Mezzanine Financing Meaning: A Guide for Real Estate Investors

- Ryan McDowell

- Sep 7, 2025

- 13 min read

Reading Time: 8 min | Good for: Novice Investors (A), Informed Principals (B)

TL;DR: Key Takeaways on Mezzanine Financing

What It Is: Mezzanine financing is a hybrid form of capital that sits between senior bank debt and owner's equity in a real estate deal's funding structure (the "capital stack").

How It Works: It acts as a bridge loan to fill the gap between what a senior lender will finance (typically 60-70%) and the total project cost, reducing the cash a sponsor needs to invest.

Why It Matters to Investors: It offers higher returns (often 9-20%) than senior debt, protected by a cushion of sponsor equity, making it a compelling risk-adjusted investment for accredited investors and family offices.

Your Next Step: Understanding how mezzanine financing works is crucial for evaluating sophisticated real estate opportunities.

Market Why-Now: The Search for Yield in a Shifting Landscape

In today's real estate market, traditional financing is becoming more constrained. As senior lenders tighten their underwriting standards, project sponsors increasingly need alternative capital sources to close deals. This has amplified the role of mezzanine financing. The global mezzanine finance market, valued at roughly $197.52 billion, is forecasted to expand to $212.58 billion with a projected compound annual growth rate of 7.88%, potentially hitting $420.79 billion by 2034 (Source: LinkedIn Market Research, as of Q2 2024). This trend underscores a critical opportunity for investors seeking strong, debt-like returns with an equity upside. You can explore the full mezzanine finance market forecast for more on this trend.

What Does Mezzanine Financing Actually Mean?

Ever heard of mezzanine financing? It’s a powerful, hybrid form of capital that acts as a bridge between a traditional senior loan and pure equity in a real estate deal.

Think of it as the middle floor—the mezzanine level—in a building's financial structure. It sits just above the ground-floor mortgage but below the top-floor ownership equity, filling a critical funding gap.

In commercial real estate, a senior lender like a bank will typically only finance a certain percentage of a project's total cost—often around 60-70%. This leaves a gap that the project sponsor (the developer or operator) has to fill. They could put up the entire amount out-of-pocket as equity. Or, they could use a tool like mezzanine financing to cover a big chunk of it.

That’s the core job of mezzanine debt: providing the extra capital needed to complete the project’s funding, what we call the capital stack. By bringing in a mezzanine lender, sponsors can reduce their required cash contribution, which can seriously amplify their potential returns on the equity they do invest.

Key Characteristics

Mezzanine financing isn’t just another mortgage. Instead of being secured by the property itself, it’s typically secured by a pledge of the ownership interests in the company that owns the real estate. This unique structure gives it a distinct position in the deal.

Here are its defining features:

Hybrid Nature: It blends the characteristics of both debt and equity. It has an interest rate and a maturity date like a loan, but it can sometimes include a share in the project's profits, known as an "equity kicker."

Subordinate Position: Mezzanine lenders are second in line to be repaid, right after the senior mortgage lender. If the project defaults, the senior lender gets paid first from any foreclosure proceeds.

Higher Returns for Higher Risk: Because they take on this subordinate risk, mezzanine lenders demand higher interest rates than senior lenders. We’re often talking in the 9% to 20% range, depending on market conditions and the specifics of the deal.

Flexible Terms: The repayment structures can be pretty creative. Often, interest can be deferred and paid at the end of the loan term, which really helps a project's cash flow during its development or stabilization phase.

Mezzanine Financing At a Glance

So, how does mezzanine debt really stack up against the other layers of capital? This stacked list gives you a quick side-by-side comparison, showing its place between the safety of senior debt and the high-risk, high-reward nature of pure equity.

Senior Debt * Position in Stack: Most senior (bottom) * Typical Return: Lower (e.g., 4-7%) * Primary Security: First mortgage on property * Risk Profile: Lowest

Mezzanine Financing * Position in Stack: Middle * Typical Return: Moderate (e.g., 9-20%) * Primary Security: Pledge of ownership interest * Risk Profile: Moderate

Common Equity * Position in Stack: Most junior (top) * Typical Return: Highest (potential) * Primary Security: No direct security * Risk Profile: Highest

As you can see, mezzanine financing occupies a unique middle ground, offering a balanced risk/return profile that can be the perfect solution for getting a deal across the finish line.

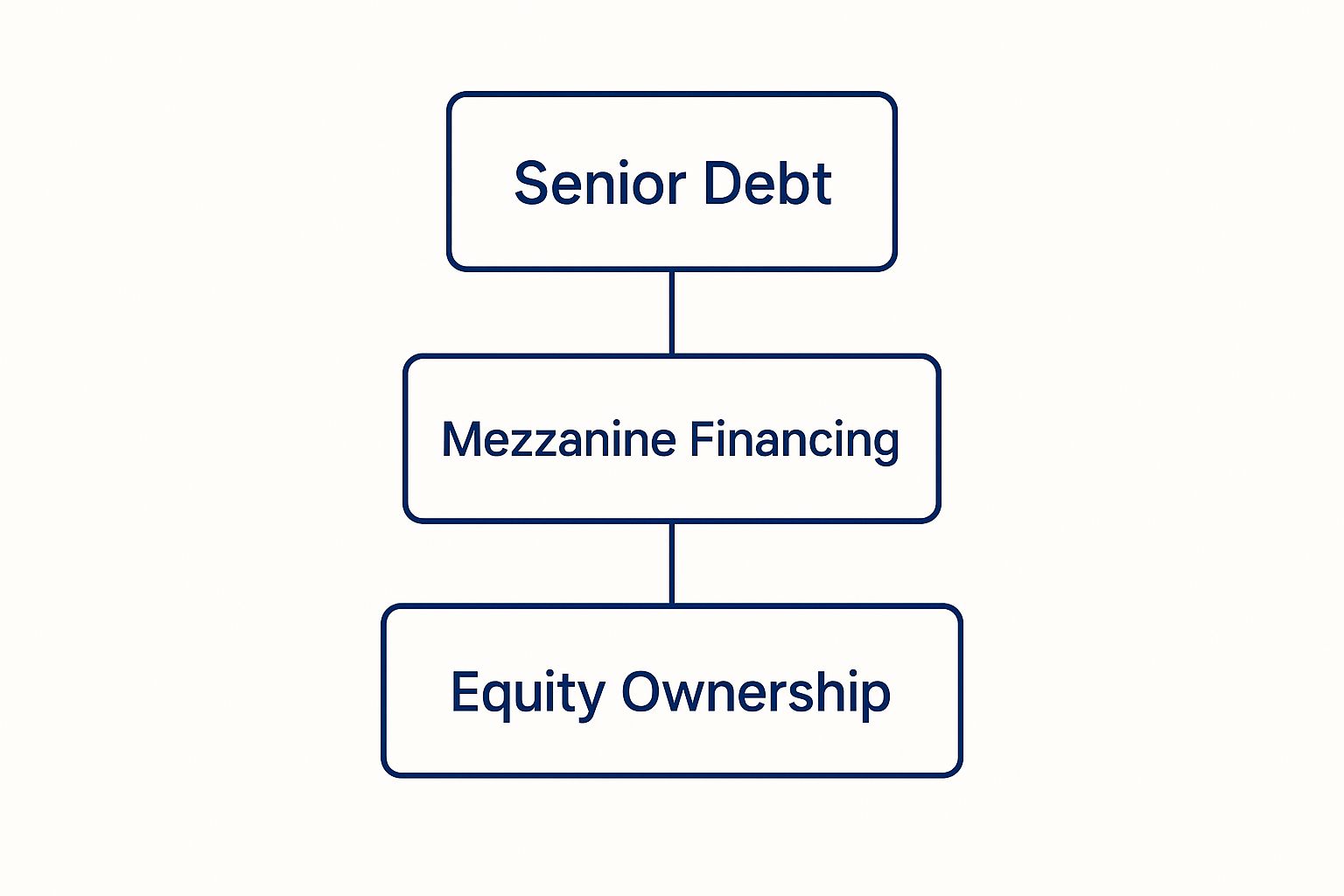

Visualizing the Real Estate Capital Stack

To really get what mezzanine financing is, you first have to understand where it fits in the pecking order. Think of a real estate deal’s funding structure—its capital stack—as a pyramid. Where each layer sits in that pyramid dictates its safety, its cost, and who gets paid first if the project is a home run, or if it runs into trouble.

Every capital stack tells a story about the trade-off between risk and reward. The layers at the bottom are the most secure, so they naturally offer the lowest returns. As you move up the pyramid, the risk gets higher, but so does the potential for a bigger payday.

The Foundation: Senior Debt

Right at the bottom of the stack, you’ll find senior debt. This is the main mortgage on a property, usually coming from a bank or another big institutional lender. It holds the first-lien position, which is a fancy way of saying that if the deal goes south and the property is foreclosed on, the senior lender is the very first one to get their money back from the sale. Because they're first in line, senior debt is the least risky piece of the puzzle.

The Middle Floor: Mezzanine Financing

This is where we're focusing. Mezzanine financing slots in right above senior debt, making it subordinate—or second in line for repayment. A mezzanine loan isn’t secured by a mortgage on the property. Instead, it’s secured by a pledge of the ownership interests in the company that owns the real estate. That subordinate position is exactly why mezzanine financing offers juicier returns.

This diagram shows you exactly how the layers relate to each other.

You can clearly see how mezzanine debt acts as a bridge, filling the gap between the safest debt and the highest-risk equity.

The Penthouse: Common Equity

At the very top of the capital stack sits common equity. This is the cash put in by the project's sponsors and their investors. Equity holders are taking the biggest risk in the entire structure. They are dead last to get paid. If the project underperforms, the equity investors are the first to lose everything. But they also stand to gain the most. In a successful deal, once all the debt is paid off, the equity holders split all the remaining profits.

Investor Takeaway: Understanding the capital stack isn't just theory; it's a core part of due diligence. The amount of equity underneath the mezzanine position—the "equity cushion"—is a critical sign of how safe your investment is. A thicker cushion means the project can handle more financial stress before your own capital is at risk.

The relationships between these layers are all spelled out in a legal document called an intercreditor agreement. This contract lays out the rights and remedies for both the senior and mezzanine lenders, making sure everyone knows the rules of engagement and the exact repayment order if things get rocky.

How a Mezzanine Loan Actually Works

So, you understand where mezzanine debt fits in the capital stack. But how does it actually work? Let's pop the hood and see what makes it tick.

Unlike a simple mortgage with a predictable interest rate, a mezzanine loan’s return is built differently. It's designed to reward the lender for taking on more risk by sitting in that subordinate spot.

The total return for a mezzanine investor isn't just a single interest rate. It's a combination of a few key ingredients, all negotiated to balance the sponsor's need for cash flow with the lender's need for a solid, risk-adjusted return.

Breaking Down the Return Components

The beauty of mezzanine financing is its flexibility. The returns are rarely one-size-fits-all and usually blend the following elements to hit the lender's target.

Current Cash Interest (The "Coupon"): This is the simplest part. It’s a fixed interest rate paid in cash every month or quarter, just like a regular loan. It provides the lender with a steady, predictable income stream.

Deferred Interest (PIK Interest): Here's where it gets interesting. "PIK" stands for "Payment-In-Kind." This is interest that accrues over the life of the loan but isn't paid out in cash right away. Instead, it gets tacked onto the principal and paid back in one lump sum when the property is sold or refinanced. This is a massive plus for sponsors, as it frees up cash flow when they need it most—during a renovation or the development phase.

Equity Kicker: This is the secret sauce that gives mezzanine debt its equity-like upside. An equity kicker is a slice of the project's future profits. It can be structured as a percentage of revenue, a share of the profits at sale, or even an option to convert the debt into an ownership stake. This feature is powerful because it aligns the lender's interests with the sponsor's. When the project does well, everybody wins.

Novice Lens: Why It MattersThink of it like a hybrid car. The cash interest is the reliable gas engine, giving you steady power. The PIK interest is the battery charging up on the side, ready to give you a boost later. The equity kicker? That’s the high-performance electric motor that delivers a burst of acceleration when you successfully reach your destination.

The Unique Security Mechanism

This is a critical distinction every investor needs to grasp. A senior mortgage is secured by the property itself—the actual brick-and-mortar building.

Mezzanine debt is different.

It's secured by a pledge of the ownership interests in the LLC or partnership that owns the property. The mezzanine lender doesn't get a lien on the real estate; they get a claim on the company that holds the deed. If the borrower defaults, the lender can foreclose on those ownership shares through a Uniform Commercial Code (UCC) foreclosure. This is typically much faster and cheaper than a traditional real estate foreclosure. Once complete, the mezzanine lender effectively becomes the new owner of the property-owning company (subject to the senior loan).

You can check out our guide on mezzanine debt funds to see how these structures are pooled for investment.

Deal Lens Example: A Value-Add Multifamily Project

Theory is great, but mezzanine financing really clicks when you see the numbers in motion. Let’s walk through a simplified case study—a value-add multifamily deal—to see the direct impact of this powerful tool.

Imagine a sponsor finds an underperforming apartment complex. The all-in cost to acquire the property and complete the necessary renovations is $50 million.

The Scenario Without Mezzanine Debt

In a traditional deal, the senior lender—usually a bank—is willing to lend up to 60% of the total cost (a 60% loan-to-cost, or LTC). This leaves a pretty big funding gap. To close the deal, the sponsor has to come up with the remaining 40% out of pocket.

Total Project Cost: $50,000,000

Senior Loan (60% LTC): $30,000,000

Required Sponsor Equity (40%): $20,000,000

That $20 million check can strain a sponsor's capital reserves and might prevent them from pursuing other opportunities.

The Scenario With Mezzanine Debt

Now, let's bring a mezzanine lender into the picture. This lender is comfortable funding another 20% of the project cost. Suddenly, the deal looks very different for the sponsor:

Total Project Cost: $50,000,000

Senior Loan (60% LTC): $30,000,000

Mezzanine Loan (20%): $10,000,000

Required Sponsor Equity (20%): $10,000,000

By adding that middle layer of financing, the sponsor has slashed their equity contribution in half, from $20 million to just $10 million.

Investor Takeaway: This is the magic of mezzanine debt. It allows a sponsor to control a $50 million asset with only $10 million of their own capital, amplifying their financial leverage and freeing up the other $10 million for the next deal. This increased leverage can dramatically boost their potential return on equity (ROE), even after accounting for the higher cost of the mezzanine loan.

For the sponsor, paying a higher interest rate on that mezzanine piece is a calculated trade-off. They’re accepting a slightly smaller overall profit in exchange for a much higher leveraged return and the flexibility to keep their capital working on other investments. That’s the essential financial engineering that makes mezzanine financing a cornerstone of sophisticated real estate deals.

Weighing the Benefits and Risks for Investors

No investment is a sure thing, and mezzanine financing is no different. For investors, this hybrid form of capital is a compelling option, but it absolutely demands careful due diligence. It sits in a unique middle ground, offering a shot at higher returns without the direct hands-on risk that comes with holding common equity. But you have to balance that potential upside against the reality of being in a subordinate position in the capital stack.

The Upside for a Mezzanine Investor

The real appeal of mezzanine debt is its carefully engineered risk-return profile. It gives investors a powerful mix of income, a layer of protection, and a piece of the potential upside.

Enhanced Returns: With typical returns between 9% and 20%, mezzanine debt provides a strong, steady income stream that significantly outperforms senior loans.

Equity Cushion: You aren't the first in line to lose money. A protective layer of the sponsor's own equity sits right below your position. If things go south, their capital is the first to get hit.

Flexible, Tailored Structures: Mezzanine deals are negotiated privately. This means the terms can be customized to fit the deal, including features like PIK interest or equity "kickers" that tie your success directly to the sponsor's.

Risk & Mitigation Table

Those attractive benefits don't come for free. They carry risks that have to be actively managed, and the biggest one is the subordinate nature of the debt.

Risk: Subordination to Senior Debt If the property goes into foreclosure, the senior lender gets paid back first. It’s possible there won't be enough money left to make you whole. * Mitigation: Insist on a rock-solid intercreditor agreement that clearly spells out your rights. Also, ensure the total debt on the project (senior + mezzanine) stays at a conservative loan-to-value (LTV) ratio.

Risk: Reliance on Sponsor Execution Your return is completely tied to the sponsor's ability to execute their business plan and create the value they promised. * Mitigation: This is all about due diligence. Dig deep into the sponsor’s track record, their experience with this specific type of property and market, and the quality of their team.

Risk: Illiquidity These are private, illiquid investments. You can't just log into an app and sell your position. You need to be ready to hold it for the long haul. * Mitigation: Only commit capital you can afford to lock up for the entire loan term, which is usually 3-7 years. Ensure it fits with your portfolio's overall need for liquidity.

While mezzanine debt is its own unique tool, it does share some DNA with other hybrid capital, like preferred equity. For a deeper dive, you can learn more about preferred equity in our detailed guide.

Checklist: Questions to Ask a Sponsor

Due diligence is the foundation of any smart investment. A good sponsor will welcome tough questions as a sign you're a serious investor. These questions are all about cutting through the glossy pitch deck to get to the real heart of the deal.

Understanding Your Position and Protections

What’s the total loan-to-value (LTV) or loan-to-cost (LTC) when you combine the senior loan and the mezzanine debt? Critically, how much of the sponsor's own equity is sitting behind my position?

Walk me through a worst-case default scenario. What are our specific rights in the intercreditor agreement, and how quickly can we act on them with a UCC foreclosure?

Is there any situation where the senior lender could block us from exercising our rights if the borrower defaults on our mezzanine loan?

Scrutinizing the Business Plan and Exit Strategy

What are the 3-5 key assumptions in the financial model that are driving the exit value and our repayment? (e.g., rent growth, exit cap rate, final occupancy).

How much stress can you put on those assumptions before our loan coverage gets shaky?

What's the primary exit strategy—a refinance or a sale? And just as importantly, what's Plan B if the market isn't cooperating when it's time to exit?

For a look behind the curtain at the sponsor's side of the table, our guide on **how to raise capital for real estate** shows exactly how sponsors prepare for these conversations.

FAQ: Common Questions on Mezzanine Financing

How is mezzanine debt different from preferred equity?

This is the most frequent—and most important—question. While both occupy that middle ground between a traditional mortgage and owner’s equity, their legal DNA is completely different. Mezzanine financing is a loan. If the borrower defaults, the lender’s recourse is a Uniform Commercial Code (UCC) foreclosure to take over the ownership shares of the property-owning company. Preferred equity is an equity instrument. In a default, the "pref equity" holder doesn’t foreclose; they typically gain direct control of the company, often by having the right to remove the sponsor as manager.

How is mezzanine financing treated in a bankruptcy?

In bankruptcy court, there's a strict pecking order called the "absolute priority rule." Mezzanine debt is subordinate to all senior debt. The bank holding the first mortgage must be paid back in full before the mezzanine lender sees a dime. However, it is senior to all forms of equity, including preferred and common equity. In a worst-case scenario, equity investors get wiped out before the mezzanine lender loses capital.

Investor Takeaway: This is precisely what makes mezzanine debt a compelling risk-adjusted investment. The sponsor's "first-loss" equity acts as a protective cushion, meaning their money is on the line before yours.

Is mezzanine financing only for huge institutional deals?

Not anymore. While mezzanine debt has long been a go-to tool for massive institutional transactions, it's becoming much more common in the middle market. As real estate deals have gotten more creative, sponsors working on smaller projects—from a value-add apartment building to a new boutique hotel—are using mezzanine financing to fill their funding gaps. This opens the door for accredited investors and family offices to access opportunities that used to be reserved for the billion-dollar players.

Well-structured real assets, including investments like mezzanine debt, can be a prudent and resilient component of a long-term wealth strategy. At Stiltsville Capital, we specialize in structuring and identifying these types of institutional-quality opportunities for our partners. To see how investments like these might fit into your portfolio, we invite you to schedule a confidential call.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.

Comments