If you hold a Series 7, Series 65, or Series 82 license and are in good standing, you’re in.

Knowledgeable Employees: If you're a director, executive officer, or another employee of a private fund who's directly involved in its investment activities, you can be considered accredited for investments in that specific fund.

Entities and Trusts: It’s not just for individuals. Entities like banks, registered investment companies, and certain trusts with total assets over $5 million also make the cut. This is a big one for family offices and institutional investors.

One last point, specifically for Rule 506(b) offerings: there’s a category for "sophisticated" investors. These are folks who might not meet the strict financial tests but have enough knowledge and experience in finance to capably evaluate the deal. It’s a subjective call made by the sponsor, which highlights how important trust and relationships are in these kinds of offerings.

Your Step-by-Step Journey Through a Private Placement

Jumping into a Regulation D private placement can feel like you're being let in on a secret, but the process itself is surprisingly straightforward. Once you understand the steps, you'll have the confidence to navigate your first—or next—deal like a pro.

Let’s walk through the entire journey from an investor’s perspective, using a hypothetical deal to acquire a multifamily apartment building as our example.

Stage 1: Discovery and Initial Review

It all starts with learning an opportunity exists. How you find out about a deal depends on whether it's a Rule 506(b) or a 506(c) offering.

For a 506(b) "Quiet Offering": You won’t see these advertised. You might hear about a deal through a trusted wealth advisor or directly from a sponsor like Stiltsville Capital, but only if you have a pre-existing relationship. It’s an invitation-only affair.

For a 506(c) "Public Offering": This is a different story. You could stumble upon the deal through a webinar, an industry newsletter, or right on the sponsor’s website. The door is open to any accredited investor who's interested.

Once an opportunity catches your eye, the sponsor will send over a package of offering documents. The most important document in this stack is the Private Placement Memorandum (PPM).

Think of the PPM as the complete owner's manual for your potential investment. It lays out everything: the business plan, property details, financial projections, potential risks, and the deal's legal structure.

This document is your best friend during due diligence. A well-written PPM gives you all the transparency you need to make a smart, informed decision. For a closer look at what goes into these, you can check out our guide to private placement memos for real estate investors.

Stage 2: Subscription and Verification

After you’ve thoroughly reviewed the PPM and done your own homework, it’s time to formally commit by filling out the subscription agreement.

This is a legally binding document that spells out the exact terms of your investment, like how much you're putting in and your acknowledgment of the risks involved. It’s what officially "subscribes" you to the offering.

If it's a 506(c) deal, there's one more step: the sponsor has to verify that you’re an accredited investor. This usually means providing documents like tax returns or getting a confirmation letter from your CPA or attorney to prove you meet the SEC’s financial requirements.

Stage 3: Funding and Closing

With your subscription accepted and your status verified, it's time to send in the funds. The sponsor will issue a formal capital call, which is just a notice requesting your investment amount. You'll then wire the funds to a secure, dedicated escrow account.

Some deals have a single capital call at the beginning, while others—especially new construction projects—might have multiple calls over time. The PPM will always make the funding schedule crystal clear. Once all the investor capital is collected, the sponsor closes on the property, and congratulations, you're officially a part-owner.

Stage 4: The Post-Investment Experience

Your journey doesn't stop when the deal closes. A great sponsor will keep you in the loop with consistent, transparent communication for the entire life of the investment.

Here's what you should expect:

Regular Reporting: You should receive detailed quarterly or semi-annual reports. These should cover financial statements, key property metrics (like occupancy rates and rent growth), and a personal update from the asset manager on how the business plan is progressing.

Consistent Distributions: As the property generates cash flow, you’ll receive your proportional share of the profits, typically paid out quarterly.

Tax Documentation: Every year, you’ll get a Schedule K-1. This form reports your share of the investment’s income, deductions, and credits, which you'll need for your tax filings.

Major Event Updates: The sponsor should reach out immediately to inform you about any big news, like a major renovation project or a plan to refinance the property.

This ongoing partnership is what really defines a successful private placement. And for entrepreneurs looking to raise capital on a global scale, figuring out how to open an offshore company can often be a crucial first step in their own capital-raising journey.

Understanding the Scale of the Private Placement Market

When you hear "private placement," it’s easy to think of it as a small, niche corner of the financial world. But that couldn't be further from the truth. The private market isn't just an alternative; it's a dominant, powerful engine for capital formation in the U.S., often raising more money for companies each year than the entire IPO market combined.

This is exactly why sophisticated investors and family offices make these offerings a priority. It's the primary venue where institutional-grade opportunities in commercial real estate, venture capital, and private equity get funded—long before they ever hit the public's radar.

A Multi-Trillion Dollar Engine

Market Signal Box: As of Q1 2024, data from the SEC shows that companies raised approximately $64.4 billion through Regulation D offerings in a single quarter. This figure excludes private equity and hedge funds, which raised an additional $199.8 billion in the same period.Investor Take: The private market, powered by Reg D, is a massive and liquid source of capital, consistently outpacing the public IPO market in fundraising volume. This scale creates a steady stream of diverse, institutional-quality opportunities for accredited investors. (Source: SEC data, analyzed by NAIC, updated Q1 2024).

The sheer volume of capital flowing through these private channels is staggering. The Regulation D private placement framework facilitates hundreds of billions—and often trillions—of dollars in deals every single year, spanning every asset class imaginable. You can explore more on these private securities trends to see the full picture.

Why Rule 506 Is the Market's Workhorse

Within the Reg D framework, one rule is the undisputed champion for issuers: Rule 506. This rule, which covers both 506(b) and 506(c) offerings, is the most widely used private placement exemption in the U.S., accounting for the vast majority of capital raised.

The secret to its dominance is flexibility. Rule 506 allows an issuer to raise an unlimited amount of capital from an unlimited number of accredited investors. This incredible scalability makes it the perfect vehicle for everything from a mid-sized real estate syndication to a multi-billion dollar private equity fund.

This structure gives sponsors the runway they need to execute ambitious, large-scale projects that require serious capital. For you as an investor, the prevalence of Rule 506 means you have access to a steady and diverse flow of professionally managed, institutional-quality deals that simply wouldn't be possible under more restrictive fundraising caps. It’s a sign of a mature, robust market where real capital gets put to work.

Key Questions to Ask Before You Invest

Getting a handle on the mechanics of a Regulation D private placement is step one. But step two is where the rubber really meets the road: thorough due diligence. A slick Private Placement Memorandum (PPM) is a great start, but the real story is found by asking the right questions.

Asking sharp questions helps you look past the marketing gloss and truly understand the sponsor, the deal itself, and how it’s all put together. Think of this as your essential checklist for digging in.

Evaluating the Sponsor

In any private real estate deal, the sponsor is everything. Their experience, integrity, and whether their interests truly align with yours will make or break the investment, far more than any fancy spreadsheet.

What's your track record through a full market cycle? You’re looking for someone who has navigated both the good times and the bad. A sponsor who has only ever played in a rising market might not have the chops to protect your capital when things get rocky.

How much of your own money is in this deal? You want to see significant "skin in the game." Typically, 5% to 10% of the total equity shows they have real conviction and that their interests are directly tied to yours.

Can I talk to investors from a deal that *didn't* go as planned? Anyone can produce happy references from a home-run project. Hearing from someone whose deal hit a few bumps will tell you a ton about the sponsor’s communication, transparency, and character.

Analyzing the Deal and Assumptions

This is where you put the business plan under the microscope. The goal here is to pick apart the core assumptions driving the financial projections and decide for yourself if they’re both realistic and conservative.

Every investment thesis is built on a story about the future. Your job is to pressure-test that story with healthy skepticism and ensure the numbers backing it up are realistic.

Here’s what you should be asking:

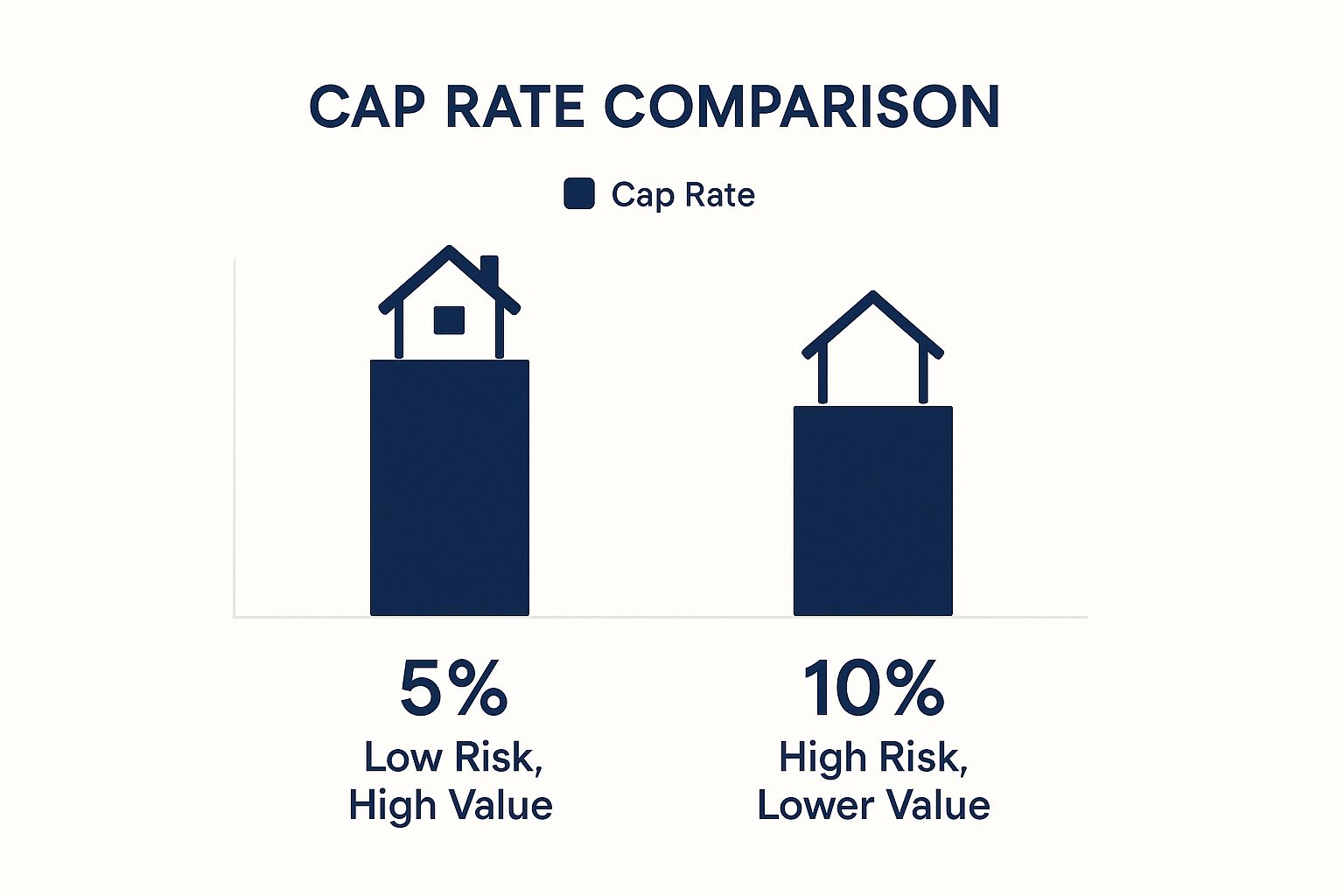

What are your exit cap rate and rent growth assumptions? A smart, conservative sponsor will assume an exit cap rate that's higher than today’s market rate. Their rent growth projections should also be backed by solid, third-party market data, not just wishful thinking.

What does the sensitivity analysis look like? Ask to see what happens to the returns if occupancy dips, rent growth stalls, or interest rates climb. This is how you find out the deal’s true risk profile.

How does this deal fit into the bigger market picture? The sponsor should be able to clearly explain the specific market drivers—like local job growth or a lack of new supply—that make this specific investment a good bet.

Understanding the Structure and Fees

The fine print in the legal and financial structure dictates how, and when, you get paid. For a deeper look at this, you can learn more about real estate syndication returns in our detailed guide.

Can you walk me through the *entire* fee structure? Look beyond the headline numbers. You need a full breakdown of acquisition fees, asset management fees, disposition fees, and any other charges that might pop up.

How does the distribution waterfall work? Get clear on the preferred return and the promote structure. Is there a "catch-up" provision for the sponsor? Make sure the structure fairly rewards both the investors’ capital and the sponsor’s performance.

Common Questions About Regulation D

Even after getting the hang of the rules, a few practical questions almost always pop up when you're looking at a Regulation D private placement. Here are some quick, straightforward answers to the things investors ask us most.

What Is This Form D, and Is It My Problem?

Think of Form D as the official notice the deal sponsor files with the SEC within 15 days after the first investment comes in. It’s basically a headcount for the private party, letting regulators know who's raising money and from how many people.

The good news? It’s 100% the issuer's responsibility, not yours. As an investor, you don't have to touch it. It's simply part of the public record that keeps the private market transparent.

Can I Just Sell My Shares on the Stock Market?

In short, no. Securities bought through a Regulation D offering are "restricted." That's a key detail. They aren't registered for public trading, so you can't just log into your brokerage account and sell them on the NYSE or NASDAQ like a stock.

This illiquidity is a core feature of private placements. You should go into it expecting to hold your investment for the full term laid out in the offering documents. There's no active secondary market to easily cash out.

Are These Reg D Deals Only for Real Estate?

Not at all. While Regulation D is the engine that powers most commercial real estate syndications, it’s the same framework used across a huge range of private investments.

From tech startups raising their first seed round of venture capital to massive private equity funds buying whole companies, they all rely on this exact set of rules to raise capital privately and efficiently.

The core principles of Regulation D are universal. It doesn’t matter if the asset is an apartment building, a new software company, or a portfolio of loans—Reg D is the foundational framework for private capital raising in the United States.

At Stiltsville Capital, we provide accredited investors with exclusive access to institutional-grade commercial real estate opportunities structured for clarity and performance. Well-structured real assets can be a prudent, resilient component of a long-term wealth strategy, and our disciplined underwriting aims to mitigate risk while seeking superior returns. To learn how our approach can fit within your portfolio, schedule a confidential call with our team.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.