Equity Multiple Formula Real Estate: A Clear Guide for Investors

- Ryan McDowell

- Sep 8, 2025

- 9 min read

Reading Time: 7 min | Good for: Novice Investors (A), Family Offices (B), Investment Committees (C)

For every dollar you put into a real estate deal, how many dollars do you get back?

That’s the essential question every investor wants answered. The equity multiple gives you that answer, plain and simple. It’s a powerful, straightforward metric that tells you the total cash you’ll receive relative to the total cash you invested over the entire life of a project.

TL;DR: Key Takeaways* What it is: The equity multiple is your investment's "cash-back score." A 2.0x multiple means you doubled your money—for every $1 invested, you received $2 back.* How it's calculated: The formula is simple: Total Cash Distributions / Total Equity Invested.* Why it matters: It provides a clear, cumulative measure of total profit on invested capital, cutting through complex financial jargon.* Its weakness: It ignores the time value of money. A 2.0x multiple in 3 years is far better than a 2.0x multiple in 7 years. Always pair it with the Internal Rate of Return (IRR) to understand the speed of your returns.

Your Investment's Cash-Back Score

Before diving into complex cash flow models and debating discount rates, you need a quick way to gauge a deal's core profitability. The equity multiple is that tool. Think of it as a single, clean number summarizing the total return on your hard-earned capital.

It gets right to the heart of the matter: did you get your money back, and then some?

An equity multiple greater than 1.0x means you turned a profit.

An equity multiple of 1.0x means you broke even—you got your initial investment back, but no more.

An equity multiple less than 1.0x means you unfortunately lost some of your principal.

If a real estate syndication projects a 2.5x equity multiple, it means that for every $1 you invest, you are projected to get $2.50 back in total. This includes all cash distributions during the holding period plus the final proceeds from the sale.

Novice Lens: Why It Matters FirstThe beauty of the equity multiple is its simplicity. It cuts through financial jargon to give you a clear measure of capital growth. While other metrics like IRR are crucial for understanding the speed of your returns, the equity multiple focuses purely on the total size of your profit. It’s a foundational metric for a first-pass filter on any deal.

Equity Multiple at a Glance

This table summarizes the key components, making it easy to reference when you're evaluating your next real estate opportunity.

Metric Component | What It Represents | Investor Takeaway |

|---|---|---|

Total Distributions | All cash returned to the investor, including periodic cash flow and the final proceeds from the sale. | This is the total cash in your pocket over the investment's lifetime. |

Total Invested Capital | The total amount of equity contributed by the investor over the course of the project. | This is your total cash out of pocket. |

Equity Multiple | The ratio of Total Distributions to Total Invested Capital. | A simple score showing how many times you've multiplied your original investment. |

Essentially, the equity multiple gives you a clear, cumulative picture of an investment's performance from start to finish, without complex time-based calculations muddying the waters. For a deeper dive, you can see how industry pros like the team at Colony Hills Capital use this metric.

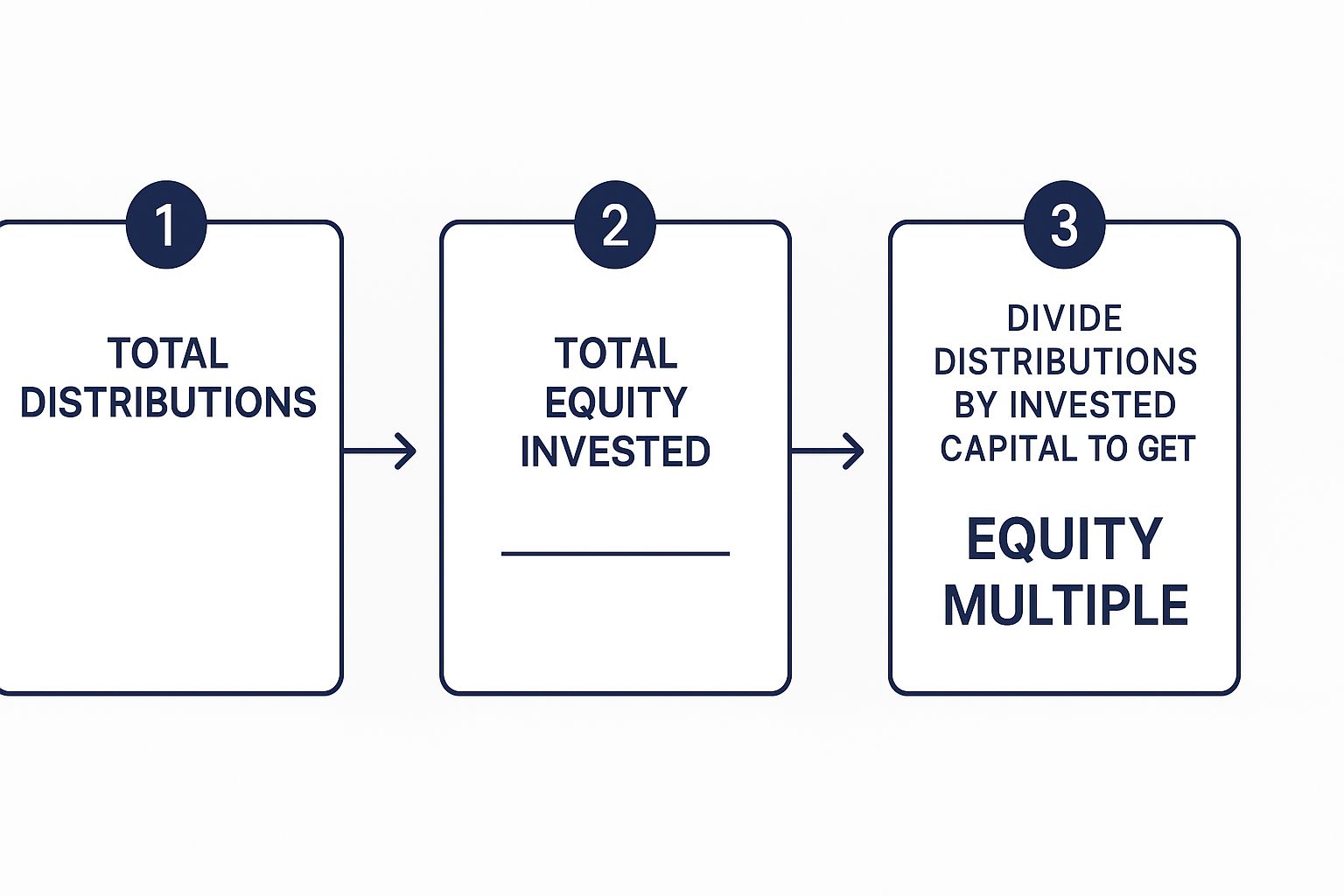

How to Calculate the Equity Multiple Step-by-Step

Figuring out the equity multiple is simpler than it sounds. At its core, the formula is just a clean ratio of total cash out versus total cash in. It answers one critical question: how much money did you get back for every dollar you put in?

As you can see, it’s a simple division problem. You take your total returns, divide them by your total investment, and you get that single, insightful number.

Unpacking the Formula Components

To use the formula with confidence, you have to be precise about what goes into each side of the equation.

1. Total Cash Distributions (The Numerator)This is every dollar that comes back to you from the investment. It’s made up of two types of cash flow:

Periodic Distributions: These are the regular cash flows generated during the holding period. In a multifamily deal, this is your share of the rental income after all operating expenses and debt service are paid.

Equity Returned upon Sale: This is the final capital event. After the property is sold and the mortgage is paid off, this lump sum represents your original investment coming back, plus your share of the profits.

2. Total Equity Invested (The Denominator)This is every dollar of your own money you contributed to the deal. This includes your initial investment at closing and, importantly, any subsequent capital calls for things like major renovations or unexpected repairs.

A Real-World Example: A Value-Add Multifamily Project

Let's walk through a scenario to see the equity multiple formula in action.

Imagine you invest $100,000 as a limited partner (LP) in a value-add apartment building with a projected five-year hold.

Year 0 (Acquisition): You contribute $100,000.

Years 1-4 (Operations): The property performs well, and you receive annual cash flow distributions of $5,000 each year. That's $20,000 total.

Year 5 (Sale): The sponsor completes the renovation, increases rents, and sells the property. Your share of the net proceeds is $180,000.

Now, let's crunch the numbers:

Calculate Total Cash Distributions: * Periodic Distributions: $20,000 * Equity Returned upon Sale: $180,000 * Total Distributions = $200,000

Confirm Total Equity Invested: * Total Invested = $100,000

Apply the Formula: * Equity Multiple = $200,000 / $100,000 = 2.0x

Deal Lens Example: A Value-Add Medical Office Building

Theory is great, but investors make decisions based on what works in the real world. Let's walk through a realistic commercial property deal to see how the equity multiple formula in real estate is used to underwrite an investment.

Imagine we're evaluating a value-add medical office building. The business plan is to acquire a well-located but dated property, invest capital for modernizations to attract higher-credit tenants on longer leases, and stabilize the asset over a five-year hold.

The Financial Story of the Investment (Illustrative)

To calculate our equity multiple, we need to track every dollar in and every dollar out. For this deal, let's assume the total investor equity contribution is $2,000,000.

Here’s a year-by-year breakdown of the projected cash flows:

Year | Investor Activity | Annual Cash Flow | Cumulative Cash Flow |

|---|---|---|---|

0 | Initial Equity Invested | ($2,000,000) | ($2,000,000) |

1 | Leasing & Renovations | $150,000 | ($1,850,000) |

2 | Operations | $250,000 | ($1,600,000) |

3 | Operations | $300,000 | ($1,300,000) |

4 | Operations | $300,000 | ($1,000,000) |

5 | Sale of Property (Net Proceeds) | $3,500,000 | $2,500,000 |

Calculating the Final Equity Multiple

With all the numbers in front of us, we can plug them into the formula.

First, let's sum up all cash distributed to investors. This includes the annual distributions from operations and the net proceeds from the sale.

Total Cash Distributions = $150,000 (Y1) + $250,000 (Y2) + $300,000 (Y3) + $300,000 (Y4) + $3,500,000 (Y5 Sale) = $4,500,000

Next, we look at the total amount invested, which was our initial $2,000,000.

Now for the easy part:

Equity Multiple = Total Cash Distributions / Total Equity InvestedEquity Multiple = $4,500,000 / $2,000,000 = 2.25x

That 2.25x multiple gives us a clean, simple measure of the total return. It means for every dollar put into the deal, the investor is projected to get $2.25 back. This kind of quick, powerful analysis is bread and butter for private equity real estate firms when they’re sizing up a potential investment.

What a Good Equity Multiple Looks Like

You’ve got the calculation down. Now for the real art: figuring out what that number means for your portfolio. A common question from investors is, “What’s a good equity multiple?”

The answer is: it depends on the strategy and the risk.

A target multiple is tied directly to the business plan. A stable, low-risk property will naturally target a more modest multiple than a high-growth, opportunistic development project. A 2.0x equity multiple sounds fantastic, but if it takes ten years to achieve, its appeal fades. Conversely, a 1.7x multiple in just three years on a solid core-plus asset could be an absolute home run. The holding period gives the multiple its meaning.

Benchmarking Returns by Strategy

Different real estate strategies target different outcomes. Understanding these helps you gauge if a sponsor's projections are realistic. You can dive into some of these in our guide to commercial real estate investment opportunities.

Here’s a breakdown of typical target ranges. Keep in mind, these are illustrative industry targets, not guarantees.

Investment Strategy | Typical Hold Period | Target Equity Multiple Range | Risk Profile |

|---|---|---|---|

Core / Core-Plus | 7-10+ Years | 1.5x - 1.8x | Lower |

Value-Add | 3-7 Years | 1.8x - 2.2x | Moderate |

Opportunistic | 2-5 Years | 2.0x - 3.0x+ | Higher |

As you can see, higher multiples are paired with shorter timelines and higher-risk strategies, like ground-up development or a major property repositioning. This makes sense—investors expect to be compensated with a greater return for taking on more risk.

Why the Equity Multiple Needs a Partner Metric

No single metric provides the full picture. The equity multiple is fantastic for measuring total profit, but it has one major blind spot: it ignores the time value of money.

Put simply, it tells you how much you made, but not how fast you made it. A dollar today is worth more than a dollar in five years, but the equity multiple treats them exactly the same.

The Problem of Time Illustrated

Let’s compare two hypothetical deals. Both require a $1 million investment and both return $2 million, giving them an identical 2.0x equity multiple.

Deal A: Returns $2 million in three years.

Deal B: Returns $2 million over seven years.

Any investor would choose Deal A. Getting your capital back and doubled four years sooner is a massive win. That money can be redeployed into the next deal, compounding your wealth much faster. The equity multiple, on its own, misses this crucial difference.

IRR: The Essential Partner to Equity Multiple

This is where the Internal Rate of Return (IRR) comes in. Think of IRR as the equity multiple’s essential partner. It was designed specifically to account for the timing of cash flows. IRR calculates the annualized rate of return, effectively measuring the speed at which your investment grows.

Using both metrics together provides a balanced, institutional-grade view of a deal. The equity multiple confirms total profit potential, while the IRR reveals how efficiently you’ll get that return. They are two sides of the same coin and work best alongside other key metrics like the one we cover in our guide to understanding cash-on-cash return.

Advanced Lens: The Role of the Discount RateFor investment committees and CIOs, it’s worth noting that IRR is technically the discount rate at which the Net Present Value (NPV) of all cash flows—both in and out—equals zero. This academic definition highlights how IRR is fundamentally rooted in the time value of money, making it the perfect counterbalance to the time-agnostic equity multiple.

Checklist: Questions to Ask a Sponsor About Their Equity Multiple

Knowing the formula is one thing. Knowing how to pressure-test a sponsor's projections is where real diligence begins. Arm yourself with these critical questions for your next sponsor call to peel back the layers of their pro forma.

What are your assumptions for rent growth and exit cap rate? Ask where they source their data (e.g., CoStar, CBRE) and why they believe their assumptions are conservative compared to the market.

What does the equity multiple look like in your downside scenario? A good sponsor must be able to show you a stress-tested case (e.g., higher vacancy, slower rent growth) and its impact on returns.

What is the all-in cost basis per unit/foot, and how does it compare to recent sales? This question grounds the deal in reality. If the projected sale price requires a massive leap over current market values, you need to understand the value creation plan.

How much leverage are you using, and is the debt fixed or floating-rate? More debt can inflate an equity multiple but also adds significant risk, especially in a volatile interest rate environment.

Can you walk me through the key risk factors and your mitigation strategies for each? This reveals how deeply they have considered potential obstacles and their operational expertise in navigating them.

A transparent sponsor will welcome these questions and have data-backed answers ready.

FAQ: Common Questions About the Equity Multiple

What’s the difference between Equity Multiple and Cash-on-Cash Return?

Cash-on-Cash Return is an annual snapshot. It measures the cash flow received in a single year against the total equity invested. The Equity Multiple is the final report card. It measures the total cash returned over the entire life of the investment, including sale proceeds.

Can an Equity Multiple be less than 1.0x?

Yes. An equity multiple below 1.0x indicates a loss of principal. For instance, a 0.8x multiple means for every dollar invested, you only received 80 cents back.

How does leverage affect the Equity Multiple?

Leverage (debt) acts as an amplifier. When a deal performs well, smart leverage can significantly increase the equity multiple for investors. However, it also increases risk, as the lender is always paid back before equity holders in a capital event.

Ready to explore how institutional-grade real estate can fit into your long-term wealth strategy?

The equity multiple is a vital tool, but it's just one piece of a disciplined underwriting process. At Stiltsville Capital, we pair rigorous quantitative analysis with on-the-ground operational expertise to identify and execute compelling investment opportunities.

[Schedule a confidential call with Stiltsville Capital](https://www.stiltsvillecapital.com)

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.

Comments