- Ryan McDowell

- Dec 13, 2025

- 16 min read

Reading Time: 8 min | Good for: Novice Investors (A), Family Offices (B)

A Delaware Statutory Trust, or DST, is a legal structure that allows a group of investors to pool their capital and own fractional shares in large, institutional-quality commercial real estate. Think of it less as a dry legal document and more like a purpose-built vehicle for passive real estate ownership.

For investors, it offers a powerful combination of passive income, liability protection, and a direct route to deferring capital gains taxes through a 1031 exchange. It's the go-to solution for anyone looking to trade the headaches of active property management ("tenants, toilets, and trash") for a professionally managed, institutional-grade portfolio.

TL;DR: Key Takeaways on the Delaware Statutory Trust

What it is: A legal entity that allows multiple investors to co-own high-value real estate assets passively.

Who it's for: Accredited investors, particularly those completing a 1031 exchange, and family offices seeking hands-off real estate exposure.

Primary Benefit: It qualifies as "like-kind" property for a 1031 exchange, enabling investors to defer capital gains taxes from the sale of a previous property.

Why it Matters Now: A wave of retiring real estate owners and a sustained demand for stable, passive income are driving record capital into DSTs.

Investor Action: Understanding the DST structure is the first step toward accessing institutional deals and optimizing your real estate portfolio for tax efficiency.

Decoding the Delaware Statutory Trust

For a busy family office principal or a high-net-worth investor, a DST solves a huge problem: how do you maintain an allocation to high-quality real estate without dealing with leaky roofs and late rent checks? It’s like upgrading from personally managing a handful of rental houses to owning a piece of a professionally run, high-rise apartment building or a brand-new Amazon distribution center.

As an investor, you become a "beneficiary" of the trust. An experienced real estate firm—the "sponsor"—handles everything else. They find the deal, arrange the financing, manage the property, and eventually sell it. The entire structure is built to be completely hands-off for you.

The key reason DSTs have become so popular is their role in streamlining the 1031 exchange process. When you sell an investment property and need to find a replacement to defer taxes, the clock starts ticking. A DST offers a pre-packaged, professionally vetted replacement property, making it much easier to meet the strict 45-day identification and 180-day closing deadlines the IRS imposes.

The Rise of the DST Structure

DSTs aren't new, but their use has exploded in recent years. This isn't a random fluke; it's being driven by some powerful market and demographic trends.

Demographic Shifts: A significant amount of U.S. real estate is owned by individuals over 55. Many are tired of being active landlords and want to simplify. The DST is a perfect off-ramp, letting them convert their hands-on properties into a passive, professionally managed income stream without a massive tax bill.

Demand for Passive Income: In an unpredictable economy, investors are hungry for stable, income-producing assets that don't ride the same roller coaster as the stock market. DSTs, often backed by long-term leases on essential properties like apartment buildings or medical clinics, are an excellent fit.

Access to Institutional-Quality Deals: Most individual investors can't acquire a $50 million trophy asset on their own. The DST model opens the door, allowing an accredited investor to own a piece of a portfolio they could never access alone.

These forces have funneled a record amount of capital into the space. Securitized 1031 exchange programs, which are almost all DSTs, raised a record $7.4 billion in 2021. That figure more than doubled the previous record set in 2006, showing just how much sustained demand there is for this structure. You can explore more data on this growth and the trends driving the market.

Novice Lens: What Is a 1031 Exchange?A 1031 exchange, named after Section 1031 of the U.S. tax code, is a strategy that lets you sell an investment property and defer paying capital gains tax on the profit. The catch? You must reinvest all the proceeds into another "like-kind" property within a tight timeframe. It's one of the most powerful wealth-building tools available to real estate investors.

Advanced Lens: The Power of Revenue Ruling 2004-86For those who want to get technical, the entire modern DST industry rests on a single piece of IRS guidance: Revenue Ruling 2004-86. This is the ruling that clarified that owning a beneficial interest in a properly structured DST is treated the same as "direct ownership" of real estate for tax purposes. That's the magic key. It’s the legal foundation that officially qualifies DSTs as replacement properties for 1031 exchanges and unlocks their massive tax-deferral power.

How a DST Investment Is Structured

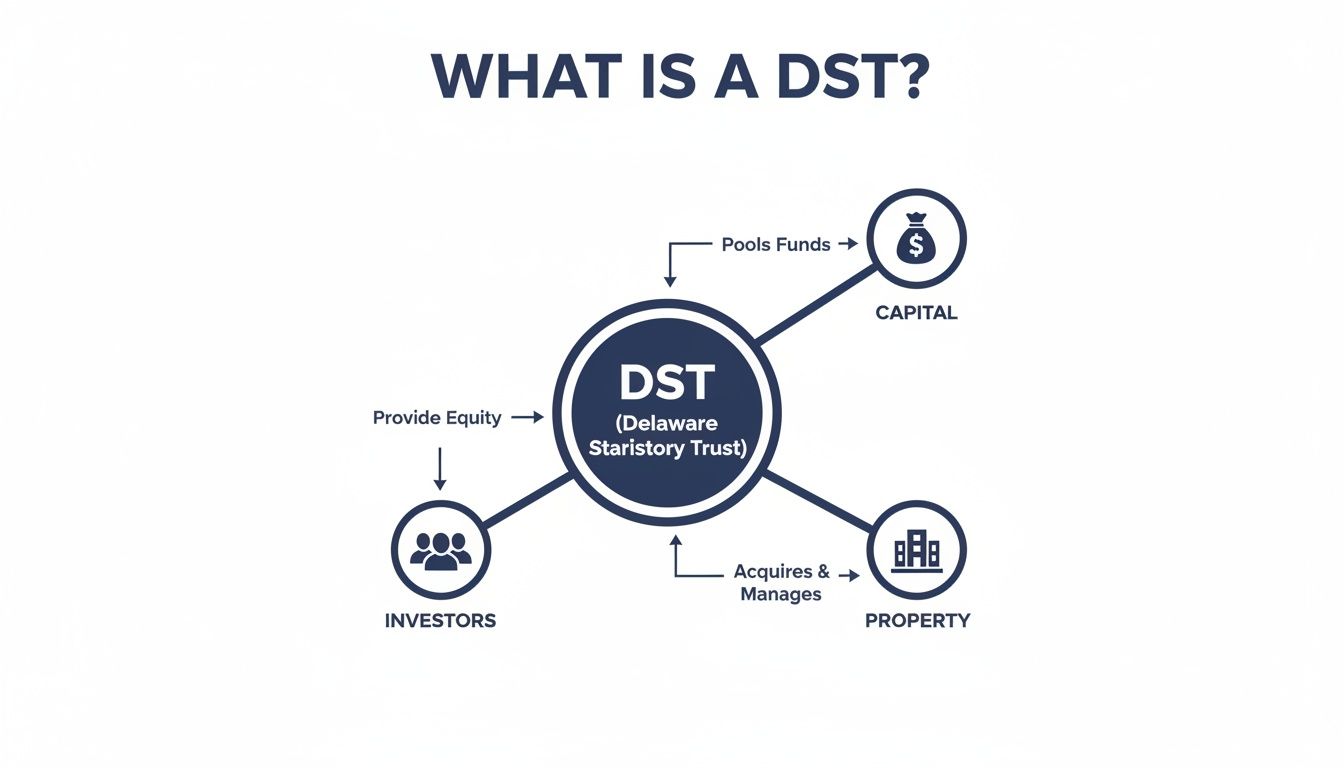

Think of a Delaware Statutory Trust not as a casual partnership, but as a carefully engineered legal vehicle. Its entire structure is designed to give investors passive ownership of high-quality real estate while complying with strict IRS rules to unlock powerful tax benefits. At its heart, the DST separates you, the investor, from the headaches of day-to-day property management.

It all starts with an experienced real estate firm, known as the Sponsor. They’re the master architect of the deal. The Sponsor finds a promising property, runs it through an exhaustive due-diligence process, arranges financing, and then places the asset into a brand-new DST. At that point, the trust legally holds the title to the real estate.

As an investor, you don't buy a piece of the building itself. Instead, you purchase beneficial interests in the trust. This makes you a beneficiary, entitling you to a pro-rata share of the rental income and any profits when the property is eventually sold. The Sponsor, or an affiliate, acts as the Trustee, handling all management duties. This clean separation of roles is what makes the investment truly hands-off for you.

This diagram shows how investors, capital, and the property all fit together within the DST framework.

As you can see, the flow is straightforward: investors pool their capital into the trust, which then acquires and holds a single, institutional-grade real estate asset.

The Legal Bedrock and Why It Matters

The entire setup is built on the foundation of the Delaware Statutory Trust Act. While these investments are available nationwide, Delaware provides the legal home base because of its well-established, business-friendly corporate laws. Sponsors rely on this legal certainty to structure these complex offerings.

It’s a specialized niche. According to the Delaware Division of Corporations, statutory trusts made up just 0.7% of all new business formations between 2022 and 2024. While that sounds small, this unique legal tool supports a massive amount of investor capital across the country, showing just how vital it is to the commercial real estate world. You can dig into the numbers yourself and see how Delaware’s legal system supports these structures.

The Seven "Deadly Sins" of DSTs

To ensure a DST is eligible for a 1031 exchange, the IRS imposes very tight restrictions on what the Trustee can and cannot do. These rules, often called the "Seven Deadly Sins," are there to ensure the trust remains a passive investment vehicle, not an active, operating business. Breaking one of these rules could disqualify the 1031 exchange and trigger a significant tax bill for every investor.

The Trustee is strictly forbidden from doing any of the following:

Raising new capital after the offering closes.

Selling the property to buy a new one (they can only sell to dissolve the trust).

Refinancing the property or taking on new debt.

Entering into new leases or renegotiating existing ones.

Reinvesting profits (all cash flow must be distributed to investors).

Making major upgrades to the property, unless required by law.

Holding cash between distributions in anything other than short-term government debt.

Investor TakeawayDon't let the name fool you—these "sins" are actually your friends. They're critical guardrails that preserve the passive nature of your investment, which is the whole reason it works for a 1031 exchange. For an investor, these rules offer peace of mind, ensuring the Sponsor sticks to the original business plan for the property and creating a predictable, hands-off investment.

Comparing DSTs to Other Real Estate Investments

When you're weighing your options, you must understand how a Delaware Statutory Trust stacks up against other ways to own real estate. Every structure offers a different mix of control, liability, and tax benefits. The right choice really comes down to what you're trying to accomplish with your portfolio, how hands-on you want to be, and—crucially—whether you need to satisfy 1031 exchange rules.

Direct ownership gives you total control, but that also means total responsibility for every late-night maintenance call. On the other hand, structures like Limited Liability Companies (LLCs) and Tenancy in Common (TIC) arrangements let you co-invest, but they bring their own challenges. The DST was engineered from the ground up for investors who want passive income and a clean, simple 1031 exchange solution.

DST vs. Tenancy in Common (TIC)

Before DSTs became the standard for 1031 exchanges, the Tenancy in Common (TIC) structure was a popular choice. In a TIC, up to 35 investors can co-own a property, with each person holding a separate deed for their share.

But the TIC model has serious drawbacks. Lenders get nervous underwriting a loan for a property with dozens of different owners on the title. More importantly, major decisions—like selling or refinancing—often require unanimous consent. All it takes is one holdout to derail a deal. A DST neatly solves this by putting one professional trustee in charge of all major decisions.

DST vs. LLCs and Partnerships

LLCs and partnerships are fantastic for pooling money to actively buy, manage, and sell real estate. They offer solid liability protection and a lot of flexibility in how profits and losses are split.

Here’s the catch: the IRS does not consider an ownership interest in an LLC or partnership to be “like-kind” property. That means you can’t roll your 1031 exchange funds into an LLC. This distinction alone makes the DST the clear winner for any investor focused on deferring capital gains taxes from a previous property sale.

For a deeper look into how different legal wrappers work for investors, you can learn more about how a pooled investment vehicle works.

A Side-by-Side Look at Investment Structures

To really spell out the differences, let’s put these investment vehicles head-to-head on the factors that matter most to a serious investor or family office.

Investment Structure Comparison: DST vs. TIC vs. LLC vs. Direct Ownership

This table compares key features of different real estate investment structures to help investors choose the best fit for their goals, particularly regarding 1031 exchanges and passive management.

Feature | Delaware Statutory Trust (DST) | Tenancy in Common (TIC) | LLC/Partnership | Direct Ownership |

|---|---|---|---|---|

1031 Exchange Eligible? | Yes (core benefit) | Yes (but can be complex) | No (partnership interests don't qualify) | Yes (the original asset) |

Liability Protection | Excellent (similar to a corporation) | None (direct ownership risks) | Excellent (shields personal assets) | None (full personal liability) |

Management Control | Passive (Sponsor/Trustee manages) | Active (all owners must agree) | Active (via Manager/General Partner) | Active (you are in full control) |

Investment Minimums | Typically $100,000+ | Varies widely, can be high | Varies widely | 100% of property value |

Financing Complexity | Low (one loan to the trust) | High (lenders wary of multiple owners) | Moderate (one loan to the LLC) | Moderate (one loan to the owner) |

Investor TakeawayThe DST truly shines because of its unique combination of 1031 exchange eligibility, passive management, and institutional-grade liability protection. While other structures might give you more control, they either don't work for a 1031 (like LLCs) or create major operational headaches (like TICs). This makes the Delaware Statutory Trust a purpose-built tool for investors who are serious about tax deferral and hands-off portfolio growth.

Understanding DST Economics: Fees and Returns

To understand what makes a Delaware Statutory Trust tick, you have to look under the hood at the numbers. Every DST offering comes with a Private Placement Memorandum (PPM), and learning how to read it is what separates a novice from a seasoned investor. Let's break down the economic engine of a DST, from the fees sponsors charge to the returns you might expect.

The fee structure is mission-critical because it directly impacts your bottom line. Sponsors are compensated for their expertise in finding, managing, and eventually selling the property, and these fees usually fall into three main buckets.

Dissecting the Fee Structure

Getting a handle on these costs is step one in evaluating any deal. A high fee load isn't an automatic red flag—especially if the sponsor has a stellar track record—but you absolutely need transparency.

Acquisition Fee: This is the sponsor's finders' fee. It’s a one-time, upfront charge for sourcing, underwriting, and closing on the property. You’ll typically see this run from 2% to 5% of the total purchase price.

Asset Management Fee: This is an ongoing fee for the day-to-day work of managing the property and the trust. It’s usually paid out of the property's rental income and is often between 1% and 2% of gross revenue or a percentage of the equity invested.

Disposition Fee: When the property is sold, the sponsor charges this back-end fee for handling the marketing and sale process. It’s typically 1% to 3% of the final sale price.

The total fee load can significantly shape your outcome. The market is broad here, with total front-end fees ranging from 2–3% on the low end to as high as 10–15% on the high end. A DST that buys a property for $20 million and sells it five years later for $25 million has a 25% gross appreciation, but your net return is what's left after paying down debt and covering all fees detailed in the trust agreement.

Illustrative Deal Example: An Investor's Lens

Let's walk through a simplified example to see how the numbers play out. Imagine a sponsor puts together a DST for a stabilized apartment building.

Property Purchase Price: $50,000,000

Loan Amount (60% LTV): $30,000,000

Total Equity Raise: $20,000,000

Your Investment: $500,000

Over a 5-year hold, the property generates steady rental income. After the mortgage, property expenses, and the sponsor's asset management fee are paid, the remaining cash flow is distributed to you and the other investors. Let's say this works out to an average annual cash-on-cash return of 5%.

Your Annual Distribution (Illustrative): $500,000 x 5% = $25,000 per year

Five years later, the sponsor sells the property for $60,000,000. They use the proceeds to pay off the $30 million loan, cover closing costs, and take their disposition fee. The profit that remains is then distributed to investors, creating a total return from both appreciation and the income received along the way.

The Return Driver Stack

What really moves the needle on your final return? An investor's total return, often measured by the Internal Rate of Return (IRR), is driven by a few key levers. For many investors rolling out of direct ownership, one of the biggest economic wins of a DST is the ability to use a 1031 exchange and tap into powerful strategies to offset capital gains.

Here are the main drivers of performance:

Rent Growth: The ability to raise rents over time, driven by market demand and smart property management.

Leverage: Using debt can amplify returns on your equity (but it also magnifies risk).

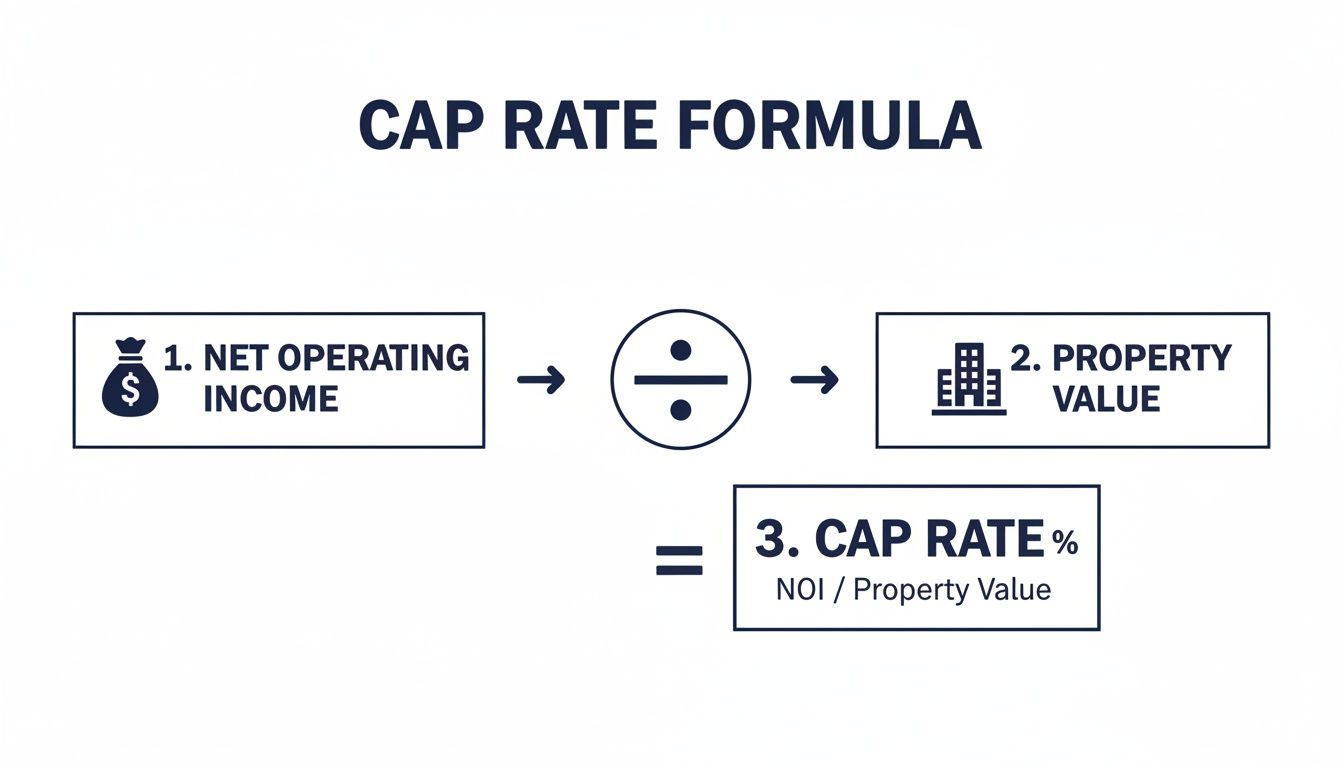

Exit Cap Rate: A lower capitalization rate when the property is sold means a higher valuation, which boosts your appreciation.

Operational Efficiency: This is the sponsor’s skill in controlling expenses and maximizing net operating income (NOI).

Sponsors model these variables to project a target IRR. It’s absolutely critical that you scrutinize these assumptions in the PPM. To sharpen your skills, check out our guide on how to calculate Internal Rate of Return and get comfortable with the math behind the projections.

Your Due Diligence Checklist for DST Sponsors

When you invest in a Delaware Statutory Trust, you're not just buying a piece of property—you're choosing a partner. The sponsor is the single most important factor in your investment's success. A shaky sponsor can run a trophy asset into the ground, while a great operator can find value and drive returns even when the market gets tough.

Think of due diligence as more than a box-ticking exercise. It's the bedrock of a sound investment. You need to dig into the sponsor’s history, the property’s real-world numbers, the deal's financial structure, and the exit plan. This checklist will guide you through the essential questions to ask before you commit capital.

The Sponsor and Their Track Record

The sponsor serves as the trustee, which means they have a fiduciary duty to you and the other investors. It's critical to understand the serious consequences of a breach of fiduciary duty.

Performance History: How has your firm actually performed with this asset type through both good and bad market cycles? Ask for their full, verifiable track record—not just a highlight reel of their biggest wins.

Team Expertise: Who are the key people making the decisions? What’s their direct, hands-on experience buying, managing, and selling properties of this specific type and size?

Alignment of Interests: Does the sponsor have significant "skin in the game" by investing a meaningful amount of their own capital alongside investors?

Investor Relations: What is your communication process? How often will I receive updates and financial reports? Can you connect me with some of your current or past investors?

The Property Itself

Look past the glossy marketing brochure. You need a clear picture of the property's real operational and market risks.

Tenant Quality and Risk: Who are the main tenants? Are they creditworthy, and when do their leases expire? A property that relies heavily on a single, non-credit tenant is a major red flag.

Market Fundamentals: What’s really going on in this specific submarket? What are the local economic and demographic trends? What does the supply and demand pipeline look like for this type of property?

Capital Expenditures: What is the budget for property improvements? Is there enough cash reserved to keep the asset competitive throughout the hold period?

Investor TakeawayA sponsor's projections are only as good as the assumptions they're built on. You have to pressure-test their numbers. Compare their assumptions for rent growth, occupancy, and expenses against real, third-party market data from credible sources like CBRE or JLL.

The Financial Structure and Fees

The way a deal is financed and how the sponsor gets paid will directly impact your bottom line. You need total transparency here—it’s non-negotiable.

Leverage: What’s the loan-to-value (LTV) ratio? Is the debt fixed-rate or floating? You need to know the loan covenants and exactly when it matures.

All-In Fee Load: What is the total percentage of all fees—acquisition, asset management, disposition—relative to the total equity raised?

Projected Returns: What are the detailed assumptions driving their projected cash-on-cash return and IRR? How do those returns change if you tweak key variables, like rent growth or the exit cap rate? Our guide on real estate due diligence offers a much deeper dive into how to pull these financial models apart.

The Exit Strategy

A great investment is only great if you have a clear path to getting your capital back, hopefully with a profit.

Exit Cap Rate: What’s their baseline assumption for the exit cap rate? How does that number compare to what similar assets are trading for in the market today?

Contingency Plans: What’s the backup plan? What happens if the market is in a downturn when it's time to sell?

Navigating Risks and Liquidity in DSTs

While the benefits of a DST are compelling, a prudent investor always examines the risks. Before you commit capital, it’s crucial to understand the inherent risks—and just as importantly, how a quality sponsor plans to mitigate them.

These investments are not immune to market forces, and their unique structure introduces considerations you won't find with publicly traded stocks or bonds.

Right at the top of that list is illiquidity. When you buy into a DST, you should be prepared to hold that position for the full investment cycle, which is typically five to ten years. There’s no public exchange to sell your shares on a whim. This isn't like offloading stock with a click; your capital is tied to a physical property.

This long-term commitment is a feature, not a bug. It gives the sponsor the runway needed to execute their business plan. But it absolutely requires you to align your personal liquidity needs with the investment's timeline.

Risk & Mitigation Table

A disciplined, conservative approach to underwriting and management is your primary defense. Let's break down the key risks and what a top-tier sponsor should be doing about them:

Risk: Illiquidity * Mitigation: The capital you commit needs to be truly long-term money you won't need for near-term expenses. A good sponsor clearly defines the expected hold period and exit strategy in the offering documents so there are no surprises.

Risk: Real Estate Market Cycles * Mitigation: A sponsor can't control the market, but they can control their underwriting. Look for conservative assumptions on rent growth and exit cap rates. Investing in recession-resilient assets—like workforce housing or medical offices—can also add a layer of defense.

Risk: Interest Rate Fluctuations * Mitigation: This is a major risk. Savvy sponsors lock in long-term, fixed-rate debt whenever possible. That single move takes the risk of rising interest rates eroding your cash flow off the table.

Risk: Sponsor Performance * Mitigation: This is the most critical risk. The only way to manage it is through exhaustive due diligence on your part. Scrutinize the sponsor's track record across multiple economic cycles, verify their expertise in the specific asset class, and confirm they have significant "skin in the game" to ensure their interests are aligned with yours.

Investor TakeawayRisk can never be eliminated, only managed. In a DST, you place immense trust in the sponsor's ability to navigate these challenges. A transparent partner won't just sell you on the upside; they will provide a clear, detailed breakdown of how they plan to protect your capital when things get tough.

Your DST Questions, Answered (FAQ)

Even for experienced professionals, the Delaware Statutory Trust can seem complex at first. It’s a specialized tool, after all. Let's break down a few of the most common questions we hear from family offices and investors considering a DST for the first time.

Can I invest with "regular" cash, not just 1031 exchange money?

Yes, absolutely. While DSTs are famous for their 1031 exchange benefits, they are open to both "exchange" and "cash" investors. The primary requirement is that you meet accredited investor standards. Many investors use a DST as a straightforward way to add institutional-grade real estate to their portfolio without the headaches of direct ownership.

What happens if the sponsor's business fails?

This is a critical question that gets to the heart of why the DST structure is so sound. A properly structured Delaware Statutory Trust is its own legal entity, separate from the sponsor. It holds the title to the real estate, which walls off the property from the sponsor's corporate finances. Think of it this way: your investment is in the trust itself, not in the sponsor’s company.

Investor Takeaway: A well-drafted trust agreement always plans for this contingency. It will include a "successor trustee" clause. If the original sponsor goes under, this provision allows another qualified firm to step in and take over management, protecting your investment and ensuring the property continues to operate smoothly.

What happens when the property is sold?

When the sponsor decides it’s the right time to sell the asset, the trust is typically dissolved. First, the sale proceeds go toward paying off any mortgage on the property and covering standard closing costs. The remaining cash is then distributed to you and the other investors based on your ownership percentage. At that point, you have a choice: you can take the cash and pay the deferred capital gains taxes, or you can roll it all into a new 1031 exchange, continuing to defer those tax obligations.

At Stiltsville Capital, we specialize in helping accredited investors access institutional-quality real estate opportunities. Well-structured real estate can be a prudent, resilient component of a long-term wealth strategy. If you're curious about how a DST could fit into your portfolio, let's schedule a confidential call to discuss your goals.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results. Verification of accredited status is required for participation in Rule 506(c) offerings.