Reading Time 6 min | Good for: Novice Investors (A), Family Office Principals (B)

TL;DR: Key Takeaways on Syndication Returns

Dual Profit Engines: Real estate syndication returns are driven by two sources: consistent cash flow from property operations and capital appreciation realized at the sale or refinance.

Key Metrics to Master: To properly evaluate a deal, you must analyze three core metrics together: the Internal Rate of Return (IRR), Cash-on-Cash (CoC) Return, and the Equity Multiple. Relying on just one can be misleading.

Typical Target Ranges: While every deal is unique, well-structured value-add syndications often target a 7-12% average annual cash-on-cash return and a 15-20% total annualized return (IRR).

Sponsor Assumptions Matter: Projections are only as good as the sponsor's underwriting. Diligent investors must question key assumptions like rent growth, exit capitalization (cap) rates, and expense forecasts.

The Market "Why-Now": The Shift to Tangible Assets

Sophisticated investors are increasingly allocating capital toward private real estate, and for good reason. In a world of volatile public markets and persistent inflation, tangible, income-producing assets provide a compelling blend of stability and growth.

A 2023 survey by Campden Wealth revealed that North American family offices now allocate an average of 17% of their portfolios to direct real estate investments, with many planning to increase that number (as of Q4 2023). This strategic shift underscores a strong conviction in the asset class's ability to preserve wealth and deliver attractive, risk-adjusted returns. For investors seeking both income and appreciation, understanding how real estate syndication returns are generated is the first step toward participating in this trend.

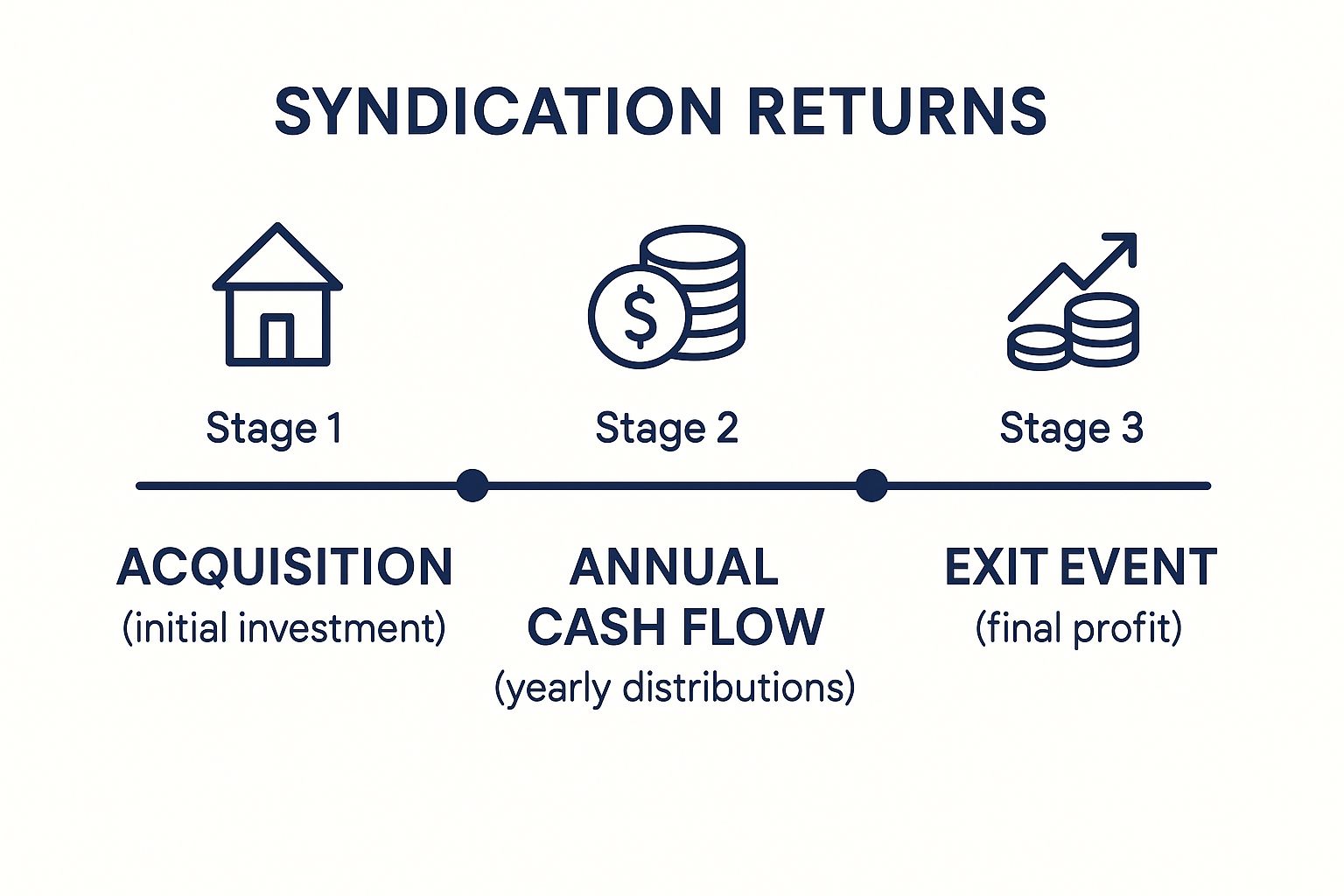

Demystifying Real Estate Syndication Returns

Before you can make a smart investment, you must understand exactly where the money comes from. Unlike a simple stock dividend, syndication returns are multifaceted. Sponsors design these deals to deliver value to investors in two distinct ways:

Ongoing Cash Flow: This is the regular income—often paid out quarterly—that comes from the property's net operating income (NOI). Think of it as the property's profit after all the bills are paid but before the mortgage is covered.

Capital Appreciation: This is the big one. It’s the growth in the property's value over the hold period, which you realize when the asset is sold or refinanced. In most value-add deals, this is where the lion's share of the profit is made.

Setting Realistic Expectations

For anyone evaluating these deals, it's critical to ground your expectations in reality. So, what’s a typical target?

Historically, real estate syndication returns average between 15% to 20% in total annualized returns for investors. But we need to break that down. The cash-on-cash return, which is a simple measure of your annual cash income against your initial investment, usually lands between 7% to 12%.

Meanwhile, the internal rate of return (IRR)—a more sophisticated metric that accounts for the timing of your money—often targets the 10% to 15% range. These numbers show you how syndications work to provide both immediate income and long-term appreciation. You can get more real-world insights on what you can actually make when investing on Disruptequity.com.

The Three Key Metrics to Master

To really understand any deal, you need to speak the language of returns. Sponsors might throw a dozen numbers at you, but your focus should boil down to three core metrics. Together, they paint the full picture of an investment’s potential.

Investor Takeaway: A single metric can be misleading. A high IRR might hide a long wait for your capital, while a great cash-on-cash return could mean there's little long-term growth. True diligence means looking at all three key metrics together.

Here's a quick look at the main performance metrics you'll see in just about every syndication deal.

Typical Return Metrics in Real Estate Syndication

Metric | What It Measures | Typical Target Range |

|---|---|---|

Internal Rate of Return (IRR) | The total annualized return, factoring in the time value of money. | 10% - 15% |

Cash-on-Cash (CoC) Return | Your annual pre-tax cash flow as a percentage of your initial investment. | 7% - 12% |

Equity Multiple | The total cash you get back divided by the total cash you put in. | 1.75x - 2.25x |

These are the indispensable metrics. Mastering them is non-negotiable for anyone serious about building a high-performing real estate portfolio.

Internal Rate of Return (IRR): The big-picture number showing your total annualized return, factoring in when you get your money back.

Cash-on-Cash (CoC) Return: The "mailbox money" metric, showing your annual cash flow relative to your initial investment.

Equity Multiple: The simplest of them all—it tells you how many times you'll get your money back over the life of the deal.

Learning these three lets you compare different opportunities on an apples-to-apples basis. It helps you align your capital with deals that actually match your goals, whether you’re chasing immediate income or long-term wealth.

The Three Pillars of Syndication Returns

When you're looking at real estate syndication returns, you can't just fixate on a single headline number. An investment’s real performance is a story told through three distinct, but deeply connected, metrics. Getting a firm grip on these pillars—the Internal Rate of Return (IRR), Cash-on-Cash (CoC) Return, and the Equity Multiple—is what separates a wild guess from a calculated investment decision.

Think of them as the vital signs of a deal. One metric might look great, but you need to check all three for a complete diagnosis.

IRR: The All-In-One Performance Grade

First up is the Internal Rate of Return (IRR), the most comprehensive of the three. It calculates the total annualized return on your money, but with a critical twist: it cares a lot about when you get paid. Money in your pocket today is worth more than the same amount years from now, and IRR captures this "time value of money."

Novice Lens: Why IRR MattersThink of IRR as the investment’s final, time-weighted report card. It doesn’t just tell you how much you made; it tells you how hard and how fast your capital was working for you. It's the ultimate equalizer, letting you compare a three-year project to a five-year project on an apples-to-apples basis.

A high IRR, often targeted between 10% and 15%, usually means profits are returned relatively quickly. However, a savvy investor knows to look closer. A sponsor can sometimes inflate a projected IRR by forecasting an unrealistically short hold period. It’s a powerful metric, but never look at it in a vacuum.

Cash-on-Cash Return: Your Annual Paycheck

While IRR gives you the big picture, the Cash-on-Cash (CoC) Return is all about the here and now. It’s a wonderfully simple metric showing the annual cash flow you receive compared to the cash you put in.

If you put $100,000 into a deal and get $8,000 back in distributions that year, your Cash-on-Cash return is 8%. Simple as that.

Investors focused on generating passive income love this metric. Deals with a strong and steady CoC, typically aiming for 7% to 12%, can provide a reliable stream of cash. The usual trade-off? A deal with a monster CoC might not have the same explosive growth on the back end. If you're curious how this fits into the broader strategy, you can explore our guide to private equity real estate investing.

Equity Multiple: The Final Scoreboard

Last but not least, the Equity Multiple gives you the clearest, most direct measure of success: how many times did you multiply your money? It’s calculated by dividing the total cash you get back (from both annual cash flow and the final sale) by the total cash you put in.

An Equity Multiple of 2.0x means you doubled your money—you invested $100,000 and got $200,000 back over the life of the deal.

While beautifully simple, the Equity Multiple has one major blind spot: time. A 1.8x multiple achieved in just three years is a much better outcome than a 2.0x multiple that took ten years to hit. That’s why you always use it alongside IRR, so you can understand both the size and the speed of your return.

How Returns Are Actually Generated

Knowing the key metrics is one thing, but understanding how a sponsor engineers those returns is where the real magic happens. Real estate syndication returns aren't pulled out of a hat. They’re the direct result of a smart, disciplined business plan, driven by two fundamental profit engines: day-to-day cash flow and long-term appreciation.

Think of an apartment building like any other business. Rent is your revenue, and expenses are your costs. What’s left over is the profit—the core of your return.

Engine 1: Cash Flow from Operations

The first source of returns is the property’s operational cash flow. This is the investment's lifeblood, providing the steady stream of capital for investor distributions. It all starts with Gross Potential Rent and ends with Net Operating Income (NOI). This NOI figure is the single most important number for analyzing a property's cash flow and determining its value. It's the pure, unleveraged profit the asset generates before any mortgage payments are made.

Engine 2: Capital Appreciation at Exit

The second—and often much larger—piece of the puzzle is capital appreciation. This is the growth in the property's value over the hold period. A good sponsor doesn't just hope the market lifts the property's value. They actively force appreciation by executing a value-add business plan. Common strategies include:

Unit Renovations: Upgrading kitchens and baths to justify higher rents.

Amenity Enhancements: Adding a modern fitness center or dog park.

Operational Efficiencies: Installing energy-efficient lighting to cut expenses.

Here's the powerful part: every dollar added to the NOI can translate into $15-$20 of additional property value, depending on the market cap rate. This multiplier effect is how a well-executed plan generates substantial profits for investors at the exit.

Understanding the Waterfall Distribution

So, how is all this profit divided? This is laid out in the "waterfall" structure, which ensures an orderly, tiered distribution of profits.

Insight Edge: The Return Driver StackIn a typical value-add deal, the total return is a "stack" of several levers:* Rent Growth (40-50%): The primary driver, from renovations and market increases.* Expense Reduction (10-15%): Achieved through operational efficiencies.* Debt Paydown (10-15%): The mortgage portion paid down, increasing equity.* Cap Rate Compression (Variable): Market-driven changes in the exit valuation. A skilled sponsor underwrites conservatively here.

The most common waterfall includes a preferred return, or "pref." Think of this as a hurdle rate—often 6% to 8% annually—that limited partners (investors) receive before the sponsor gets any share of the profits. It’s a crucial feature that aligns interests by ensuring investors get paid first.

For a deeper look into how this priority position works, you can read our breakdown of what preferred equity is for real estate investors.

Once the "pref" has been paid, remaining profits are split according to a predetermined ratio, like 70/30 (70% to investors, 30% to the sponsor). The sponsor's share is their incentive to maximize the deal's performance.

A Practical Look Inside A Sample Deal

Theory is great, but seeing how the numbers play out in a real deal makes it all click. Let's walk through a simplified, but realistic, case study of a value-add multifamily deal.

Setting The Stage: The Acquisition

Let’s imagine Stiltsville Capital spots a 100-unit apartment complex in a growing market. The property is tired but in a great location, making it a perfect value-add candidate.

Purchase Price: $10,000,000

Renovation & Closing Costs: $2,000,000

Total Project Cost: $12,000,000

The sponsor uses both debt and equity. A lender provides a loan, while a group of Limited Partners provides the equity to close the deal and fund renovations.

Bank Loan (Debt): $7,500,000

Investor Equity (LP Capital): $4,500,000

This structure allows investors to control a $12 million asset with just $4.5 million of their own money—a classic example of using responsible leverage to amplify returns.

The Business Plan In Action: Years 1 to 5

Over the next two years, the sponsor renovates units, gives common areas a facelift, and brings in better property management. This allows them to raise average monthly rents from $1,000 to $1,300.

By year three, the property is stabilized and generating consistent cash flow. Let's say it throws off $360,000 in distributable cash each year. For an investor who put in $100,000, their annual distribution check would be $8,000.

Cash-on-Cash Return Calculation:($8,000 Annual Distribution / $100,000 Initial Investment) = 8.0% CoC Return

This provides a steady income stream while the property’s value keeps climbing.

The Grand Finale: The Exit

After five years, the sponsor decides it's time to sell. Thanks to the increased Net Operating Income (NOI), the property is now worth much more.

Sale Price: $16,500,000

Remaining Loan Balance: $7,000,000

Sale Proceeds (before fees): $9,500,000

These proceeds are divvied up. First, the original $4,500,000 of investor equity is returned. The remaining $5,000,000 is profit, which is then split. A typical 70/30 split gives investors $3,500,000.

Our $100,000 investor's share of that sale profit is $77,700. Don't forget, they also collected $40,000 in cash flow over the five years.

Equity Multiple Calculation:($40,000 Total Distributions + $100,000 Capital Returned + $77,700 Sale Profit) / $100,000 Initial Investment = 2.18x Equity Multiple

What does that mean? For every dollar they put in, they got $2.18 back. When you run all cash flows through a calculator, the project clocks in with a deal-level IRR of 16.9%—a textbook example of a successful syndication.

Benchmarking Returns Against Other Investments

How do real estate syndication returns stack up against other investments? Context is everything. Private real estate offers a powerful blend of strong risk-adjusted returns, lower volatility than public stock markets, and a solid hedge against inflation. It's a tangible asset that produces real income—a quality that becomes incredibly valuable when the economy gets shaky.

Historical Performance: Real Estate vs. Stocks and Bonds

Over the long term, real estate has more than held its own. One 145-year global study of 16 industrialized countries found that rental properties returned an average of 7.05% per year, edging out stocks at 6.89%.

More recently, from 1972 to 2023, publicly traded real estate (REITs) delivered an average annual return of 11.1%, nearly neck-and-neck with the S&P 500's 12.1% average return. Private real estate syndications often do even better thanks to their focused, value-add strategies and hands-on operational improvements.

The Private Market Premium

Why the outperformance? A big part is the "illiquidity premium." Because private real estate can't be sold with the click of a button, investors expect to be compensated with higher potential returns. The National Council of Real Estate Investment Fiduciaries (NCREIF) consistently shows that private commercial real estate has historically been far less volatile and delivered more stable returns than publicly-traded REITs, which get tossed around by the daily whims of the stock market.

This stability is a huge draw for anyone looking to build a resilient, long-term portfolio. For a deeper dive, check out our guide on what makes a Class A building stand out.

Key Questions To Ask A Sponsor About Returns

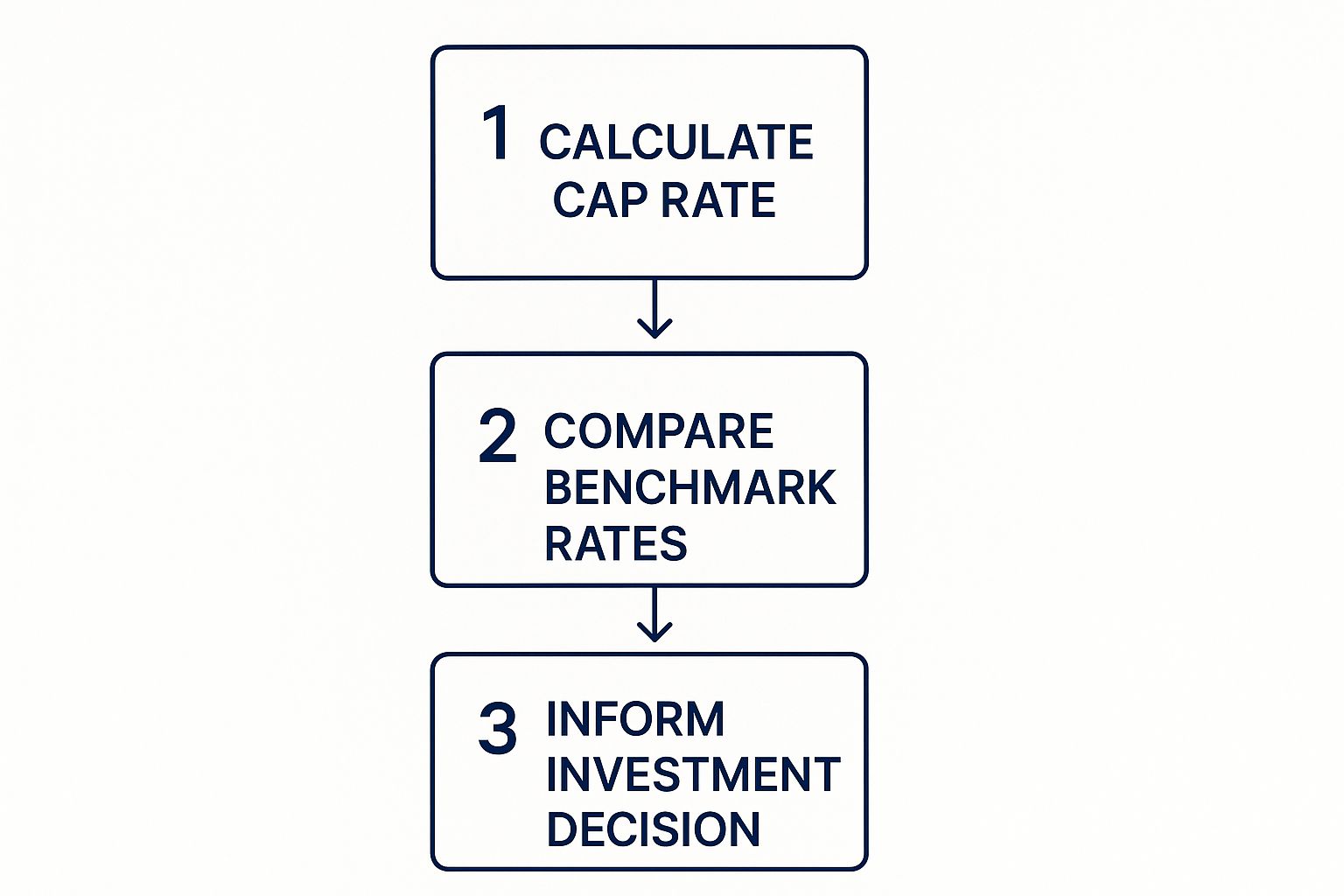

Getting a handle on the key metrics is one thing. But the real work begins when you pressure-test the assumptions a sponsor uses to create those shiny projections. A pro forma is only as good as the numbers plugged into it. This is where you shift from being a passive investor to an active analyst.

Investor Checklist: Questions to Ask a Sponsor

Rent Growth: What annual rent growth are you projecting, and how does that compare to the submarket’s actual 3-year average?

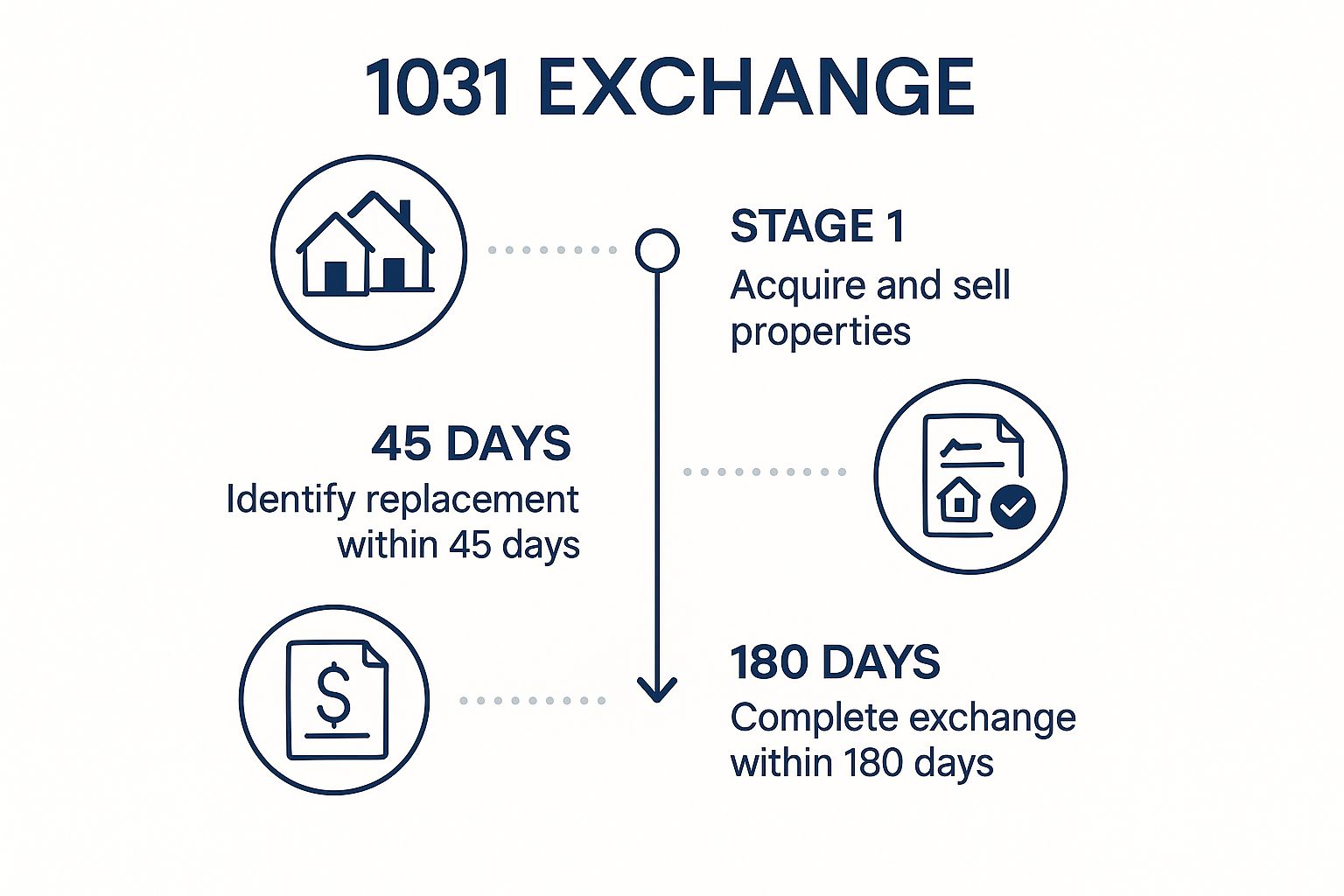

Exit Cap Rate: What is the target exit cap rate? Is it higher than the purchase cap rate to build in a margin of safety?

Vacancy Rate: What are you assuming for both economic and physical vacancy? How does this align with the property’s history and current market trends?

Operating Expenses: How did you model for expense growth, particularly for property taxes and insurance?

Downside Scenarios: Can you show me a sensitivity analysis? How do the returns hold up if rent growth or the exit cap rate miss projections by 10%?

Refinance Risk: If a refinance is planned, what is Plan B if interest rates are higher than expected?

Break-Even Occupancy: How far can occupancy drop before the property can no longer cover its debt service?

Sponsor "Skin in the Game": How much of your own capital are you (the sponsor) personally investing in this deal alongside the limited partners?

Risk & Mitigation: A Disciplined Approach

Experienced sponsors don't just hope for the best; they plan for potential challenges.

Risk: Market Downturn * Mitigation: Focus on markets with diverse economic drivers. Underwrite conservative rent growth and build a capital reserve for unexpected vacancies.

Risk: Interest Rate Hikes * Mitigation: Secure long-term, fixed-rate debt when possible. Purchase interest rate caps to limit exposure on floating-rate loans. Stress test for higher rates.

Risk: Execution Delays * Mitigation: Partner with sponsors who have a proven track record. Get multiple bids from vetted contractors and include a healthy contingency budget (10-15%).

Risk: Liquidity Constraints * Mitigation: Invest with a long-term mindset. Ensure you have sufficient liquid reserves outside of the investment so you won't be forced into a premature sale.

Ultimately, no investment is without risk. The key is to partner with a sponsor who has a clear, battle-tested strategy for navigating potential threats.

Your Questions Answered

When you're digging into real estate syndication, a few practical questions always pop up. Let's tackle some of the most common ones we hear from investors.

How Are Syndication Returns Taxed?

This is where real estate really shines. One of the most powerful perks of investing in syndications is how tax-efficient they are. As a passive partner, you'll get a Schedule K-1 form, not a 1099. That form allows you to benefit from the property’s depreciation, a "paper" expense that can offset the actual cash income you receive. For many investors, this means the distributions they pocket in the first few years are often partially or even completely tax-sheltered.

When Do Investors Start Receiving Distributions?

It all comes down to the business plan. For a stable, cash-flowing property, you could see your first quarterly distribution within three to six months after closing. For a heavy value-add or development project, the sponsor might pause distributions for the first 12-18 months while they put your capital to work stabilizing the property. This should be spelled out clearly in the investment documents.

Investor TakeawayAlways check the projected distribution schedule in the Private Placement Memorandum (PPM). Knowing the cash flow timeline is critical for matching an investment with your financial goals and setting the right expectations for when you'll start seeing a return on your capital.

Well-structured real estate assets can be a prudent, resilient component of a long-term wealth strategy. While the returns are compelling, they are achieved through disciplined underwriting and active management of inherent risks like illiquidity and market cycles.

Ready to see how institutional-grade real estate could fit into your portfolio? The team at Stiltsville Capital is here to provide the clarity and access you need.

Schedule a confidential call with Stiltsville Capital today to discuss your investment goals and learn more about our current opportunities.

Information presented is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any offering is made only through definitive offering documents (e.g., private placement memorandum, subscription agreement) and is available solely to investors who meet applicable suitability standards, including “Accredited Investor” status under Rule 501 of Regulation D. Investments in private real estate involve risk, including loss of capital, illiquidity, and no guarantee of distributions. Past performance is not indicative of future results.